France’s government bonds have recently seen a significant rise in yields. This dynamic is due to a combination of political instability, high government debt and market uncertainty regarding the lack of structural reforms. How should the current situation in France be classified?

Note: An investment in securities involves risks as well as opportunities.

“Rien ne va plus”: Macron appoints his third prime minister within a year

As generally expected, the Bayrou government had no chance in the vote of confidence at the beginning of September and lost the vote. This adds another chapter to the saga unfolding in France and there seems to be no end in sight for the time being.

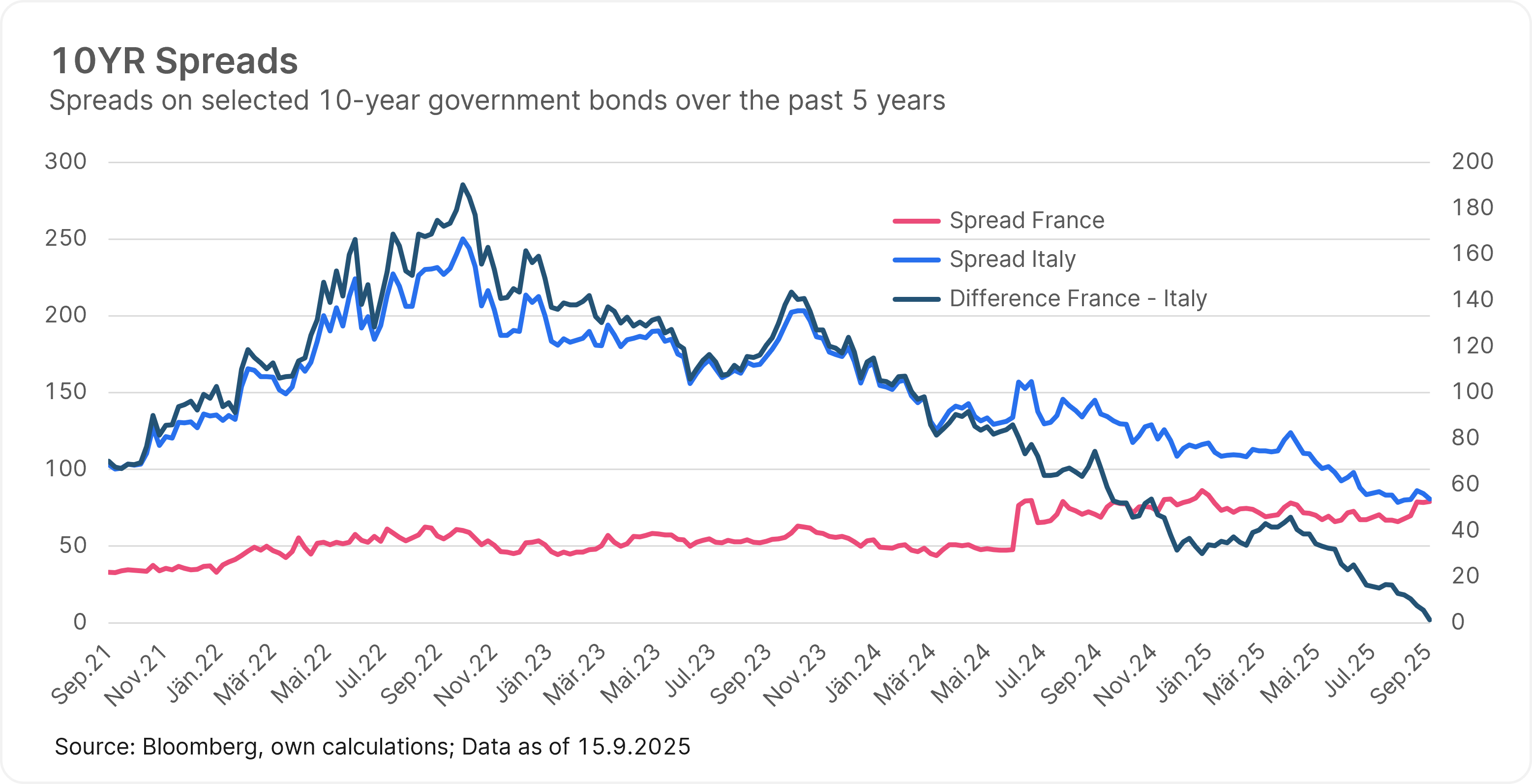

The reaction of the capital markets to Bayrou’s resignation was rather muted (particularly with regard to the 10-year credit risk premium of French government bonds over German bonds), as the result of the vote had apparently already been priced in. President Macron did not waste much time and appointed a new prime minister, Sébastien Lecornu, a few hours after the vote of confidence, with a mandate to consult the political forces represented in parliament in order to primarily adopt a budget and then propose a new cabinet.

On a positive note, the appointment of a new prime minister was made quickly, thus averting a complete political deadlock for the time being. However, the three main opposition parties (RN – Rassemblement Nationale, LR – Les Républicains, PS – Parti socialiste) were critical immediately after the appointment and described the new appointment as a continuation of Bayrou’s agenda. The headwind for the upcoming budget talks should therefore continue.

France’s problem is its starting point

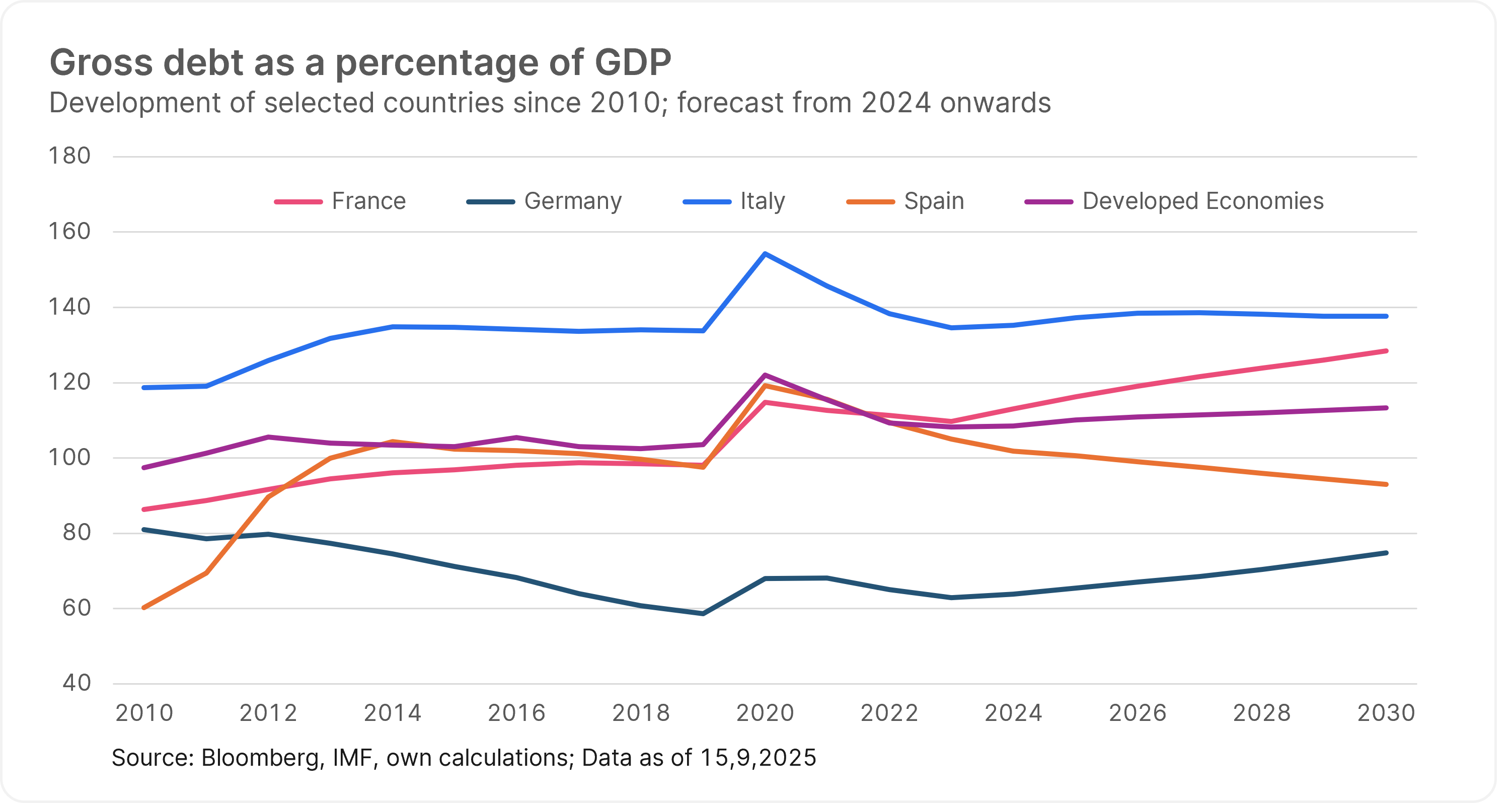

France has a high budget deficit (over 5% of gross domestic product) and low economic growth (forecast for 2025: 0.7% compared to the previous year). Both appear to be structural (i.e. chronic) rather than cyclical in nature. The fiscal outlook is therefore difficult, especially considering the relatively high public debt of around 113% of GDP.

The only common denominator of all political camps (left, center, right) is higher government spending. But France is not an isolated case. Numerous governments in developed economies are facing rising debt levels and increased budget deficits. What distinguishes France from other countries, however, is the lack of decisive political measures to curb budget growth.

Note: Past performance is not a reliable indicator of future performance.

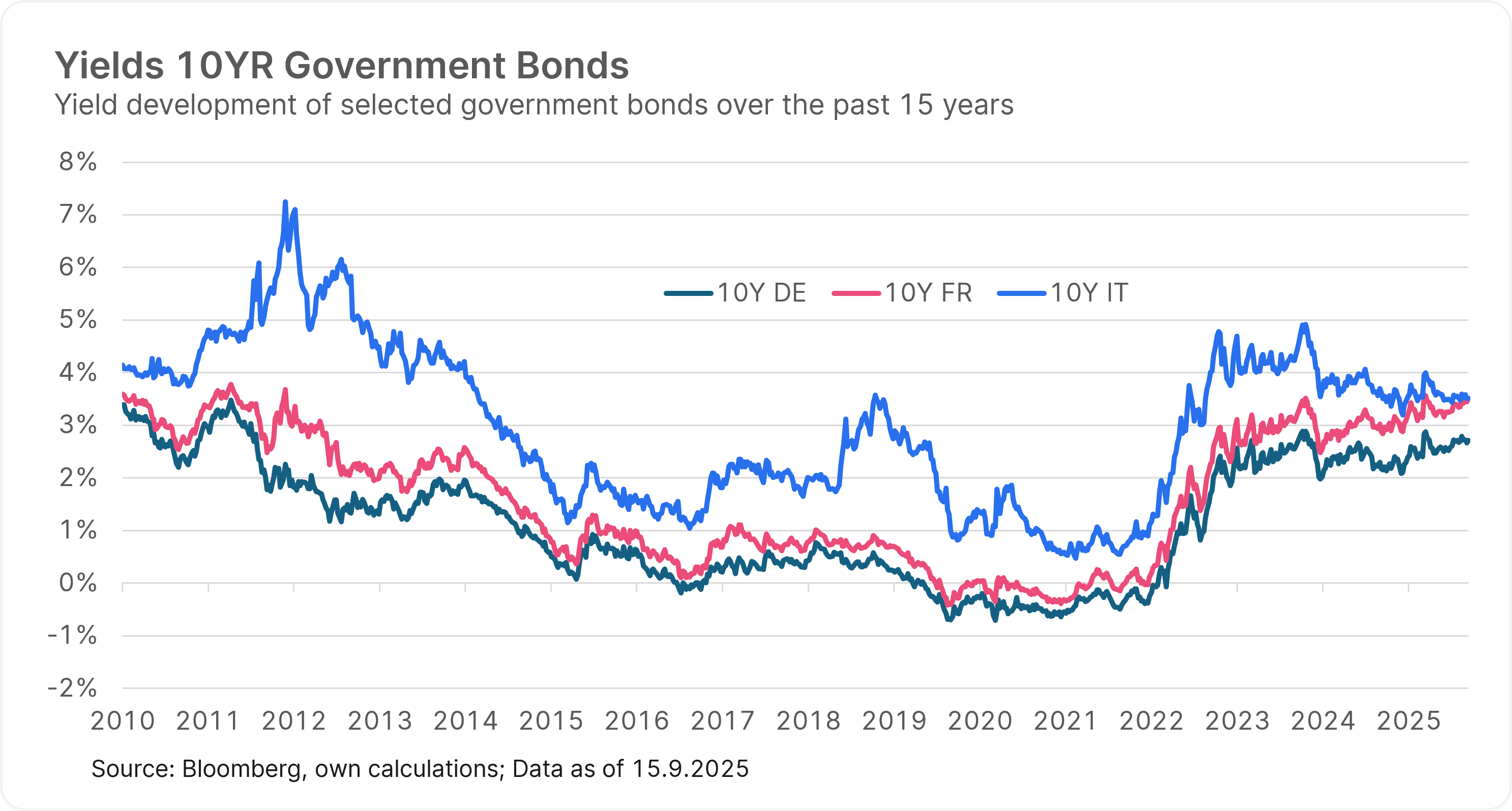

The current developments have led investors to reassess the risk of French government bonds. A clear sign of this was that, for the first time since 1999, the yield on ten-year French bonds was at times at the same level or higher than that of Italian counterparts. Although several factors play a role in this, the decisive factor is the extent to which the markets trust the respective state to manage its finances soundly.

Note: Past performance is not a reliable indicator of future performance.

While Italy has recently gained confidence because it presents its budget management as stable and predictable, France has lost credibility in the eyes of many investors.

Note: Forecasts are not a reliable indicator of future performance.

The latest estimates from the International Monetary Fund confirm the changed perception of observers: France’s debt to economic output (GDP) ratio is expected to continue to rise over the next five years. By contrast, the IMF expects Italy’s debt ratio to remain largely stable.

The predicted increase in debt, political fragmentation and the uncertain budget consolidation path were among the reasons why a major rating agency downgraded France’s credit rating in mid-September – from AA/negative to A+/stable. Although the direct impact on French government bonds was minor, there is a risk that other rating agencies could also lower the rating.

Base scenario: status quo versus risk scenario: new elections

With the appointment of Lecornu, President Macron may be playing his last trump card by appointing one of his closest ministers. He is said to be able to maintain a balanced and neutral basis for discussion with other parties outside the center parties. According to insiders, he is also respected by Marie Le Pen, among others. Based on the last election and therefore the current division in the national parliament, the party around Marie Le Pen – Rassemblement National (RN) – has the opportunity to confirm or overturn the budget and therefore also the government. In other words, the draft budget must – or should – look like a moderate RN budget, otherwise there is a risk of renewed failure – unless the socialist PS party does not reject the reproach.

In view of its political past and its relationship with parties that tend to belong to the center-right spectrum, the probability of finding a compromise on the draft budget has increased slightly. The baseline scenario is therefore that France will continue to get by for the time being with low growth, slightly higher yield premiums and only a minor budget correction. This should reduce short-term uncertainty and stabilize the environment for French assets.

The risk scenario describes the fact that there is once again no political compromise. The new Prime Minister Lecornu does not manage to get enough support for his budget plan. This is likely to lead to another vote of no confidence – and Lecornu would probably have to resign. President Macron would then have little choice but to call new parliamentary elections. However, even these elections would not guarantee a sustainable solution: instead, based on current polls, Marine Le Pen’s Rassemblement National party would gain even more votes. The political situation would therefore be even more fragmented than before and the implementation of necessary reforms less likely. This situation could lead to increased volatility for French assets.

Another point that should not be overlooked is the announced protests. These are being or have been organized via social media. If they become larger and last longer, they could have a negative impact on the economy and the general mood. This could also increase the pressure on politicians.

Protests against the government in France have recently increased. (c) FRED SCHEIBER / Action Press/Sipa / picturedesk.com

Outlook

In summary, the real casualty of the French saga could be the necessary fiscal consolidation. The outlook remains clouded for the time being in the medium term due to budget slippages, increasing pressure on credit ratings and worsening political fragmentation. Even if the immediate political stalemate can be contained, the structural challenges remain unresolved.

In the short term, the aforementioned risks already appear to be partially reflected in prices. French government bonds, such as those with a term of 10 years, are already trading at a small discount – in other words, as if they had a lower rating. However, the situation could calm down: President Macron has reacted quickly and the new Prime Minister Lecornu is proving adept at negotiations. If he manages to pass a budget with the help of other parties, this could reduce uncertainty and cause risk premiums for French bonds to fall again.

It is also positive to note that an institutional framework has been created since the last sovereign debt crisis more than ten years ago and that considerable external pressure is being exerted on the European Union (including from the USA and Russia) to reach an agreement. This should maintain Europe’s structural convergence and thus support European assets.

Note: An investment in securities involves risks as well as opportunities.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.