“Change is the only constant in life”, said the Greek philosopher Heraclitus of Ephesus (535 – 475 BC) hundreds of years ago. Or, a more contemporary quote could be : “Nothing is as constant as change.” And that is also true for the equity market. Every price increase is followed by a market correction.

Often, such corrections are perceived as “bad”, as they curb the gains achieved so far or even result in losses. But don’t such price declines also offer opportunities?

In this article, we want to discuss the opportunities and risks of investments in dividend shares that arise from major falls in price and present an entry strategy for this market segment.

The equity market fluctuates – constantly

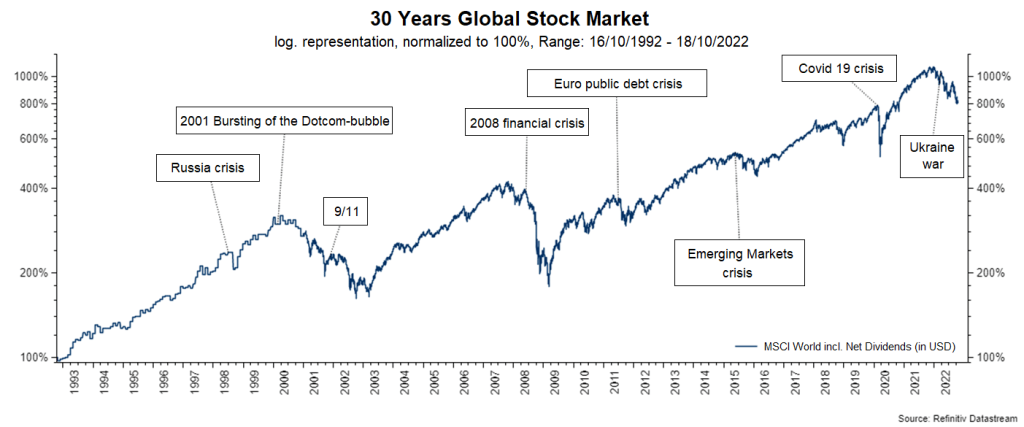

In order to make the fluctuations of the global equity market tangible, it makes sense to look at a longer time series.

Source: Refinitiv Datastream, Display period: 30 years, Data as of 18/10/2022

Note: Past performance is not a reliable indicator for future performance of an investment.

The long-term chart illustrates two aspects very clearly:

- Major slumps occur regularly

- In the long term, these price declines have been recovered

Of course, it is not possible to directly derive a course of action for the future from historical price data. However, for those who believe in the future of the companies in question and thus in the equity market, downturns represent opportunities to buy high-quality shares.

What are high-quality companies?

During crises, investors often prefer companies with a proven business model that can generate profits even in difficult times. Such companies can also pay attractive dividends in difficult market phases.

However, it should always be borne in mind that any company can get into difficulties during a crisis. It therefore makes sense to diversify the investment e.g. across sectors and countries. This is the case for dividend equity funds.

When is the right time to invest?

It is advisable to only invest in equities if one assumes that the planned investment can survive difficult times. A crisis usually leads to a decline in share prices. So, what could be more obvious than to use significant corrections on the equity markets to build up positions? Catching the lowest price during a correction would be a matter of pure luck. Also, many investors easily lose the courage to buy into a falling market.

If pure luck is not your friend, you need a pre-defined entry strategy. This should answer the following questions:

- What investment (target)?

- What amount?

- How far should prices come down for you to invest?

- How should the investment be made (one-off investment or repeated, smaller amounts)?

A possible entry strategy

As mentioned earlier, the duration and extent of price corrections cannot be predicted. In the literature, a fall in share prices of 20% or more is referred to as a bear market. Assuming that every bear market ends at some point, a possible strategy would be the following one:

- Split the total investment amount into twelve tranches

- Invest monthly over the following twelve months

- Initiate purchases at the outset of the bear market once prices have decreased by 20% from the peak

While such a gradual entry strategy will not result in the absolute low in terms of entry (which would theoretically be possible with a one-off payment), at least part of the capital is invested at lower prices.

Why choose dividend equity funds?

We only know the duration and extent of a market correction at hindsight. If it were to last longer than expected, investments with regular payouts would at least provide an incentive to hold out in difficult times.

A dividend equity fund offers some essential aspects in this context:

- Selected companies with a stable business model

- Regular income in the form of dividends means regular income in the fund

- Broad diversification

ERSTE RESPONSIBLE STOCK DIVIDEND is an investment opportunity worth taking into consideration here. For more information on the fund and ways of investing, please refer to the fact sheet and the legal documents of ERSTE RESPONSIBLE STOCK DIVIDEND or visit an investment advisor at any branch office of Erste Bank or Sparkassen in Austria.

Conclusion

For investors with a defined investment strategy, falling prices in the market can also offer opportunities. Dividend equity funds with a broad diversification can be a viable investment option in phases of an extended market correction. However, one should be aware that every type of investment entails risks. Investors should therefore be conscious of said risks and have a correspondingly long-term investment horizon.

Risk notes for ERSTE RESPONSIBLE STOCK DIVIDEND

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK DIVIDEND as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK DIVIDEND, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK DIVIDEND as described in the Fund Documents.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.