Have you ever been to a Californian beach? If you have, you may have noticed the hoards of “searching”, elderly people. They would usually be holding a metal rod that beeps, looking for valuables that no-one else has found. And sometimes somebody finds a lost golden watch on the beach. But most of the time the things that turn up are only worthless beer caps.

Investors on the interest rate market are in a similar situation. They are always looking for higher yields. In this article, we would like to look at a market that, by comparison with other markets, currently offers high yields: the US high-yield bond market. In the current environment, it constitutes an interesting investment opportunity (albeit at commensurate levels of risk). We are mostly interested in the spreads.

US high-yield – a place to be?

Bonds with lower ratings, i.e. from BB+ onwards and below, are regarded as high-yield (or non-investment grade). Investors should be aware of the fact that these bonds are investments that have a high to very high degree of risk associated with them. In compensation for this higher risk, the bond offers higher yields or higher spreads (in comparison with government bonds of the same maturity).

US high-yield market, yield and spread

The market for US high-yield bonds consists of hundreds of different issuers. Therefore, we are going to look at the market data on the basis of a representative index as opposed to an individual market.

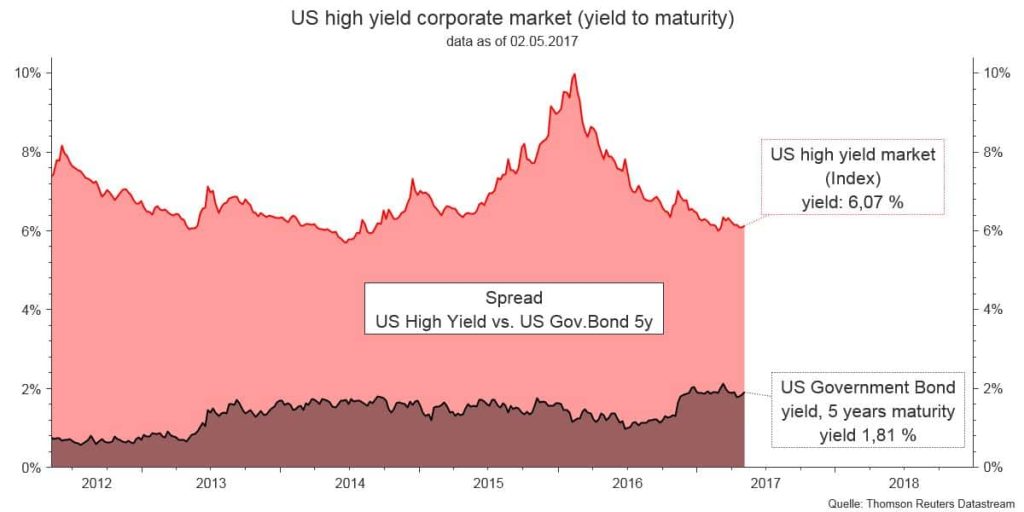

Chart: Yield US corporate bonds high-yield segment as compared to the US Treasury bond with 5Y remaining time to maturity Interest rate differential (i.e. spread), observation period 5 years Sources: Datastream, as of 2 May 2015

- The chart shows the yield of the US high-yield market, which is currently at 6.07%. The yield is clearly subject to significant fluctuations over time.

- As part of the market yield, the yield of the safe US Treasury bonds (5Y) were inscribed. This yield is currently at 1.81%.

- The difference between the credit-safe yield and the risky alternative is called risk premium or spread. It is currently 4.26% (= 6.07% – 1.81%). The spread also fluctuates over time.

Does the spread compensate for the risk?

Under the assumption that investors act rationally, we can do a simple calculation for the advantageousness of a possible investment alternative:

The credit-safe bond (US Treasury) serves as basis. Given that it cannot default by definition, the return of a bond (for example 5 years for a bond with 5Y remaining time to maturity) can be calculated. A risky investment (over the same period of time) is preferable if the return is higher (taking into account possible defaults).

- The question is therefore: “Does the spread compensate for the volume of defaults?”

A simple question that is not easily answered, because the yield of the security is calculated on the basis of its end of maturity under the assumption of redemption at 100%. However, defaults are a common occurrence in the high-yield segment. This occurrence will happen in the future – which is uncertain.

The different assessment by investors of future developments is what makes this market so exciting – with the accordingly high degree of volatility.

A practical example: the tasks of a fund manager

In an investment market where defaults are to be expected, a wide degree of diversification is a must. Unfortunately one cannot predict which bonds will be defaulting. But one relation is clear: the lower the rating, the higher the probability of a default.

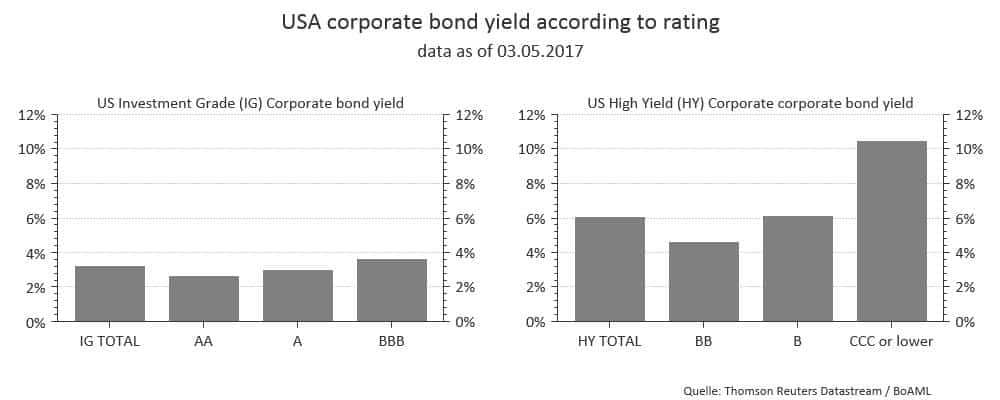

This means that one should not just select the bond with the highest yield. The following chart shows the yields of US corporate bonds by rating.

Chart: yield of US corporate bonds investment grade (left) vs. high-yield (right) Source: Datastream, as of 3rd May 2017

The “HY Total” bar to the right shows a yield of 6%. This is also in line with the chart further up. Alongside, we have the segments “BB”, “B”, and “CCC or lower”. If one were to only take into account the yield, one would have to choose the segment “CCC or lower”, which currently offers a yield of above 10%.

When selecting the issuers, the fund manager has to ensure a sufficient level of diversification with regard to

- Rating

- Maturity

- Sector/region

This means that the fund manager contributes his/her specific know-how and optimises the portfolio with regard to return and risk. A fund that invests in US high-yield bonds may contain 300 or more individual titles, given the relevance of broad diversification.

Why do investors need this information?

Investing in high-yield bonds requires know-how. Simply buying an individual bond with high yield is not the optimal route due to its likelihood of a default. Interested investors should ideally invest in this segment by way of a broadly diversified investment fund.

Conclusion:

One could indeed go out and look for deals with a “yield detector”. But you will only find something extraordinary where nobody else has looked – and on the financial markets, there are loads of people looking alongside you. Do not get blinded by yields, because behind every higher yield you will find a higher level of risk. A broadly diversified fund might be the solution for many investors in this segment.

Diversification is part of the active management of funds at Erste Asset Management. For more information about the range of products of Erste Asset Management, please visit our homepage at www.erste-am.at

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.