Harald Kober, fund manager of ESPA STOCK BIOTEC since 2010

Biotech shares are regarded as highly promising due to the innovative strength of the sector, but they also tend to be subject to drastic price fluctuations both ways.

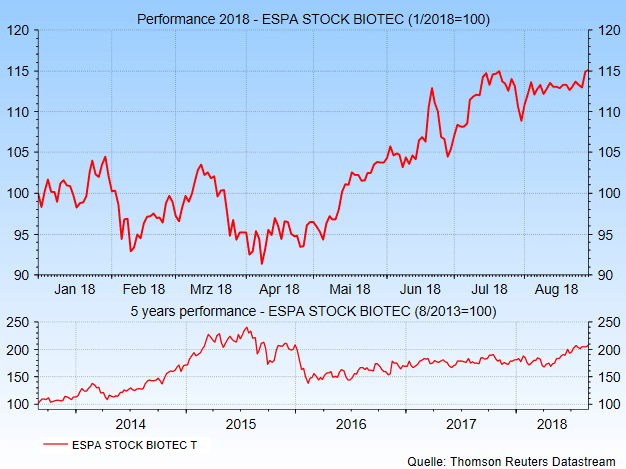

After a long period of consolidation, biotech shares have embarked on a clear upward trend since May 2018. Harald Kober, Senior Fund Manager of the equity fund ESPA STOCK BIOTEC, explains the reasons for the investors’ optimism.

What sort of performance have the listed biotech companies seen in recent months and years?

Biotech shares had been on a steady upward path for more than six years to their all-time-high in mid-2015. This was followed by a sharp correction, when Hillary Clinton, the later US presidency runner-up, announced a healthcare reform in her election campaign that would have had a negative impact on the sector in the event of her victory. Things turned out differently, as we know: while the incumbent president, Donald Trump, has let the sector know that he does not appreciate higher drug prices either, a statutory regulation is currently not up for debate.

Note: Past performance is not indicative of future development.

Biotech share prices have picked up by a substantial degree recently. What are the driving factors?

In comparison with other sectors, the entire technology sector has performed well in the year to date; the reasons are not the least internal ones: biotechnology shares currently command attractive valuations on the stock exchange, especially the Big Ten. And the sales and profit estimates for 2018-2020 suggest an increase in the double digits – the low double-digits, but the double digits all the same. In addition, we have seen numerous new studies, some of which with promising research results that boost investor confidence and have caused an inflow of capital since the beginning of June.

What kinds of innovation and research results can boost the sector? Can you give us examples?

According to an announcement by the US biotech giant Biogen, a drug against Alzheimer’s has made it through phase II of the FDA drug development process. This drug disposes of deposits in the brain, as a result of which symptoms recede. Investors reacted positively to this bit of news, and now the hope is for the drug (BAN2401) to be approved for commercial use at the end of phase III in about two years. I am a bit sceptical, as the results were not 100% unequivocal.

Apart from Alzheimer’s, what area of application seems promising from today’s perspective?

Definitely genetic research and gene technology. The so-called genome editing is a big issue at the moment. In simple terms, this refers to the method of genetic engineering by which defective genes are repaired or removed. This has recently worked on a patient for the first time. The US biotech companies Sangamo Therapeutics and Crispr Therapeutics have been pioneering this field. We are only at the outset of a broad area of applications. Perhaps many diseases can be treated at the root in some years rather than on the basis of their symptoms.

Onpattro is the first drug based on RNAI technology and approved for a small group of patients with a rare heritable disease.

All that sounds highly interesting, but what are possible stumbling blocks for the biotech sector?

An increase in sales prices above the rate of inflation should become more difficult to achieve in the future. President Trump has threatened to intervene in case the pharma- and biotech sector failed to bend to the government’s wishes. I do believe, however, that such statements have been expected, and the pharma- and biotech sector is open to compromise so as not to put new markets with large potential at risk. Governmentally regulated drug prices would definitely constitute the worse alternative.

You addressed potential mergers and investors speculating on such transactions. Are mergers still part of the narrative?

Yes, they are. Large pharmaceutical companies are still looking for small innovative biotechnology enterprises. For example, the Swiss pharmaceutical giant Novartis acquired the US company Avexis by $ 8.7 billion this year to expand its position as a leading gene therapy and neuroscience company. And Sanofi has swallowed € 3.9 billion for the Belgian company Ablynx, which is working on medicines for rare diseases of the blood system. The merger of the US company Shire with the Japanese pharmaceutical company Takeda, a deal worth $ 62 billion, is still in progress.

Investing in biotechnology shares

Investors willing to broadly diversify the high risk associated with an investment in biotechnology shares can do so by investing in ESPA STOCK BIOTEC by Erste Asset Management. The fund is invested in the most important listed biotechnology companies. Those are mainly companies based in the USA. Equities from the Pacific region and Europe carry significantly less weight, but are added in selectively. Currencies are not hedged against the euro.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.