About five years ago, the world seemed to come to a virtual standstill overnight. Originating in China, the coronavirus spread rapidly around the globe. The extensive lockdowns to contain the spread of Covid-19 were having far-reaching effects on more than just society. The economy also suffered massively from the consequences of the coronavirus crisis. Not least, the financial world experienced one of the fastest stock market crashes in modern history. Within a few weeks, the major indices had shed trillions in value, triggering panic among investors.

Looking back on the Covid pandemic from a stock market perspective, the crisis and the subsequent crash have shown one thing above all: markets can recover faster than expected. Those who kept a cool head and stayed invested during the Covid crash were rewarded. The initial crash was followed by a rapid recovery – which once again shows that emotional decisions in investments can lead to missed opportunities and that long-term thinking pays off when investing money. Please note: investing in securities involves risks as well as opportunities.

What this article covers

👉 What caused the market crash in 2020 and why prices were falling off a cliff

👉 How governments and central banks intervened to stabilise the economy

👉 The rapid recovery – and why selling at the bottom was a costly mistake

👉 What lessons investors can learn from past market turmoil for their strategy

From the outbreak to a global pandemic

The first cases of the coronavirus (later officially named SARS-CoV-2) were detected in the Chinese city of Wuhan at the end of December 2019. The threat was not initially recognised and priced into the markets – after all, there had been previous outbreaks of SARS viruses. However, those had been contained before spreading beyond China’s borders.

When the virus finally reached other countries and the number of infections in Italy, Iran, and South Korea skyrocketed, it became clear that Covid-19 was more than a regional problem. At the end of February, Italy reported major outbreaks of the virus in Lombardy, leading to the first lockdowns in Europe.

Source: unsplash.com

A historic crash is picking up momentum

On the stock exchanges, investors began to price in disruptions in supply chains, travel bans, and the threat of a recession. After all, the virus quickly made itself felt on an economic scale as well. As early as February 2020, maritime container exports from China fell by 30%. Soon after, more and more major events were also cancelled in Europe.

In the week of 24 to 28 February, the Covid crash took its course: global markets recorded their worst weekly drop since the 2008 financial crisis. The S&P 500 fell by over 11% in just five days.

Severe economic fallout

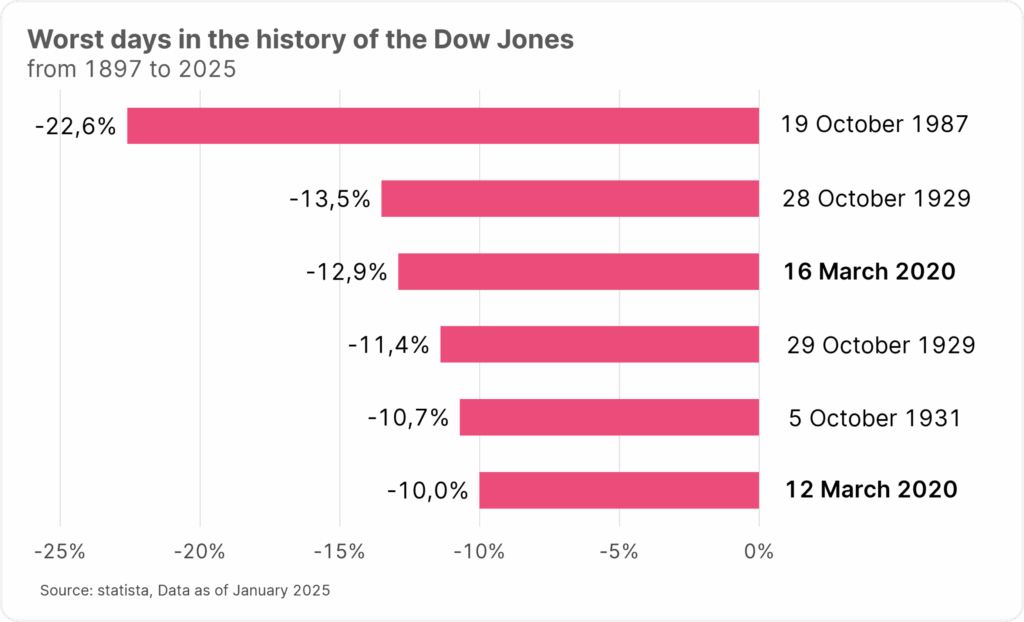

After the World Health Organization officially declared Covid-19 a global pandemic on 11 March 2020, equity markets continued to tumble. On 12 March, the Dow Jones fell by 10% in a single day – the worst decline since 1987 and the third-largest daily loss in the index’s history. On 16 March, prices fell by a further 10% as investors feared a complete economic shutdown.

Note: Past performance is not a reliable indicator of future performance.

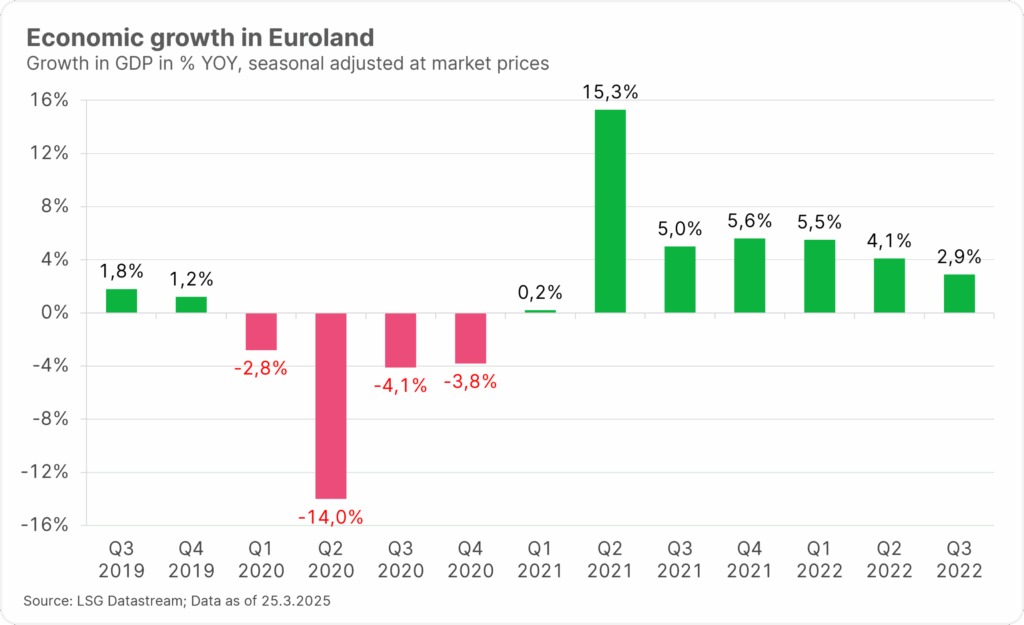

The impact of the pandemic on global economic figures was massive. Not only did economic growth forecasts collapse, but unemployment also rose rapidly. In the week of 26 March, the number of initial applications for unemployment benefits in the USA increased tenfold to over three million – an unprecedented historical increase. In total, almost ten million Americans lost their jobs in March 2020. In Austria, too, unemployment rose dramatically. Economic growth experienced an unprecedented slump.

Please note: Past performance is no reliable indicator of future developments.

Markets hit rock bottom in March 2020

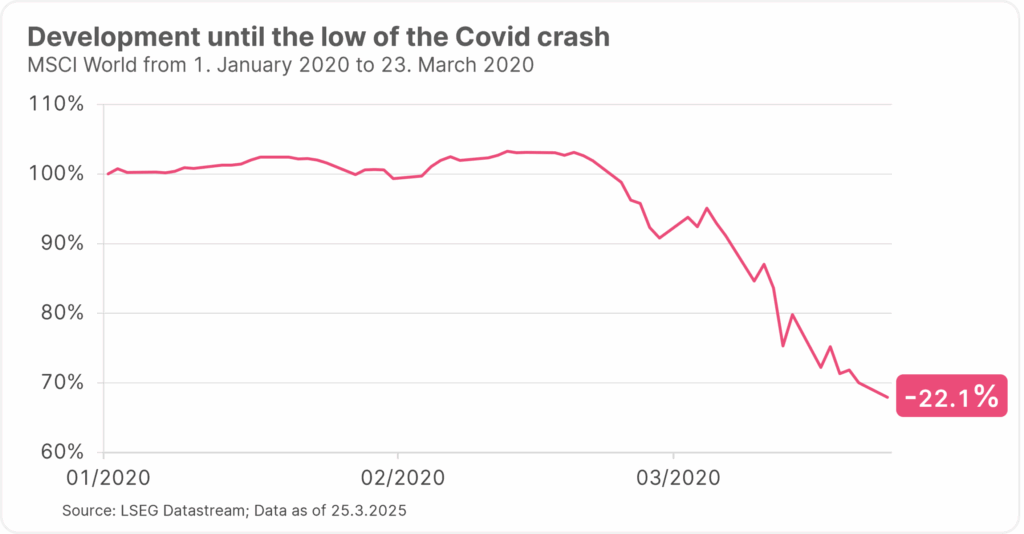

By then, markets worldwide had shed a huge amount of value. The MSCI World index, an equity index that reflects the performance of stock markets in developed economies, plunged by over 22% by the time the Covid crash bottomed out. In Europe, too, indices recorded a historically weak first quarter. Germany’s leading index, DAX, in Frankfurt dropped by over 30% in the first three months of the year.

Please note: Past performance is no reliable indicator of future developments. The chart is indexed at 100% = 1 January 2020.

The situation on the oil market at the beginning of the COVID crisis was easily as turbulent. The slump in demand due to the numerous lockdowns led to a sharp fall in the price of crude oil, which was further exacerbated by a price war between the oil exporters Saudi Arabia and Russia. Compared to the beginning of 2020, the price of crude oil fell by a quarter. The situation came to a head on 20 April 2020, when the price of US West Texas Intermediate (WTI) briefly turned negative for the first time due to the threat of oil inventories overflowing as a result of the severe oversupply.

The pandemic caused an economic standstill that was unprecedented, at least in the modern world. Uncertainty surrounding the further development of the coronavirus crisis was the main cause of the immense losses that markets incurred in February and March 2020. As panic was spreading, even traditionally stable assets would record sharp declines. Many hedge funds and institutional investors were forced to sell their holdings to meet margin calls, further exacerbating the downward spiral. However, this opened up a historic buying opportunity for investors, as it turned out.

The quick recovery

After the initial shock and the massive losses, the markets soon began to recover. This recovery was supported by the rapid and decisive response by governments and central banks. The European Central Bank (ECB) and the US Federal Reserve (Fed) lowered their key-lending rates and launched extensive bond purchase programmes to stabilise the financial markets. In addition, massive fiscal measures were taken, including direct financial assistance for companies and households, as well as extensive economic stimulus packages in many countries.

The support measures and additional liquidity caused prices to rebound significantly. By August, the S&P 500 had already made up all the losses it had suffered during the crisis. Despite the severe crash and a historically weak first quarter, the important US equity market index managed to close out 2020 with a gain of over 16%.

Please note: Past performance is no reliable indicator of future developments. The chart is indexed at 100% = 1 January 2020.

Lessons from the crash: keeping a cool head has proven the go-to strategy

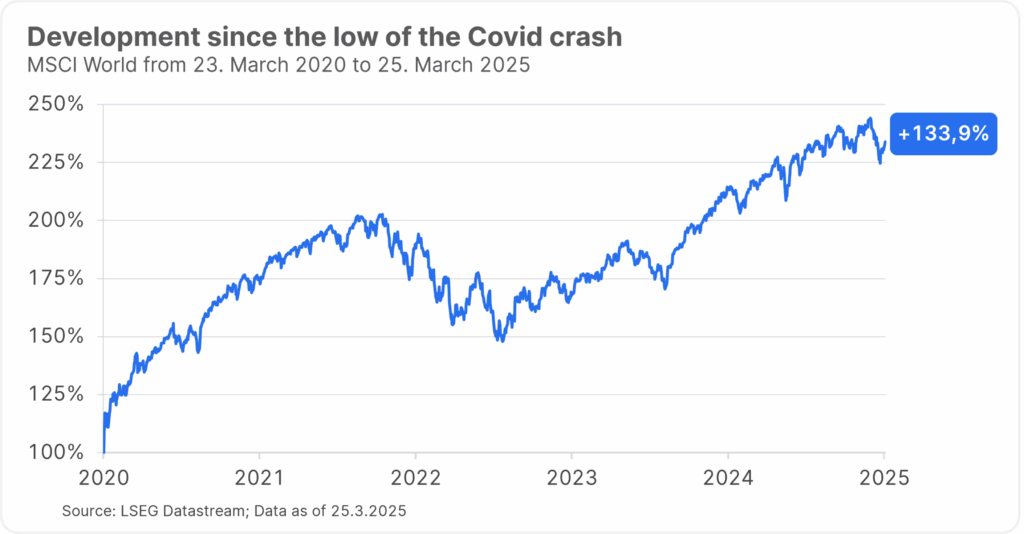

The year 2020 showed that markets were able to recover faster than expected. Investors who sold their positions during the crash incurred significant losses. Those who waited on the sidelines to catch the perfect entry point missed out on much of the stock market recovery. By contrast, those who remained invested or even used the losses to make further purchases benefited from the subsequent recovery.

Even in the current uncertain situation, investors should not panic but remain focused on their long-term goals. History has shown that patience and perseverance pay off. In the stock market, the saying “Time in the market beats timing the market” is emblematic of this – it is better to stay invested in the market than to try to catch the best entry point through perfect timing.

The principle of dollar-cost averaging can help investors to take advantage of downturns in the markets to make additional purchases. Investing a certain amount on a regular basis, regardless of market developments, lowers the average purchase price when prices fall – investors get more units for the capital they have invested. What is particularly important to remember is that investing in the stock market is a marathon, not a sprint.

Please note: the effect from dollar-cost averaging decreases as the savings plan progresses, because the accumulated assets increasingly behave as they would if you had invested the entire amount in a single lump sum. Depending on market developments, a one-time investment may also prove to be more favourable. Investing in securities involves risks as well as opportunities.

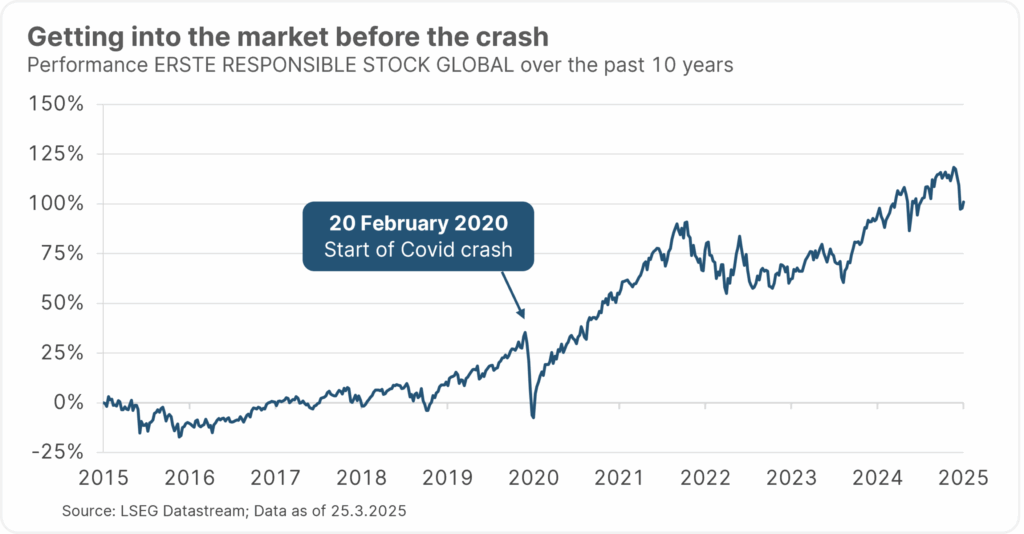

The Covid crash shows that investors should focus on a long-term investment horizon, regardless of boom phases or crises. Even those who only invested in the global stock market shortly before the 2020 crash would have long since recovered the losses from this investment, as the following example shows:

If you had invested broadly in the stock market on 20 February 2020, right before the first losses and the beginning of the Covid crisis – for example, in the ERSTE RESPONSIBLE STOCK GLOBAL equity fund – the capital invested would have lost almost a third of its value within about a month. However, if you had stuck to your strategy and not exited the market, you would have achieved an average return of 7.9% per year to date.

Please note: Past performance is no reliable indicator of future developments. The chart is indexed at 100% = 1 January 2020. Investing in securities involves risks as well as opportunities. Performance calculated according to the OeKB method. The performance accounts for a full re-investment of any dividends and for the management fee and any performance fee. It does not allow for a one-time load, if applicable at the time of purchase, nor any other transaction fees or fees reducing return such as individual account or depositary fees.

Conclusion

The coronavirus pandemic kept the world and the markets in suspense in 2020. Indeed, the following years were also characterised by lockdowns, uncertainty, and the race for a vaccine against Covid-19. While the coronavirus crash on the stock markets went down in history as the fastest crash of all time, the subsequent recovery was also remarkably rapid. Investors who kept a cool head and stayed invested were able to participate in this rebound after the crash.

Today, uncertainty still prevails in the markets due to Donald Trump’s tariff policy, geopolitical tensions, and economic challenges. These factors are causing volatility and occasional losses. However, the lessons of the coronavirus crisis show that long-term investing is a good way to build wealth over the long term, despite short-term uncertainties. That being said, investors should always keep in mind that investing in securities also involves risks.

Risk notes ERSTE RESPONSIBLE STOCK GLOBAL

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK GLOBAL as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.