From 12 to 16 June, an investor trip to Uzbekistan took place at the invitation of Invest in Visions, in which Martin Cech, the fund manager of ERSTE RESPONSIBLE MICROFINANCE, participated. In the first part of his travel report, he writes about the visits to several banks that also specialise in lending to Small & Medium Sized Enterprises (SME) and microcredit. In addition, he also visited some microfinance institutions (MFIs) whose main business is the granting of microcredits. Finally, the programme included an exchange with representatives of the Uzbek Central Bank.

The country of Uzbekistan

With an area of about 450,000 km2 and a population of about 36 million, Uzbekistan has been an independent state since 1991. The capital of the predominantly Muslim country is Tashkent in the north-east of the country.

Local economic growth is currently between 5.5% – and 6.0% p.a., the inflation rate is in double figures with a slight downward trend recently – the target value is 5% p.a.. The key interest rate is currently at 14% after a reduction of 3%. Uzbekistan is currently the third highest weighted country in the ERSTE RESPONSIBLE MICROFINANCE with a share of 4.53%.

Hamkorbank

Hamkorbank (“Partner Bank”) is the highest weighted MFI in the ERSTE RESPONSIBLE MICROFINANCE with a share of 2.14% and is based in the city of Andijon in the Ferghana Valley. The bank was established in 1991 and was a pioneer in raising foreign

The bank, which employs around 3,000 people, has 150 outlets, 60 of which are branches. The bank is ranked 4th in the country in terms of profitability, has a strong position in retail, microfinance, money transfer and small & medium sized enterprises and has an S&P rating of B+ with a positive outlook. The bank has 1.8 million customers, of which 40,000 are enterprises. On the lending side, there are 187,000 retail customers (consumption, real estate, car loans, microfinance) and 20,000 business customers. The ratios have improved strongly again, PAR Zero+ (overdue loans) is 1.2%, PAR 90 (late payments of 90 days or more) is 0.6%. During the Corona period, more than 50% of the loans had to be restructured, which was a significant effort for the risk management department.

Impact: Impact programme in cooperation with Asian Development Bank: financing of female business owners, energy efficiency project, various solar energy projects pushed by the government, strong growth of e-mobility, cooperation with EBRD (European Bank for Reconstruction and Development) on technical support for start-ups.

Outlook: Promotion of digitalisation, focus on SME and private customers; possible IPO in the medium term.

Ipak Yu´li („Silk Road“)

The institute has a share of 1.33% in the fund. Ipak Yu’li was founded in 1990 and its shareholders include institutions, private companies and individual investors from Uzbekistan, as well as a microfinance fund from the Netherlands.

Outlook: Digital transformation, focus on retail, microfinance and SME. The bank wants to be “the fastest, highest quality bank, but it is not cheap”. Customers are mainly from the retail (SME), service, manufacturing, transport and communication sectors; textile has only a 2% share. The total loan volume is around USD 700 million. The share of non-performing loans (NLP) peaked at 7% and is currently around 2.5%. During the Corona period, about 55% of loans were restructured, maintaining an open dialogue with clients. The bank has about 2,000 employees in 17 branches scattered throughout the country.

RU/UA conflict: Many business sectors suffer from regulations and sanctions against Russia: Uzbekistan generally wants to stay out of the war in Ukraine. In addition to inflows from Russia, there was a strong influx of IT experts and skilled workers from Russia. This led to a strong increase in property prices and thus to a shortage of supply.

Impact: Support for the purchase of e-mobility (10%) and photovoltaic systems (20%). Agreement with EBRD on green financing (renewable energy, energy efficiency) and women in business.

MKBank (Mikrokreditbank)

The bank has a 0.11% share in ERSTE RESPONSIBLE MICROFINANCE. MKBank was founded in 2006 and is the third largest commercial bank with 162 branches scattered in all regions of the country. The focus is on SME clients and the loan portfolio amounts to around USD 1.2 billion. The bank is fully state-owned and has a rating of Ba3 or BB-. Around 3,400 employees serve 250,000 business and 660,000 private customers.

Online loans up to 30,000 USD can be granted, the term is 6 or 12 months, NPL is below 1%. A commitment can be made within 15 minutes after checking via credit bureau and taxes. Manually, a loan commitment is made within 2 days.

Micro-loans to women have an average amount of around USD 5,000-10,000 and are mainly used for services, agriculture, facilities such as kindergartens as well as retail, the NPL here is very low at 0.3%. Interest rates on loans are around 24% in local currency UZS, 12%-14% in USD and 11%-13% in EUR. There are socially subsidised loan programmes by the state for a maximum of USD 25,000; these are used for social entrepreneurship and family businesses, among others. The interest rate here is 15%, the government subsidy 10%.

Impact: Solar panels in all branches generate 40% of the required electricity. There is also an ESG policy with a focus on corporate governance.

Funding is favoured in UZS; loans in USD and EUR are also possible. One challenge is competition; with many new banks or fintechs opening with similar products, speed and proximity to the customer is what counts.

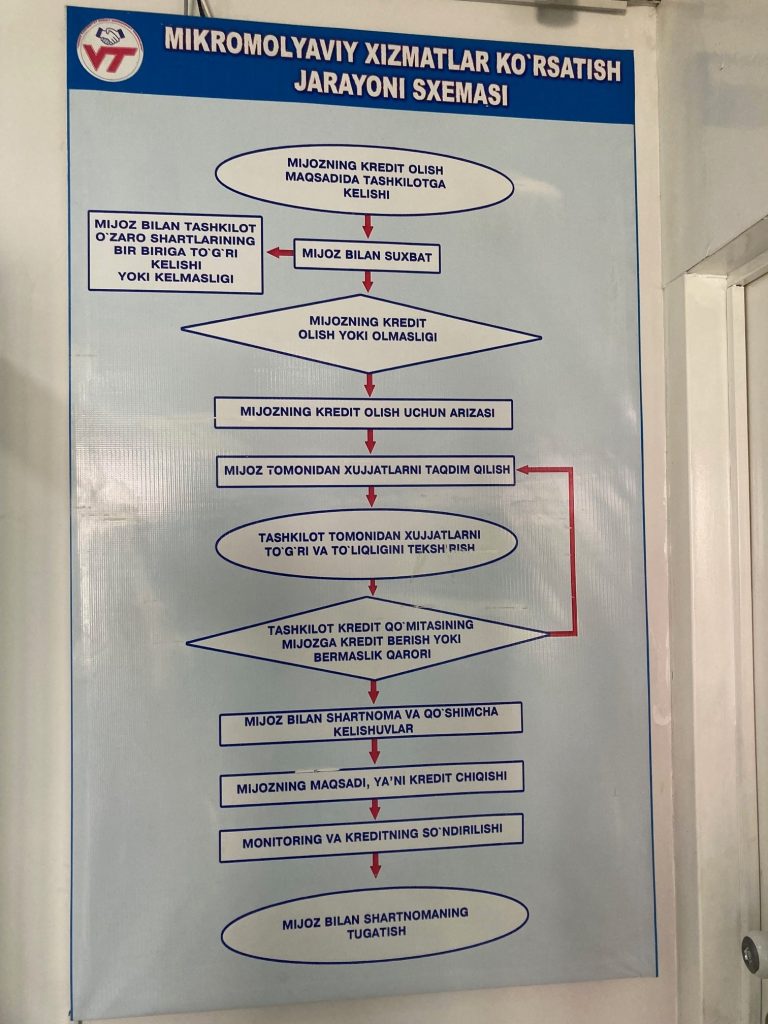

Vodiy Taraqqiyot MFI („Developing Values”)

The institute’s share in the fund is 0.05%. MFI, with 5 branches/outlets, was established in 2015 and currently has 115 employees. The company is based in the town of Buvayda in the Ferghana Valley. 97% of the shares are held by the founder and his son, who is also operational. Due to expansion and restrictions on licensed MFIs, a separate MFI – Imkon for Household Appliance Finance – was established.

The total assets amount to USD 21 million and so far loans amounting to USD 20.1 million have been granted to 13,000 borrowers. The average loan amount is EUR 2,000, with interest rates ranging from 30% to 32%. 400 loans are overdue, 109 current cases, after 90 days legal action is taken. Vodiy has a share of around 10% of the Uzbek MFI market.

82% of the loans are microloans to individuals, 17% are car-secured loans to individuals (occasionally also secured by jewellery). 78% of the loan clients are male, 22% are female. The loans are mainly used for trade, agriculture, services (e.g. taxi).

PAR Zero+: 3.6%, PAR 30: 1.8%. In the event of a delay of more than 30 days, an on-site visit is made and a joint attempt is made to restructure the loan. Borrowers are not trained on an ongoing basis, but on an ad hoc basis; customer protection principles are being developed. Group lending is possible but not popular in Uzbekistan. Customer acquisition is done by word of mouth and flyers. Vodiy Taraqqiyot MFI can rely on a stable client base.

40% of the clients are under 30 years old, loans run for 12 or 24 months. There are “microloans” up to a maximum of EUR 4,000 and “microcredits” up to a maximum of EUR 25,000.

Credit applications are processed through a centralised credit bureau and a decision is made within two hours. For new clients, there is an on-site visit. During the Corona period, up to 40% of the loans had to be restructured. One goal is to grant up to EUR 800 directly without collateral via Mobile Verification in the future. Staff benefits include a canteen (breakfast/lunch), a guest house for staff and a training programme for new recruits. Client files are kept in the office for one year and in an archive for 10 years.

Fortuna

Fortuna has a 0.04% stake in the fund. The institution is based in Ferghana and was established in 2018…. Assets under management amount to USD 50 million. There are currently 263 employees in the 6 branches, of which 138 are loan officers.

ERSTE RESPONSIBLE MICROFINANCE is a fund of funds that invests in microfinance funds or bonds on microfinance instruments and funds as well as up to 10% in shares in companies and microfinance institutions. Foreign currencies are mostly hedged. The investment decision focuses on a measurable positive impact on the environment or society.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Portfolio positions of funds disclosed in this document are based on market developments at the time of going to press. In the course of active management, the portfolio positions mentioned may change at any time.

The companies listed here have been selected as examples and do not constitute an investment recommendation.

Advantages for the investor

- Global lending in particular to individuals in emerging markets is supported.

- Correlation is low compared to traditional asset classes.

- Opportunity for long-term attractive earnings.

Risks to be considered

- With regard to the modalities regarding the issue and redemption of unit certificates, please note the key investor information / KID and § 21 AIFMG point 10.

- Investments are made in alternative investments, which in particular involve increased liquidity risks.

- Due to the investment in foreign currencies, the net asset value in Euro can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For further information on the sustainable focus of ERSTE RESPONSIBLE MICROFINANCE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current §21 AIFMD Document, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE MICROFINANCE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE MICROFINANCE as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.