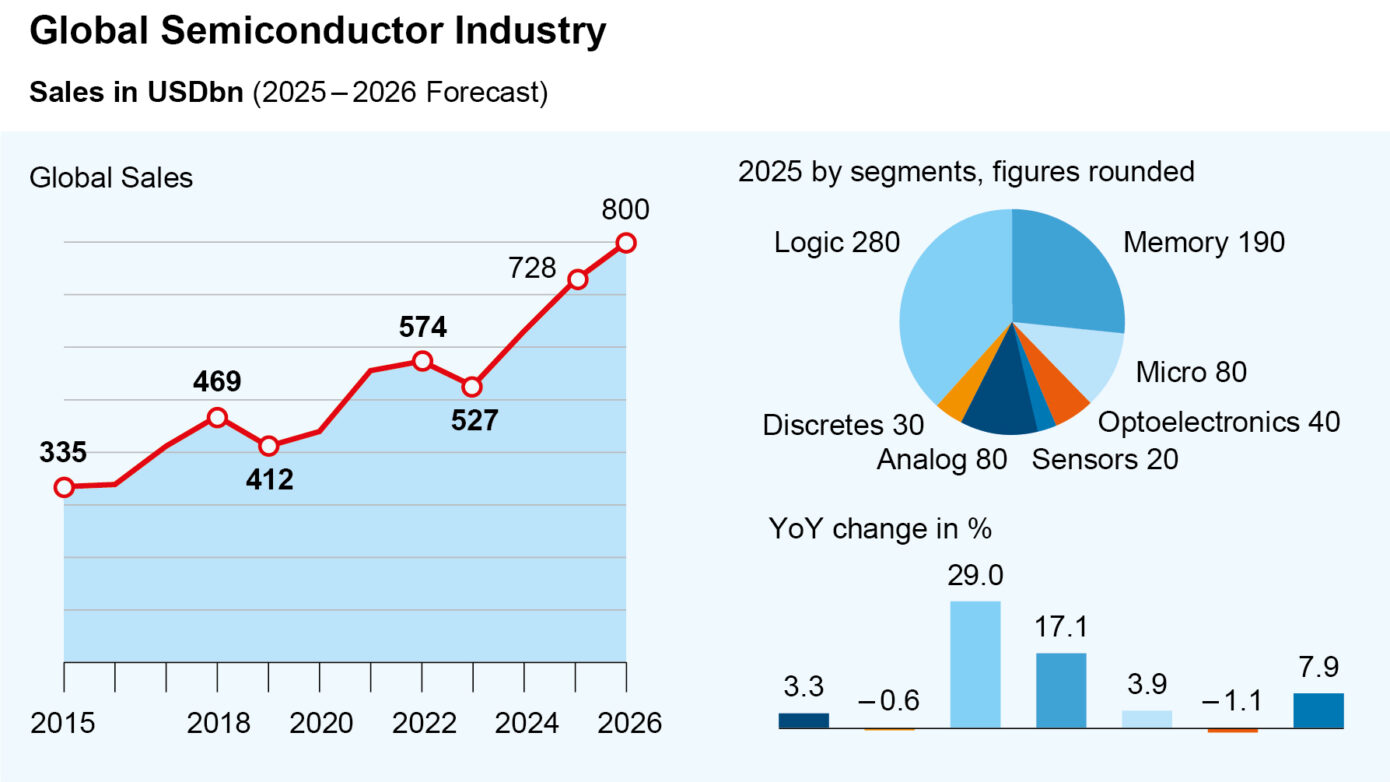

The semiconductor industry is expected to continue growing strongly in 2025, despite uncertainties surrounding US President Donald Trump’s trade policy, thanks to the AI boom. The World Semiconductor Trade Statistics organisation (WSTS) recently raised its growth forecasts for this year slightly. They’re now expecting growth of nearly 15 per cent for the current year, with a global market volume of USD 728bn.

For the first half of 2025, the WSTS calculates a volume of USD 346bn. This corresponds to an increase of just under 19 per cent year-on-year. According to the WSTS, the primary growth drivers were logic and memory chips, with increases of 37 and 20 per cent, respectively. These segments were driven by strong demand from AI data centres and new AI applications, the organization reports.

Note: Forecasts and past performance are not reliable indicators of future developments. The companies listed here have been selected as examples and do not constitute investment recommendations.

Several Semiconductor Companies Have Raised Their Forecasts

A number of leading semiconductor companies have also recently reported strong quarterly figures and raised their forecasts for this year. For example, the world’s largest chip contract manufacturer, TSMC, continued to benefit from growing demand for AI chips and recently reported the best quarterly results in its history. TSMC’s revenue grew rapidly by 40 per cent to the equivalent of nearly EUR 27bn, while the group’s net profit rose by 60 per cent to EUR 11.6bn in Q2. The Taiwanese company said that there is no end in sight to this development. TSMC has forecast another jump in revenue for the current quarter.

Thanks to the leading role of its technology companies in this field, Taiwan is one of the main beneficiaries of the booming demand for AI chips. The country’s economy grew by 8 per cent year-on-year in Q2. This is its strongest growth in four years. However, advance orders are also likely to have played a role in view of the impending US tariffs. Despite the tariffs, Taiwan’s Department of Statistics expects demand to remain strong and recently raised its growth forecast for 2025 from 3.1 to 4.45 per cent.

However, American and European companies will also likely continue to benefit from the AI trend. AMD expects sales to exceed the latest analyst estimates thanks to strong demand for its AI chips. The California-based chip manufacturer recently forecast revenues of around USD 8.7bn for Q3, benefiting from cloud providers such as Microsoft and Meta increasing their investments in AI infrastructure.

German semiconductor manufacturer Infineon earned significantly less in the past quarter, but is also looking into the future with greater confidence. Dutch industry peer ASML, on the other hand, was more cautious in its outlook despite positive figures and booming demand for AI chips. ASML CEO Christophe Fouquet spoke of “increasing uncertainty due to macroeconomic and geopolitical developments.”

Trump Wants to Bring Chip Manufacturing Back to the US With Higher Tariffs

The major uncertainty factor for the industry remains the tariff policy of US President Donald Trump. In the coming weeks, Trump wants to impose new tariffs on semiconductor chips in order to bring a larger share of chip manufacturing back to the US. “I’ll be setting tariffs next week and the week after on steel and on, I would say, chips,” Trump told reporters aboard Air Force One last week. The tariffs would be lower at first to allow companies to set up manufacturing in the US. They would rise later, the Republican president added, without giving specific figures. Shortly before that, Trump had already announced plans to impose tariffs of 100 per cent on semiconductor products. Trump expressed confidence that companies would choose to manufacture in the US rather than pay high tariffs.

In response to the US tariffs, international semiconductor companies have already begun to scale back investments in facilities outside the US and plan manufacturing sites in the US. According to media reports, TSMC has delayed the construction of a plant in Japan in favour of a new facility in the US.

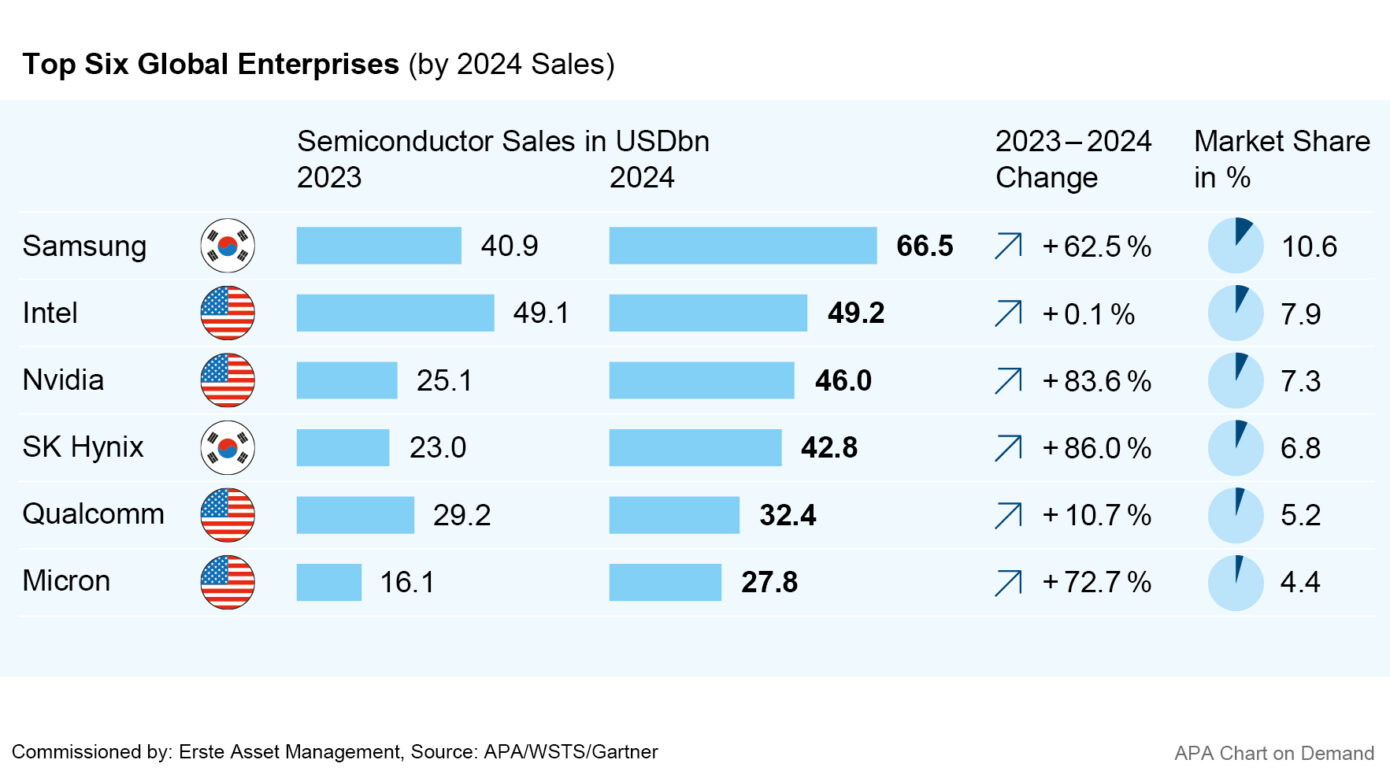

However, Trump not only wants to impose higher tariffs on international companies, but also to support the domestic chip industry in return. According to a media report, the US government is considering investing in the struggling US company Intel. President Donald Trump’s administration is holding talks to this effect, the Bloomberg news agency reported last week, citing well-informed sources. However, there has been no official statement from Intel or the US government as yet.

Exports Of AI Chips to China Could be Permitted Again

Exports of AI chips from the US to China are also a thorn in Trump’s side. In order to slow down China’s technological and military rise, the US has already imposed increasingly strict restrictions on exports of high technology to the country under Trump’s predecessor Joe Biden.

US industry leader Nvidia responded by developing new, scaled-down versions of its AI chips, but even these eventually fell under Trump’s export restrictions. Nvidia itself estimated the resulting loss of revenue at USD 15bn. However, the US president recently did not rule out allowing Nvidia to resume sales of the less powerful AI chips to China. The Trump administration had previously confirmed an agreement with Nvidia and AMD under which the US government would receive 15 per cent of the revenue from sales of certain advanced chips in China.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.