“Reality is always the best testimony to what is possible”

(Johann Nepomuk Nestroy)

The world economy and global financial markets are in trouble. In addition to its disastrous medical consequences, the coronavirus pandemic is about to trigger a global recession with all its negative consequences like rising unemployment, overburdened social systems and rising bankruptcies.

And it has already lead to the most severe turmoil in the markets for risky assets since the Great Financial Crisis in 2007-08.

The over-quoted first sentence of Tolstoy’s Anna Karenina – “Happy families are all alike; every unhappy family is unhappy in its own way” – is sometimes applied to financial crises, suggesting that bull markets are all the same, while crises and crashes differ. I remain unconvinced.

Yes, the roots of market collapses may vary, as we saw in the course of the last three big crashes in 2000 (bursting of the tech bubble), in 2007-08 (US mortgage crisis and the collapse of Lehmann) and the current virus-related crisis.

But regardless of the initial catalyst, the dynamics of markets on the way down as reflected in the performance of key equity indices, volatility indicators, prices of supposedly safe assets and currencies are often astonishingly similar.

The last crisis that is still fresh on everybody’s mind is the Great Financial Crises (GFC) that started in 2007 and accelerated in September 2008 following the collapse of Lehman Brothers. It led to a global recession, a destruction of 40-45% of global wealth according to some estimates and the introduction of hitherto not known monetary policy instruments and regulatory interventions.

The GFC, therefore, is probably the best reference point for any assessment of what is happening right now in financial markets and how things could play out in the months to come.

Corona vs. Lehman – a comparison

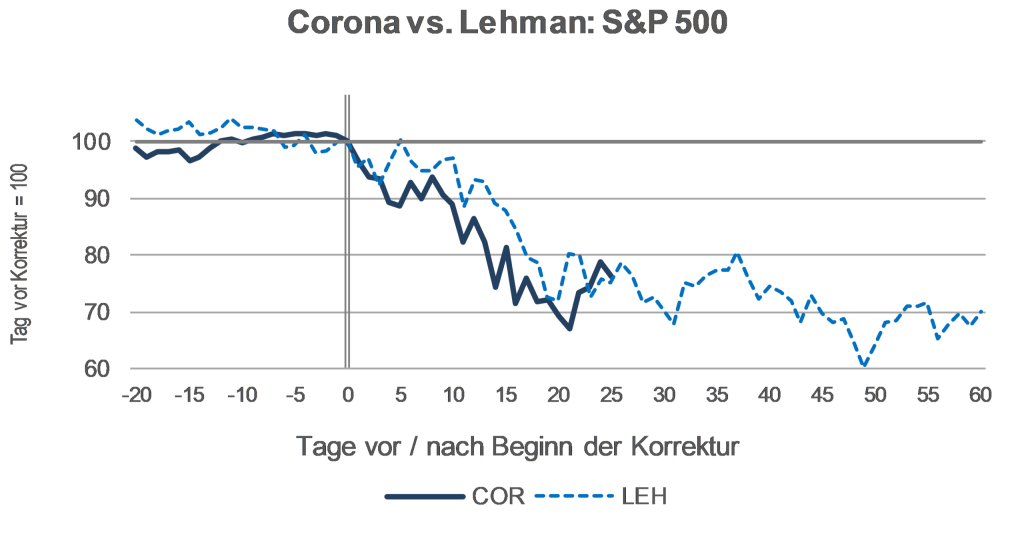

The 2008 crash had, similar to the current one, a massive impact across all asset-classes. One example is presented in the chart below, which shows the performance of the S&P 500 after Feb 21, 2020, when European and US financial markets started responding vehemently to the breakout of the coronavirus, in comparison to what happened after September 15, 2008 – the date when Lehman Brothers went bankrupt.

Source: Bloomberg; Erste Asset Management; data as of March 27, 2020.

Needless to say that such a comparison should not be confounded with a forecast. But the similarities might tell us what is possible in financial markets following a major shock like the coronavirus pandemic.

And the differences between the two crises may also provide clues on whether the current crisis could follow a different course as we go along.

Comparing the crises in 2008 and 2020 in more detail points to a number of noteworthy developments:

1. In the first five weeks, the coronavirus sell-off in global stock markets has been steeper and deeper than during the Lehmann-related crash, at least in Europe and the US. One notable difference is that in the twelve months prior to the collapse of Lehmann, global stocks had already lost more than 20%, whereas the correction last month came just few days after major equity indices had reached all-time highs.

2. In terms of relative performance Europe initially underperformed the US during the current crises. This has changed more recently though after the US has also been fully hit by the virus. Emerging markets have outperformed because the pandemic started receding in Asia but is still gaining momentum in developed markets. However, the experience in 2008 suggests that as soon as the global economic turbulences are severe enough, emerging markets cannot escape and may even be hit harder than the developed world.

3. Unsurprisingly, key volatility and risk indicators have reflected the stress related to the current pandemic. Equity volatility jumped to levels last seen in 2008. Likewise in bond and currency markets volatility has surged but has stayed well below levels during the 2008 crisis. But note that they came from very low levels at the outset of the crisis.

4. Other classes of risky assets have felt the heat as well. In the US, high-yield spreads – the gap between rates for non-investment grade corporate bonds and government bonds – have soared to over 1, 000 basis points – a level that in 2008 was reached only at a later stage in the crisis. The main reason for the swift rise this time was related to the shale oil industry, which is a prime victim of collapsing crude prices and, in the meantime, accounts for a significant share of non-investment grade bonds.

5. US bonds followed quite a different trajectory now and then. In 2020, the initial response was a drop in yields from already very low levels, while 12 years ago the market response to the deteriorating economic backdrop happened two months after the event. In both cases, yield curves steepened in the US as well as in Europe in anticipation of monetary easing by the central banks.

6. In both instances – 2008 and during the current rout – the US dollar strengthened after a few days of weakness, reflecting its status as a safe haven currency. However, during the current crisis this trend has reversed as of late as the coronavirus has taken hold of the US as well.

7. Gold has moved sideways in recent weeks, while in 2008 it gained almost 20% within few days after the Lehman debacle. It later posted a decline, which proved temporary though. Over the following three years gold rose by 140%, most likely in response to the unprecedented monetary easing by the US central bank, which triggered inflation fears (that were unfounded as we know now).

8. The price of oil has fallen about twice as fast this time around compared to 2008. In addition to the downward pressure due to the expected recession, the failure of Saudi Arabia and Russia to agree on production cuts has accelerated the price drop. In 2008, oil was already heading south before Lehmann, and Brent lost another 60% before it hit bottom at USD34/bbl three months later.

9. Consensus expectations both for economic growth and corporate profits have come down faster in the course of the coronavirus crisis than after Lehman. Given the experience back in 2008, and taking into account the fact that consensus forecasts are slow-moving indicators, one can expect further downgrades in coming weeks and months.

Uncertainty and volatility to remain elevated

Forward-looking valuation is right now an even less reliable indicator than in more normal times. Still, what the data show is that last week’s equity rally should not be mistaken for a sign that markets have already entered into calmer waters. Even if forward earnings multiples should have bottomed (a big if), further earnings revisions will continue putting pressure on equity markets.

One lesson from the GFC twelve years ago is that disruptions of such a massive order tend to have longer-term repercussions. Thus, also in the current crisis we may face bumpy ride ahead of us.

How should equity investors respond?

Another lesson from the last crisis, respectively from periods of elevated volatility in general is that market timing – i.e. the attempt to adjust your equity allocation based on daily and weekly markets fluctuations – has little chance of success.

Even in a volatile environment like now, regular investments in stocks are the best way to add to positions at low market prices and benefit from the possible recovery.

Our dossier on coronavirus with analyses: https://blog.en.erste-am.com/dossier/coronavirus/

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.