The selection of shares on the basis of certain factors has become popular again recently. This is nothing new. Even back in the 1990s, numerous publications were describing shares with specific features that defied the teachings of modern portfolio theory (as developed by Markovitz in 1952). This theory suggests that the trade-off of better performance is a higher risk. Reality has frequently contradicted this theory.

So, what are those features that promise a better performance even when adjusted for risk? Dozens of criteria have been analysed and introduced, but to date only a few have been generally accepted:

Equity factors / equity strategies

| Value strategy | Shares are selected on the basis of valuation ratios (e.g. low price/earnings ratio or high dividend yield)

|

| Momentum strategy | Shares that have beaten the market performance in the past six to twelve months

|

| Size strategy | Shares with low market capitalisation, i.e. so-called small caps

|

| Quality share strategy | Shares from companies with highly profitable business models, low gearing, and stable earnings development

|

| MinVola strategy | Shares with low volatility in comparison with the equity index

|

In a wider sense, shares from emerging markets can also be regarded as factor strategy, as can growth strategies. That being said, to date there is still no standardised definition for growth as factor. Sometimes past earnings are used for portfolio composition, sometimes future expected earnings, sometimes the price momentum, and sometimes a key ratio like (a high) price/book value.

A possible outperformance of the overall market is one thing, but what about the risk?

Especially in turbulent times on the stock market, many investors feel the need for safety. One measure of safety is volatility. The lower an investment’s volatility, the less painful should the losses be during difficult phases. When the overall market is falling, this affects almost all shares, but possibly at very different degrees.

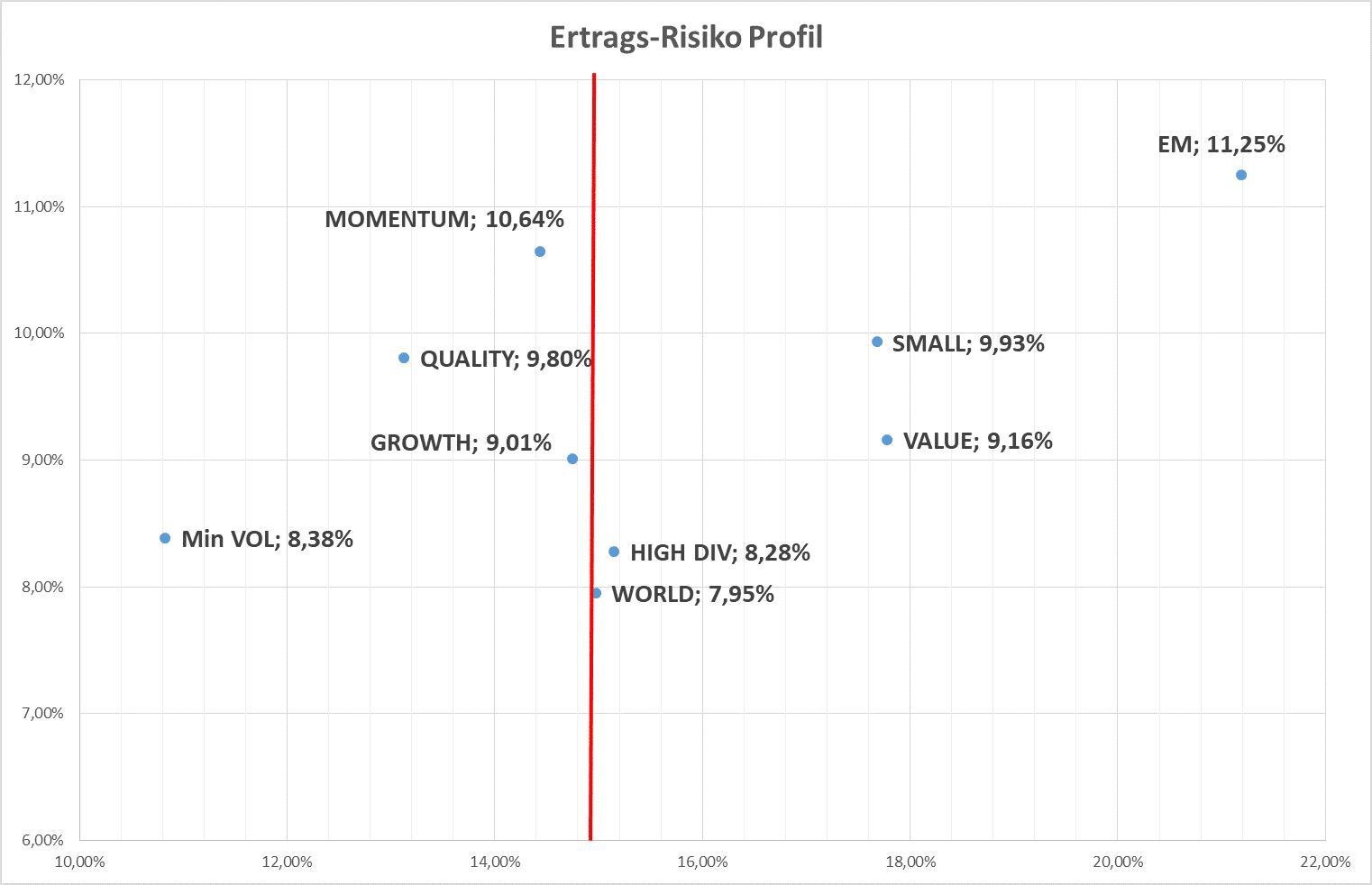

With respect to the most well-known factors, the following chart illustrates the risk (x axis)/return (y axis) profile of the past 20 years:

Risk/return profile of various equity strategies (-20Y)

Risk/return profile

Chart 1; source: Bloomberg; Erste Asset Management; annualised values; no fees or taxes taken into account; own calculations

All the aforementioned equity strategies (i.e. factors) managed to outperform the market over the past 20 years, albeit not necessarily at the same time. Factor performance is the performance of a portfolio of shares that share one of the above-cited features. The risk associated with the factors, momentum, quality, growth, and MinVola is lower than for the overall market.

Quality shares preferable during turbulent times

High dividends, value, small caps and emerging markets also outperformed the overall market, but at higher risk levels. However, it is during turbulent times in particular when lower risk is a welcome feature. This means that investors should currently focus on quality shares, growth shares, and shares with low volatility. Shares with above-par levels of risk will probably incur higher losses amid market corrections.

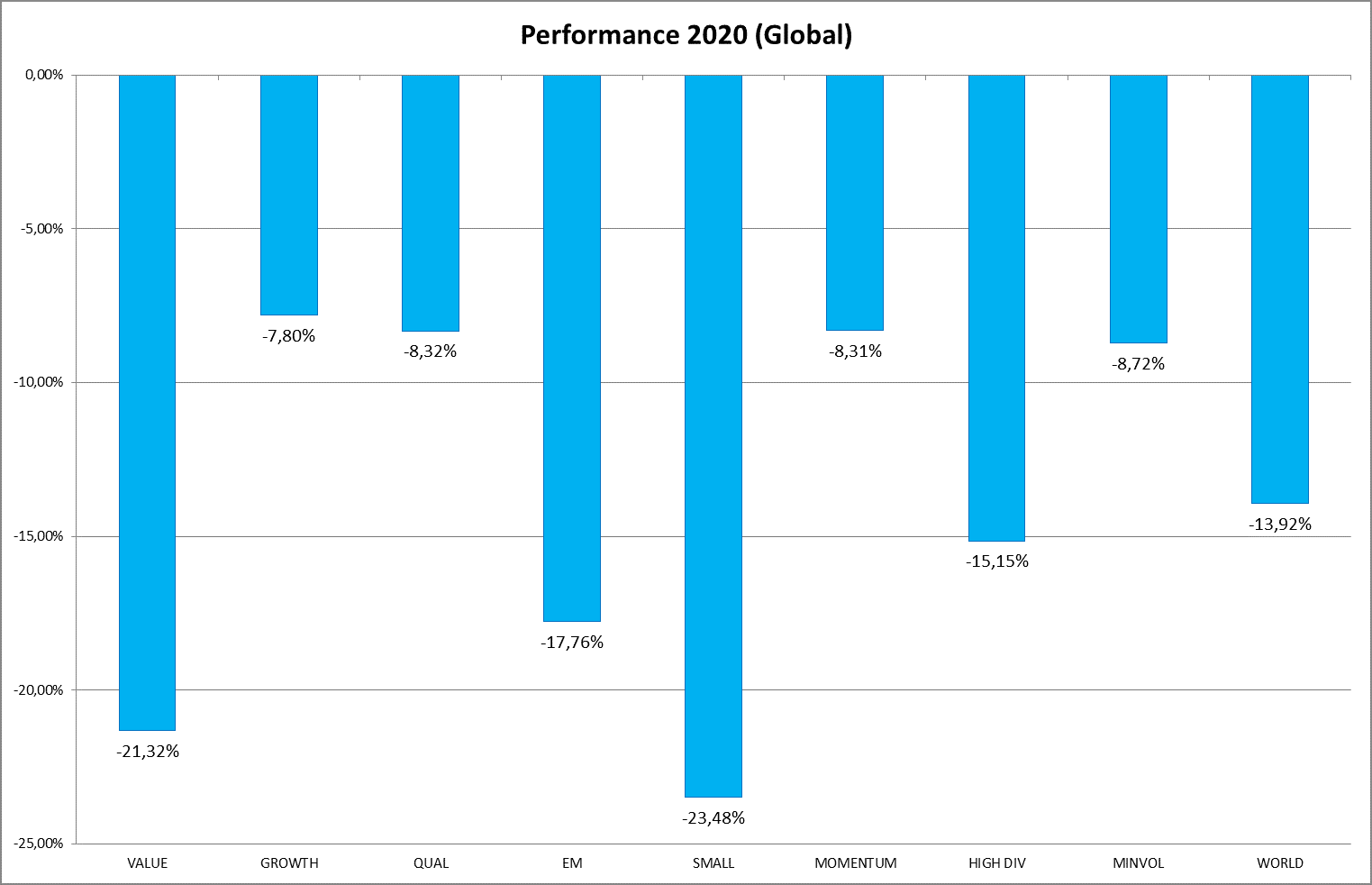

Value small caps, and emerging markets with heavy losses during the crisis

The stock market is currently correcting. From 20 February to 24 March, a global equity portfolio would have lost more than 30% of its value (but would have managed to rebound in the following 20 days by 28%).

The reaction of the various factors discussed above has been rather mixed, as chart no.2 illustrates. Value shares and small caps have incurred significant losses, whereas quality, growth, momentum, and MinVola shares have fared better. This confirms the gist of chart no.1, according to which some factors are less risky than others.

Performance of various equity strategies by comparison (2020)

Chart 2; source: Bloomberg

In addition to value shares and small caps, shares from the emerging markets were also among the losers, as was to be expected. While value shares tend to command low valuation metrics (e.g. price/book value, price/earnings), this often comes with a reason and does not offer any protection against above-average losses.

These shares depend more significantly on the economic activity and perform badly in the event of a deteriorating economic environment. This means that investors who expect a quick recovery after the corona crisis can now buy value shares at attractive valuations. However, at this point, only a minority still expects a V-shaped recovery.

Quality shares interesting for longer investment horizons

Investors who expect a difficult phase at the stock exchange but who still want to maintain their chances of outperforming the overall equity market will now opt for quality shares with above-average profit growth and low volatility. These shares are particularly well suited for investors with a long investment horizon and for those who do not constantly want to adjust their portfolios to the economic development.

Investment recommendations

The ERSTE EQUITY RESEARCH fund invests in quality shares, based on the publicly accessible list of recommendations from Erste Group Research. Global players account for 80% of this list, i.e. the most important and biggest companies in their respective sectors, while so-called rising stars make up the remaining 20%, i.e. companies that might turn into global players in the coming years.

The fund portfolio currently consists of 49 shares, and at the moment we prefer sectors that depend less on the economic cycle than the broad market; for example, the healthcare sector and IT, which together account for about half of the volume of the fund. Industries that are badly affected by the current decline such as tourism, the leisure industry, the automotive sector, and commodities, are not represented in the fund at this point in time.

ERSTE STOCK GLOBAL and ERSTE FUTURE INVEST are other equity funds that rely on high quality and growth in their selection process. These funds have seen a solid performance, given the ongoing crisis.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.