Trends come and go. This also applies to the equity markets. Some trends are currently very popular, e.g. artificial intelligence. Other topics, such as stocks from the biotechnology sector, were less popular on the markets last year, for various reasons.

Are things going to change now? The healthcare sector has been in the spotlight again since the beginning of the year: biotechnology stocks could gain momentum thanks to successes in research and market approvals of new drugs.

👉 What will you read in this article?

❔ What does “biotechnology” mean?

In biotechnology, organisms (e.g. bacteria, fungi, cell cultures) or their components (e.g. enzymes, other proteins, etc.) are used for technical processes.

🧪 Where is biotechnology applied?

Biotechnology is applied across numerous fields: in medicine, antibodies are produced for the diagnosis and treatment of diseases. In agriculture, crops are bred for higher yields and resistance to pests and diseases. Biotechnology is also a crucial component for the development of biofuels, which are produced from renewable resources. In environmental technology, certain biotechnological applications contribute to the remediation of soil or wastewater.

💰 How can I invest in biotechnology?

The biotechnology sector provides investors with a wide range of investment opportunities in companies involved in the development of new drugs, diagnostics, genome analyses, and other biotechnological products. It should be noted that biotechnology stocks contain a higher level of risk than other sectors due to high research and development costs, stringent regulatory requirements, and uncertainty regarding the approval of new products.

Investment funds such as ERSTE STOCK BIOTEC diversify the risk across a large number of promising companies, some of the best-known of which include Amgen, Biogen, Gilead Sciences, Vertex Pharmaceuticals, and Regeneron Pharmaceuticals.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. The portfolio positions listed may change at any time as part of active management. There is no guarantee that securities will be permanently included in the portfolio. An investment in securities entails risks as well as opportunities.

👩🔬 What are the perspectives that the biotechnology sector offers?

The biotechnology sector has generated strong growth for years, with a high level of innovation and promising prospects for future developments. One of the main drivers of this growth is the increasing demand for biopharmaceutical products, such as antibodies or vaccines, due to rising healthcare costs and an ageing population. The demand for personalised medicines and the use of gene therapy technologies should also boost growth in the sector.

Competition within the industry is high, and the development of new products is extremely cost-intensive, leading to high market concentration. Note: Please note that an investment in securities entails risks in addition to the opportunities described.

🌎 Which are the most interesting biotechnology markets?

The biotechnology market is unevenly distributed in terms of its geography: North America is traditionally leading the way, followed by Europe, and Asia-Pacific. Asia-Pacific’s market share is expected to increase in the coming years as countries such as China and India invest in the biotechnology industry and are able to offer lower costs and a growing number of drugs admitted for sale.

Overall, the growth factor of the biotechnology industry is significant due to its high level of innovation and potential in future medicine. However, it remains vulnerable to regulatory and macroeconomic developments. This was also the case last year, when the sector came under pressure due to key-lending rate hikes and the resulting increase in financing costs. Note: Prognoses are not a reliable indicator of future performance.

🔍 Interview with fund manager Harald Kober

We spoke with Harald Kober, senior fund manager of ERSTE STOCK BIOTEC, about the current market environment, opportunities, perspectives, and challenges of 2024.

While last year was tricky, we might be seeing a trend reversal this year already. How do you assess the recent performance?

Harald Kober: 2023 was indeed difficult and disappointing in terms of performance if you compare biotech shares with the big tech giants such as Google, Apple or Microsoft, for example. But the things that weighed on the market, such as high interest rates, are now priced into the shares. When interest rates come down again, which we expect to happen from the middle of the year onwards, the traditionally smaller companies in the biotechnology sector will find it easier to do business. That’s also when the investors’ risk appetite will increase again (Note: Prognoses are not a reliable indicator of future performance). The development that we have seen in the year to date has been encouraging, and as far as an investment in the sector is concerned, please let me resort to the well-known saying: “The early bird catches the worm”.

Harald Kober

Fund manager

The early bird catches the worm.

What could drive stocks from the biotechnology sector in 2024 in particular?

Definitely takeovers and takeover fantasies. Large, well-funded companies in particular are on the lookout for niche players with innovative products and promising research results. At the same time, the number of IPOs could also increase again. After 2020/2021, the IPO market practically came to a halt for a while. Then again, the takeover of Seagen by Pfizer at the end of the previous year was a real megamerger, from which ERSTE STOCK BIOTEC benefited. The takeover of Reata Pharmaceuticals by Biogen in July contributed positively to the fund’s performance as well. Biogen thus secured a promising drug for the treatment of inflammatory diseases. Another highlight was the acquisition of Iveric Bio (specialising in retinal diseases) by Astellas in April. ERSTE STOCK BIOTEC was also invested here.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. The portfolio positions listed may change at any time as part of active management. There is no guarantee that securities will be permanently included in the portfolio. An investment in securities entails risks as well as opportunities.

Could you name examples or use cases that might trigger a takeover?

I am thinking, for example, of obesity and Alzheimer’s disease. The large pharmaceutical and biotechnology groups have bulging coffers and, with the exception of the “obesity shares”, Eli-Lilly and NovoNordisk, are trading at historically low price/earnings ratios (P/E ratios). Larger companies also want to widen their positioning in oncology. One topic that we want to address more in ERSTE STOCK BIOTEC is cystic liver inflammation (NASH research). Small and medium-sized enterprises are leading the way in research and development in this area. To this day, there has been no effective treatment for this disease. In 2024, sales of the Alzheimer’s drug LEQEMBI from Biogen/Eisai should also pick up momentum and open up a market with the first new drug in 20 years.

The commercial success of Syfore from Appelis Pharmaceuticals in dry, age-related macular degeneration (disease of the centre of the retina of the eye) is also significant. We are focussing on companies (see also above) with a future-oriented business model and promising drug developments. Other examples include the shares of AstraZeneca (focus on oncology, strong sales and earnings growth in the coming years) and Biogen (has received approval for a new Alzheimer’s drug that reduces protein deposits in the brain and is therefore expected to slow the progression of the disease).

A company that does not really convince us is the German MorphoSys, for which the Swiss pharmaceutical group Novartis has recently made a takeover bid.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. The portfolio positions listed may change at any time as part of active management. There is no guarantee that securities will be permanently included in the portfolio. An investment in securities entails risks as well as opportunities.

What do you pay attention to in particular as fund manager when making an investment?

We take a close look at the pricing policy. This is important in the entire business. By this I mean whether a company succeeds in achieving sustainable, competitive prices for its innovative drugs over a sustainable period of time. After all, the sustainability of a biotech drug is jeopardised if something better comes along quickly, regardless of whether it is about fighting cancer or alleviating Alzheimer’s or eye diseases.

How do you currently rate biotechnology stocks in economic and valuation terms? What role does artificial intelligence play?

I am cautious when it comes to moulding the developments I mentioned earlier into a set of figures. But I am not the only one who is convinced that the biotechnology sector will be growing at a faster pace than the economy as a whole over the next few years. Biotechnology shares are moderately valued at the moment. The topic of artificial intelligence (AI) will be particularly important in preclinical research. The experience gained will accelerate the development process through AI.

Investors are currently focusing even more on commercial biotechnology companies with sales and profits that do not require any major volume of external finance. Small and mid-sized companies with very low valuations will be able to benefit more from a positive sector sentiment than large-capitalised companies.

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Money tip: Investing in biotechnology stocks

Where does ERSTE STOCK BIOTEC excel?

ERSTE STOCK BIOTEC invests primarily in companies in developed markets in the biotechnology sector. The fund’s investment process is based on fundamental corporate research. The majority of companies in this area are based in the USA. As a result, shares from the Pacific region and Europe tend to play a subordinate role in the fund.

Over the past ten years, the fund value has recorded a performance of 5.52% per year. With the investments outlined above, we are convinced that we have laid the foundations for a promising long-term performance.

Note: Past performance is not a reliable indicator of future performance.

How has the fund performed?

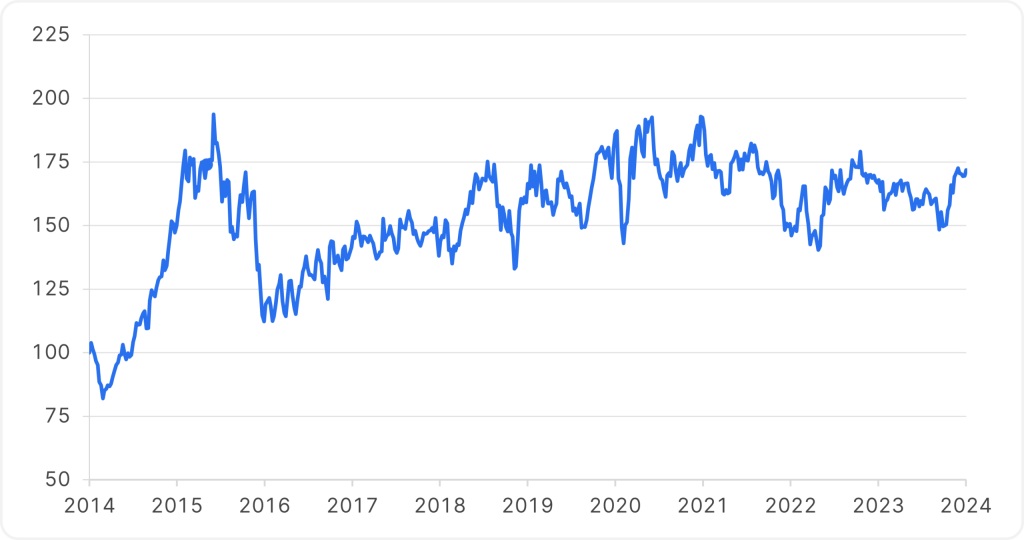

Performance of ERSTE STOCK BIOTEC over the past 10 years

Note: Chart is indexed (17.2.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Opportunities and risks at a glance

Advantages for the investor

- Broadly diversified investment in biotechnology companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the fund can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Hinweise zum ERSTE STOCK BIOTEC

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE STOCK BIOTEC as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK BIOTEC, consideration should be given to any characteristics or objectives of the ERSTE STOCK BIOTEC as described in the Fund Documents.

More articles on the topic of equities 👇

No Posts Found

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.