“This time is different”: In my opinion, these four words are probably the most dangerous in the financial world. When I started my career in finance in 2000, the bull market on the US tech exchange Nasdaq and the German “Neuer Markt” had just come to an end and the first fallout from the excesses of the markets had become apparent.

In the previous years, money had been flowing into companies with new technologies and ideas on the equity markets without interruption. Many of them could not be valued using traditional financial ratios: instead of profits and cash, sales or the number of clicks on the website had to be used. “This time it’s different”: traditional key figures and the valuation of shares from a historical perspective no longer seemed relevant.

Spreads at low levels

However, I don’t actually want to write about the equity markets, but about the current valuation of the credit markets. On the bond markets, we are now on the other side of the repair phase following the major financial crisis and the Covid-19 pandemic. Yields (and central bank key-lending rates) are currently trying to find a new equilibrium. European and US government bonds offer yields of 2-5.5% again. Many strategists recommend corporate bonds or emerging market bonds in the government or corporate sector, as yields in these asset classes are “historically high”.

Well, yes, if you limit history to the past 15-17 years, corporate and emerging markets bond yields are indeed high – but so are those of government bonds. The spread on government bonds is a good starting point to figure out whether a specific spread product (i.e. a product with a risk premium, a “spread”) is actually cheap per se. The table below shows different risk markets in the bond sector and their current spreads.

| Bond | Spread in basis points (bps) (as of 13 Feb 2024) | Change in spread YTD | Lowest spread in the past 12M | Highest spread in the past 12M |

| Asia Investment Grade | 98 | -10 | 98 | 153 |

| Asia High Yield | 622 | -154 | 622 | 1055 |

| USA Investment Grade | 95 | -4 | 92 | 163 |

| USA High Yield | 318 | -5 | 311 | 516 |

| Europe Investment Grade | 58 | 0 | 57 | 104 |

| Emerging Markets Investment Grade | 123 | +7 | 114 | 160 |

| Emerging Markets High Yield | 694 | -7 | 694 | 926 |

What we notice is that the spreads on the majority of markets are trading at or very close to the lowest levels of the past twelve months. In the longer term, the picture is no different: the cost of hedging against default for European investment grade issuers is currently just 10bps away from the lowest level in the past 13 years.

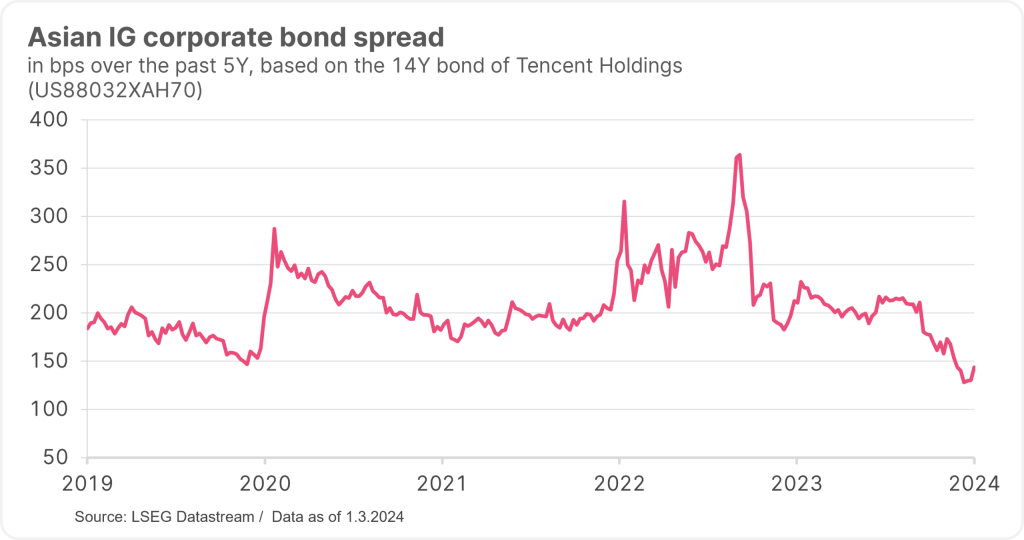

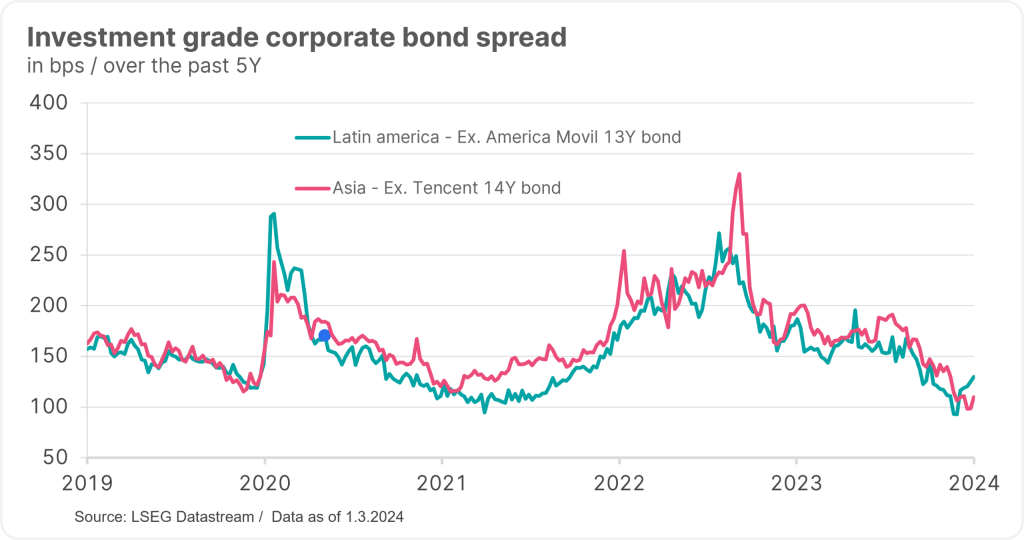

However, the picture looks very similar across the board. Our asset class, emerging markets corporate bonds, is no exception; that is particularly true for the markets in Asia.

Please note: past performance is no reliable indicator of future value development.

Low spreads despite difficult environment

Based solely on the historical development, which has seen up and down phases in the economic cycle as well as political developments, the markets are not cheap at this point. You could even say they are expensive. At current levels, investors are only very poorly compensated for any economic or political fluctuations.

Or, expressed in numbers: in the case of Asian investment grade bonds, which have an interest rate sensitivity of at least around 4.6%, the widening of the spread for which an investment in a US government bond with the same interest rate sensitivity would yield the same performance over twelve months is around 20bps.

In other words, if spreads widen by about 20bps, an investment in investment grade bonds from Asia is comparable (due to the additional yield on corporate bonds) to a US government bond. The additional return on the investment grade bond is consumed by the widening of the spreads. These 20bps are easily imaginable based on the historical fluctuation of spreads and are therefore not exaggerated.

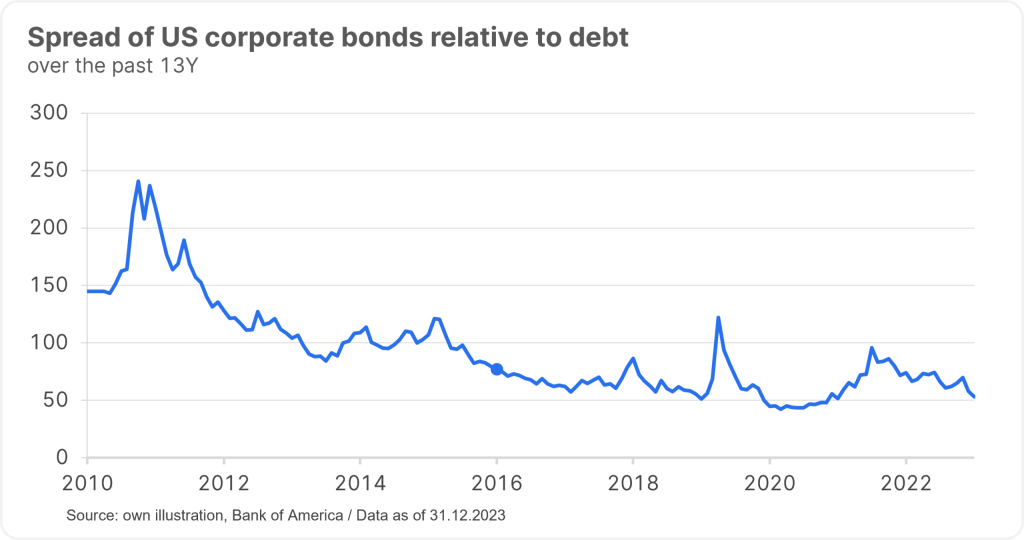

Apart from the historical context, what does the compensation of investors for the gross debt of companies look like? The following chart illustrates the spreads of US corporate bonds in relation to their debt. The chart speaks for itself. We are also finding more and more issuers in the emerging markets where spreads are at historical lows despite the sometimes significant deterioration in fundamentals (e.g. the chemical industry).

Please note: past performance is no reliable indicator of future value development.

But what are the reasons? Why do the markets act this “euphorically” despite the difficult political and economic environment?

Supply and demand

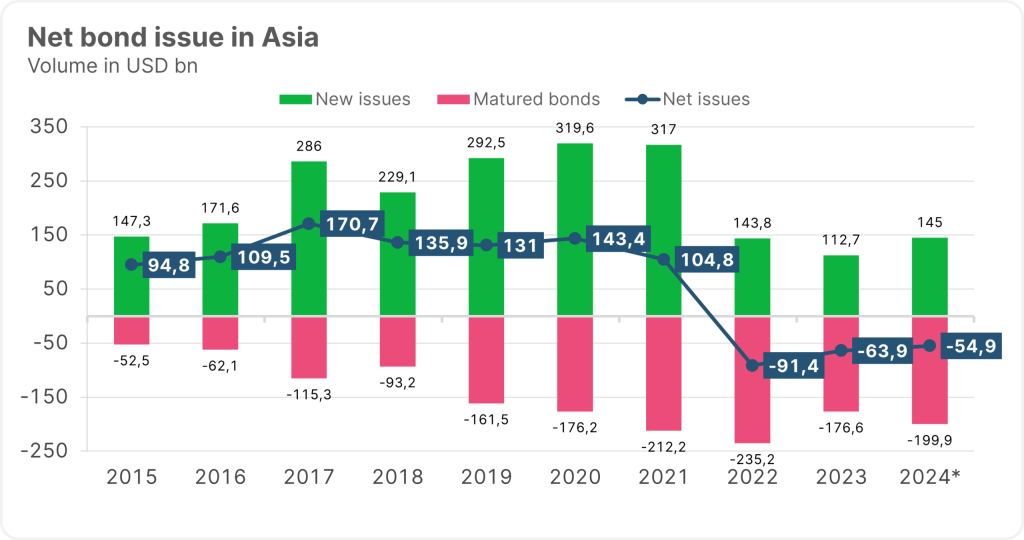

If there is a shortage of supply compared to demand, this will drive up the price – especially if demand increases at the same time. We can currently see such a perfect storm in emerging markets corporate bonds, particularly in Asia. For more than a year now, fewer new corporate bonds have been issued from China than have been bought back by issuers or than have simply matured.

Please note: past performance is no reliable indicator of future value development.

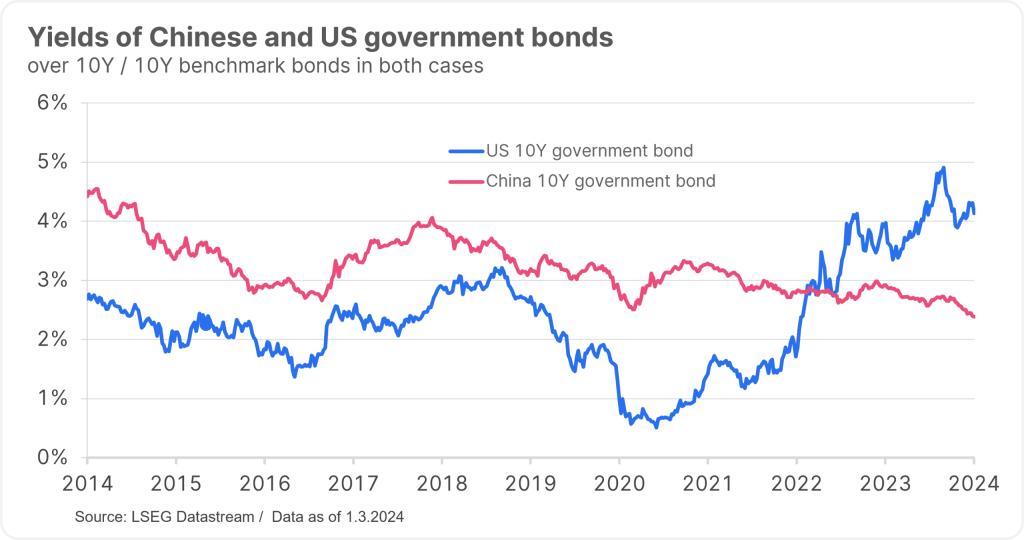

At the same time, China has been subject to a consumer slump of sorts. This slump is having a deflationary effect, which the central bank is combating with low interest rates, among other things.

This situation comes with two implications for us:

- On the one hand, it is cheaper for Chinese companies to refinance locally.

- On the other hand, for many savers (or banks with investable assets) it is more lucrative to invest in US dollar bonds than in the local market, especially when the local currency tends to depreciate.

Please note: past performance is no reliable indicator of future value development.

In general, a significant shift in supply and demand could very well cause spreads to break out of the previous long-term trading band. The strong tightening in China makes other Asian corporate bonds visually cheaper. Supported by the generally low issue volume and lower local yields (including in Thailand and South Korea), the spreads on these bonds are also narrowing.

I also want to mention short-term investors. They often include some private banks or hedge funds who, as with the equity markets, jump on the momentum and sometimes take trends to extremes.

Please note: past performance is no reliable indicator of future value development.

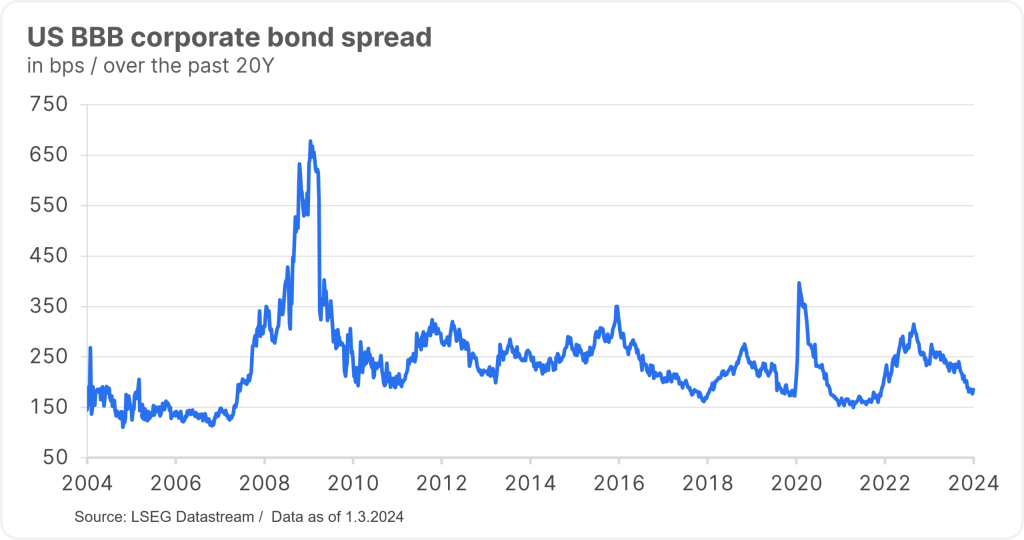

However, there must be additional reasons why spreads are generally so expensive from a historical perspective. In the US, we can indeed see a massive increase in the net new issue volume of corporate bonds, and yet spreads (as illustrated by US BBB bonds) are only just off the lows of the past 20 years.

Please note: past performance is no reliable indicator of future value development.

Imminent interest rate cut expected

The high yields on US government bonds compared to the past 20 years and the significant fall in inflation rates are giving rise to high hopes among investors that interest rates will be cut soon. At the same time, however, more and more arguments are suggesting that the interest rate turnaround might be delayed.

This means that historically high yields can now be locked in over a longer investment horizon, triggering a significant regrouping into bonds. Despite the news of a possible common currency among the BRICS countries (Brazil, Russia, India, China and South Africa) geared at weakening the US dollar and the badmouthing of the US currency, the US bond markets remain the most liquid and largest in the world. They are still considered an important part of the investments of wealthy investors around the world.

The US economy is also doing very well at the moment thanks to the extremely expansive fiscal policy and savings from the Covid era. This is fuelling the risk appetite on the markets. As a result of these factors, a lot of money is flowing into US corporate bonds that appear cheap (based on yields), even though the spreads would historically argue against an increased allocation.

So, the question arises: how long can this continue? Can the spreads narrow further?

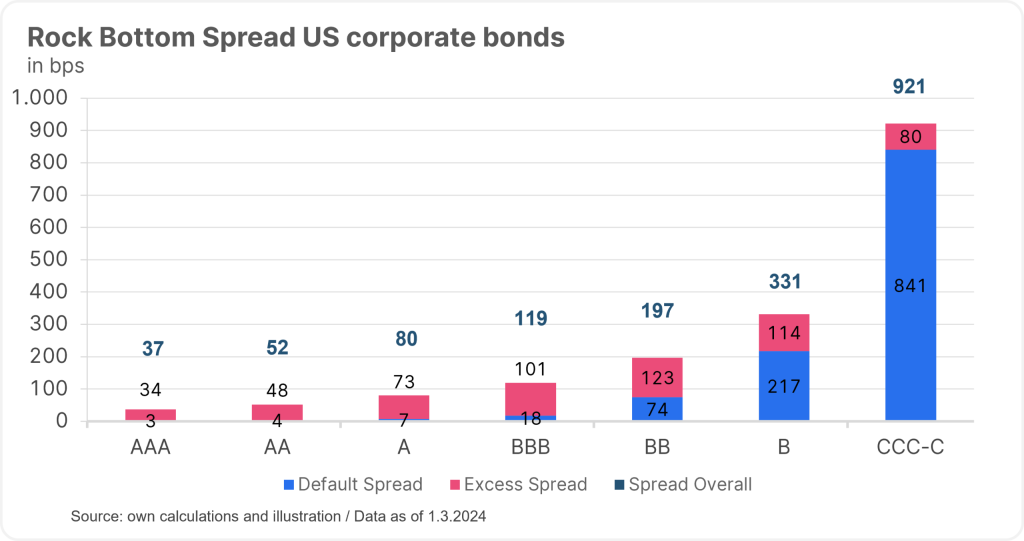

Rock-bottom spread

To answer this question, let’s take a look at the so-called rock-bottom spread. Put simply, this is the part of the spread that should be charged based on the historical frequency and extent of defaults in a particular rating category in order to be compensated for any defaults in a broadly diversified portfolio.

For US corporate bonds in the BBB rating category, the rock-bottom spread for a holding period of five years is around 18bps. For the calculation, we used the historical default rates from S&P and a standard market average recovery value of 40%.

Given that there are also other factors for the spread, such as a liquidity premium, the composition of the respective sectors, and the course of the economy, the market is trading around 100bps above the rock-bottom spread. That being said, there is theoretically still a certain buffer for the market, which is relatively highest for investment-grade issuers; the high-yield segment also appears to be quite expensive from this perspective.

For AAA to A issuers one might argue that they could also theoretically trade with a negative spread to US Treasury bonds (strategically important names such as Microsoft, for example), should the (excess) supply of US Treasury bonds lead to yield increases and an imbalance between supply and demand due to a budget deficit.

Conclusion: this time it really is somewhat different

Even analysts at investment banks are currently perplexed by the development and status of spreads. In many cases, the current levels are well below expectations for 2024.

Knowing the driving factors described in the article, we can partially explain the level of spreads. Our rock-bottom analysis shows that there is still a certain narrow buffer in the market for buy-and-hold investors (or products such as broadly-based basket funds). The spreads can still narrow somewhat or remain at current levels. However, the air is already thin, and investors run the risk of suffering a negative absolute or relative (to government bonds) performance in the event of unfavourable news and a correction. Depending on news and investment flows, this correction could also be of a more significant nature.

To come back to the title, this time, as we have seen, is indeed different to a certain extent. However, knowing that such phases will come to an end sooner or later, as experienced asset managers and fund managers with a medium to long-term focus, are more cautious for our clients at these levels. We prefer to review our portfolios for ways in which we can reduce risk without having to give up a lot of return/risk premium rather than – to use a familiar comparison – dancing the party to the end.

Spread products: this is how you can invest

Investors who are aware of the opportunities and risks of investing in securities can use the ERSTE BOND EM CORPORATE bond fund to invest in a broad mix of corporate bonds from emerging markets, including growth markets such as Brazil, India, and Mexico.

The fund was recently honoured at this year’s Euro Funds Awards: based on performance, ERSTE BOND EM CORPORATE took second place in the category “Bond Fund Emerging Markets Corporate Bonds in Euro” over each of the three-, five-, and ten-year periods. Hint: Please note that an investment in securities entails risks in addition to the opportunities described.

For more information, please visit our website.

Benefits for the investor

- Chances of attractive rate of return on the basis of the most interesting corporate bonds in the emerging markets.

- Global diversification across emerging markets.

- Foreign currencies largely hedged against the euro.

- Diversification due to numerous bonds from a vast array of issuers.

Risks to bear in mind

- Elevated risk due to medium to low issuer rating of the participating companies.

- Emerging markets are traditionally subject to significant fluctuations.

- Capital loss is possible.

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act.

Notices ERSTE BOND EM CORPORATE

For further information on the sustainable structuring of ERSTE BOND EM CORPORATE and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE BOND EM CORPORATE, please take into account all features and goals of ERSTE BOND EM CORPORATE as described in the fund documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.