The year 2022 will be remembered on the basis of numerous superlatives and headlines: record inflation, rapid interest rate hikes, large global yield increases, and much more. The Bank of Japan (BoJ) held its monetary policy meeting on 20 December 2022, the last central bank decision of the major G-4 central banks. Thus, the eventful year 2022 has now come to an end as far as central bank decisions are concerned.

Surprise move by Bank of Japan

At its last monetary policy meeting, the BoJ surprised market participants by changing its yield curve control (YCC) framework much earlier than expected. By calling on this monetary policy tool, the central bank prevented unsolicited yield changes in either direction. At the same time, it left the key-lending rate and the yield target for 10Y bonds unchanged for the time being (- 0.1 % and 0.0 %, respectively). As for the policy change, the increase in the tolerated trading band around this 0% level from the recent +/- 25bps to +/- 50bps came as a surprise and heralds the beginning of a possible end to the bank’s ultra-loose monetary policy. The BoJ has been dragging its feet in this department compared to other central banks this year. While other central banks have embarked on their biggest tightening cycle in a generation, it has maintained interest rates at the zero lower bound.

We should not underestimate the impact: a tighter Bank of Japan policy would remove one of the last global anchors that has helped keep borrowing costs low across the board. However, the fact that the BoJ has surprised financial markets again is no new phenomenon: previous unexpected moves have contributed to the reputation of the Bank of Japan’s general inclination to throw a surprise move at the markets from time to time.

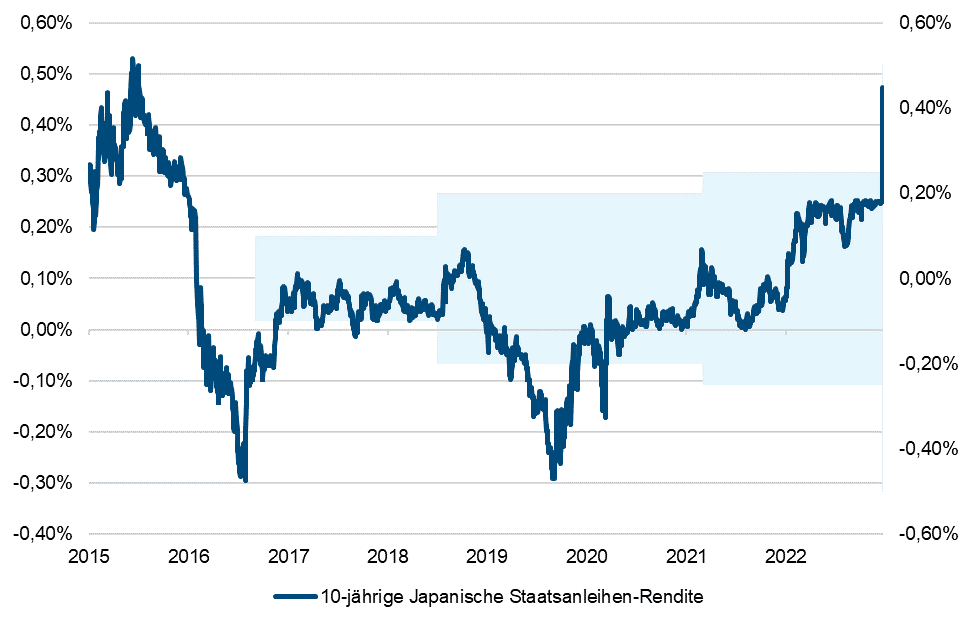

Chart: 10Y Japanese government bond & yield curve control (YCC)

Note: Past performance is not a sufficient indicator of the future performance of an investment. Representation of an index, no direct investment possible.

Unsurprisingly, Japanese government bond yields rose sharply on the back of the announcement. The 10Y yield on climbed by about 15bps (100 basis points = 1%) to 0.41% immediately after, having previously remained at 0.25% for months. Equally spurred by the surprise move, the Japanese yen (JPY) made a comeback against the US dollar and the euro, appreciating by more than 3%.

What is the fair value of a Japanese government bond?

In its monetary policy statement, the central bank announced the rationale behind the decision:

- An improvement of the functioning of the bond market,

- the promotion of a smoother formation of the overall yield curve, and at the same time

- the maintenance of accommodative financial conditions.

However, it surprised with its announcement of a significant expansion of its JGB purchase operations. The BoJ will increase the size of its regular monthly purchase operations from JPY 7.3 trillion to about JPY 9 trillion in the first quarter of 2023. It will also offer to buy 10Y JGBs (government bonds) at a yield of 0.5% on each business day through fixed-rate purchases.

The decision to increase the control margin makes sense in the current environment. However, increasing buying volumes at the same time to defend the new target taints the decision a little. We can use the 10Y Japanese swap rate to establish a possible fair value of the 10Y Japanese government bond.

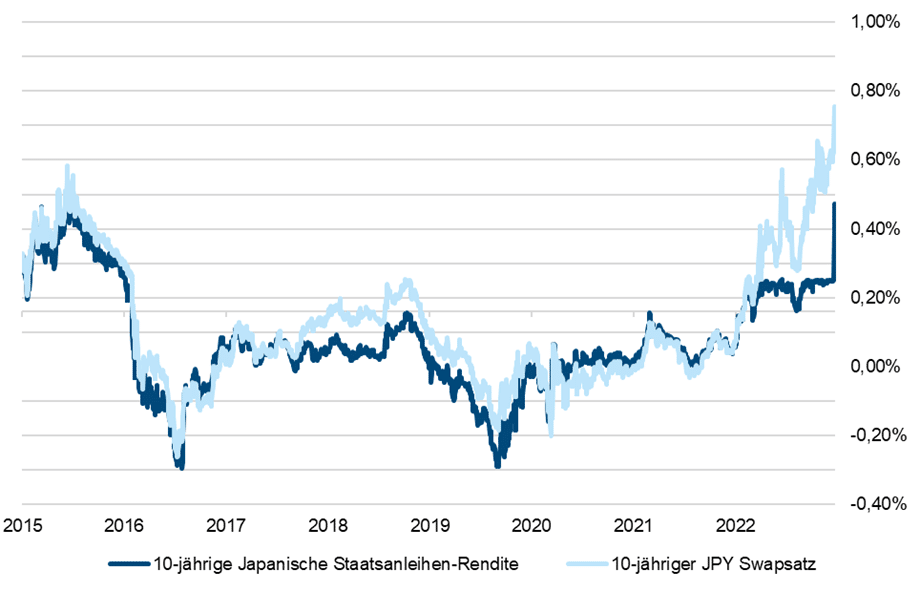

Chart: 10Y Japanese government bond yield & 10Y swap rate

Note: Past performance is not a sufficient indicator of the future performance of an investment. Representation of an index, no direct investment possible.

When comparing the 10Y JPY swap rate with the 10Y Japanese government bond, we find a possible fair yield of about 0.75%.

Transition to the new Governor of the central bank

The central bank’s decision at its last monetary policy meeting in 2022 seems all the more surprising considering that the current Governor, Haruhiko Kuroda, will end his second and last term in April 2023. Most recently, he has repeatedly made dovish comments (N.B. a monetary policy that seeks to promote rather than restrain economic growth) and advocated loose monetary policy. It is possible that the decision can be interpreted as a first admission of upward pressure on global yields and, at the same time, a preparation of the path for Kuroda’s successor.

At the moment, the current Deputy Governor Masayoshi Amamiya is being considered as Mr. Kuroda’s successor. Amamiya follows a similar line as Kuroda. So, from this angle there should be no surprises. Going forward, the Bank of Japan’s focus will be, on the one hand, on revising part of the forward guidance (i.e. communicating future monetary policy intentions). These are still partly tied to COVID-19. On the other hand, the 2013 agreement between the government and the central bank is to be revised as well.

In the base-case scenario, the BoJ will maintain the principles of the current policy and thus make no additional changes to its policy in 2023. One risk factor in this scenario are the annual wage negotiations between unions and employers in spring. Should a deal higher than 3% be reached here, a further step towards the normalisation of the interest rate policy could not be ruled out.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.