War, inflation and interest rate worries – as an investor, you need strong nerves and endurance in 2022. Whereas the previous year brought record-breaking gains on the stock exchanges, the trading year to date has been dominated by a gloomy mood on the markets. But especially in times of crisis, it is worthwhile for shareholders to persevere, as a long-term look at the markets shows.

Turbulent half-year

Looking at the most important indices, the bottom line of the first half of the 2022 stock market year is negative. At the beginning of the year, the highly regarded S&P-500 in the USA climbed to a new record high. Soon after, however, negative factors such as rapidly rising inflation and the intervention of central banks gained the upper hand. The Russian invasion of Ukraine at the end of February also caused the markets to plunge deeper and fueled concerns, especially in Europe, of a slump into recession.

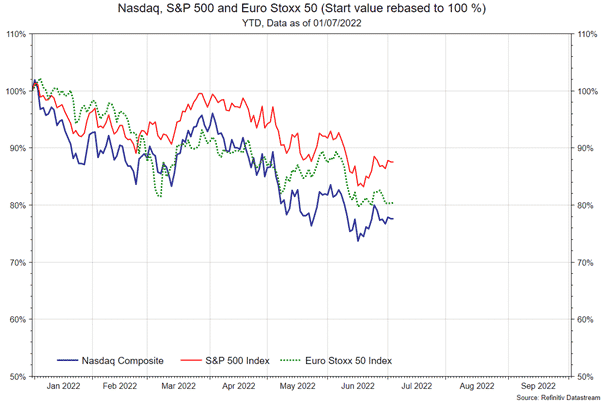

For the first time since the 2020 Covid crash, the S&P-500 is back in a bear market. This means that the stock market index is inclining more than 20 percent below its all-time high reached at the beginning of January. In Europe, the situation is no different for important indices such as the Euro-Stoxx-50 or the DAX. The year-to-date losses were even more pronounced for the technology-heavy US Nasdaq Composite index, which has lost almost 30 percent since the beginning of the year. The prospect of a stricter monetary policy with higher interest rates is weighing particularly heavily on high-growth companies in the technology sector, which often still have little or no profitability.

In euro terms, the two US indices are less clearly in the red (see chart). This is due to the fact that the euro exchange rate has fallen significantly against the US dollar so far this year. With a current rate of 1.019 US dollars per euro (as of July 6, 2022), the European currency is currently around 13 percent below the level of a year ago.

Crises occur again and again

A sense of crisis is nothing new on the financial markets. Again and again, economic developments or unforeseen events cause falling prices on the stock markets. The memory is still very fresh of the outbreak of the Covid-19 pandemic in 2020 and the subsequent crash on the stock markets. The bursting of the US real estate bubble in 2008 and the dotcom bubble at the beginning of the millennium also sent the markets into a tailspin and left many investors perplexed.

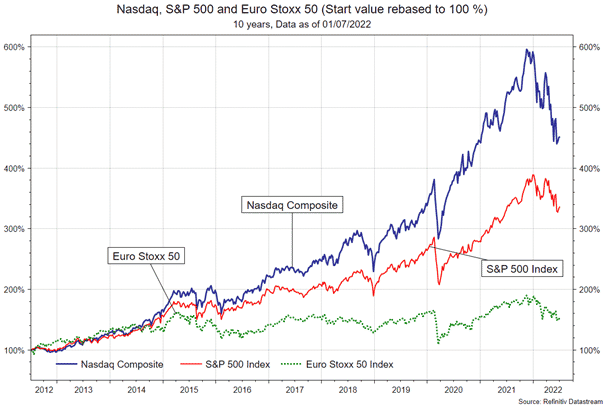

However, a look at the “big picture” shows that even after the sharpest falls, share prices have always recovered and climbed to new all-time highs. Anyone who entered the market before the financial crisis in 2008, for example, had to put up with significant losses temporarily, but would have more than doubled their invested money by now, despite the Covid crash and the current bear market.

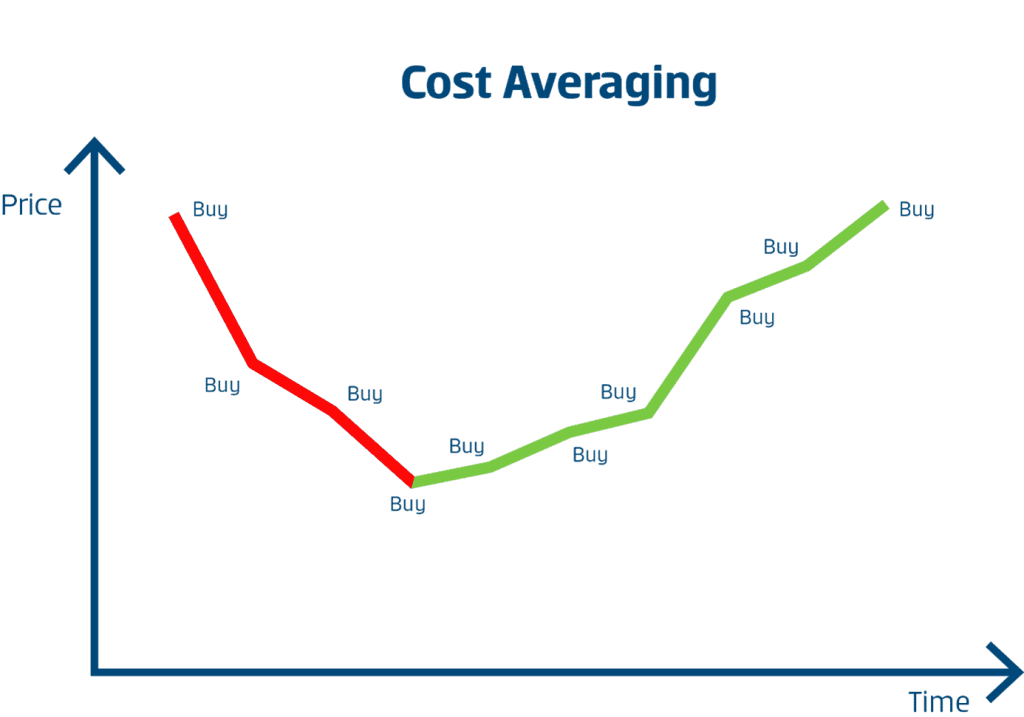

The cost-average effect

For investors who regularly invest in the market via a fund savings plan, lower prices also offer an opportunity. They can profit from the cost-average effect. Depending on the performance of the investment fund, the performance of an s Fund Plan will differ from that of a one-off investment (higher or lower). A loss of capital is possible in both cases. Essentially, this means that you get more units for the monthly savings rate when prices fall. Conversely, if the savings amount remains the same, fewer shares are bought when the stock markets are on the way up again.

As a result, more shares are purchased via a savings plan, especially in uncertain times on the stock markets, and you can profit more when the markets recover, and prices rise. For example, anyone who opens a savings plan in the current bear market should enjoy an attractive return as soon as prices return to the levels seen at the start of the year.

The “U” example demonstrates the advantage of a cost-averaging strategy clearly. The “U” on the stock exchange simply means that prices fall from a high and then rise again after bottoming out – just like the letter U. If, for example, you were to invest 1,000 euros in the market at the beginning of the “U”, dive through the downturn and then sell at the end of the “U”, when prices have reached their initial level again, you would not have achieved any return.

With a cost-average strategy, things are different. If you, for example, spread the 1,000 euros over ten months at 100 euros per month, you will collect more shares for the same amount when prices fall at the beginning. In both cases, you invest a total of 1,000 euros. If the prices rise to the initial level, as in the case of a “U” trend, you have already won compared to a one-time investment. The invested money yields a positive return even though the price is only the same as at the beginning of the investment. The stronger the “U”, the higher the return. Price fluctuations are very pronounced, especially in the case of stocks. It therefore makes sense to save regularly and continuously, especially in the case of volatile investments such as shares.

However, even with the cost-averaging approach, there is no guarantee that the investment will perform positively. In addition, it should be noted that in the event of constantly rising prices over a long period of time, a one-time investment would have yielded more return in retrospect than continuous saving according to the cost-averaging principle.

The difficulty of market timing

“Time in the market is better than timing the market” – according to this old stock market wisdom, it is better to be invested in the market even in more difficult times than to try to catch the highs and lows of the stock markets through correct timing. On the one hand, not even the most experienced experts can predict where the markets will go and when it is the perfect time to buy or sell. Investors may therefore run the risk of missing the re-entry into the market and thus a possible rise in prices. On the other hand, frequent changes in terms of the strategy, i.e. multiple exits and re-entries into the market, cause additional transaction costs. The motto applies: “Too much trend-chasing leads to the poorhouse”.

Conclusion: Perseverance pays off on the stock market

Especially in times of crisis, it is important to keep your nerve and stay true to your strategy. Those who invest their money long-term in a savings plan, for example in a fund, and do not let the dreaded bear get them down can profit in the long run.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.