The international stock exchanges recorded a rather dismal start into the new year. The reasons cited most frequently were China and the declining oil price. A weaker Chinese economy will definitely register also on an international scale due to the mere size of the country. While a weaker oil price is beneficial to consumers, it does cause significant levels of stress in the energy sector as well as among banks that provide credit to the sector.

A factor that has hitherto been more or less disregarded is the general earnings situation of listed companies. Therefore we want to take a closer look at this topic in this article. Without earnings growth, there can be no sustainable rise in share prices.

Earnings cycle has peaked out

In the developed markets equity universe the earnings cycle peaked out in February 2015. Since then, earnings have been on a slow but steady decline.

This development is not limited to the energy sector. Even non-cyclical consumer goods have shown a weaker tendency for two years now. Only healthcare and the technology sector have so far been able to buck the trend.

Current earnings trend advises caution

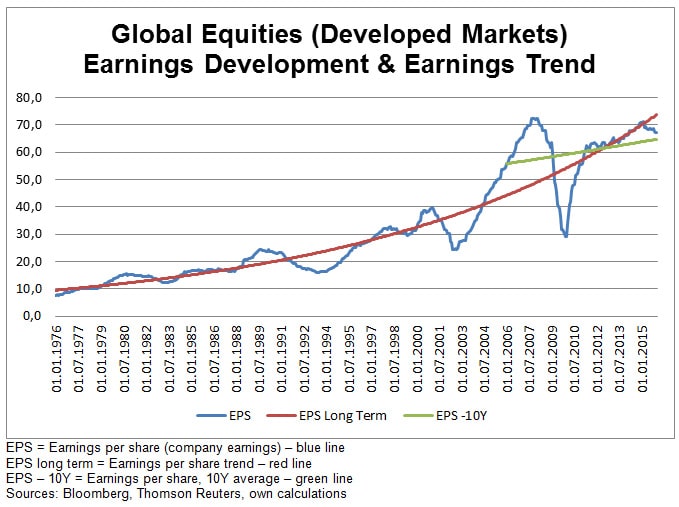

The long-term chart covering the past 40 years (blue line) shows the cyclical nature of the earnings development. The red line indicates the earnings trend over the entire period. Earnings have increased since the 1970s by an average of 5.6%. The green line illustrates the earnings trend over the past ten years, which is significantly flatter. In this less extensive analysis, earnings have only increased by an average of 1.9%, with five MSCI sectors (energy, commodities, financials, telecoms, and utilities) recording no growth at all over that period.

We can see that whenever earnings have fallen clearly below the trend line, a recession ensued, or indeed a recession was already occurring. In the past 40 years this has been the case four (!) times.

The current earnings development definitely advises caution: as long as the negative trend prevails, the international stock exchanges will be finding it difficult to rise.

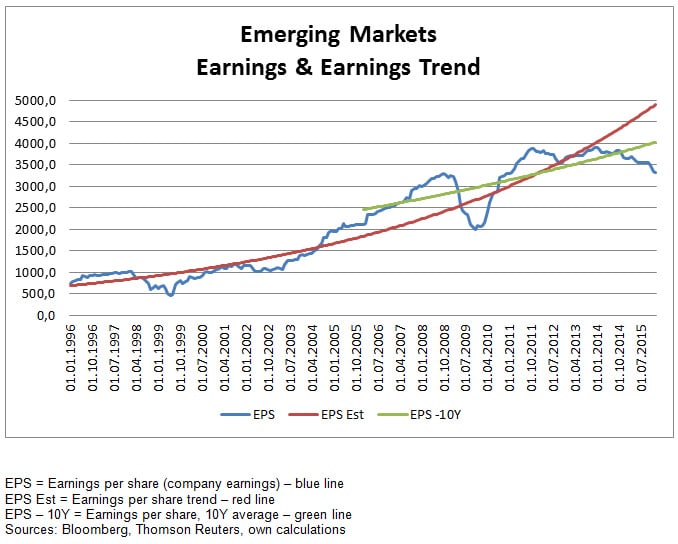

The earnings trend in the emerging market has been negative for a while

In the emerging markets the earnings situation has been negative for a while, which explains the weak performance of this equity class. While earnings recovered after the financial crisis, they peaked out back in 2011 and have not reached that level again since then; in fact, earnings have been on the decline since that time. This can also be explained by the composition of the equity indices. The index weighting of sectors displaying relative strength such as the technology sector and healthcare is low to non-existent. On the other hand, energy, commodities, and financials command very strong weightings.

Falling earnings are a negative indicator for equities. As long as no stabilisation or trend reversal is in sight, the pressure on the markets will not let up.

As explained above, earnings have increased by an average of 5.6% in the past. At +6.3%, the MSCI World index has recorded a slightly better performance. This is due to the fact that the price-earnings ratio has widened from 13.7x to 18.0x, which can be explained by the decline in yields and which therefore cannot be repeated. By adding dividends, we get a total historical performance of 9.1% p.a.

New reality: lower total performance expected

The average earnings increase of 5.6% is pretty much in line with global, nominal GDP growth over the past 40 years. Assuming a generally weaker growth rate and lower rates of inflation in the future, company earnings should increase more slowly as well. This means we will hardly see a repeat-performance of past gains. With regard to the extent, we can only speculate: perhaps in the future an expected total performance (price increases and dividends) of five to six percent will be the new reality.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.