Just as equity markets looked set for a smooth finish to the year, the emergence of Omicron – a new variant of Covid-19 – rattled investor confidence and led to a multi-day sell-off, starting on November 26th.

Even though the decline in major indices was in many ways different than the ones we observed throughout 2021, one thing didn`t change: market participants quickly jumped in to buy, resulting in the strongest 2-day performance of equities this year.

Omicron and the Fed

A worsening pandemic and a further round of lockdowns continue to pose the biggest risk to the ongoing recovery in earnings and in the economy. Therefore, it should come as no surprise that new variants of the virus have a tendency to hurt investor sentiment in the short term.

This time, however, the nervosity was elevated by the fact that the Fed just recently started tapering its monthly asset purchases. As inflation numbers show no signs of easing yet, there is an increasing likelihood that the world`s most important central bank will soon be forced to tighten monetary policy faster than initially planned.

Capital markets project multiple rate hikes in the US going forward

As a result, the MSCI World index declined by more than 4% from its recent peak and volatility indices jumped to their highest level since early February.

As part of the risk-off mode, 10-year yields on both sides of the Atlantic declined and the US yield curve – which is one of the main indicators for confidence in future growth – flattened to levels not seen since the end of 2020.

The VIX volatility index increased above 30 for the first time since February

Source: Bloomberg

Interestingly, the tech heavy Nasdaq Composite fell disproportionately in the week from November 26th to December 3rd – underperforming the S&P 500 by a margin of 1.4% – even though the fast-growing tech sector usually exhibits defensive traits when market stress increases and yields decline.

The Nasdaq Composite underperformed during the sell-off, before bouncing back

Source: Bloomberg

Market optimism quickly returns

While it would definitely be a mistake to dismiss Omicron’s potential to harm markets just yet, it is fair to say that one of the reasons for the quick rebound in equities lies in this year`s investor experience, namely that the risks associated with new variants have turned out to be overdone in many cases.

So far, data suggests that while Omicron has higher transmissibility, the symptoms associated with the variant are milder than in the case of its predecessors.

Also, it is likely that the market realized it will take more than just some short lockdowns here and there to significantly derail the global economy from its expansionary course. The world is slowly but surely adjusting to short-term interruptions caused by the pandemic, and until there is growth, equities will likely continue the bull market which started in March last year.

So how will this year end?

As I argued recently, equities remain an attractive asset class even in a riskier environment, as bond yields are just too low in comparison.

A policy mistake by the Fed – by tightening too aggressively – has the potential to hurt this narrative in the future, but one should not forget that we are just in the early stages of monetary tightening, and the Fed has proven over the last years to be a very skilled market communicator.

News of Omicron sent the US 10-year yield lower and led to a flattening of the yield curve

Source: Bloomberg

The uncertainties caused by Omicron and the Fed will likely leave us with higher volatility into year-end. Even so, developed market indices are on their way to finish 2021 with solid double-digit percentage gains.

For the S&P 500 and MSCI World, this would be the third such year in a row, measured in USD-terms, whereas the European gains come after last year`s declines in indices like the Stoxx 600 or the Eurostoxx 50.

Whether 2022 can by a similarly good year for equities, remains to be seen.

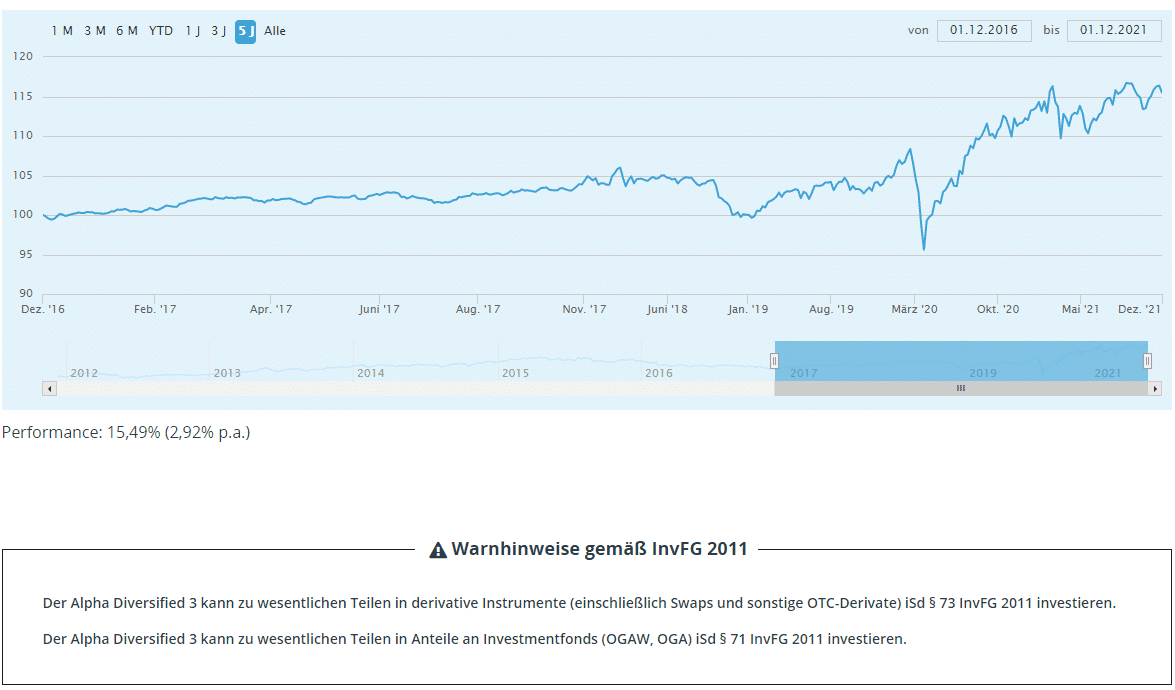

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.