The year 2025 promises to be an interesting chapter in the world of international financial markets, especially when it comes to companies going public (traditionally via IPOs, i.e. initial public offerings). While fewer newcomers have been entering the stock market in recent years, this could soon change.

Some innovative companies, for example from the tech or fintech industry, are likely to be in the starting blocks to go public in the coming year. But what does it actually mean for a company to be listed on the stock exchange?

What is an IPO?

A company’s stock market career usually starts with its initial public offering (IPO). If a company dares to take the step to go public, its business model has usually already proven itself and reached a critical size.

There may be many reasons for a company to go public: expansion plans, new research and development fields that the company wants to tap into, an exit of a venture capital firm or existing shareholders, or a plan to reduce debt. Regardless of the company’s plans, going public usually means one thing above all: fresh equity capital, however it is used by the company.

A listing on the stock exchange also comes with numerous obligations. For example, listed companies must regularly report on their figures and business performance. However, if the IPO is successful, it can not only strengthen the company’s financial base, but also significantly increase its profile and market position.

Types of going public

Depending on the company’s objectives and the current market situation, there are different ways to go public:

📝 Traditional IPO

In a traditional IPO, a company issues new shares to investors to raise fresh capital. The transaction is carried out with the help of investment banks, which determine the price and the number of shares to be issued, and then also organise continuous trading on the stock exchange.

✍ Direct Listing or SPO (Secondary Public Offering)

In a direct listing, existing shares are listed on the stock exchange, and no new shares are issued. This allows existing shareholders to sell their shares to third parties without the company receiving any new capital.

For example, a venture capital fund wants to sell its shares. An investment bank places these shares with a wide range of institutional and private investors, lists the company’s shares on the stock exchange, and then organises ongoing trading.

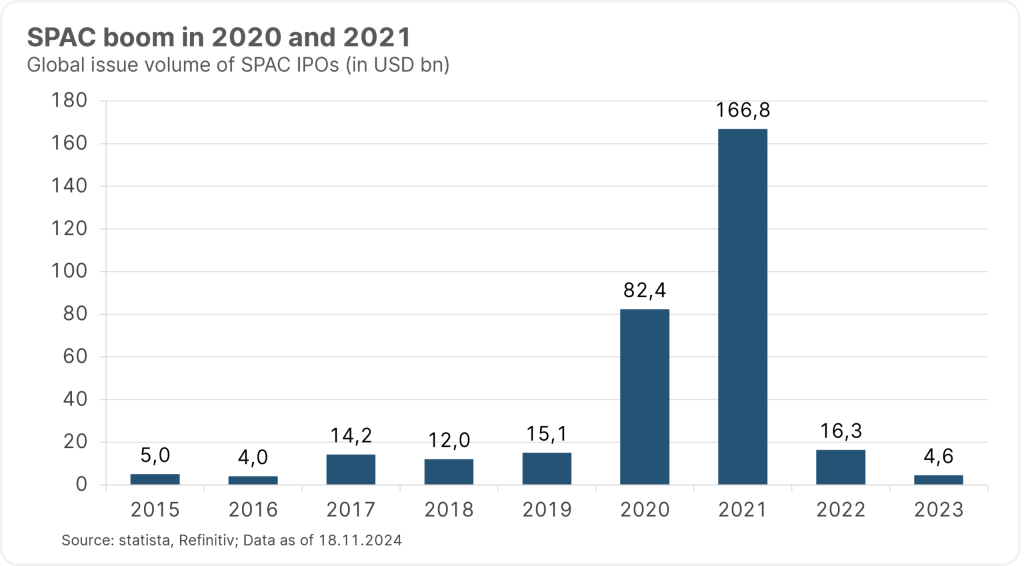

🔍 SPAC (Special Purpose Acquisition Company)

This type of going public was particularly popular in 2020 and 2021. In this case, a shell company (the SPAC) is formed with the purpose of taking over another company at a later date. The company therefore sells its shares and raises capital on the stock exchange in order to then use these funds to take over another company (which may also be listed). When the transaction is complete, the shareholder ultimately holds shares in the acquired company.

The advantage is that it is often a faster and less regulated way to go public. Investors can use a SPAC to invest in companies that might not have dared to go public via a traditional IPO. However, there are also risks associated with SPACs – for example, there is no guarantee that the takeover by a SPAC will be successful. Furthermore, it is not possible to estimate how expensive or cheap the takeover will be.

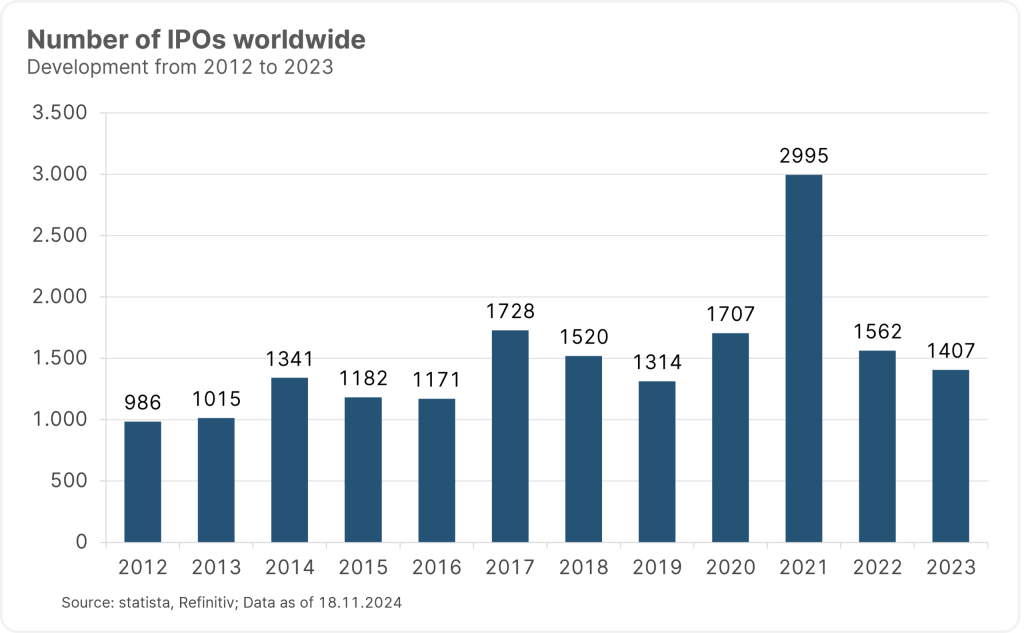

All (relatively) quiet on the IPO front in recent years

While IPOs were still booming in the Corona years of 2020 and 2021, things have been quieter recently when it comes to new companies going public. In 2022, the carmaker Porsche AG was one of the few IPOs in Germany to list its shares on the Frankfurt Stock Exchange. So far, this IPO has been less than successful for investors, with a loss of over 20% since the initial listing. Porsche is also struggling with the current crisis in the automotive industry.

In 2023, British chip designer ARM Holdings showed that things could look brighter though when it ventured onto the trading floor of the Nasdaq technology exchange in New York for the first time. In just over a year since the IPO, ARM’s shares have gained more than 120%.

Issue price and stock market price

Whether or not an IPO is successful depends not only on the company’s business model and performance, but also on the issue price and the stock market environment. The issue price is the price at which a share is first placed. If demand for the share is high, the first stock market price is often significantly higher than the issue price.

If the shares were placed at too high a price or hopes of a high first price were too ambitious, the initial listing can also be significantly lower than the issue price. Many factors play a role here, such as the stock market environment or the size of the transaction.

Generally speaking, the number of IPOs internationally has fallen over the past two years. In the USA, one of the largest IPOs this year has been that of social media platform Reddit, which was floated at a market capitalisation of USD 9.5bn (at the time of the IPO). The social network has already played a central role in connection with the stock market in the past, with meme stocks being the buzzword here.

In Europe, the Swiss cosmetics company Galderma, among others, ventured onto the stock market. It was valued at EUR 20bn. The Midea Group, the world’s leading manufacturer of household appliances, went public on the Hong Kong stock exchange this year and raised USD 4bn.

(Potential) newcomers in 2025

IPOs could pick up momentum again in the coming year. Former start-ups in particular could take the plunge and go public, or indeed already have specific IPO plans. Here is a selection of (potential) newcomers:

Please note: the companies listed have been selected as examples and do not constitute an investment recommendation.

🐼 Bitpanda

The first candidate on our list comes from Austria: according to insiders, the Vienna-based crypto exchange Bitpanda is considering an IPO, as reported by the Bloomberg news agency at the end of October. According to the report, the company could seek a listing on the Frankfurt Stock Exchange. However, a trade sale is also one of the possible options. According to the report, Bitpanda could be valued at a minimum of USD 4bn.

💶 Klarna

The Swedish fintech company, known for its “Buy Now, Pay Later” solutions, will soon go public in the USA. Klarna recently submitted the relevant documents to the US regulatory authority, SEC. According to analysts, the company could be valued at USD 14.6bn in the event of an IPO.

💰 Stripe

The US payment services company has been repeatedly expected to go public in recent years, but the IPO has been postponed time and again due to the market situation. Midway through 2024, the company officially announced its intention to go public. It plans to decide how, where, and when the IPO will take place within a year. According to experts, the company could currently be valued at around USD 55 to 60bn on the stock exchange.

👕 Shein

As early as the end of 2023, the Chinese fashion retailer informed the US Securities and Exchange Commission of its plans to go public. The company produces clothing in China and distributes it internationally, primarily in Europe and the USA. However, due to political and regulatory hurdles, nothing came of it then. In the past, the company has repeatedly been confronted with serious allegations of forced labour and close ties to China’s political leadership.

Now, Shein is planning to go public in London. The company is currently valued at around USD 66bn, which could make the IPO one of the largest of 2025.

🎲 Databricks

Founded in 2013, the software company could also go public soon, in which case it is expected to fetch a market capitalisation of USD 40 to 57bn. Databricks develops cloud-based solutions for building and managing data for companies and links this to AI models. In 2023, the company generated a turnover of USD 1.6bn.

📞 Reliance Jio

One of the largest IPOs in 2025 is likely to take place in India. The telecommunications company Reliance Jio is planning an IPO there, with analysts valuing the company at around USD 100bn. India’s largest telecom provider serves around 480 million customers and could soon set the record for the largest IPO in India.

However, the different experiences of past IPOs show that success depends heavily on the issue price and the market environment, and not every IPO goes well for investors. For good risk diversification, it can therefore make sense for private investors to invest in a broadly-based equity fund that invests worldwide, such as ERSTE RESPONSIBLE STOCK GLOBAL. The fund comes with the benefit that it invests in high-quality companies and actively manages the positions in the fund’s portfolio. In addition, an investment fund has a better chance of acquiring new shares in IPOs than a private investor. It should be noted that investing in securities involves risks as well as opportunities.

For investors who are primarily interested in tech companies, ERSTE STOCK TECHNO offers the opportunity to participate in the development of this industry. With ARM Technologies, the fund is currently also invested in one of the more successful IPOs of recent years. It should be noted that the fund’s price may also be subject to strong price fluctuations.

Notes ERSTE RESPONSIBLE STOCK GLOBAL

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the investment company’s part.

Benefits for investors

- Broadly diversified investment in equities from the developed markets.

- Participation in environmentally, ethically, and socially acting companies.

- Active asset selection based on fundamental criteria.

- Chance of attractive gains.

Risks to bear in mind

- The price of the fund may be subject to significant fluctuations (volatility).

- Foreign exchange fluctuations may affect the value of the fund due to the investment in foreign currency.

- Capital loss is possible.

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act.

Notes ERSTE STOCK TECHNO

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the investment company’s part.

Benefits for investors

- Broad diversification in technology companies even with low capital investment.

- Active title selection according to fundamental criteria.

- Opportunities for high value appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital growth.

Risks to bear in mind

- The price of the fund may be subject to significant fluctuations (volatility).

- The investor bears, in particular, the risk of the technology sector and the issuer risk of the participating companies.

- Foreign exchange fluctuations may affect the value of the fund due to the investment in foreign currency.

- Capital loss is possible.

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.