Interview with Dr. Manfred Frühwirth, Vienna University of Economic and Business Administration

What is Behavioural Finance?

Behavioural Finance is located at the interface of finance and psychology. As a rule, Behavioural Finance investigates how irrational behaviour (most often on the investors’ part) affects asset prices on the capital market.

2a) Are there any examples of this irrational behaviour that we can see on the stock exchange?

A typical example of irrational behaviour that I can think of are bubbles and stock exchange crashes. Just think of the “Corona crash” in early 2020. Psychological phenomena such as herd behaviour, extrapolation errors, availability heuristic, myopia, and affect heuristic triggered a massive slump back then. This was irrational exuberance that we often see at the stock exchange. The concept of irrational exuberance has been known by science for a while. It was developed by Robert Shiller from Yale University a few decades ago, and he received the Nobel Prize for it in 2013.

Is Tesla an example of irrationality?

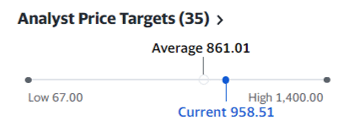

The mispricing of individual shares cannot that easily be ascertained at a glance. At the very least, you need a serious company valuation model, and then you can compare the market price with the fundamental value from the model. The current share price of Tesla is USD 950. Analyst estimates of the fundamental value (“price target”) suggest the following:

Analyst Price Targets:

The consensus analyst estimate for the fundamental value of USD 861 suggests a significant overvaluation. But be careful – analysts are known to have been wrong! For example, studies show that analysts, too, are subject to herd behaviour. Also, there are anchor effects: the fundamental value, i.e. target price, as calculated by analysts is often biased towards the current market price.

If we, regardless of analyst estimates, believe in the market timing hypothesis from Behavioural Corporate Finance, we have to deduce from the fact that Elon Musk is currently considering the sale of his own shares that he himself regards them as overvalued.

Reasons for a potential overvaluation of Tesla could be herd behaviour and availability heuristic. Many people buy Tesla shares because for years everyone has been talking about Tesla and Elon Musk (and in parts about topics that have nothing to do with the shares, e.g. Mr. Musk’s tweets, Dogecoin, and space travel courtesy of his company).

What are the main mistakes investors make in general when investing their money?

From the top of my head, I can think of the following ones:

Extrapolation mistake: you buy an asset (e.g. a share) because the share price has increased in the past and you believe that it will do so in the future as well. Your rationale is: “The price IS increasing.” (instead of “The price HAS increased.”) And the same applies the other way around: you sell an asset because the price has fallen, and you believe that it will do so in the future as well. Here, your rationale is: “The price IS falling.” (instead of “The price HAS fallen.”) Overall, therefore, you will buy at a higher price and sell at a lower price. We saw that during the financial crisis of 2007 to 2009. Many retail shareholders sold their shares exactly at the bottom of the crisis.

Herd behaviour: you buy an asset because others (e.g. friends or colleagues) have bought the same one. And you sell an asset because others have sold it as well. These transactions are not always fundamentally justified.

Loss aversion: you dislike losing significantly more than you enjoy winning the same amount. This is why people become risk-takers in the loss zone (please see also my response to question 5). On the capital market, this leads to the so-called disposition effect, which works like this: you sell winning shares (i.e. shares where the current price is above the purchase price) too soon because you are generally (and in the winning zone even more so) risk-averse; and you hold losing shares (i.e. shares where the current price is below the purchase price) too long because you do not want to realise the loss, and you become a risk-taker in the losing zone (N.B. this is basically the hope that a price increase will wipe out the losses). There has been empirical evidence for the disposition effect for decades.

Overconfidence: you have too much confidence in your abilities, faculties, and know-how. As a result, investors do not turn to advisors, invest excessive amounts actively (because they believe too much in their market timing and stock/sector-picking competence), and diversify too little. By contrast, studies have shown since the 1960s that (as a rule and in the long run) passive investment strategies beat active strategies. Goldman Sachs argues along the same lines that the right asset allocation (as opposed to stock-picking or market timing) accounts for 91.5% of the investment success.

As you can see from this short list, the number of popular psychological mistakes and their examples are too plentiful to discuss in this interview. But there are still a lot of other mistakes and examples on the 160 pages of chapter 5 of my new book.

Why are so many people overconfident?

Among other things, this is due to the attribution of causalities that we handle in such a way as to maximise our self-worth: every person experiences positive and negative events in their life. These events are interpreted in a, shall we say, slightly self-aggrandising way. As a result, the reasons of positive events are located in oneself, whereas the reasons of negative events are attributed to exogenous factors (e.g. other people, injustices, or bad luck). For example, a trader will generally put down his successful trades to his good instincts and the correct valuation to his expertise, whereas unsuccessful trades will be put down to bad luck, unforeseeable events, or insider trading by others.

Over time, this results in learnt overconfidence: every positive event in your life further boosts your overconfidence. This creates the risk that over the period of one’s career, every promotion – clearly a positive event – keeps building overconfidence. Scientific studies show as much.

5) Why do many people become reckless after suffering relatively small losses and thus get themselves into even deeper trouble?

This is due to the phenomenon of risk aversion. Once you are in the loss area (in the casino, as a manager, as politician, or as investor), you are willing to take more risk in order to get the chance to get out of this psychologically painful area.

Why do people tend to react rather than to act?

Here, I can think of several reasons from psychology:

First, loss aversion causes the so-called status quo bias. Active behaviour (i.e. deviation from the status quo) of any kind triggers changes that can bring about gains or losses. But since losses are more painful than gains are cause for celebration, you prefer to stick with the status quo. This prevents the risk of psychologically dearer losses.

A second reason is the anticipated regret, i.e. you are afraid that your own decision may at hindsight turn out to have been bad. Therefore, non-action is preferable.

A third possible reason is learnt helplessness. If you have seen repeatedly that your efforts do not pay off, you stop trying (even if the conditions have changed and there is actually the chance of a positive outcome).

For the aforementioned reasons, many savers do not dare to invest in shares and stick with the savings booklet that basically pays no interest and thus forego a possible high (expected) yield in their efforts to build capital for their retirement.

Do you regard equities as overvalued at the moment?

This is a question that is difficult to answer. If I gave you a straightforward answer, this would probably indicate overconfidence. There are a whole range of research studies from recent decades that indicate that the market timing of investors or fund managers works only very rarely. For example, numerous international studies by the two US researchers Barber and Odean show that the success of day traders (speculators) is very limited. 85% of day traders lose money over a period of six months, and only 1% of all day traders can beat the market for more than one year.

My personal assessment is that shares currently command HIGH valuations. But the reason is the extremely low level of interest rates. This is the so-called TINA problem (There Is No Alternative). As investors are running out of alternatives, many assets currently have high valuations (e.g. shares, bonds, real estate).

This does not mean they are OVERvalued. Overvaluation means that the price is above the fundamental value. And if the interest rates are very low, future earnings, dividends, or cash flows are discounted at lower rates as well, as a result of which the fundamental value of the shares increases automatically.

Thank you for the interview!

Recommended reading: Behavioural Corporate Finance – Grenzen der Rationalität in der Betrieblichen Finanzierung (Behavioural Corporate Finance – Limits of Rationality in Corporate Finance by Dr. Manfred Frühwirth)

The book consists of two volumes and came out in October.

It contains essential and well-structured elements of financial management, corporate finance, behavioural economy, behavioural finance, and behavioural corporate finance. The topics are presented graphically and from an application-oriented perspective. They are complemented by many real-life case studies, interviews with investors, and results from manager surveys.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.