In a time of domestic political turmoil, Japan has recently struck a trade agreement with the US, averting a possible trade conflict. The US will impose tariffs of 15 per cent on imports from Japan. US President Donald Trump had originally threatened tariffs of 25 per cent. In return, Japan will invest in the US and facilitate access to its markets for American manufacturers.

Japan’s important automotive industry is central to the negotiations

The core of the negotiations concerned the reduction of automobile tariffs. Cars account for more than a quarter of Japanese exports to the US and are therefore the most important export sector. This was precisely what Donald Trump found so objectionable, as Japan imports significantly fewer US cars. The president therefore introduced tariffs of 25 percent on Japanese cars in April. With the deal, car tariffs have now been reduced to 15 per cent. In addition, the US has decided not to impose an upper limit on imports of Japanese cars.

In return, Japan has pledged to invest up to USD 550bn in the US. This will take the form of loans and guarantees from Japanese state banks and other government agencies. The Japan Investment America Initiative is intended to promote investment in sectors such as semiconductors, AI technologies, pharmaceuticals, steel, shipbuilding and cars. US companies will also be given easier access to the Japanese market. For example, Japan will abolish additional safety checks for US vehicles, which US representatives considered a trade barrier.

Japanese exports of steel and aluminium, which are subject to a separate US tariff of 50 per cent, were not included in the agreement. Regulations on exchange rates, a previous point of contention, are also not part of the deal.

Note: Past performance is not a reliable indicator of future performance.

Japan’s stock market reacts positively to the averted trade war

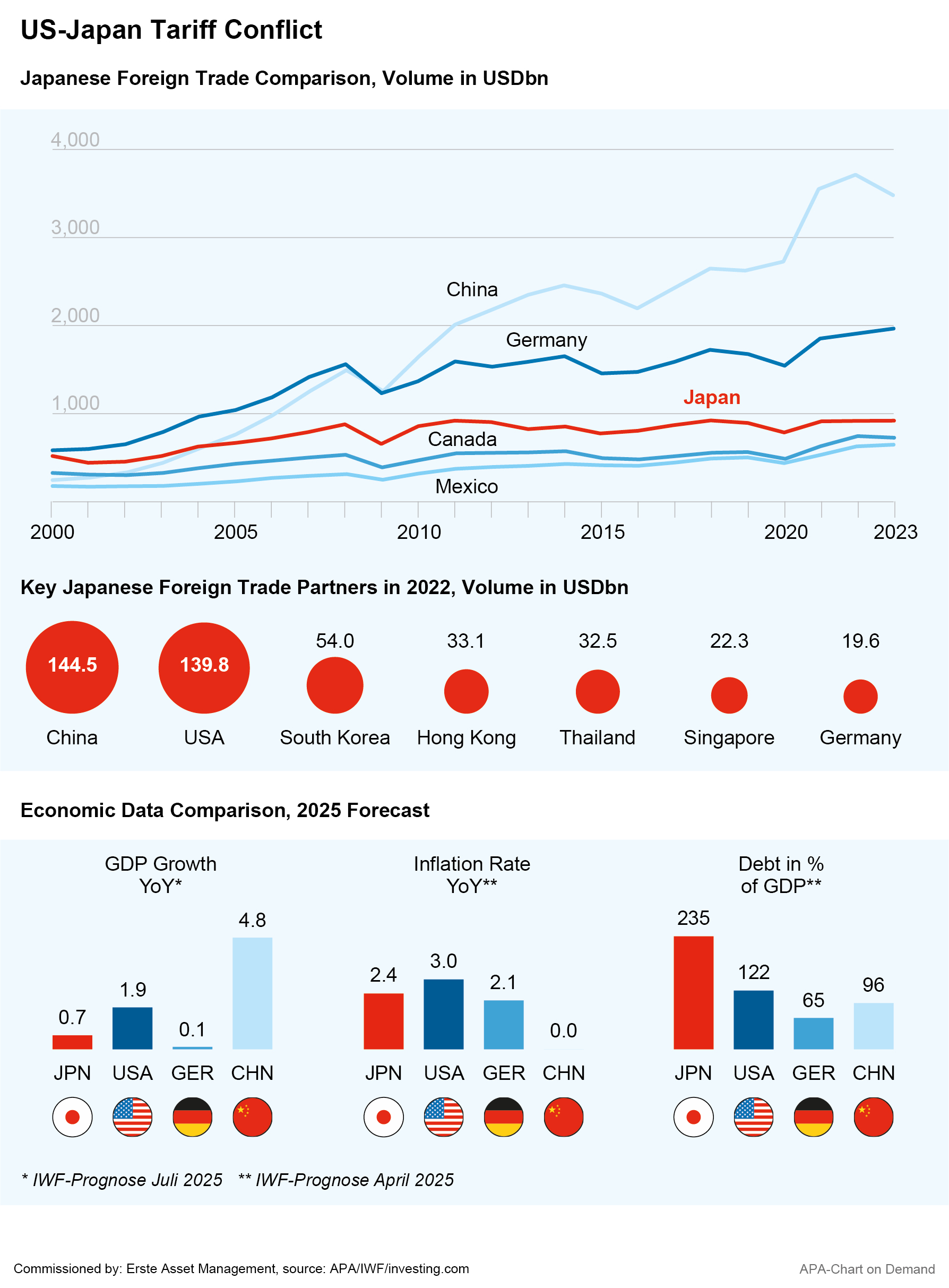

The agreement came as a relief in Japan. The US is Japan’s most important export market, so a trade conflict would have hit Japan’s economy hard. Japan is the US’s fifth-largest trading partner. Bilateral trade volume amounted to almost USD 230bn in 2024, with a trade surplus for Japan of almost USD 70bn. The Japanese Nikkei index rose to its highest level in a year after the trade deal was announced. Automobile stocks naturally benefited particularly strongly. Shares in car manufacturers Honda and Toyota rose by over 10 per cent after the agreement was announced.

Note: The companies listed here have been selected as examples and do not constitute investment recommendations. Past performance is not a reliable indicator of future performance.

Prime Minister wants to continue coalition as a minority government

For Japan’s ruling party, the deal comes at a difficult time, as it had to enter the negotiations politically weakened after a lost election – just a few days before the agreement was concluded, Prime Minister Shigeru Ishiba’s coalition government lost its majority in the upper house elections. His Liberal Democratic Party (LDP) and its coalition partner Komeito won 47 seats in the final results, falling short of the 50 seats needed for a majority. The coalition had already lost its majority in the lower house in October.

According to polls, many voters were dissatisfied with the government’s response to rising consumer prices. Although Japan’s core inflation dropped to 3.3 per cent in June, it is still above the central bank’s target of 2 per cent. The ruling party has so far rejected tax cuts demanded by voters and opposition parties to ease price pressures, out of consideration for the bond markets and the country’s high debt.

After the lost election, Ishiba announced that he would continue his work with a minority government. Although Japanese media reported on the prime minister’s plans to resign after the election, Ishiba denied such plans after the deal with the US was finalised. Regardless, his government faces a difficult task: he is the first prime minister since World War II to govern without a majority in both houses of parliament. Experts also fear that the prime minister could fall victim to a party rebellion or a vote of no confidence by the opposition.

Europe and Japan want to strengthen partnership

Internationally, however, Ishiba appears to have won allies for his country. According to experts, the trade deal could make Japan an important partner for the US in Asia. Europe also wants to collaborate more closely with Japan in order to jointly ward off pressure against the two economies, EU Commission President Ursula von der Leyen said last week after an EU-Japan summit in Tokyo, which Ishiba also attended. Japan is seen as a role model in Europe because it has built up raw material reserves to become more independent of political pressure from other countries.

The EU and Japan are striving to strengthen economic security, said von der Leyen. This is aimed at China, for one, which has imposed restrictions on exports of rare earths that are needed by both Japanese and European industry. “We will also work more closely together to counter economic coercion and combat unfair trade practices,” von der Leyen noted. “We believe in global competitiveness that should benefit everyone.” The EU and Japan also agreed to strengthen the defence industry and to start talks on a data security and privacy agreement.

Broadly diversified investment in Japanese equities

The ERSTE RESPONSIBLE STOCK JAPAN equity fund offers the opportunity to invest in a wide range of Japanese companies from various sectors. The fund focuses on companies with medium to high market capitalization, attractive dividend yields, and above-average quality. Environmental, social, and governance aspects are also taken into account when selecting stocks. However, the risks should also be noted. The fund price can fluctuate significantly at times, and the share value may be affected by exchange rate changes due to investments in foreign currencies, particularly the Japanese yen.

👉 You can find out more about the fund on our website

Notes: The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK JAPAN as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK JAPAN, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK JAPAN as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.