With the number of infections on the rise again in some regions, researchers around the world are frantically working on potential vaccines against the coronavirus and drugs for the treatment of COVID-19, the lung disease caused by the virus. The pharmaceutical companies and universities racing to develop a corona vaccine are making strides: according to the World Health Organisation (WHO), 25 candidates are currently undergoing clinical trials.

Before an active substance is approved as a drug on the market, it must undergo several test phases. The first of these are the so-called preclinical studies. Once the vaccine has been developed in the laboratory, it is first tested in vitro – in a test tube, as it were – on organic molecular compounds and cell cultures. This is followed by tests on living, non-human organisms – from simple bacteria to laboratory animals. According to the WHO, 141 vaccine candidates are currently in this preclinical test phase.

Promising candidates for a drug will then be approved for clinical trials. During the so-called “phase 1”, an active substance is first tested on healthy, voluntary test candidates. Initially, only general tolerability and safety of administering the drug is to be demonstrated. If this phase is successful, the active ingredient moves on to phase 2 and phase 3. The goal of phase 2 is to demonstrate the general efficacy of the potential drug a small group of actual patients. Finally, in phase 3, a larger group of patients will be treated with the drug, among other things to address questions such as dosage and side effects. Only after successful completion of phase 3 can marketing authorization for a drug be applied for.

Five vaccine candidates currently in final testing phase before approval

According to the WHO, five vaccine candidates have already moved on to phase 3 and are thus in the final stage before potential market approval. Among them are three active ingredients developed by Chinese institutes. The Chinese pharmaceutical company Sinovac has recently started the third test phase of its vaccine candidate in Brazil.

An active ingredient co-developed by the University of Oxford and British pharmaceutical group AstraZeneca is also well along in development. According to a study published in the journal “The Lancet”, the vaccine proved to be well-tolerated in previous test series and stimulated the formation of antibodies to cause immunisation against COVID-19. The results of the decisive third test phase are expected in autumn. If successful, the pharmaceutical company plans to launch a coronavirus vaccine by the end of the year. According to AstraZeneca CEO Pascal Soriot, this vaccine will be sold worldwide “at cost price” of approximately EUR 2.50 per unit. The prospect of a corona vaccine has been well received on the stock exchange, and AstraZeneca’s share price has risen by around 13 per cent since the beginning of the year.

A vaccine from the US pharmaceutical company Moderna has already been approved for Phase 3. The company recently received a grant of USD 486m from the US government. As part of its “Warp Speed” programme to combat the virus, the US government has already granted huge sums of money to several vaccine projects.

According to the WHO, 13 active ingredients are currently at least partially in Phase 2 studies. Great hopes rest on a vaccine co-developed by US pharma company Pfizer and the German biopharmaceutical company BioNTech. Unlike AstraZeneca and China’s pharmaceutical companies, the two companies are working with a vaccine type that uses ribonucleic acid. This chemical messenger substance contains instructions for the production of proteins. The body recognises these virus-like proteins as intruders and can thus trigger an immune response against the actual virus.

A total of four RNA vaccine candidates from BioNTech and Pfizer are currently undergoing Phase 1 and 2 studies in the US and Germany. According to experts, initial results of these studies in the USA have been positive. 45 human test subjects developed antibodies against the SARS-CoV-2 pathogen. However, it is still unclear whether these antibodies actually protect against infection. Further tests with up to 30,000 test subjects are expected to reveal this information.

Pfizer and BioNTech now plan to start further phase 3 studies as soon as possible. For example, Brazil, which has been hit particularly hard by the pandemic, has recently approved the German-American vaccine candidate for testing after Sinovac and AstraZeneca. If the pending studies are successful, the application for approval is to be submitted in October. The US has already ordered more than 100 million doses of the active ingredient for close to USD 2bn.

Vaccine fantasy boosts share prices

With the hope of finding a vaccine candidate, BioNTech has recently also attracted attention on the stock exchange. The company has been listed on the US technology exchange Nasdaq since October 2019. Since the beginning of the year, the price of BioNTech’s depository receipts (ADR) has already risen by around 161 per cent. With a capital increase, the company has recently raised around USD 512m, thus securing further funds for vaccine development.

The German vaccine developer CureVac has now also started clinical trials. Its active substance is expected to be ready for the market by mid-2021. CureVac is also planning an IPO in the USA. The main investor in CureVac is currently Dievini, the SAP founder Dietmar Hopp’s investment company. In addition, both the German government and British pharmaceutical company GlaxoSmithKline have recently invested in CureVac to the tune of 23 per cent and 10 per cent respectively.

Austrian-French company Valneva, with a research site in Vienna, is also currently working on a vaccine candidate. The company formed through the merger of Austrian Intercell and French Vivalis plans to start clinical trials of its potential corona vaccine in November or December. Against this background, the stock market price of Valneva has already nearly doubled this year.

In addition to the development of novel vaccines against the corona virus, the company is also testing the efficacy of existing drugs for treatment worldwide, with hopes resting on the drug Remsdesivir distributed by US pharmaceutical company Gilead, for one. The drug was originally developed for the treatment of the viral disease Ebola, but was never approved for this use.

Remdesivir is now regarded as one of the few effective drugs for treating severe cases of the lung disease caused by the virus. The European Medicines Agency (EMA) has recommended approval for patients aged 12 years and older. Doctors do not see Remdesivir as a panacea, but as a ray of hope for corona patients. The drug dexamethasone, produced by Nichi-Iko Pharmaceutical, has also been shown in studies to reduce mortality in patients and has now been approved for treatment in Japan.

Austrian company Marinomed set to test its active ingredient carragelose

The listed Austrian company Marinomed also wants to test its active ingredient carragelnose in a clinical study against the coronavirus. Cell tests have shown that carragelose has the potential to reduce the risk of contracting COVID-19, or possibly to treat the disease.

The biotech company already has products for the treatment of colds on the market, whereby the active substance is applied in the nose and throat. Come next year, a product for inhalation is to be launched that is effective against the virus in the lungs; “provided the clinical data allow for it,” said Marinomed CSO Eva Prieschl-Grassauer at a press conference.

With increased concentration of the active substance, more than 90 per cent of the virus could be suppressed. The product was developed for use against colds to protect the cells against penetration by viruses. A cell test has now shown that the active ingredient can also protect cells against the novel coronavirus.

ERSTE STOCK BIOTEC benefits from rising healthcare expenditure

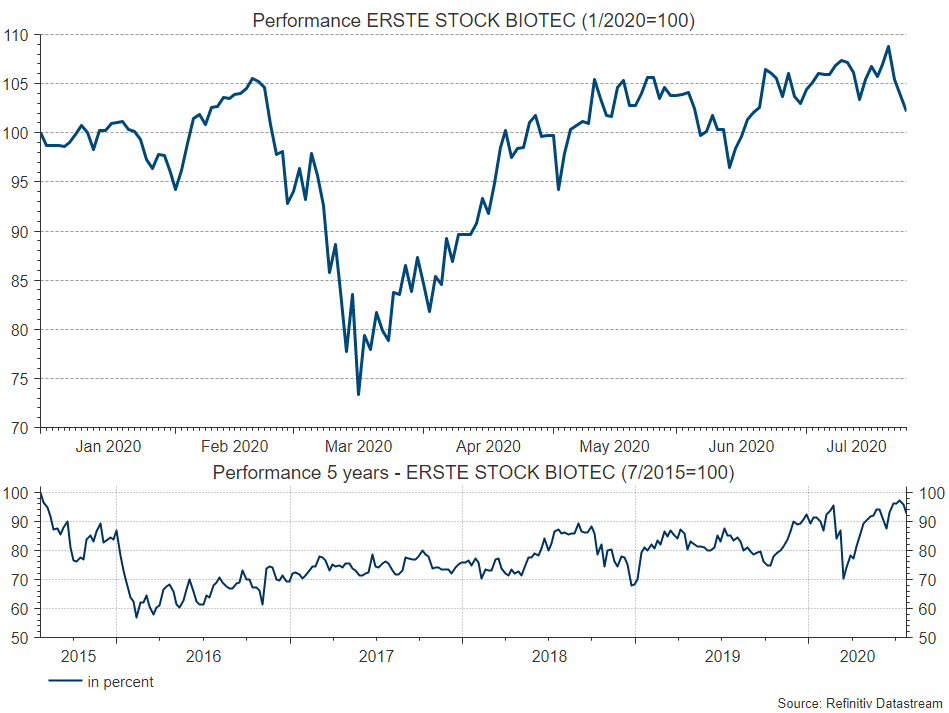

Some of the companies mentioned are also included in the portfolio of ERSTE STOCK BIOTEC. Erste Asset Management’s equity fund, which was launched in April 2000, shows a positive performance of 2.8 per cent* this year (as of 24 July 2020, source Reuters Eikon), calculated over 5 years the performance is minus 0.62 per cent per year*, see chart. Since the fund was launched, a remarkable increase in value of 8.9 percent per year* has been achieved.

Fund manager Harald Kober, who closely monitors the development of corona vaccines, does not believe that only one cure or one vaccine will achieve the breakthrough. There will be several active ingredients from different companies that have different modes of action – for example for the elderly or other groups – Kober said in an interview with the daily newspaper Die Presse. It is questionable whether this is the way to earn big money, especially since many companies want to make their products available at cost price. In addition, there are still uncertainties, for example on the question of how long the vaccinated persons remain immune or how many doses are needed.

*The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium of up to 4,00 % which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. Past performance is not a reliable indicator of the future performance of a fund.

Will Corona be “big business”?

The biotechnology sector benefits from many other fields of activity, for example the fight against different types of cancer or diseases for which no effective treatment is yet available. The Covid crisis has shown how important expensive research and development is. In view of the ageing world population, it is also necessary to advance diagnostics in order to reduce the burden on public funds. The industry will grow independently of the economic situation, emphasised Kober.

Investors who are considering entering the biotechnology sector are well advised to do so with a broad diversification, such as that offered by ERSTE STOCK BIOTEC. This is because it has often been shown in the past that the share prices of promising companies rise rapidly, but can also fall all the more rapidly if high expectations are disappointed. Conversely, the biotechnology sector promises above-average growth opportunities in view of the ageing of society and the still large number of diseases that have not been defeated. A correspondingly long-term investment horizon is essential.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.