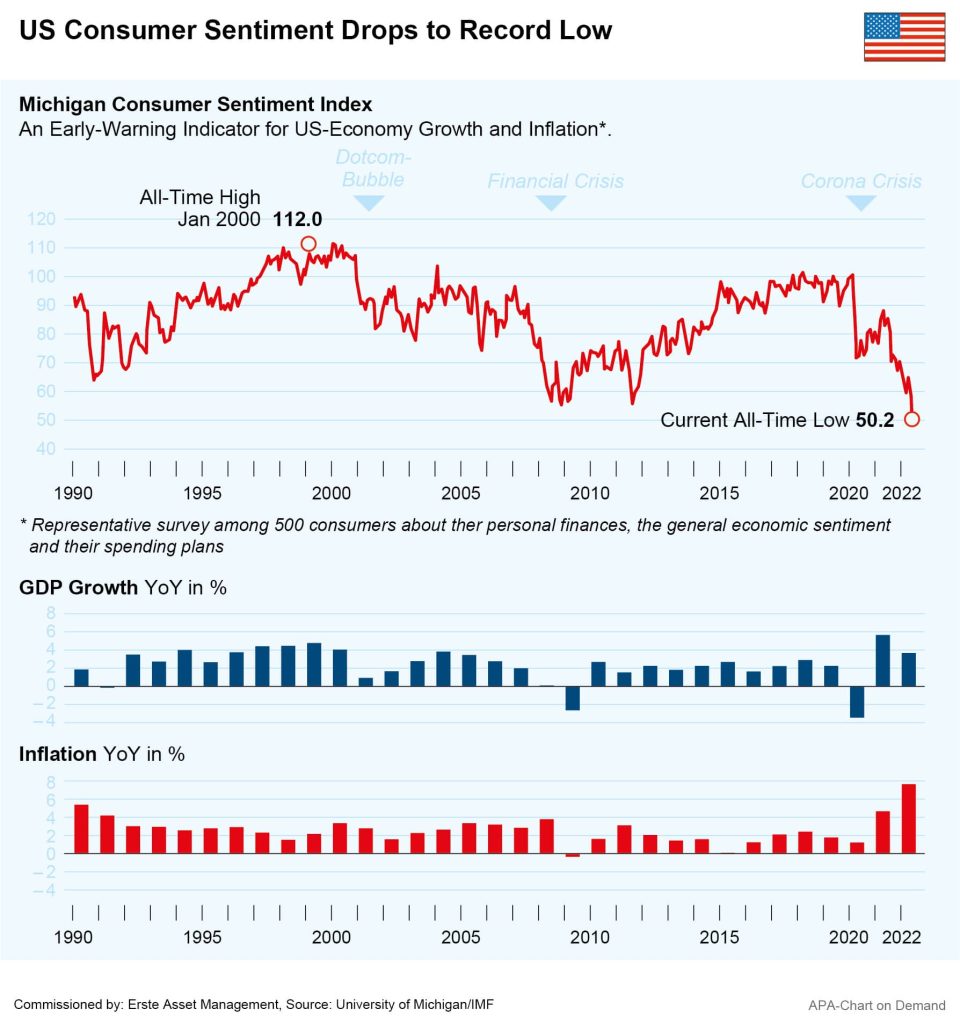

US consumer sentiment recently fell to a record low owing to unusually high inflation driving prices. The index of consumer sentiment surveyed by the University of Michigan dropped surprisingly sharply by 8.2 points to 50.2 points compared to the previous month, the university reported on Friday after a first round of surveys, making this the lowest reading ever recorded. Analysts had expected only a mild average decline to 58.1 points. The US stock markets reacted to the figures with heavy losses at the end of the week, with the Dow Jones dropping by 2.7 per cent and US bonds also falling.

The University of Michigan indicator, a popular indicator on the financial markets, is a measure of the purchasing behavior of US consumers, and is based on a telephone survey of around 500 households. The survey asks respondents about the financial and economic situation and the corresponding expectations. According to the survey, both the assessment of the current situation and expectations for the future received low ratings this time.

Above all, high inflation, and here in particular the markedly higher petrol prices, are weighing on consumers’ expectations, said Joanne Hsu, head of the survey. Forty-six per cent of consumers surveyed attributed their negative view of the situation to inflation, with already-high inflation expectations increasing slightly. Consumers expect inflation to reach 5.4 per cent over the next year, up from the previous year’s expectation of 5.3 per cent.

Inflation Rate Climbs to 40-Year High

Consumer price inflation data reported by the US Department of Labor on Friday reinforced this picture. After a slight decline in April, consumer price inflation accelerated again, reaching a 40-year high. In May, the year-on-year inflation rate was 8.6 per cent, the highest level since December of 1981.

Energy in particular was massively more expensive in the USA in May, increasing by 34.6 per cent, or more than a third, within the space of a year. Food prices also rose by an above-average 10.1 per cent, the biggest price increase since March of 1981. Globally, the war in Ukraine is currently reflected in rising prices for food and energy. In addition, there are ongoing supply chain problems, and in the US concerns are now also emerging about a possible wage-price spiral.

Gasoline Price Increases Are Becoming a Political Problem

In the US, high inflation has now also become a political problem for President Joe Biden. The price hike is currently having a massive impact at gas stations in particular. There, the price of a gallon of petrol (a little under 3.8 liters) has risen to over five dollars on average across the nation for the first time, according to data published on Saturday by the AAA automobile association.

Biden, responding to the inflation data, called it “Putin’s price hike” and said, “Even as we continue our work to defend freedom in Ukraine, we must do more—and quickly—to get prices down here in the United States. But it is also important that the oil and gas and refining industries in this country not use the challenge created by the war in Ukraine as a reason to make things worse for families with excessive profit taking or price hikes.”

Inflation Data Continue to Drive Rate Hike Fears

In US equity markets, the inflation data triggered sharp losses at the weekly close, as the data increase pressure on the Fed to raise its key interest rates further at its meeting this week to fight the inflation. Particularly the interest rate-sensitive technology stocks reacted accordingly with losses.

In view of high inflation, the Fed took the biggest interest rate step in 22 years in early May and raised the key interest rate by half a point to a new range of 0.75 to 1.0 per cent. Fed President Jerome Powell has signaled similar increases for both the June and July meetings, willing to accept that growth will be dampened by monetary tightening.

Us Treasury Secretary Yellen Says Recession Is Unlikely

However, rate hike expectations and record-low consumer sentiment are also fueling concerns about the economy. US consumer sentiment is of particular importance in the US economy, which is heavily dependent on domestic consumption, and is currently at low comparable to the recession in the early 1980s, according to the University of Michigan.

In the first quarter of the current year, the US economy shrank by 1.5 per cent on an annualized basis. However, US Treasury Secretary Janet Yellen believes a recession in the United States is unlikely. “I don’t think we’re going to have a recession,” Yellen said Thursday, ahead of the release of the latest data.

For a glossary of technical terms, please visit this link: Fund Glossary (erste-am.at)

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.