Economic growth in Central and Eastern Europe is likely to remain significantly higher than in the eurozone in 2025. At least, that is the conclusion of the latest spring forecast published by the Vienna Institute for International Economic Studies (wiiw). The forecasts predict continued robust growth rates for countries in the region.

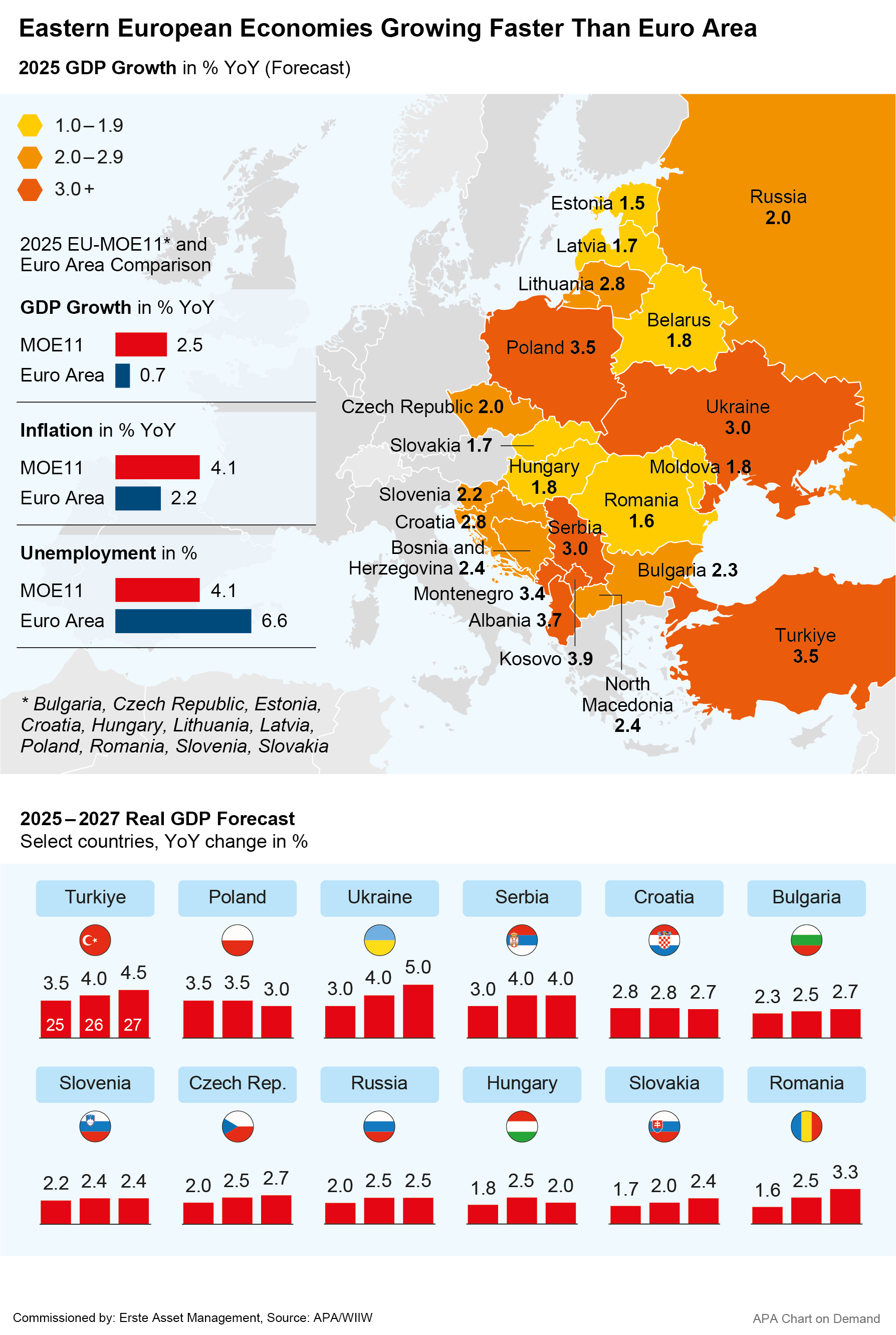

For the EU member states in Central, Eastern and South-Eastern Europe, the wiiw forecasts average GDP growth of 2.5 per cent for this year. This is a slight correction of 0.3 percentage points compared to the winter forecast; however, it is still three times higher than the growth in the euro area. While economic growth in the CEE region’s EU member states is expected to accelerate to 2.8 per cent in 2026 according to the wiiw forecast, the eurozone is only expected to grow by 0.7 per cent in 2025, with an increase to 1.4 per cent in 2026.

According to wiiw, the uncertainties surrounding the trade conflict under US President Donald Trump are unlikely to have much impact on solid growth in Eastern Europe. Direct trade flows between the CEE countries and the US are already low. Bond fund manager Anton Hauser, on the other hand, expects negative effects from the increased uncertainty: “These uncertainties have an impact on investment and spending decisions and therefore negatively influence economic growth.” Foreign trade accounts for a significant portion of economic output in Eastern European countries, but Hauser also notes that the majority of trade is with EU countries. As a result, secondary effects of the trade conflict will have the greatest impact on economic performance in Central and Eastern Europe.

Note: Past performance is not a reliable indicator of future performance.

Investment offensive in Germany could compensate for trade conflicts

Industries in countries such as the Czech Republic, Slovakia, Hungary and Romania, which are closely intertwined with Germany, are likely to continue struggling with Germany’s industrial recession. However, the negative effects of Trump’s tariffs could be largely offset by Germany’s changed fiscal policy with its EUR 500bn package for defence, infrastructure and climate protection, Grieveson said.

According to the wiiw, though, the most important driver of economic growth in Eastern Europe remains the region’s strong private consumption thanks to strong real wage increases. Investment could also contribute to economic growth – on the one hand through EU transfer payments, but also through falling interest rates, which favour private investment.

Poland with strongest growth among CEE EU members

According to the wiiw forecasts, Poland is once again the leader in economic growth among the eastern EU member states, with expected growth of 3.5 per cent for both the current and next year. Countries with large domestic markets, and notably Poland, are likely to prove particularly resilient to the negative effects of external factors, the wiiw economists explained. At 2.8 per cent each, the institute forecasts the second strongest growth this year for Croatia and Lithuania. Even the weakest growth forecasts of 1.5 per cent for Estonia and 1.6 per cent for Romania are still well above the forecast for the euro area.

Overall, the wiiw expects growth of 2.8 per cent for the Visegrad states of Poland, the Czech Republic, Hungary, Slovakia and Slovenia this year, nearly four times higher than the forecast for the euro area. According to wiiw, the six countries in the Western Balkans can expect average growth of 3 per cent in 2025 and 3.6 per cent in 2026, while Turkey is expected to grow by 3.5 per cent in 2025 and 4 per cent in 2026.

Situation in Ukraine remains difficult

In contrast, the situation in Ukraine remains difficult. Although the wiiw expects 3 per cent growth in 2025 and 4 per cent in 2026 for the war-torn country, whose economy has recently proven to be extremely resilient, uncertainty is high. According to the institute, much will naturally depend on the development of the military situation. Ukraine continues to struggle with the destruction of its infrastructure due to Russian airstrikes and an acute labour shortage due to mobilisation for the war as well as seven million people having fled the country.

In Russia, on the other hand, the economic outlook is improving despite the war and Western sanctions. The wiiw has raised its growth forecast for Russia for 2025 slightly to 2 per cent, with growth of 2.5 per cent expected for 2026. However, new sanctions could have a negative impact – the EU recently adopted a new package of sanctions against Russia. The US will not be joining in, as was clear from a telephone conversation between US President Trump and EU Commission President Ursula von der Leyen.

US sanctions show little effect

“Should there actually be a ceasefire or peace agreement in Ukraine, the economic isolation of Russia by the US would probably come to an end,” said Vasily Astrov, Russia expert at the wiiw. “The current US sanctions are already being enforced only half-heartedly,” says Astrov. International companies such as Renault, Hyundai and Samsung are already considering returning to Russia. The South Korean electronics group LG recently even ramped up production at its Moscow plant again.

Possible negotiations for peace in the war in Ukraine, which has now been going on for more than three years, are still on the table – even though the latest talks between representatives of both countries in Istanbul ended without result. According to fund manager Hauser, a potential peace would have very positive effects for the entire region: “Companies from CEE countries could benefit from the reconstruction in Ukraine due to their geographical proximity and the associated expertise.” On the capital market, an end to the war should also lead to a decrease in risk premiums in the region.

Trade conflict remains a risk factor for good forecast figures

According to the wiiw, dangers to the positive forecasts for Eastern Europe include the uncertainty among consumers and companies fuelled by Trump’s erratic trade policy and a renewed escalation of the trade conflict with China. Geopolitical tensions, an ongoing war in Ukraine and a possible slowdown in the inflow of EU funds would also put pressure on growth. Nevertheless, the region’s economic resilience is higher than in previous crises, Grieveson pointed out.

Romania on the upswing after the election?

Bonds from CEE countries offer a higher yield than bonds from other EU countries with very similar risk, as Hauser, fund manager of the ERSTE BOND DANUBIA bond fund, emphasizes. In his view, Romania in particular could prove to be an interesting investment opportunity in the coming months. (Note: Please note that investing in securities involves risks as well as opportunities.)

Following the presidential election, which ended in victory for the pro-European mayor of Bucharest, Nicsusor Dan, political uncertainty has certainly decreased. “In our main scenario, we assume that a new government will introduce fiscal measures to consolidate the budget. This should also reduce the current account deficit and cause risk premiums on Romanian government bonds to fall again,” says Hauser, expressing a positive view of the outlook for Romania’s national budget.

Investing in Eastern European bonds and equities

Certain funds offer the opportunity to invest in stocks or bonds from the CEE region. On the bond side, investors can use the ERSTE BOND DANUBIA, for example, to invest in government bonds from Eastern and Southeastern Europe, the former Soviet states, and Turkey. The Czech Republic, Romania, and Poland currently have the highest weightings in the fund.

For investors looking to invest in Eastern European equities, the ERSTE STOCK EUROPE EMERGING equity fund may be worth a look. The fund’s investment process is based on fundamental company analysis. The selection of securities focuses on high-quality, high-growth companies from Central, Southern, and Eastern European countries. More than a third of the portfolio is currently made up of companies from the particularly fast-growing Polish market, including the financial and insurance group PZU and the Polish internet auction platform Allegro.

Note: The companies listed here have been selected as examples and do not constitute investment recommendations.

Risko notes ERSTE STOCK EUROPE EMERGING

Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Risk notes ERSTE BOND DANUBIA

Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Risk notes according to 2011 Austrian Investment Fund Act

In accordance with the fund provisions approved by the Austrian Financial Market Authority (FMA), ERSTE BOND DANUBIA intends to invest more than 35% of its assets in securities and/or money market instruments of public issuers. A detailed list of these issuers can be found in the prospectus, para. II, point 12.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.