The equity market is one of the most productive parts of an economy. Listed companies are being closely monitored by many market participants and must therefore deliver results for their shareholders.

The equity market distinguishes between companies that rely on a business model that promises new growth opportunities (growth shares), e.g. in the field of artificial intelligence, and companies that are more active in traditional sectors and industries and regularly pay dividends (value shares).

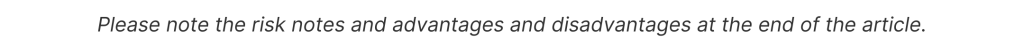

Global equities – performance in recent years:

Global equities overall vs. global growth shares and global value shares (09/2004 – 09/2023)

Note: Past performance is not a reliable indicator of the future performance of the fund. Representation of an index, no direct investment possible. The indices mentioned were used for comparison purposes only. The comparative indices have no influence on the discretionary power of the management company in selecting the assets of ERSTE FUTURE INVEST.

Growth shares have the edge

Since the 2010s, growth-oriented shares have clearly outperformed traditional companies. This has to do with the enormous technological developments that we have seen since the turn of the millennium.

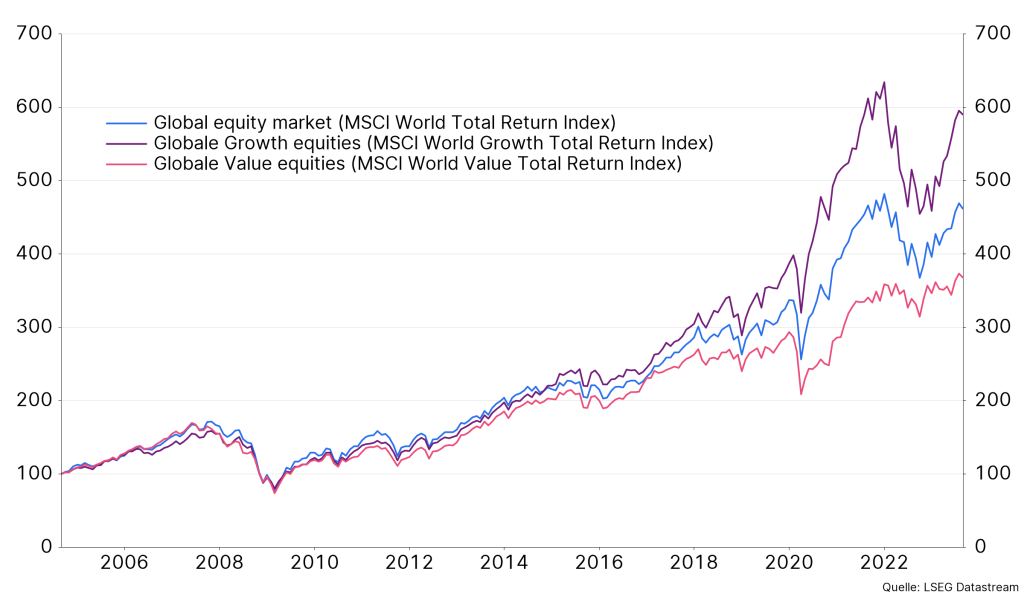

We are at the beginning of far-reaching developments in people’s lifestyles, the use of new technologies (e.g. artificial intelligence), ground-breaking advances in healthcare or in the environment (e.g. clean energy). Megatrends generate growth and thus opportunities for investors who invest in the most exciting companies.

Does it make sense to invest in megatrends?

Over the past years, it would have made sense to invest in megatrends and the growth companies behind them. At the same time, the past performance of investments is no guarantee that they will continue to perform positively in the future.

What is more interesting, therefore, is the future, long-term earnings potential of investments in megatrends. Let’s ask one of the megatrends itself – artificial intelligence:

ERSTE FUTURE INVEST: a future-oriented investment in megatrends

Megatrends therefore have the potential to last for many years and to bring about significant changes in all our lives. ChatGPT is also convinced that investors can benefit from the growth opportunities that these trends offer. However, as the artificial intelligence-based chat service points out, thorough research and balanced diversification are particularly important.

The first piece of good news: with a fund, you don’t have to worry about that. You invest broadly across many companies. The research that helps identify the best and most promising companies is done for you by the fund management team.

The second piece of good news: the broadly diversified and global ERSTE FUTURE INVEST equity fund gives you the chance to invest directly in five megatrends:

- healthcare & pension,

- lifestyle,

- technology & innovation,

- environment & clean energy, and

- emerging markets.

In the selection process, shares are selected that belong to one or more of the above-mentioned trends. The individual shares are selected on a qualitative basis by a fund manager. The fund is broadly diversified and invests globally. There are currently around 60 companies in the portfolio, with a small proportion of special equity funds blended in (e.g. topics such as biotechnology, robotics, digital security).

Top 15 in ERSTE FUTURE INVEST:

| Company | Megatrend | Country |

| Microsoft | Technology, Software, Innovation | USA |

| Nvidia | Artificial Intelligence | USA |

| Novo Nordisk | Nutrition, Lifestyle | Denmark |

| Amazon | E-Commerce, Digital Services | USA |

| Alphabet | Technology, Innovation | USA |

| Biotech-Aktienfonds | Demographics, Healthcare | Global |

| ASML | Technology, Innovation | Netherlands |

| Scout 24 | Lifestyle | Germany |

| Fisery Inc. | Payment service provider | USA |

| ABB Ltd. | Energy supply, Industry, Transport | Switzerland |

| EnerSys | Leading provider of batteries, chargers etc. | USA |

| Mastercard | Global payment service provider | USA |

| Stryker Corp. | Medical engineering | USA |

| Abbot Laboratories | Pharmaceutical and medical products | USA |

| Taiwan Semiconductor | Semi-conductors | Taiwan |

Source: Erste Asset Management; the data is based on the market development as of the editorial deadline (28 September 2023). In the context of active management, the portfolio positions mentioned may change at any time. The companies listed here have been selected as examples and do not constitute an investment recommendation.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE FUTURE INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE FUTURE INVEST, consideration should be given to any characteristics or objectives of the ERSTE FUTURE INVEST as described in the Fund Documents.

Advantages for the investor

- Participation in global, promising future topics (“megatrends”).

- Investment in an actively managed portfolio consisting of quality and growth stocks.

- Risk diversification across multiple countries and industries.

Risks to be considered

- The securities in the portfolio may be subject to increased price fluctuations.

- Due to investments denominated in foreign currencies, the net asset value of the fund can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.