What’s happening on the markets? In our Investment View, the experts of our Investment Division regularly provide insights of current market events and their opinion on the various asset classes.

Note: Prognoses are not a reliable indicator of future performance. Please note that an investment in securities entails risks in addition to the opportunities described.

👉 What you read in this article

Macro outlook

In our view, the most likely scenario for the current year is still “no landing”. We believe that inflation in the developed markets will remain above the target of around two percent, while the economy will continue to grow. Yields on the bond markets are likely to trend sideways to higher. The US tariff policy should further increase the growth differences between the US and the rest of the world. We expect the US Federal Reserve to lower its key interest rate to 4% by the end of the year and the ECB to cut it to 1.75% by the end of 2025.

Scenarios

Scenario 1 (no landing/heterogeneous environment)

Trend towards growth in developed markets. The US tariff increases widen the gap between the USA and the rest. While growth in the US is forecast at 2.4% in 2025 in this scenario, it should be just 0.7% in the eurozone. The inflation trend would also be heterogeneous: USA 2.7%, Eurozone 2.2%. In this case, the Fed would cut its key interest rates only slightly to 4%, while the ECB would make stronger interest rate cuts to a level of 1.75%.

Probability in our view: 35%

Scenario 2 (soft landing/normalization)

Weaker growth below potential – growth in the eurozone remains low. Inflation falls towards the target value. The central banks respond with significant interest rate cuts.

Probability in our view: 25%

Scenario 3 (stagflation/trade war)

A potential trade war would increase inflation and reduce growth. Economic sentiment would deteriorate and global trade and production would be at risk of shrinking. On a geopolitical level, higher energy prices would have an impact. Both monetary and fiscal policy would be loosened.

Probability in our view: 25%

Scenario 4 (recession/restrictive policy)

Monetary and fiscal policy remain restrictive for too long, which would lead to a significant slowdown in the labor market and falling inflation. A trade war, stagnating productivity in the EU and potential deflation in China would be risk factors.

Probability in our view: 15%

Asset classes

Market performance in January was quite volatile. One of the key market themes in January was the inauguration of President Trump and the potential impact on policy, particularly in relation to the expected changes in tariffs and their impact on US and global markets. The 10-year yield in the US reached a 14-month high before falling amid signs of disinflation and a flight to relatively safe asset classes. One of the reasons for this was the Chinese start-up DeepSeek, which is challenging the US for leadership in the field of artificial intelligence.

Shares in AI-related companies such as NVIDIA saw some sharp price falls as investors digested the news that DeepSeek had trained its generative AI capabilities to achieve comparable results to the market leaders, but at a fraction of the cost. This calls into question the need for the heavy investment in advanced AI chips and data center capacity.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation.

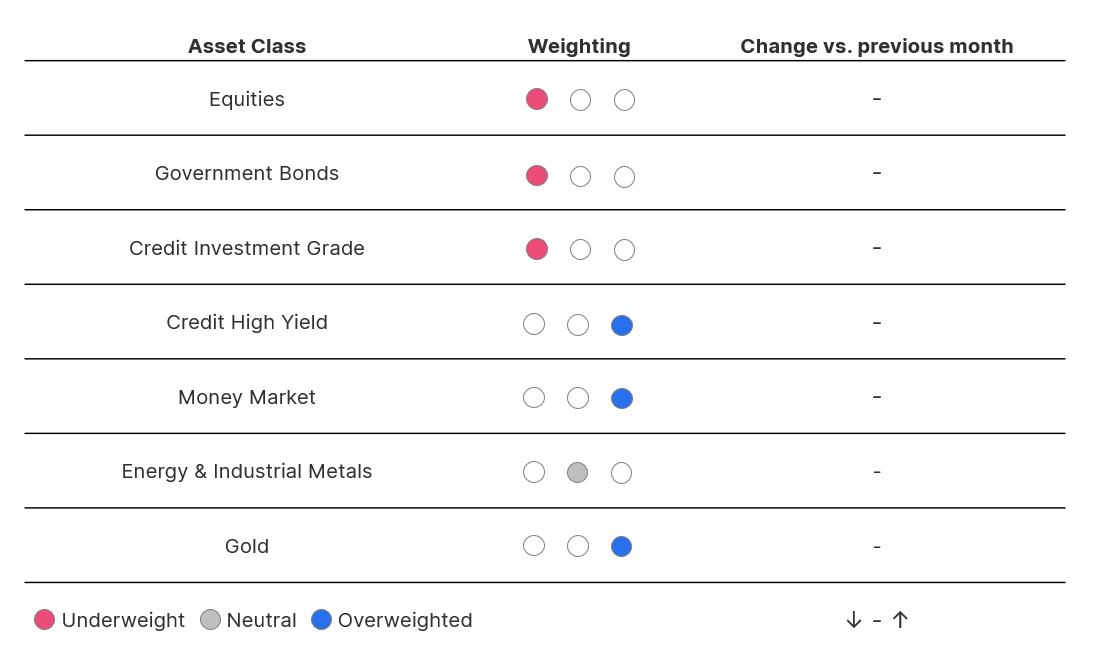

The recent market volatility highlights the high level of uncertainty, which has led us to maintain our current allocation in February. We continue to favor a diversified approach with a slight underweight in equities and an overweight in high yield bonds and gold. This positioning provides a good balance between risk and reward and ensures resilience for the coming months.

Note: Portfolio positions of funds disclosed in this document are based on market developments at 21.2.2025. In the context of active management, the portfolio positions mentioned may change at any time. Please note that an investment in securities entails risks in addition to the opportunities described.

Equities

Our slightly defensive equity positioning is due to the ongoing risks, in particular the potential of an impending trade war.

We have made a strategic shift in our equity allocation from growth stocks to value stocks. In our view, the valuations of growth stocks are sometimes excessive, while value stocks remain attractively valued as their P/E ratios (price/earnings ratios) are at the long-term average. This offers the opportunity for significant upside potential as investors could increasingly shift to value stocks in a broadening market that rewards strong fundamentals beyond the mega-caps. In addition, rising interest rates are a headwind for growth stocks, particularly in the technology sector.

Against this backdrop, we have increased our positions in European and US value stocks while reducing our exposure to US growth and low volatility stocks. This move has also led to an overall increase in our exposure to European equities at the expense of the US region. The signs of a sustained economic recovery in Europe offer an attractive diversification opportunity,

Government bonds

In response to recent market developments and yield movements, we maintain a negative stance on government bonds. We continue to favor positions that benefit from a steeper yield curve as both short and long-term inflation expectations continue to rise globally.

In the US, neutral interest rate estimates are trending upwards and the risk of fewer rate cuts has increased due to strong economic growth and sustained inflation. There is even the possibility that the US Federal Reserve could move from a dovish stance to a neutral or tighter stance. This would mean a pause in interest rate cuts or even rate hikes again.

Against this backdrop, we prefer European bonds, as economic growth in parts of the eurozone remains weak, which increases the likelihood of further interest rate cuts. Furthermore, we maintain our positive view on emerging market local currency bonds. The devaluation of local currencies in emerging markets appears to be over, which supports this asset class.

Credit

High yield bonds remain an attractive market, supported by solid corporate fundamentals, low default rates and continued investor demand. While the potential for a further tightening of risk premiums appears limited, financing conditions remain favorable overall, particularly in selected regional markets.

We see European high-yield bonds as a good option, benefiting from the ECB’s supportive policy. Valuations remain attractive, which underlines our positive view of the region.

Asian high yield bonds offer diversification benefits, with China’s stimulus measures providing a tailwind. Their low correlation with other markets increases their resilience and makes them a valuable component of a balanced portfolio.

Given the general macroeconomic environment and attractive yield levels, we continue to lean towards riskier bond segments, while we are generally cautious on US high yield and investment grade bonds, where valuations and longer duration appear less favorable.

Money Market

Money market instruments remain an attractive option in the current environment as they offer a combination of liquidity, stability and competitive yields. With the yield curve showing signs of a slight steepening, short-term instruments continue to offer a solid return while mitigating duration risk. Their defensive nature makes them a valuable component of our broader investment strategy, providing flexibility in a volatile market environment.

Commodities

We are neutral on energy and industrial metals. OPEC’s production restrictions are providing some support, but the market remains well supplied and demand growth is sluggish. China’s stimulus measures have not yet provided any strong impetus and the stronger US dollar continues to weigh on industrial metals. Although geopolitical risks remain, they are not currently driving market sentiment.

We maintain our overweight stance on gold as higher inflation in the US and rising debt levels support gold’s long-term appeal. Despite a short-term setback after the US elections, the gold price has reached new highs, driven by strong technical momentum and continued buying by central banks and private investors.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.