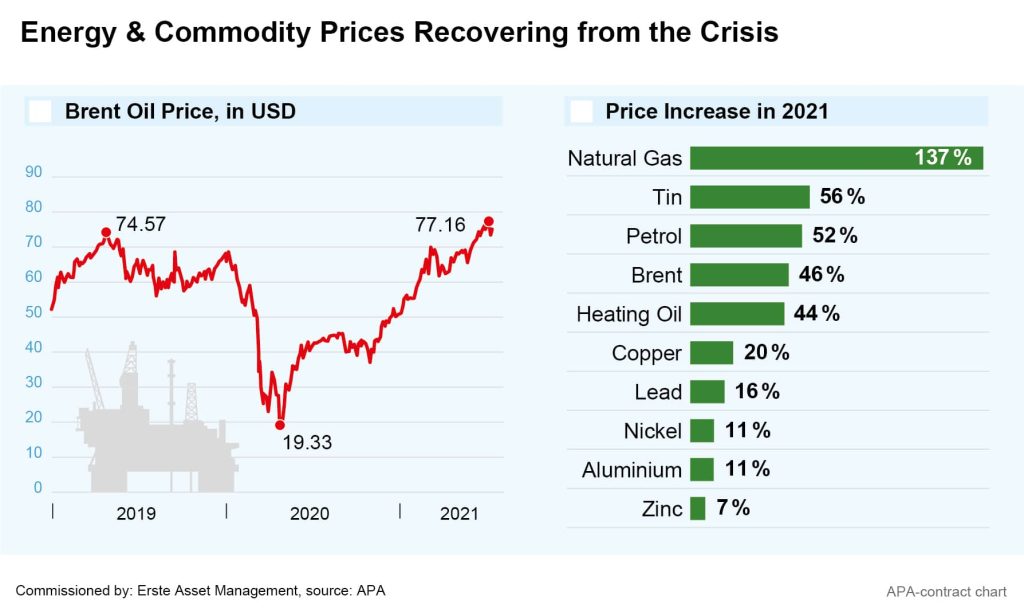

Oil prices have recently continued their rapid recovery after the surprising failure of the latest OPEC negotiations, climbing to multi-year highs. During several rounds of negotiations last week, the ministers of the OPEC+ countries, consisting of the OPEC member states and other important oil producing countries such as Russia, were unable to agree on an increase in production quotas. On the futures market, the price for a barrel of North Sea Brent crude intermittently rose to around 78 dollars per barrel, its highest price in more than two years. The important US benchmark grade West Texas Intermediate (WTI) rose to around 77 dollars, more than at any time since 2014.

This marks a multiple increase in oil prices since their lows in the spring of 2020. Brent, for example, had intermittently fallen to below 20 dollars a barrel shortly after the Corona pandemic’s escalation. The drop in demand as a result of the lockdowns and restrictions in the transport sector in order to combat the pandemic, but also a price war between the important producing countries Saudi Arabia and Russia, led to a dramatic oil price crash at the time. As a result, however, the oil cartel OPEC was able to agree a cut in production volumes with Russia and other important cooperation partners and thus halt the oil price collapse. OPEC’s production discipline combined with a global resurgence of oil demand led to a rapid price increase on the oil market.

However, not all OPEC countries are now likely to be pulling in the same direction following the recovery. In view of the continuing price increases following the increasing success of global Corona vaccination programmes as well as related inflation fears, the oil-producing countries wanted to negotiate a cautious increase in production quotas. According to reports, the important OPEC countries Saudi Arabia and the United Arab Emirates in particular did not reach an agreement.

The Emirates criticised the plan for a generally restrictive production policy with a slow and gradual increase in production. As a condition for approval, the country demanded an increase in its own production quota, but Saudi Arabia did not want to grant the Emirates any special rights. The conflict is probably about more than just oil prices: according to some experts, the conflict is also a political competition between the two countries for influence and power in the Gulf region.

Rising energy prices fuel inflation fears

The oil price surge triggered by the failure comes at an inopportune time. Not only oil prices, but also other energy prices had already risen sharply this year. On the Leipzig electricity exchange, for example, quotations for electricity deliveries in the coming year have more than doubled since March 2020 to over EUR 70 per MWh, the highest price for wholesale electricity in nearly 12 years. Prices of several important industrial metals also increased significantly in the first half of the year. The price increases were recently already clearly reflected in the producer price statistics of important industrialised countries.

According to the latest data from the European Statistical Office Eurostat, producer prices in the Eurozone were 9.6 per cent higher in May than in the previous year, the strongest increase since the beginning of the monetary union in 1999. In the USA, producer prices rose by 6.6 per cent in May, the largest increase since the beginning of the survey.

Since producer prices are also reflected in consumer prices with a certain time lag, these data have further fuelled recent inflation fears. Rising inflation could force central banks to take countermeasures and thus end their loose monetary policy earlier, which in turn could slow down the ongoing economic recovery.

In the short term, a further rise in oil prices appears likely. The recovery in demand is likely to be countered by a further tightening of supply. The US Department of Energy recently reported steadily falling crude oil inventories. Most recently and surprisingly, inventories decreased sharply by 6.9 million barrels to 445.5 million barrels.

Declining production discipline, Iran agreement and shale oil comeback could end oil rally

In the medium term, however, the oil price rally could come to an end. Several experts see the latest OPEC rift as a harbinger of an increasingly weakening cohesion among the cartel members. Rising oil prices could increase the motivation of some countries to pull out of production agreements and produce more. This could lead to new price wars and thus to falling oil prices.

A return of Iran to the oil market could also ease tensions. In 2018, under then-President Donald Trump, the USA withdrew from the nuclear agreement with Iran and imposed severe financial and oil sanctions on the country, after which Iran then gradually violated the conditions. However, under the new US presidency talks are now underway again to revive the agreement. Should this succeed, larger quantities of oil from Iran would also come onto the market in the near future.

Finally, further oil price increases could also lure US shale oil producers back into the market, putting an end to the oil price rally. With last year’s price drop, the cost-intensive fracking process for extracting oil and gas from deep shale reservoirs became unprofitable, but higher oil prices could make the extraction of the vast shale gas and oil deposits in regions like North America profitable again.

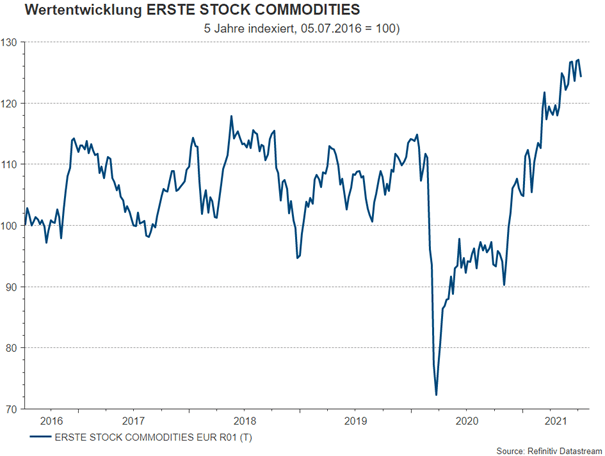

„Nibbling“ on the price increase of energy and raw materials

The ERSTE STOCK COMMODITIES equity fund offers the opportunity to benefit from the rise in prices for energy and raw materials. Companies from the oil and natural gas sector and related equipment, refinery and transport companies currently represent more than half of the fund’s assets. In addition to oil stocks, companies from the metals and mining sector, the steel industry, the paper and building materials industry and gold mines are also represented in the fund. This ensures diversification across a large number of shares and sectors, which is also advantageous from the point of view of the fundamentally higher volatility of such shares.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.