The stock markets have suffered significant losses so far in 2022. Both the US and European markets have corrected by around 20%, with technology-heavy indices losing even more. Inflation and rising interest rates are often cited as the reason. But why is this so?

Interest rates influence the valuation of equities

First, the theory: traditional stock valuation models discount future earnings with a risk premium and an interest rate. A simple model is the Gordon Growth model. The formula is:

D / (r-g) = Fair Value

Whereas:

D: expected dividend / year

r: discounting rate

g: terminal growth rate

The discount rate is often referred to as the cost of equity. This, in turn, is composed of a risk-free interest rate, a risk premium, and relative risk (beta factor).

Let’s look at an example of how fair value changes when the interest rate increases from 1% to 3%. We leave all other input factors unchanged.

In the first case, we assume a discount rate of 6% (1% interest, 5% cost of equity); in the second example, the discount rate increases to 8%.

In both cases, we assume a dividend of €10 and a growth rate of 3%.

Fair Value Example 1: 10 / (6%-3%) = €333

Fair Value Example 2: 10 / (8%-3%) = €200

Using this example, we have illustrated that a 2% increase in interest rates can reduce the fair value of a stock by 40%.

But why should a stock suddenly be worth less if, for example, earnings remain the same? Quite simply, when inflation rises, investors demand higher earnings to compensate for the depreciation of money. Thus, a stock must initially fall in order for future earnings to rise. In practice, however, it is more difficult because investors also have to take into account that rising prices mean that expenses for raw materials, merchandise and wages increase. The question is to what extent companies can pass these costs on to customers? Put simply, how will profits develop in the short term? In any case, uncertainties are increasing, which is reflected in increased volatility.

How does this play out in practice?

So much for the theory on inflation, interest rates and valuation. Now, what specifically happened to the inflation and interest rate landscape this year?

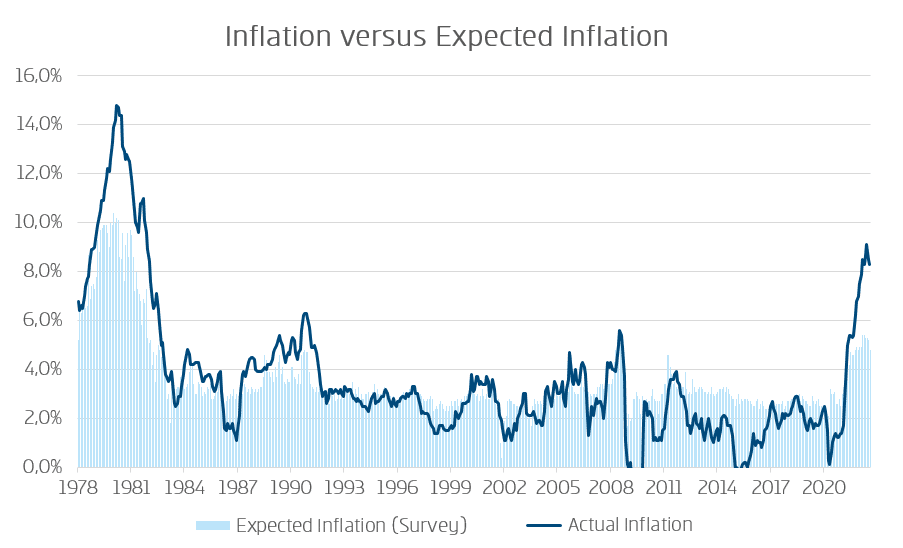

Figure (1) shows actual and expected inflation in the US over the past 45 years. At just under 9%, inflation has reached levels not seen in 30 years. Crucially, expected inflation has also risen, meaning market participants expect inflation to come back but remain at a higher level than before the Corona pandemic.

Note: Past performance is not a reliable indicator of future performance of an investment.

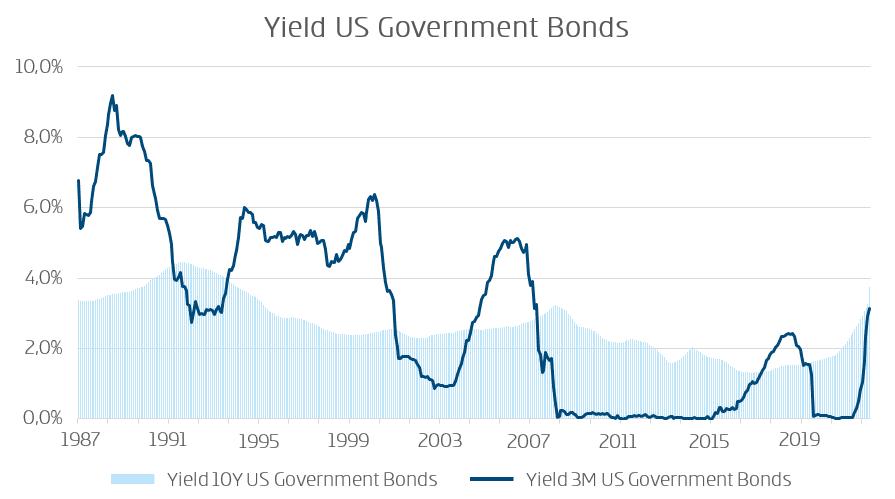

Rising inflation inevitably leads to higher interest rates. As can be seen from figure (2), the yield on 10-year US bonds has already been rising since mid-2020 and, at 3.8% most recently, has reached a multi-year high. The 3-month yield has only recently started to rise, but at a breathtaking pace. As explained earlier in the text, this rise is leading to a striking revaluation of the market. Higher interest rates mean a higher discount rate when valuing equities. If all other parameters remain the same, the fair value of a share is reduced.

Note: Past performance is not a reliable indicator of future performance of an investment.

The relationship between inflation and earnings yield

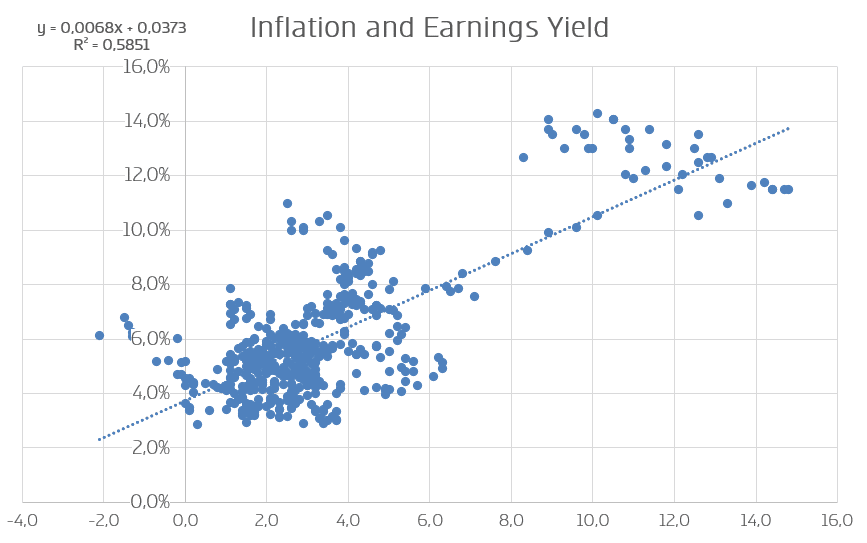

Figure (3) shows the dependence of the earnings yield (reciprocal of the price-earnings ratio) of US companies on the respective inflation. Here we assume an earnings return lagged by one year, since the market needs some time to react to a change (trials have shown that 1 year is a good assumption). A regression calculation shows that inflation explains 58% of the level of earnings yield. Other factors that (may) have an impact include profitability, dividend yield, or expected inflation in the future.

The regression shows that with expected inflation of 4.6%, the earnings yield in 12 months should be 6.6%. This equates to a price-to-earnings (P/E) ratio of 15.1. Based on a current P/E ratio of 18.8, there is a further potential correction of 19% minus the expected increase in corporate earnings over the next year.

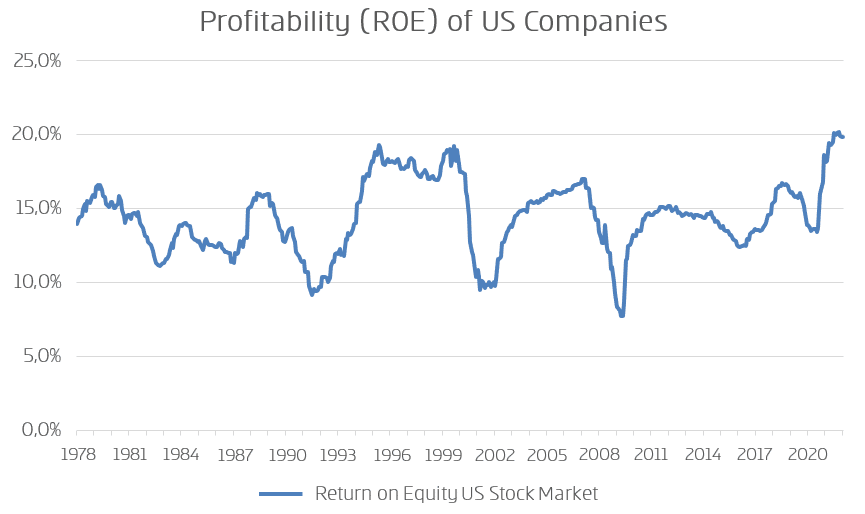

But as the regression calculation shows, inflation is only “half the story.” For example, high profitability can also justify a lower earnings yield. This is because the more profitable a company is, the more dividends can be paid out, shares bought back or money put into profitable investments. Figure (4) shows that despite higher inflation, the profitability (return on equity) of US companies remains very high. As long as this is the case, a below-average earnings yield may be assumed. Profitability is difficult to forecast. However, rising wages and higher interest rates may lower the level.

Note: Past performance is not a reliable indicator of future performance of an investment.

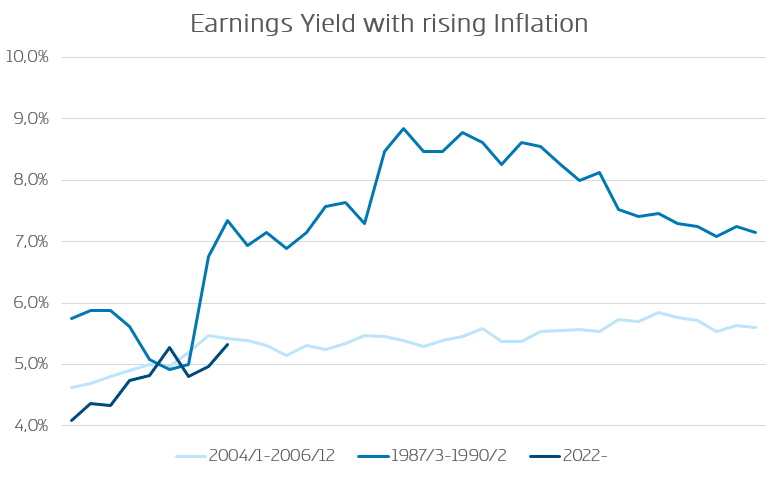

Figure (5) shows the development of profit yields in the US during periods of rising inflation expectations, similar to what we see today. Earnings yield from 1987-1990 were comparatively much higher than during 2004-2006, and today’s profitability is more comparable to 2004-2006 than during the ’87-’90 period. From this, one could infer a “fair” profit return of 5.3% (average of 2004-2006). Of course, this assumes that current inflation in the US of 8.3% approaches 4.6%. If inflation remains at 8%, we would have to assume an earnings yield of 8-9%. This would mean that the stock market is about 30-40% too expensive even at today’s level. These figures make it clear why investors are looking and reacting very nervously to the development of inflation.

Note: Past performance is not a reliable indicator of future performance of an investment.

Conclusion: Higher interest rates depress prices of equities

With inflation soaring, central banks are forced to turn the interest rate screw. Higher interest rates translate into a higher discount rate when valuing stocks, which means that even relatively small changes in interest rates can significantly reduce the fair value of a stock.

In conclusion, we can state that the US market is approximately fairly valued after the correction if the expectation that inflation will decline to 4.6% is realized. If this is not the case, we could see further falling prices next year as well. For this reason alone, it is right and important for the FED to keep its focus on fighting inflation.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.