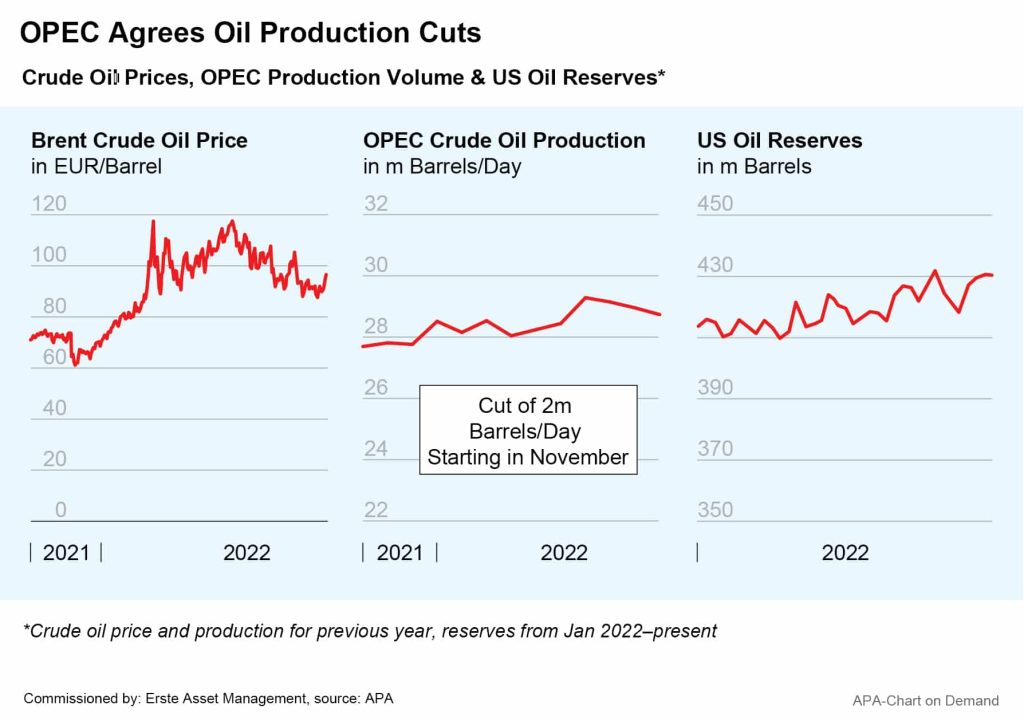

At their highly anticipated meeting last Wednesday, the OPEC+ oil alliance’s member countries agreed to cut their oil production by 2 million barrels (1 barrel = 159 litres) per day starting in November. This is roughly equivalent to 2 per cent of global oil demand. It is the largest production cut in a long time. On the markets, prices for the benchmark oil grade Brent rose from just over 91 to over 97 USD per barrel following the announcement.

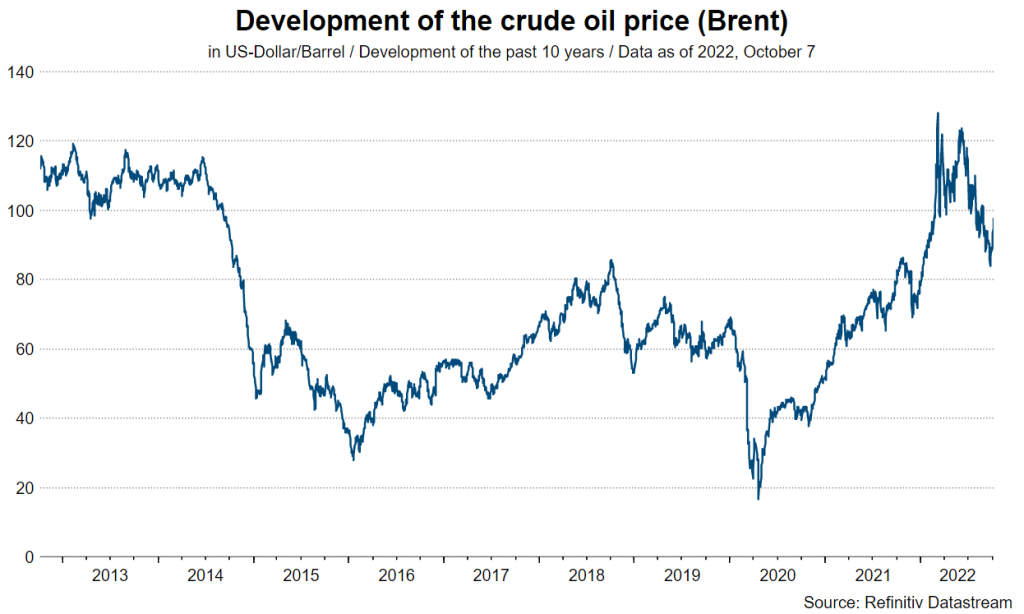

According to the association of 23 oil-producing countries, this is a reaction to the recent drops in crude oil prices. Oil prices had risen significantly in reaction to the Russian invasion of Ukraine in spring. The price of Brent crude rose as high as 138 USD per barrel at times. However, in view of the fears of the global economy slowing down and thus also a shrinking demand for oil, prices have pulled back by around 40 per cent since then, while the resilient US dollar is contributing further to the decline.

Many Countries Already Producing Less Than Agreed

In reality, however, the reaction of OPEC+ is somewhat less drastic than announced. Many member states of the alliance, such as Nigeria, Angola and Russia, are already producing less than the previous agreements allow. One of the reasons for this is the need to catch up on investments in the production infrastructure. According to the International Energy Agency (IEA), the oil cartel’s production in August was about 3.4 million barrels below the agreed level. Therefore, experts rather expect the production cut to be closer to around 1 million barrels per day.

In the Western countries, and especially in the USA, the OPEC’s decision nevertheless drew a lot of criticism. Many countries fear a renewed increase in oil prices – just before the heating season, and in a climate already rife with high energy prices and rising inflation. In addition, demand for oil as an alternative to Russian gas is bound to have increased in Europe.

US President Biden “Disappointed” and Looking for Alternatives

In a first reaction, US President Joe Biden expressed his deep disappointment about the OPEC+ production cut. In August, during a trip to Saudi Arabia, Biden had advocated a production increase. The production cut could now further drive US citizens’ fear of inflation.

For Biden, this comes at the worst possible time just before the midterm elections on 8 November. According to a Reuters poll from October, high inflation is currently the biggest concern for 30 per cent of US voters. Given low approval ratings in polls, Democrats face the possibility of losing their majorities in both chambers of Congress in the midterm elections.

Accordingly, Biden has already promised further steps against the energy crisis and inflation. “We are looking at what alternatives we have,” the US president said after the OPEC decision. One possibility would be a further release of strategic oil reserves. The US government already released 180 million barrels of strategic reserves for sale this year.

An amendment to the law is also being discussed in the USA. That could allow anti-trust measures against members of OPEC+. In view of the possible negative consequences, however, this is controversial, and the White House has also had reservations. After OPEC’s production cut and the associated diplomatic disagreement, analysts expect the “No Oil Producing and Exporting Cartels Act” – or “NOPEC” for short – to possibly be introduced after all.

Russia Seen as Possible Beneficiary of the Production Cut

Many Western countries have also interpreted the production cuts as indirect support for Russia’s war economy. In September, Russia produced 9.9 million barrels of oil per day instead of its target quota of 11 million. With the new OPEC agreement, the target was lowered to 10.5 million barrels. This is still above the current production rate.

Russia would therefore effectively not have to cut production at all, but might nevertheless profit from the resulting price increases. Although the most recent EU sanctions against Russia provide for a price cap on Russian oil, it is expected that Russia will increase its deliveries to other countries as a result. A supply shortage could also push other importing countries to buy Russian oil. However, OPEC itself has meanwhile firmly denied any political motives for its decision.

Profit from higher oil prices with ERSTE STOCK COMMODITIES

Investors can profit from higher oil prices with ERSTE STOCK COMMODITIES. The equity fund invests worldwide primarily in commodity companies and thus also in major listed oil producers. The investment strategy aims for a balanced portfolio from the commodities and energy sectors, with an overweighting of companies from the developed markets.

In the so far difficult stock market year 2022, ERSTE STOCK COMMODITIES was able to achieve a plus of around 2.7% (as of 10.10.2022). Looking at the past ten years, the value growth is 3.9% per year on average (source: Erste AM, OeKB as of the beginning of October, excluding front-end load and any individual transaction-related or ongoing income-reducing costs).

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.