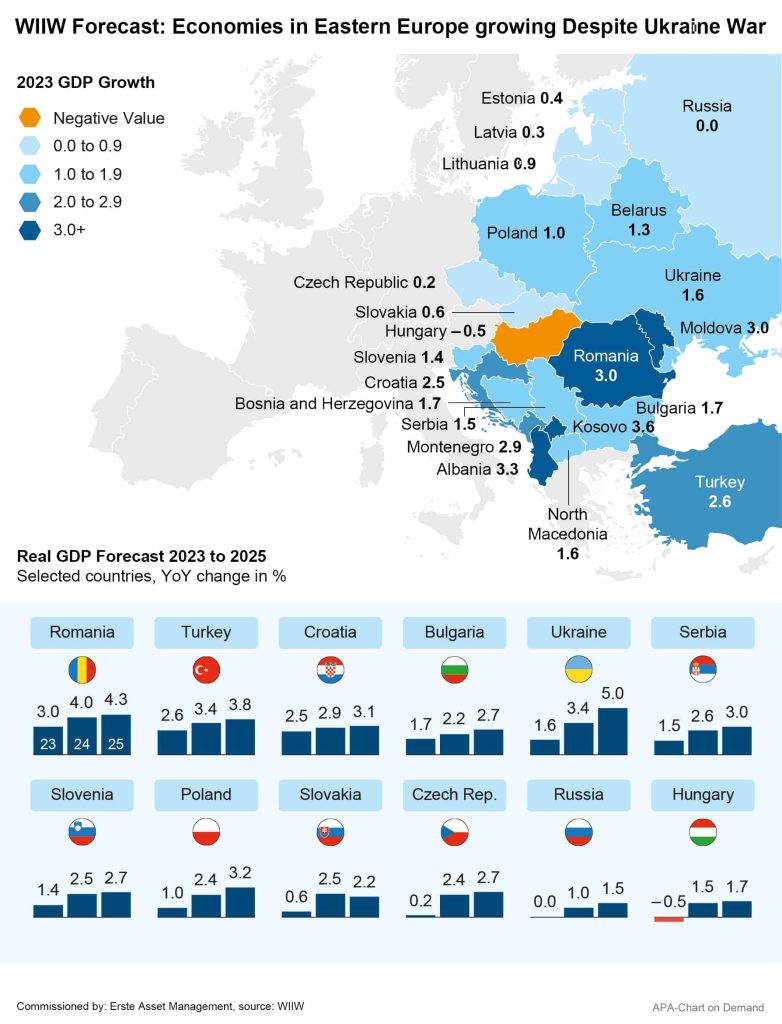

The Vienna Institute for International Economic Studies (wiiw) sees the economies of Eastern Europe on a growth trajectory, with most countries in the region likely to have overcome the economic shock of the Ukraine war. “Growth has bottomed out,” said wiiw Executive Director Mario Holzner, who presented the institute’s 2023 spring forecast, according to which the wiiw expects economic growth of 1.2 per cent for the region’s EU member states in 2023. This is twice as high as the eurozone’s projected figures (0.5 per cent). Businesses are somewhat more confident about the future, inflation has probably already peaked, and economic growth is relatively low but should accelerate over the next few years, Holzner said, summarizing the forecast.

“The worst fears have thus not materialised. Despite stubbornly high inflation, which is of course weighing on households and businesses, the mood in the region is slowly brightening,” wrote wiiw expert Olga Pindyuk. The institute expects strong growth for the countries of Southeastern Europe in particular: wiiw forecasts GDP growth of 2 per cent for the economies in the Western Balkans, while Turkey’s economy is expected to grow by as much as 2.6 per cent. The institute also forecasts strong growth for Croatia (2.5 per cent) and Romania (3.0 per cent).

Although this means weaker growth in some areas than in the previous year, which was characterized by catch-up effects in the wake of the coronavirus pandemic, according to the experts, a full year-long recession will likely be avoided, with the exception of Hungary. For the Hungarian GDP, the institute forecasts minus 0.5 per cent this year, but a return to positive growth rates from 2024 onward.

Inflation Remains Stubbornly High

According to the wiiw, persistently high inflation also remains a factor of uncertainty. Accordingly, this entails possible counteracting interest rate hikes by central banks and, in the event of a drastic tightening of monetary policy, even a “hard landing” in individual countries. Although inflation rates have recently been declining due to falling energy prices, core inflation excluding energy and food has, with few exceptions, remained in the double digits. The wiiw has therefore raised its inflation forecast for most countries. For 2023, the institute expects an inflation rate of around 17 per cent for the region as a whole, compared with 5.7 percent in the euro area.

Ukrainian Economy More Resilient Than Expected

The institute sees a further risk in a possible escalation of the war in Ukraine. According to wiiw, Ukraine’s economy is more resilient than expected. The country’s GDP drop of 29.1 per cent in 2022 was less severe than feared. In view of the enormous destruction and 15 per cent of the population having fled the country, the resilience of the Ukrainian economy is impressive, writes the wiiw. For 2023, the institute forecasts growth of 1.6 per cent for Ukraine, although this will probably largely depend on the further course of the war. In the years 2024 and 2025, GDP is expected to grow by 3.4 and 5.0 per cent, respectively, according to the wiiw forecast.

However, a more positive business climate, improved energy supplies, international financial aid and also the Ukrainian grain deal are all factors that, on balance, give reason for cautious optimism, the institute emphasises. The EU Commission recently reached an agreement in the dispute over agricultural imports from Ukraine: Poland, Bulgaria, Slovakia and Hungary will lift their bans, according to the EU. The four countries recently restricted agricultural imports from Ukraine, arguing that cheap grain from the war-torn country was causing prices to fall.

Russia Is Stabilizing, but the Sanctions Are Having an Effect

The wiiw also sees a stabilisation of the Russian economy in its spring forecast. After a GDP drop of 2.1 per cent in the past year, the institute’s experts expect stagnation for 2023. While import-dependent industries are suffering from the sanctions, the defense industry and individual areas of import substitution are doing exceptionally well. According to official Russian figures, the pharmaceutical industry grew by more than 26 per cent.

The sharp decline in revenues from oil sales is particularly painful for the Russian economy. According to calculations by the International Energy Agency (IEA), revenues have dropped by 43 per cent year-on-year. Although Russia has increased its oil exports to a three-year high, it has to offer crude oil at much lower prices than a year ago due to the sanctions. According to the wiiw, budget revenues from oil and gas sales fell by 45 per cent in Q1 of 2023, but the resulting budget deficit should be manageable, the institute expects.

The bottom line is that Russia’s economy should thus remain stable. “The booming war industry, the adjustment to the sanctions and the reorientation of trade towards Asia will probably prevent a contraction this year,” said wiiw Russia expert Vasily Astrov. “But that does not change the fact that the sanctions-related losses from the energy business are costing the Kremlin dear. It is no coincidence that President Putin has now publicly admitted that the sanctions are hurting, and the population has to prepare for more difficult times,” Astrov said. In the longer term, the lack of high technology from the West, such as computer chips, is likely to be cause problems for Russia, the expert expects.

Investing in Central and Eastern Europe

With a wide-ranging equity fund, there is a chance to participate in the recovery of the Eastern Europe region. ERSTE STOCK EUROPE EMERGING invests mainly in listed companies with registered offices or business interests in Central, Southern and Eastern European countries (including Turkey) but without Russia. The fund is suitable as an admixture to an existing equity portfolio. However, one should be aware of the risks and plan a sufficiently long investment period.

ERSTE STOCK EUROPE EMERGING

Advantages for the investor

- Broadly diversified investment in companies of Central and Eastern European emerging markets with little capital investment.

- Opportunities for capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.