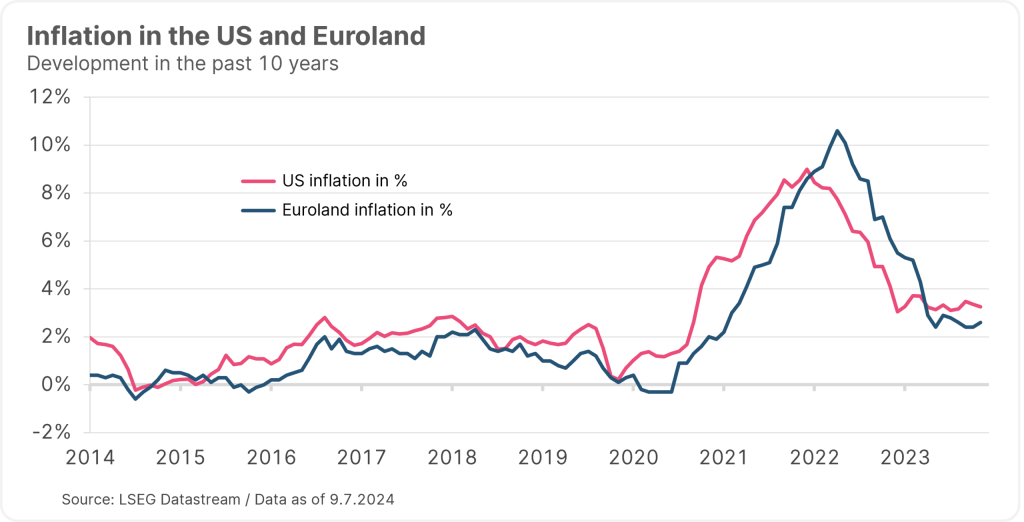

The first half of 2024 has thrown up a few surprises: At the beginning of the year, the markets were still expecting inflation rates to fall significantly and interest rates to fall accordingly. In fact, the central banks managed to get inflation more or less under control – although we are not yet at the desired target level of 2% is still (but hopefully we will be soon).

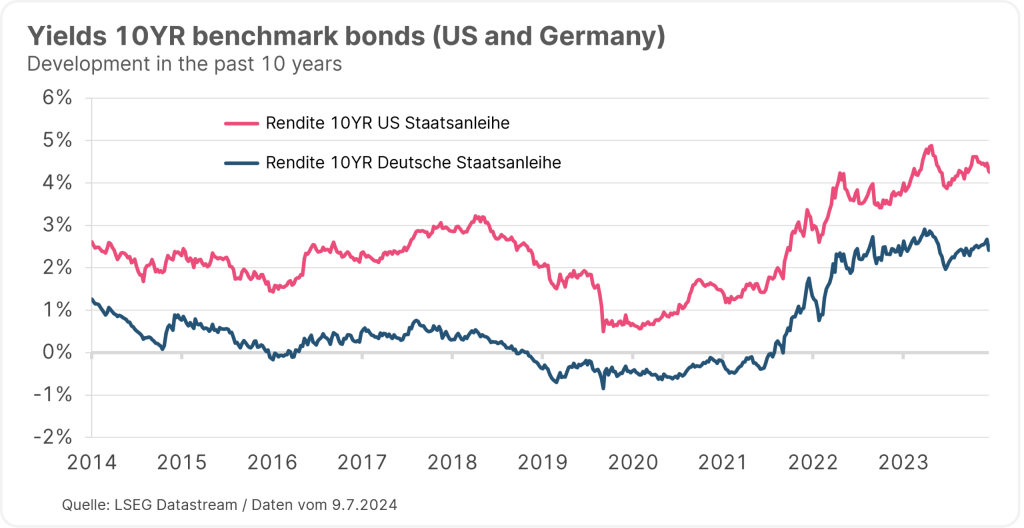

At the same time, yields on the capital market have risen significantly: 10-year US Treasury bonds now yield 4.4% p.a. (at the start of the year, the yield was below 3.9% p.a.) and 10Y German government bonds, which were yielding just under 2.0% p.a. at the start of the year, are now yielding almost 2.6% p.a., this despite a cut in the key-lending rates by the European Central Bank.

Note: Past performance is not a reliable indicator of future performance.

Political changes and greater fluctuations

In any case, a few “new“ faces in politics. And thus, probably also some surprises. We therefore expect greater fluctuations on the equity and bond markets in the coming months – but these fluctuations should not overshadow the longer-term view, in line with the motto “political equity markets have short legs“. The medium and long-term outlook remains positive:

The global economy should continue to grow and provide companies with rising profits. Double-digit profit growth rates are forecast for US companies over the next few years. And European companies should – according to the analysts’ assessment – also be able to record significantly rising profits in the medium term. (Note: Prognoses are not a reliable indicator of future development. Please note that investments in securities entail risks in addition to the opportunities described.)

Stable labour market

The positive environment is due to a stable labour market on the one hand and falling inflation rates on the other. Thanks to the wage increases of recent years, households can now once again report real wage growth after years of real wage losses, which is likely to flow largely into consumption and thus support economic growth, particularly in the USA. Here is a brief summary of the last few years:

| 05/2022 | 05/2023 | 05/2024 | |

| Inflation USA (year-on-year) | +8.6% | +4.0% | +3.3% |

| Hourly wage USA (year-on-year) | +5.6% | +4.6% | +4.1% |

#Above-inflation wage increases are generating additional income in real terms, but at the same time, inflation, at least in the USA, remains well above the Fed’s 2% target. The US Federal Reserve is therefore forced to keep interest rates higher than many experts expected at the beginning of the year. High interest rates lead to higher financing costs, and therefore less investment, less consumption and, as a result, falling prices in the medium term.

The first signs of a slowdown in economic growth are already making themselves felt. This means that inflation in the USA, as in Europe, should continue to fall, thereby increasing the scope for the US Fed to lower interest rates, prevent a recession, and support the economy and labour market.

“Soft landing” possible

Lower interest rates mean more and cheaper investments, more consumption, and as a result more jobs and a growing economy. A cycle that – if it works as it usually does – ensures stable markets and a positive capital market environment. There are signs that the central banks are succeeding in supporting a “soft landing“ of the economy.

Positioning for the second half of the year: broadly diversified and balanced

When positioning the portfolio, it makes sense – even in anticipation of stronger fluctuations – not to lose sight of the long-term goal: Asset accumulation and value growth. Our research shows how important a broadly diversified and balanced portfolio is in order to achieve this goal.

If the equity markets do not perform as planned, it can be helpful to be able to fall back on bonds to finance upcoming investments. Who wants to have to sell shares at their low? And if a conflict breaks out again in one corner of the world, a gold investment can literally make the portfolio shine again, despite otherwise dismal performance. Many investors who have complained about galloping real estate prices in recent years and have missed favourable buying opportunities could perhaps use the current slack period in the market to make a purchase or two? (Note: Please not that an investment in securities entails risks in addition to the opportunities described.)

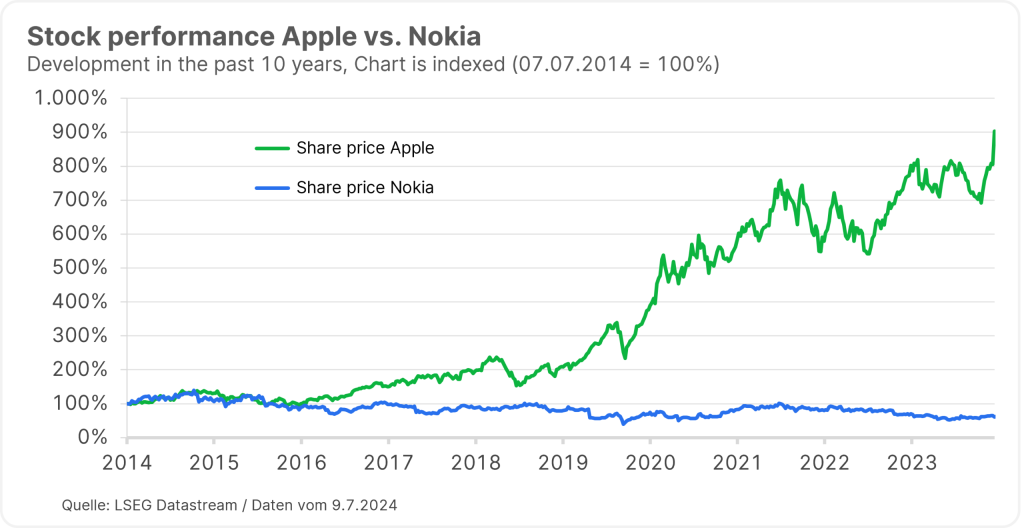

In the past 20 years, the global equity markets (measured against a broad international index, in euro, as of the end of 06/2024) have increased in value by almost 9% per annum. A small comparison shows how important the focus on quality is here: a US company with a certain penchant for smart apples managed to gain an average of 36% p.a. over these 20 years. A Finnish company that was also very hyped in the past – funnily enough, a product line that entered the market at the end of the 1990s was also strongly associated with fruit, in this case a banana – was unable to achieve this success and posted a significantly negative performance of -3% p.a.

Note: Please note that past performance is not a reliable indicator of future value development.

So, while equities have gained around 9% p.a. on average over the last 20 years, Eurozone government bonds – probably also thanks to a long phase of zero interest rates – only recorded an average of +3% p.a. and gold gained 10% p.a., probably also thanks to very volatile price phases and recent highs.

Positive development in the short and medium term

In the long term, this trend should continue. In the short and medium term, we are positive about the economic development from here on out. The central banks have the necessary tools to have both a supportive and restrictive effect and can use their tools to stabilise price trends. In the medium term, it should be possible to achieve the desired target level of 2%. A few interest rate cuts in the coming months should help to support the stable economic growth path.

We are therefore starting the second half of the year almost unchanged: a strong focus on equities; investments in bonds with good credit ratings (government and corporate bonds); high-yield bonds mixed in, as well as real estate and alternative investments such as gold and hedge funds will strengthen the portfolio’s degree of diversification and increase the chance of achieving some stability in the portfolio even in times of stronger fluctuations.

Tip: Invest in a broadly diversified way

With a broadly diversified investment, for example via a mixed fund, you can invest simply and easily in several asset classes. Depending on your risk appetite and investment horizon, it makes sense to choose a fund with a higher or lower possible equity allocation. ERSTE OPPORTUNITIES MIX, for example, gives you the opportunity to participate continuously in market opportunities. The fund invests in equities, bonds, commodities and listed private markets. ERSTE REAL ASSETS also invests in several asset classes and can therefore be of interest for a broadly diversified investment.

Note: Please note that past performance is not a reliable indicator of future value development and that investing in securities involves risks as well as opportunities.

Notes ERSTE OPPORTUNITIES MIX

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE OPPORTUNITIES MIX as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE OPPORTUNITIES MIX, consideration should be given to any characteristics or objectives of the ERSTE OPPORTUNITIES MIX as described in the Fund Documents.

Advantages for the investor

- Participation in global, future-oriented themes

- Investment in an actively managed portfolio of equities, bonds, listed private markets, commodities and currencies.

- Risk diversification across several countries, sectors and asset classes

Risks to be considered

- Investments in capital markets are subject to market price fluctuations.

- An investment in the mentioned themes can also develop negative, a loss of capital is possible.

- Due to the investment in foreign currencies, the fund value may be negatively impacted by changes in exchange rates.

- Risks that may be of significance for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus and the information for investors pursuant to Section 21 AIFMG, Section II, chapter “Risk information”.

Risk notes according to 2011 Austrian Investment Fund Act

In accordance with the fund regulations approved by the Austrian Financial Market Authority, ERSTE OPPORTUNITIES MIX intends to invest more than 35% of its fund assets in securities and/or money market instruments of public issuers. A detailed list of these issuers can be found in the prospectus, section II, point 12.

NOTES ERSTE REAL ASSETS

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

Advantages for the investor

- Investment focus on real assets

- Opportunity to achieve long term capital appreciation

- The broad investment in a vast array of assets allows for a significant degree of risk diversification in the fund, which may reduce the risk of capital losses.

- Investment funds are separate assets

Risks to be considered

- The assets in the fund may be subject to considerable price fluctuations.

- Due to investments denominated in foreign currencies, the net asset value of the fund can be negatively impacted by currency fluctuations.

- Alternative investments involve a higher level of risk

- Capital loss is possible

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Risk notes according to 2011 Austrian Investment Fund Act

ERSTE REAL ASSETS may make significant investments in investment funds (UCITS, UCI) pursuant to section 71 of the 2011 Austrian Investment Fund Act.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.