In view of the still rampant Corona pandemic, the EU Commission has recently lowered its growth forecasts for 2021. With the delays in some EU countries’ vaccination programmes, the lockdowns could also drag on, delaying the expected economic recovery, the Commission argues.

Against this backdrop, the eurozone’s economies are still expected to contract in the current first quarter, picking up down the road as the vaccination programmes get underway. The forecast is based on the assumption that there will be initial opening measures towards the end of the second quarter and then a more noticeable easing in the second half of the year. “An improved outlook for the global economy is also set to support the recovery,” the report states.

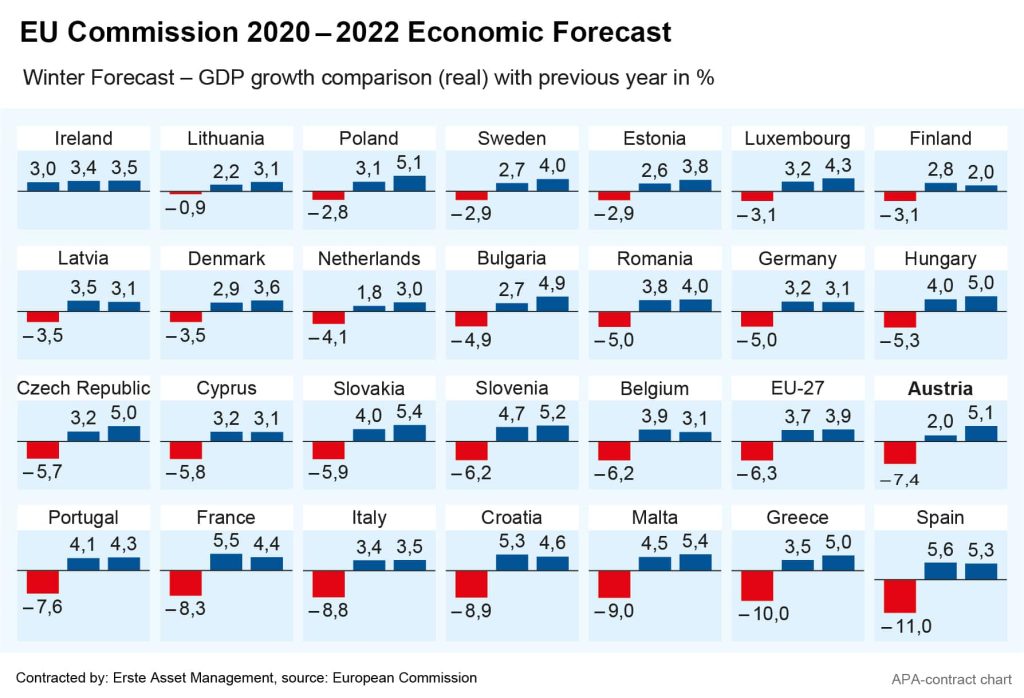

For the year as a whole, however, the economy in the euro area is likely to grow by only 3.8 per cent, according to the current EU forecast – the Commission had recently still assumed a gross domestic product (GDP) growth of of 4.2 per cent. For the EU as a whole, the new GDP growth forecast is 3.7 per cent.

The outlook for next year, however, is more optimistic. While the commission had still expected an increase of 3.0 per cent in its last forecast in autumn, the 2022 forecast for the eurozone has been revised to 3.8 per cent. Figures for 2020 show that the eurozone likely got off somewhat a little more lightly than expected. After the EU had last forecast a drop of 7.8 per cent, first estimates of the statistics authority Eurostat now show a reduced economic slump of 6.8 per cent.

Forecast for Austria halved

According to the EU forecast, the outlook for Austria’s economy has worsened somewhat. For 2021, the EU has halved its growth forecast from 4.1 to 2 per cent. The Commission justifies its revision with the lockdown in the first quarter and the effects of travel restrictions on winter tourism. In 2022, however, Austria’s economy is expected to regain its momentum and grow by 5.1 per cent.

For Germany’s economy, Brussels expects 3.2 per cent growth in 2021 and 3.1 per cent the following year. In Germany, an extension of the lockdown recently gave rise to further economic concerns. The restrictions due to the pandemic are costing the German economy dearly. According to current survey data and calculations by the Munich-based research institute ifo, Germany is losing EUR 1.5bn in value added per week.

In addition, the Corona-induced recession among major trading partners has caused the German economy to suffer the worst decline in exports since the 2009 financial crisis. Exports of goods dropped by 9.3 per cent to EUR 1,204.7bn in 2020, according to the latest figures from the Federal Statistical Office.

Significant recovery in Spain and Italy

According to the EU Commission’s forecasts, Italy and Spain, both of which have been hit hard by the crisis, could see a significant economic recovery in 2021. For Italy, the Commission expects a recovery of 3.4 per cent, after a drop of 8.8 per cent in the past year. For Spain, the EU forecasts growth of 5.6 per cent after the record drop of 11 per cent in 2020. Spain’s economy had already caused a pleasant surprise in Q4 of 2020 with a small growth of 0.4 per cent. For France, the eurozone’s second largest economy, the Commission expects growth of 5.5 per cent for the current year and 4.4 percent for 2022.

Overall, the EU Commission sees the risks of its forecasts as more balanced than in autumn, but still high. The actual extent of the economic recovery is likely to depend, above all, on the further development of the pandemic and the success of the vaccination programmes. Thus, progress with vaccines could lead to unexpectedly rapid easing and thus a stronger recovery. On the other hand, an unexpectedly persistent pandemic development or any vaccine delays could have a negative impact.

“There is also a risk that the crisis could leave deeper scars in the EU’s economic and social fabric, notably through widespread bankruptcies and job losses,” the Commission writes. This would also hurt the financial sector, increase long-term unemployment and exacerbate inequalities.

Outlook for inflation remains subdued

Inflation development is expected to remain subdued, according to the latest EU forecast. The Commission expects an inflation of no more than 0.3 per cent for 2020, rising to 1.4 per cent in the current year 2021. Compared to the autumn forecast, inflation expectations for the eurozone and the EU have thus been raised slightly for 2021, but remain low overall, with “The delayed recovery [is] set to continue dampening aggregate demand pressures on prices,” the report states. Inflation thus remains well below the European Central Bank’s (ECB) medium-term inflation target of 2.0 per cent.

Source for forecast percentages: EU commission

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.