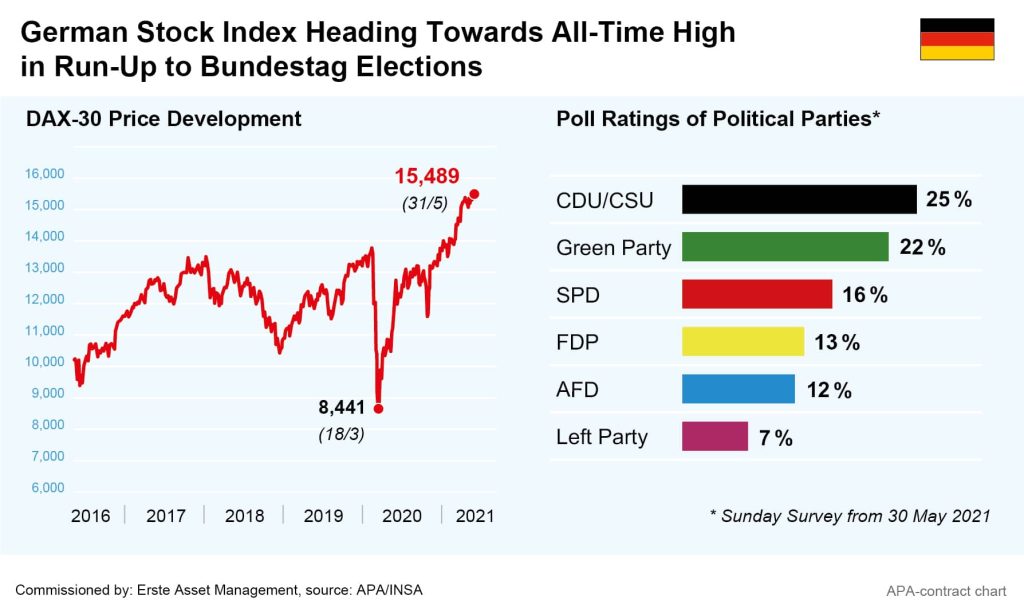

The German stock market has recently continued its record-breaking run, with the German DAX index reaching new all-time highs above 15,500 points in the last week of May. Most recently, the index failed to break this mark, remaining just below it. The rally was driven by the progress in the coronavirus vaccination programmes, but also by recent good economic figures.

After a bumpy start to the year and a corona-induced GDP slump of 1.8 per cent in Q1, recent data show an upturn and increasing momentum in the ongoing economic recovery. For example, the German ifo Business Climate Index determined in surveys rose from 96.6 points in April to 99.2 points in May. Very prominent on the financial markets, this leading early-warning indicator for Germany’s economy has thus clearly exceeded expert expectations.

Business Climate Index showing surprisingly strong upward trend

“The German economy is picking up speed,” said Ifo President Clemens Fuest in response to the survey data presented the previous week. The Ifo economists expect economic output to increase by 2.6 per cent in spring, with an even higher increase in summer. While the recovery has so far mainly been driven by exports, consumer spending is now likely to become the driver of growth. Experts expect the combination of consumer reserves saved during the crisis and the easing of the lockdown measures to drive the economy even further.

According to data from the Federal Statistical Office, the savings rate of private households shot up to a record 23.2 per cent in Q1 of 2021, while private consumer spending dropped by 5.4 per cent in the same period YOY. The partly tightened restrictions in the fight against the pandemic are the most likely cause of this, with experts from German institutes citing EUR 200bn of pent-up purchasing power amassed during the crisis.

Eased measures spur consumption

However, with the falling infection rates and ongoing easing of restrictive measures, consumption should now ramp up again and parts of the savings should be spent. “For the current quarter, private consumption is expected to increase and the gross domestic product to grow noticeably again,” said Sebastian Dullien, head of the German Macroeconomic Policy Institute (IMK).

In 2022, the recovery is likely to be driven even more strongly by an increase in consumer spending. The leading German economic institutes have therefore recently raised their joint forecast for the coming year from 2.7 to 3.9 per cent. The experts of the institutes no longer consider further economic stimulus programmes necessary in the fight against the crisis.

According to the leading institutes, the labour market should also recover thanks to the expected easing. According to their forecasts, the number of people in employment should increase by 26,000 this year and by more than half a million in 2022. The pre-crisis level is expected to be recovered in the first half of 2022.

The flip side of the upswing, however, is that consumer prices are rising again, and with them, emerging fears of inflation. In April, inflation in Germany rose to 2.0 per cent, the highest level in two years. Since the expiry of the temporary VAT cut at the end of 2020, consumer prices have thus risen for the fourth month in a row.

Questions surrounding autumn Bundestag election

Finally, a big unknown regarding the future economic policy is the upcoming Bundestag elections in late September. The Green party in particular are likely to make massive gains. Current polls by the market research institute INSA see the CDU/CSU at 25 per cent, just ahead of the Greens with 22 per cent, with the Greens even being slightly ahead at times in spring polls. The SPD (16 per cent), the FPD (13 per cent) and the AfD (12 per cent) came in slightly behind in the polls.

Climate change is likely to remain an important issue for the upcoming government. The current government has already announced that it will tighten the target for reducing CO2 emissions before the federal elections. Greenhouse gas emissions in Germany are to be reduced by 65 percent by 2030 percent compared to 1990, instead of the current 55. Climate neutrality is to be achieved by 2045 instead of 2050.

A major challenge for the future German Federal Minister of Finance also lies in the sharply increased budget deficit. Owing to the Corona crisis, the public budgets in Germany showed a larger deficit in 2020 than at any time since the 1989 reunification. According to the Federal Statistical Office, the financing deficit of the federal government, the states, the municipalities and the social security system totalled EUR 189.2bn. This is the first deficit since 2012, and public budgets are likely to show a similar deficit this year. And while tax revenues should increase as the economy recovers, this will be offset by expenditures for vaccinations and tests and, in general, the government’s budgetary policy, which will remain high-spending for the time being.

Hague court ruling against Shell oil company points the way forward

Climate protection and the reduction of greenhouse gas emissions are not only on the agenda in Germany. Under the terms of the Paris Climate Agreement, all EU member states are required to take appropriate measures to limit the temperature increase to 1.5 degrees Celsius. And through the EU’s Green Deal, 30 percent of the total spending of the EUR 1.8 trillion stimulus program is to go toward investments to improve the climate. Companies with a sustainable focus should benefit from this unique program in the long term.

It is not only the states that are directly affected, international corporations that have “gnawed” vigorously at our planet’s resources are also coming under increasing pressure from state regulations: For example, a district court in The Hague made headlines at the end of May: It handed down a ruling according to which the Dutch-based global oil and natural gas corporation Shell must drastically reduce its carbon dioxide emissions (see report in Der Standard v. 30.5.2021, in German language). Even if the company wants to appeal against this, the direction seems to be set or a pointer for other companies.

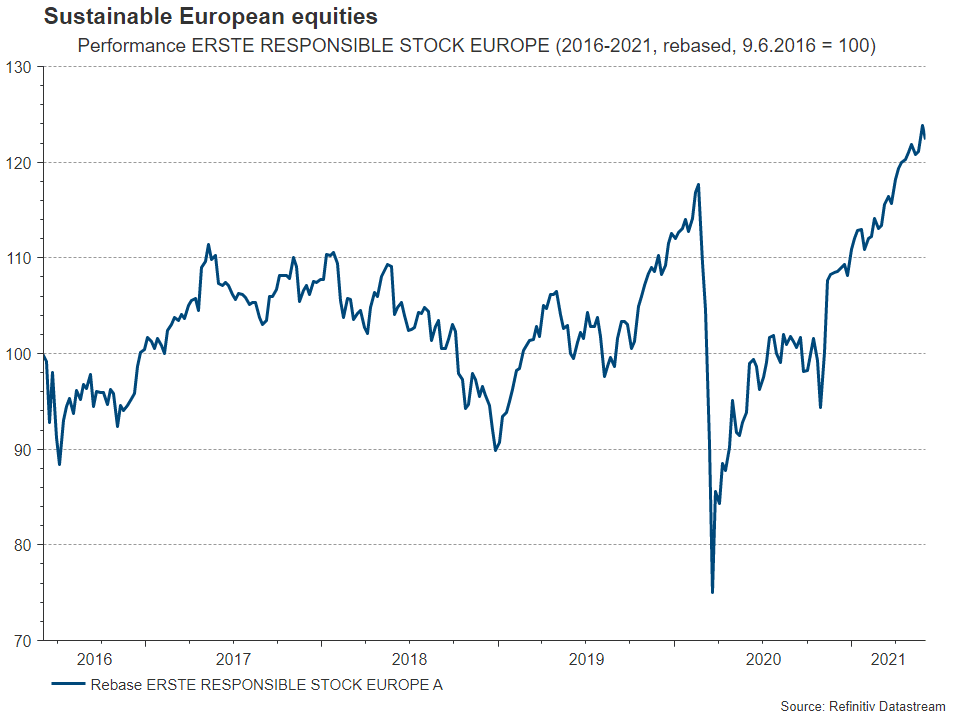

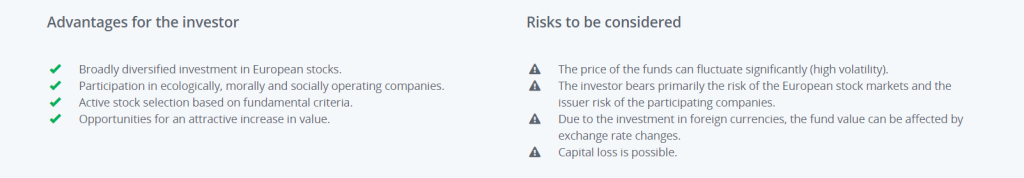

Invest in ESG pioneers with ERSTE RESPONSIBLE STOCK EUROPE

If you want to benefit from the trend towards more sustainability among European companies in the medium and long term, you should take a look at the ERSTE RESPONSIBLE STOCK EUROPE equity fund. When selecting stocks, the focus is on high-quality, high-growth companies. The focus is on shares of companies that are pioneers in terms of ESG (environmental, social, governance) criteria. As part of a holistic ESG approach, ethical aspects are also taken into account. In addition to the opportunities, investors should also keep an eye on the risks in terms of temporary fluctuations and capital loss. On the other hand, sustainable companies offer the opportunity to increase in value.

Note: Past performance is no reliable indicator for future performance.

The European “superpower” Germany is regaining its economic momentum after Corona and is facing trend-setting events. Sustainable companies are likely to benefit from the necessary reduction in greenhouse gas emissions and the associated regulatory requirements. Investors with the appropriate risk tolerance can invest in this trend with funds such as ERSTE RESPONSIBLE STOCK EUROPE.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.