US streaming pioneer Netflix reported a decline in its subscribers for the first time in more than 10 years while presenting its quarterly figures last week. In Q1, a total of around 200,000 paid subscriptions were lost, reducing the global user to 221.6 million users at the end of the quarter. One of the reasons was the war in Ukraine: Netflix, like many other Western companies, abandoned its Russian business in response to the Russian invasion of Ukraine, losing around 700,000 customers in the process. However, even allowing for this factor, Netflix would have fallen well short of its own forecast of 2.5 million, with an increase of 500,000 customers in the quarter.

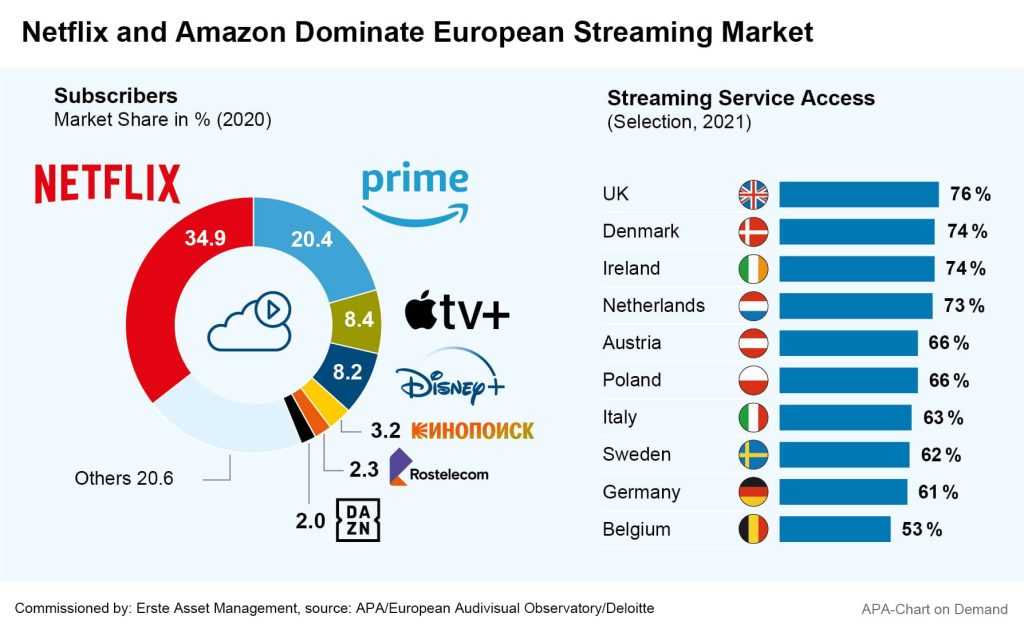

On the stock market, the numbers came as a bit of a shock: Netflix shares lost 35 per cent the day after the quarterly presentation, having already fallen by almost two-thirds of their New Year value. However, other streaming providers’ shares also reacted with losses, the figures indicating that the gold rush in the market is coming to an end and the days when a few providers profited from the streaming boom during the first Corona pandemic lockdowns are likely numbered. Now, in addition to the established industry giants Netflix and Amazon Prime, several new players have entered the market and are competing for viewers‘ favour, money, and attention spans.

More and More Providers Competing for Streaming Consumers

Entertainment behemoth Disney, for example, got off to a lightning start with its November 2019 launch of streaming service Disney+. By the end of 2021, the service already had 130 million customers. Disney‘s other streaming service Hulu also made significant gains recently. Finally, iPhone manufacturer Apple also hit the deck running and immediately became a major player with its Apple TV+ service and opulent in-house productions.

The Paramount+ service, which belongs to the US media group ViacomCBS, is also new to the market in 2021. The new platform can boast the rights to numerous films and series from Hollywood pioneer Paramount, gaining 32.8 million users by the end of the year. By 2024, Paramount wants to crack the 100 million mark.

Linear TV program providers are also increasingly involved in the market. For example, HBO, the pay-TV broadcaster known for its Game of Thrones tv series, recently reported strong growth for its streaming service HBO Max. In Q1, the service increased its subscriber base by 3 million to just under 77 million. In Germany, Bertelsman Group-owned TV group RTL relaunched its streaming service TV Now as RTL plus, reaching more than 3 million viewers by late February.

Competition is making business increasingly difficult for streaming providers, to which is added rising inflation. This is because many customers no longer want to pay for a high number of services in view of the rising cost of living and are starting to cancel existing streaming subscriptions. Especially in the saturated US market, cancellations are becoming a problem for the industry, according to a December study by consultant Deloitte: in 2021, the cancellation rate already lay at 35 per cent. Globally, more than 150 million people could cancel their paid subscriptions in 2022, according to Deloitte projections.

To retain their customers, many providers are therefore continuing to rely on lavish in-house productions. “Streaming services are forced to identify and buy new content, trends and ideas as quickly as possible in order to survive in the fierce competition,” said Lucy Smith, Director of the world’s largest television trade show “MIP TV”, most recently in an interview with the Deutsche Presse-Agentur (dpa). The big challenge for streamers, she said, is to retain subscribers and continue to increase growth rates. “But they’re obviously approaching a limit there,” Smith added.

“How much investment can the streamers handle to finance the costly productions?” Ufa CEO Nico Hofmann asked openly. He added that this also raises the question of how much talent is left in the market at all to continue to realise the content.

Streamers Increasingly Rely on Free Content

These huge investments are likely increasingly facing diminishing returns in the saturated market, the Deloitte experts believe, especially since production costs will also continue to rise. Increasing competition from streamers is also driving up prices for scripts and productions. Many providers are therefore likely to focus on niches, additional offers such as video games or ad-financed free models alongside paid premium content, the experts expect.

Netflix, for example, has already announced a cheaper subscription with intermediary advertising clips. Netflix has never had anything like this before, and Netflix CEO Reed Hastings has had little interest in it before. However, Netflix is now open to the advertising model, he said. “We’re looking at this and trying to get it up and running in a year or two.” Details such as advertising personalisation could be left to others, Hastings said when presenting the quarterly figures.

Amazon is also increasingly focusing on free content. The US retail giant plans to launch a free streaming service in Germany this year. The free streaming service IMDb TV already exists in the US and the UK and will launch in Germany “later this year.” In addition, IMDb TV will be renamed Amazon Freevee. The service is financed by advertising revenue.

In addition, many streamers want to expand their video offerings to include other services. In 2021, Netflix launched its expansion into the gaming business. The video streaming service already made its first five smartphone games available to subscribers. Video games are considered the most important competitor for streaming services alongside social media. Young people between the ages of 14 and 25 now spend more time playing video games than watching tv series, the Deloitte study shows.

CONCLUSION: The business model of streaming TV providers has come under pressure. For the first time in 10 years, the number of Netflix subscribers has fallen. Now free content with advertising and video games could gain in importance.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.