- European Union Sustainable Finance Disclosure Regulation came into force on March, 10

- The goal is to create more transparency for sustainability risks in financial investment products

- Austrian Erste Asset Management has implemented EU Sustainable Finance Disclosure Regulation

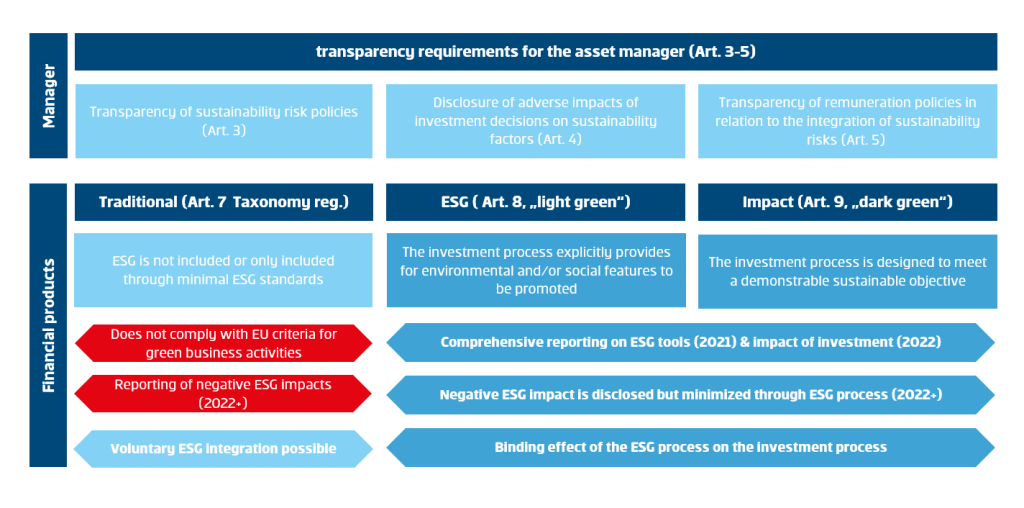

The European Union sustainable finance disclosure regulation (SFDR) came into force on March 10, 2021. From this point on, all financial products, including investment funds, must be classified according to their sustainability. This is intended to create more transparency for sustainable investments in financial investment products.

The disclosure regulation of the European Union establishes new transparency rules on the effects of sustainability risks in financial investment products and adverse effects. Austrian Erste Asset Management (Erste AM) has adapted all relevant documents to the new transparency requirements.

Transparency requirements

Sustainability risks in investment decisions

In order to meet the transparency requirements, Erste AM has adapted all relevant documents and published them on its website (for UCITS funds in the prospectuses, for AIF funds in the §21 document). The description of how sustainability risks are included in investment decisions, including an assessment of how they affect the respective product, is set out for all funds in the prospectus/§21 document.

In addition, further adjustments are made in the product-specific documents for sustainable funds in accordance with Articles 8 and 9 of the Disclosure Regulation (ESG annex in the prospectus, ESG information on the web factsheet, accountability reports with ESG reporting from 2022).

ERSTE AM funds and classification according to the Disclosure Regulation

Impact funds such as the ERSTE GREEN INVEST, invest directly in solutions for ecological and social challenges and are classified according to Article 9 of the EU Disclosure Regulation. The proven “ERSTE RESPONSIBLE” funds are recorded as Article 8 products in this scheme: They continue to meet the highest demands on sustainable investments and, in addition to the existing ESG reporting, will also meet the requirements of the Disclosure Ordinance.

For some time now, Erste AM has been consistently pursuing the path to make its product range even more sustainable. At the beginning of 2020, ESG criteria, which can improve the risk-adjusted return, were started to be integrated into funds that were previously managed in a traditional manner. The processes used can, for example, significantly reduce CO2 intensity, better map the quality of corporate management (governance) in the funds and minimize involvement in violations of international standards. We now also classify these funds as Article 8 products (ESG integration). For all other funds, we are continuously evaluating the possibilities of including even more ecological and social factors in the investment process.

- More on sustainability at Erste AM: https://www.erste-am.at/en/private-investors/sustainability

- More on the SFDR: https://www.erste-am.at/en/private-investors/sustainability/eu-sustainability-disclosure

About us:

About us: With a sustainably invested volume of over 15 billion euros (December 31, 2020) in more than 50 sustainable mutual funds and several special funds, Erste AM is the market leader in Austria in the sustainability sector. Erste AM also plays a pioneering role in the area of ethics and sustainability: Erste AM launched the first environmental equity fund back in 2001.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.