Football has two strategies. Some prefer focusing on the defensive so as not to concede a goal – i.e. they try to maintain the status quo. Other teams favour the offensive and actively engage in a fight for victory – i.e. they take risks. The strategies on the bond markets are similar. Credit-safe government bonds are preferably used to protect one’s wealth, whereas risky corporate bonds are chosen to produce surplus gains.

In the past blog entries of this series we have looked at government bonds and their spreads for different maturities, investment markets, and ratings. In this article, we want to focus on the bonds issued by companies, i.e. corporate bonds.

Corporate bonds vs. government bonds

When the German government issues bonds, the individual issues differ for example in terms of maturity or coupon. The issuer, on the other hand, remains the same for every bond – this means the quality of the issuer is easily established via the rating.

Corporate bonds are issued by companies that operate across different countries and sectors. But a company may go bankrupt. This means that the redemption of the bond depends on the rating of the respective company. Much more important than the nominal interest rate or the yield of the bond is how safe the redemption at the end of maturity is. The evaluation of the ability and willingness of the company to pay the coupon in a timely fashion and to fully redeem the nominal value is a process usually carried out by specialised institutes (rating agencies) and results in a rating for the company.

Rating categories

There are several rating agencies that scrutinise the bonds of issuers and award a rating. It can range from top levels (AAA) to the risk of default (C). The two basic categories are:

- Investment grade “AAA“ to “BBB-“

- Non-investment grade (i.e. high yield) “BB+“ and below

The corporate spread as risk indicator

The lower the rating of a company is, the higher the risk of default. In order to compensate for this risk, investors demand a higher interest rate. The assessment of the extent of the corporate bond spread requires a credit-safe reference as basis. For the European bond market, we have selected the government bonds with the best rating, i.e. the ones issued by the Federal Republic of Germany.

Spreads on the European corporate bond market

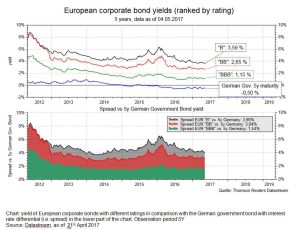

The following chart shows that higher risk comes with higher yields. The benchmark (i.e. basis) is the yield of the German 5Y government bond (because many corporate bonds have a medium-term maturity).

The upper part of the chart illustrates the yield for European corporate bonds with different ratings of BBB, BB, and B. This is the average of many bonds from the respective segment (illustration based on a representative index).

- The lower the rating, the higher the yield

- Yields fluctuate over time

- Basis: 5Y German government bond (blue line)

The lower part of the chart (along the colours of the upper part) shows the spread of the respective rating segment.

- The corporate spreads fluctuate over time

- The spread is currently higher than the yield, because the yield of the German government bond as basis is currently negative

Why do investors need this information?

The bonds issued by companies represent a very inhomogeneous investment category. There are numerous issuers and maturities. Classifying bonds by rating segment and looking at the yields and spreads can help in the decision-making process in favour of or against a specific investment. It is important to keep in mind that a lower rating comes with a higher probability of default. This means that the number of bonds in a portfolio should also be accordingly higher (i.e. diversification). Diversified investment opportunities in specific rating segments or across ratings are offered for example in the form of selected investment funds. Prior to deciding on an investment, the investor should check the rating of the potential investment vehicle (e.g. average rating in a selected fund).

Conclusion:

Avoiding the concession of a goal, or in this context the focus on credit-safe investments, does not yield particularly high returns in an environment of zero percent interest rates. Corporate bonds, ideally as broadly diversified fund, offer an alternative.

When investing, taking risks without protection (i.e. investing exclusively in a high-risk segment) does not automatically yield the desired results. It is the individual mix that paves the way to success.

Corporate spread management is part of the active management of the funds of Erste Asset Management.

For more information on the product range of Erste Asset Management, please visit our homepage at www.erste-am.at

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.