On August 4, Tesla held this year’s annual general meeting called “Cyber-Roundup” at the Gigafactory in Texas, filing the name and logo as Tesla’s own trademark. “Cyber-Roundup” thereby follows “Cyber-Rodeo” – the opening of the Gigafactory in Texas in April this year. T-shirts and other fan merchandise with the Cyber logo are also to be sold under the brand, which gave the general meeting an unusual, party-like character.

The mindset of Group CEO Elon Musk was also unusual, as the editors of Automobile Production reported: “…you can think of our factories as vast cybernetic collectives of people, machines and software. And the better the software, the better the system works. I don’t think other automakers think the way we do.”

The company had not been expected to generate profits in the past. In 2021, however, it succeeded for the first time and “at the moment we have the best margins in the entire industry,” as Elon Musk explained this year. The relationship of the public and the industry to e-mobility has changed dramatically, and now hardly any carmaker can manage without battery-powered models, and Tesla has made numerous patents public to help e-mobility achieve a breakthrough.

For the future, the self-proclaimed “technology king” Elon Musk announced his intention to produce vehicles at at least ten to twelve locations. A new location is to be announced at the end of the year. Artificial intelligence and autonomous driving would also be the topics of the future in which the company will invest.

The S-Performance of Tesla

Tesla Inc. was included in the investable universe of ERSTE WWF STOCK ENVIRONMENT in 2011 and is considered a pioneer in the field of e-mobility. The company is also considered to play an essential role in the transformation of the sector, which is positively reflected in our valuation.

Contrast this with the results regarding good corporate governance. In 2019, Tesla saw numerous allegations of controversies publicized involving a large number of S issues: alleged labor law violations, alleged discrimination based on gender, age, or race, alleged dissemination of false information to investors, etc. These developments led to the exclusion of the company from our sustainable funds.

Tesla factory a workplace segregated by race?

For example, the Tesla factory in Fremont, California, is alleged to have a racist work environment. Back in 2017, a class action lawsuit was filed by an employee alleging that the company failed to investigate several cases of racial discrimination. It said African-Americans were called names, harassed, and harassed. In 2021, the plaintiff obtained nearly $137 million in compensation through a San Francisco court; the judgment was revised this year to only $15 million. In late 2021, several women also came forward to complain of discrimination.

Finally, in February of this year, the U.S. state of California sued the group for allegedly discriminating against female and male employees on the basis of race. Hundreds of complaints from the workforce prompted the lawsuit, according to media reports. “The Fremont plant is a racially segregated workplace where minority employees are subjected to racial slurs,” the Wall Street Journal quoted the director of the California Department of Fair Employment and Housing as saying. Minorities also face discrimination in job assignments, pay and promotions, and discipline, he said, leading to a hostile work environment.

The string of lawsuits at Tesla doesn’t just involve S issues, however: Tesla CEO, Elon Musk, is also being charged regarding his investments in Twitter and allegations of possible insider trading by him and his brother, Kimbal Musk. Also the speculations about a possible withdrawal of the company from the stock exchange in 2018 or the faulty presentation of autopilot systems, repeatedly brought the company and its boss negative headlines.

Water risk at production sites

Since 2020, Tesla shareholders have also been expressing their unease about the questionable corporate culture through various shareholder resolutions at the annual general meetings. As early as 2021, a motion was introduced demanding more transparency from Tesla regarding diversity at management level, which achieved a majority of 56%. The aim of the motion would have been to achieve more transparency for the guidelines used when deciding on the composition of management. This was to ensure that minorities, who make up a relevant part of the workforce, were also represented at management level. Numerous reports and studies would point out that diversified management levels led to higher shareholder value, higher sales, higher returns, better relationships with employees, etc.,.

This year, the number of applications from the environmental and social sectors reached a new high. These addressed, for example, the dubious use of mandatory arbitration, which would be preferred to public trials in disputes, and the general right to form trade unions. Other topics included the company’s lobbying activities and their conformity with the Paris climate goals, child labor in the value chain of battery production, and the risk of water shortages at Tesla production sites.

According to the findings of the Global Risk Report 2022, water scarcity is a major trigger for migration movements, as conflicts around water as the basis for life and health, are likely. Automotive production also sees the use of water, for example in paint shops and leak testing.

Our governance and voting research partner, ISS, recommended voting in favor of a shareholder resolution at this year’s annual meeting calling on Tesla to produce a water risk report, saying shareholders would benefit from increased disclosure about how the company manages water risks. According to the requester, a large portion of Tesla’s active manufacturing sites are located in regions that are exposed to high to very high levels of water stress (by 2030), according to representations from the World Resources Institute’s Water Risk Atlas.

This circumstance has already become an issue at the Tesla site in Brandenburg, as the production limit of 500,000 vehicles per year could not be increased due to already exhausted water resources in the region. Tesla’s goal in this context is to minimize the use of water in production at all sites and thus act as a best practice for the sector. Transparency regarding the data situation around water consumption is nevertheless essential, according to the author of the motion, and it would be desirable for Tesla to take even better account of recognized reporting forms.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

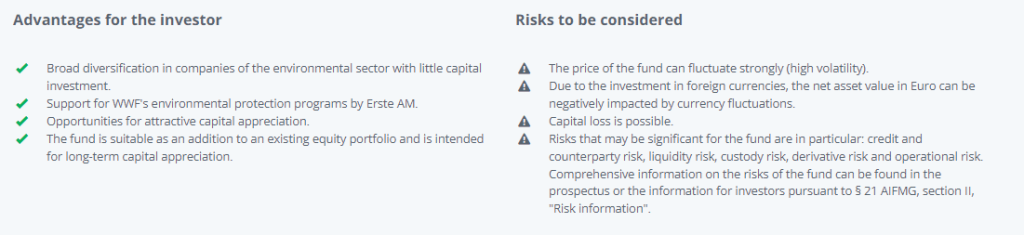

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.