Supply chain disruption and labor shortages in the past two years have brought social issues to the spotlight. Companies may find themselves struggling to source the key parts for production or have difficulties in attracting talented employees. The list of social issues can go on: Issues of layoffs and furlough, health and safety during the pandemic drew growing attention to the protection of labor rights; recent cyber-attacks on critical infrastructure highlighted the Achilles’ heel of modern society.

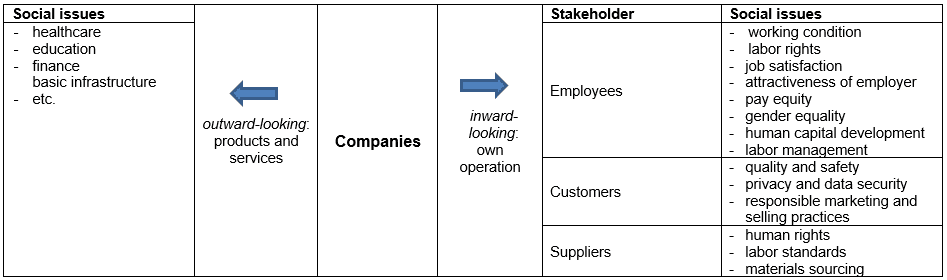

No company exists in isolation. They deal with both internal and external stakeholders of employees, customers, and suppliers. In addition, some companies directly provide goods and services with a social focus. Compared with “E”-factors (environmental) and “G”-factors (governance) of ESG rating, the “S”-factors (social) covers wide-ranging topics of which the investment industry lacks consensus. Despite the complexity, we assess social factors from two perspectives:

- How do companies interact with their stakeholders via operations?

- How do companies impact society via its product and services?

Putting ourselves in employees/customers’ shoes

Employees are vital to almost all companies. Motivated employees are more productive; by contrast, high employee turnover rates have cost implications – time, efforts and resources are needed to fill in positions and train new staff. The importance of human capital is more pronounced in the industries such as asset management, advertising, technology, pharmaceuticals as well as professional services.

While the lack of data and consistency of “S” factors continues to pose challenges in incorporating them into ESG analysis, we make qualitative assessment of companies using alternative sources on the internet. By thinking as an employee or a customer and directly looking into employee reviews and product reviews, we can gain insights of the management quality and popularity of products. Long and recent comments usually reveal some information about strength and weakness that one is not able to find in corporate reporting. We ask questions like: Would I like to work for the company if I were a job seeker? Will I buy the products after checking the reviews? By comparing with the reviews of similar companies or products, one can get an impression of how the company stands in terms of its overall management, talent development and product marketability. Third-party platforms such as Indeed, Glassdoor, Amazon, Trustpilot or discussions on Facebook and YouTube as well as specialized product review websites are places that we check. One limitation is that one must take into consideration of fake reviews, which requires some experience in identifying them.

Scrutinizing financial reports

Social issues can be material for companies. One notable example is product safety and quality. Faulty or defective products are subjected to recalls, shattering consumer confidence, tarnishing company’s reputation, and leading to losses. The Takata Air Bag Recall, which started quietly in 2008 and has since ballooned into one of the biggest recalls in history is a case of point. Total cost is estimated to exceed $24 billion, and nearly 100 million vehicles with faulty air-bag inflators made by now-bankrupt Takata were affected globally. The expenses related to product warranties are represented in provisions on the balance sheet. We can examine the assumptions made and assess whether the provisions are adequate for settlement of liability in the future.

Supply chain management and due diligence

A primary supply chain risk is the unavailability of products that are essential for a business to operate. Companies with effective, efficient, resilient, and flexible supply chains set them apart in the period of disruption. Near-shoring, diverse-sourcing, multi-sourcing and dual-sourcing strategies can be used to enhance supply chain resilience. By contrast, relying on one supplier for key parts is a warning sign.

What comes hands in hands with supply chain management is due diligence and supply chain audit. Both aim to identify any legislative and governance issues to ethical and environmental concerns risks associated with potential or existing suppliers to ensure that they uphold ethical standards and social norms. A famous case is the fast fashion retailer Boohoo, which was mired in the supply chain controversy in 2020. Companies with good supplier due diligence and regular supplier audits can mitigate such risks.

Social impact via provision of services and goods

Affordable housing, education, health, and inclusive finance are identified as four social themes in impact investing according to the PRI Impact Investing Market Map. In specific, relevant activities include managing, building or selling social housing, educational services, health facilities such as clinics or laboratories. Other examples are microcredits, SME finance and microfinance.

By conforming to criteria like the accessibility and affordability of financial services, business involved in the activities mentioned above can contribute to the UN Sustainable Development Goals, including “no poverty”, “good health and well-being”, “quality education”, “decent work and economic growth”, and “sustainable city and communities”.

In conclusion, investors are paying increasingly attention to social factors, for its wide-ranging topics and far-reaching implications. While the disclosure gap is to be fulfilled, alternative information sources and existing financial disclosure can be used to gain a glimpse of social performance of companies which investors can take advantage of.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.