The price of oil is one of the most important global economic indicators – for countries, companies and consumers alike. However, for several months now, the price of crude oil has been moving in only one direction – downwards. The market is primarily focused on the prices of Brent and WTI oil. Both recently fell to a new four-year low. In this article, we explain why this is the case, what the latest decisions by OPEC+ have to do with it and what effects on markets and investors are conceivable.

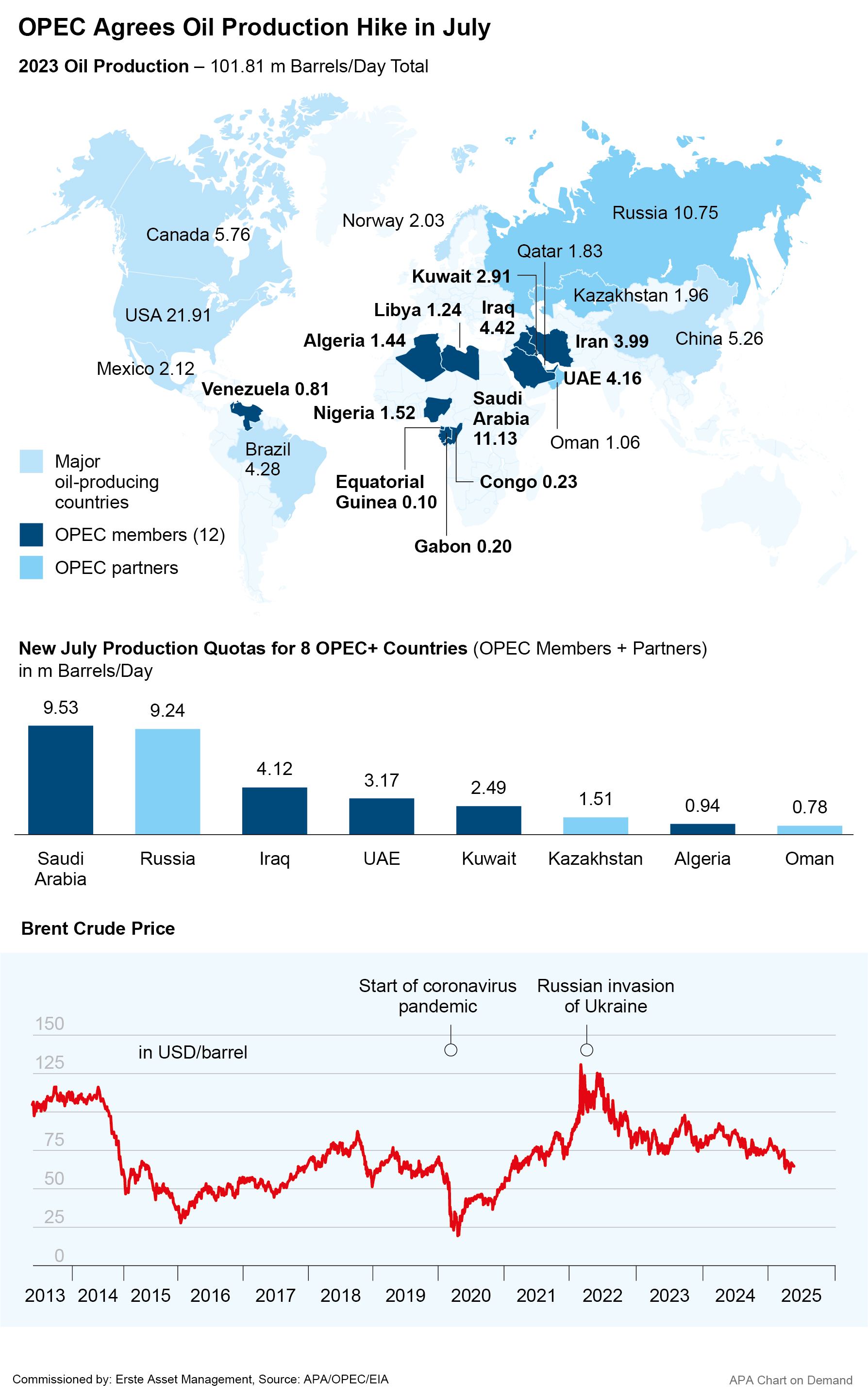

Eight OPEC+ Countries Agree to Hike Oil Production in July

A core group of OPEC+ oil cartel members have announced an increase in their production volumes despite the recent weakness in oil prices over the summer, continuing the hike started in the spring. The eight countries, including Saudi Arabia and Russia, will increase their combined daily production by 411,000 barrels (1 barrel = 159 litres) in July, according to a statement issued after an online meeting the group held over the weekend. Decision was made in light of “steady global economic outlook and current healthy market fundamentals,” the group said.

The move had already been anticipated by the markets and is therefore unlikely to have a significant impact on oil prices. Oil prices are currently also supported by geopolitical tensions: there has been no noticeable progress recently in the negotiations between Russia and Ukraine or in the nuclear talks between the US and Iran. In addition, the US dollar’s recent weakness has stabilised oil prices, as it makes oil cheaper in other currencies.

The OPEC+ group is comprised of the Vienna-based Organisation of Petroleum Exporting Countries (OPEC), led by Saudi Arabia, and additionally, oil-producing partner countries such as Russia. Together, they are responsible for around 40 per cent of global oil production. According to the group’s latest data, OPEC+ produced around 40.9 million barrels per day in April.

Please note: Past performance is not a reliable indicator for the future performance.

Oil Cartel Abandons Strategy of Stable Oil Prices With Production Cuts

Until recently, OPEC has attempted to keep the oil price stable at 90 USD per barrel by artificially restricting supply. Saudi Arabia, OPEC’s largest oil producer, relies on this oil price to cover its government spending. In recent years, the cartel’s eight core countries have cut production by 2.2 million barrels to support the oil price.

Recently, however, the OPEC countries have moved away from this strategy. In May and June, the core countries decided to increase production despite falling oil prices, making July the third consecutive month in which OPEC+ has increased production triple the originally planned amount. This comes at a time, when the dispute around US tariffs is currently weighing on global oil demand and thus on the oil price.

Concerns about the impact of the trade dispute are weighing on oil prices

In 2008, the price of Brent, the key benchmark oil grade, reached its previous record high of over 140 USD per barrel. Following Russia’s invasion of Ukraine, prices approached this high again. However, expectations of falling oil demand caused prices to drop continuously. In addition, concerns about economic slowdown and thus weaker demand in China, the world’s largest oil importer, have recently been compounded by fears of the economic consequences a further escalation of the tariff wars could have. Following the announcement of numerous tariff increases by US President Donald Trump in April, the price of Brent intermittently fell below 60 dollars per barrel, reaching a four-year low. Since then, the oil price has currently stabilised just above this level.

Production Hike Could Be a Response to Kazakhstan Exceeding Production Quota

However, with the production hike, the group of eight OPEC+ countries now risks further a further oil price drop, meaning lower revenues, and one possible reason for this is conflicts of interest within the cartel itself: Kazakhstan is not complying with its agreement to reduce production. The Central Asian country is exceeding its production quota by some 350,000 barrels per day, causing growing dissatisfaction, particularly among Saudi Arabia, OPEC’s premier producer. Experts believe that, with the hike, the eight-country core group could now try to punish Kazakhstan and regain market share from the country.

Kazakhstan has repeatedly asked for a higher production quota in the past, without success, and has announced that it will put national interests before OPEC interests. Unlike in other countries such as Russia, oil production in Kazakhstan is largely in the hands of private, international companies. These companies have previously invested in production capacities such as the expansion of the important Tengiz oil field and will not be easily persuaded by the government to reduce their production volumes.

(c) Maxim Shemetov / REUTERS / picturedesk.com

Production Increases Could Hurt the US Oil Industry

With their latest production increases, the eight core OPEC countries might however also try to wrestle market share away from the US. The US has gradually expanded its production volumes in recent years and currently produces nearly 20 million barrels per day. This means that US production is roughly equal to that of the two largest OPEC+ producers, Russia and Saudi Arabia, combined.

The US is currently able to meet its oil needs entirely on its own and is not dependent on imports. However, shale oil production, which is important for the US, is expensive. According to experts, US shale oil producers need oil prices of 50 to 60 dollars per barrel to operate profitably. OPEC countries such as Saudi Arabia can produce oil much more cheaply and therefore remain economically viable even at lower prices. The OPEC+ countries may therefore be deliberately risking further oil price declines in order to force US producers out of the market. Market experts expect that this could, of course, prompt new retaliatory measures from US President Donald Trump.

Conclusion: Oil market caught between price pressure, politics and power games

Current developments on the oil market show that OPEC+ is increasingly moving away from its previous price stabilisation strategy. Repeated production increases despite falling prices point to internal tensions – for example with Kazakhstan – and a possible strategic shift towards securing market share, even at the expense of short-term revenues. At the same time, the global oil price is being weighed down by geopolitical uncertainties, the US dollar exchange rate and subdued demand, particularly in China.

The US, the largest oil producer alongside Saudi Arabia and Russia, is coming under pressure as its shale oil production is under economic strain at current price levels. As the oil price is also considered an important indicator of the development of the global economy in general, the price slump of recent months makes one thing clear: the increasing tensions surrounding the tariff dispute initiated by the US will not leave global economic growth unscathed.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.