China’s government wants to get the country’s stagnating economy back on track and is preparing for a trade dispute with the US. At the National People’s Congress in Beijing last week, Premier Li Qiang reaffirmed the leadership’s determination to support the economy with further measures and announced a growth target of 5 per cent. Li addressed the almost 3,000 delegates in the Great Hall of the People, mentioning an increasingly tough environment and changes the world has not seen in a century.

Growth target of 5 percent

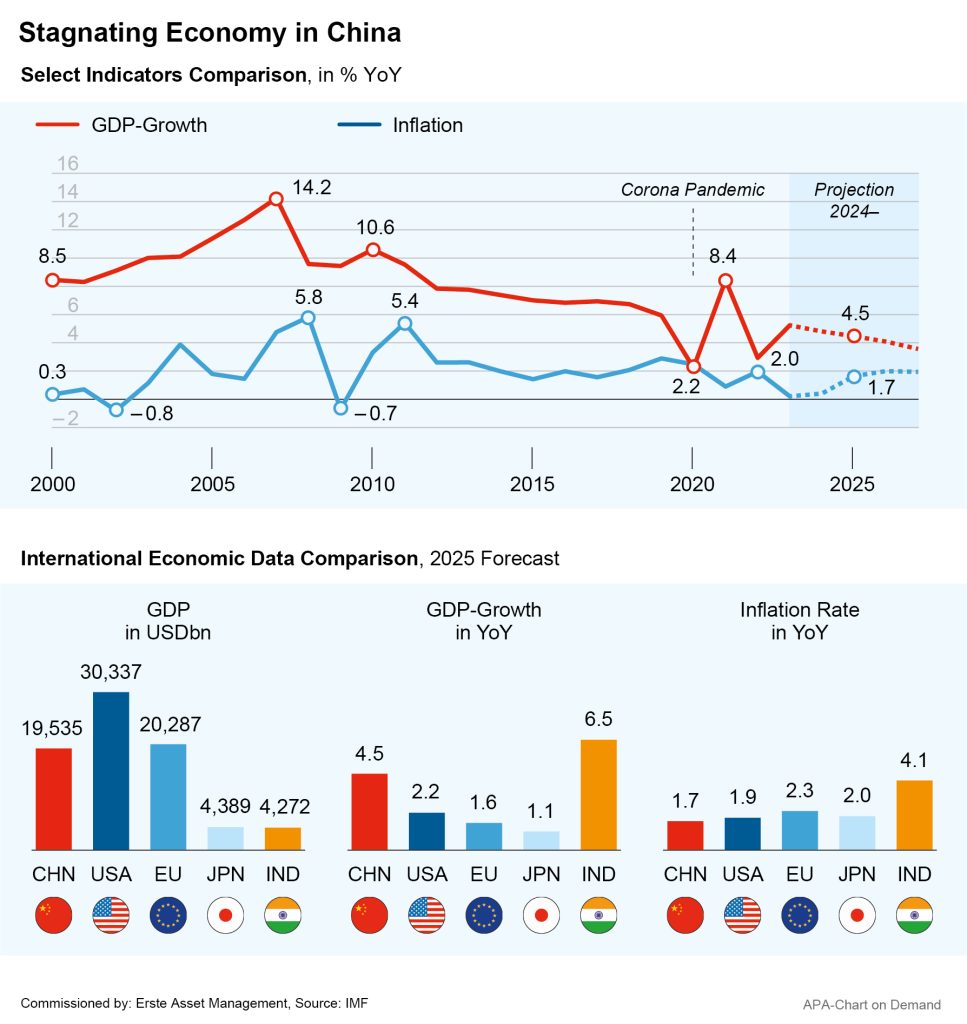

The 5 per cent economic growth target is in line with expectations, but is still considered ambitious. Dampened consumer sentiment and high youth unemployment have long been reflected in weak domestic demand. In addition, China’s economy continues to suffer from the country’s property crisis. Past performance is not a reliable indicator for the future.

Data as of March 2025

This is further exacerbated by the trade dispute with the US. The export of goods to the US remains an important pillar of the Chinese economy, and the conflict could hit the country hard. US President Donald Trump doubled the tariffs on Chinese goods imported into the US from 10 to 20 per cent immediately following his assumption of office. China has already responded with retaliatory tariffs of 10 to 15 per cent on a range of agricultural products from the US and punitive measures against some US companies. The world’s two largest economies are therefore on the cusp of a trade war similar to the one from Trump’s first term in office, when both sides continued to escalate through tariffs and counter-tariffs.

In order to revitalise the economy despite the trade dispute, China is now relying on massive investments, planning to issue billions in bonds for this purpose. The government has already increased its budget deficit plan by one percentage point to 4 per cent of the GDP – the highest level in decades. To this end, it plans to issue long-term special bonds to the tune of CNY 1.3tn (around EUR 170bn). In addition, state banks are to be provided with capital in the form of further special bonds totalling CNY 500bn.

Central Bank plans to promote key industries and announces possible interest rate cut

China’s central bank has also recently announced further measures to support the economy. According to Pan Gongsheng, governor of the People’s Bank of China, the central bank wants to cut interest rates “at the appropriate time” and inject liquidity into the financial system. However, this could fuel the trade dispute further, as a rate cut would also weaken the yuan. Trump also previously warned China against measures to weaken the national currency, as this would make Chinese products cheaper in the US.

Pan also announced new monetary policy instruments to stabilise consumption and foreign trade and promote investment in technological innovations. Among other things, a credit line for the technology sector will be doubled from CNY 500bn to CNY 1tn (nearly EUR 130bn). According to the Chairman of the National Development and Reform Commission, Zheng Shanjie, the country is planning major projects in key sectors such as the railway sector, nuclear energy and water management in order to attract private investments.

China leading in renewable energy and EVs

Meanwhile, the “Made in China 2025” government plan launched ten years ago is showing results. The country has become the global market leader in renewable energy and produces by far the most electric vehicles in the world. Chinese electric car manufacturer BYD is in the process of overtaking the previous market leader, US company Tesla. In Q2 of last year, BYD reported a higher turnover than Tesla for the first time. Chinese car manufacturer SAIC and Chinese tech giant Huawei also want to join forces in the development of electric cars, the two companies announced in February. The companies listed here have been selected as examples and do not constitute an investment recommendation.

Breakthroughs in artificial intelligence

The field of artificial intelligence (AI) has also seen some Chinese breakthroughs. Most recently, the Chinese company DeepSeek made a big splash around the world, demonstrating with its language model that China’s companies can keep up with the USA when it comes to AI. DeepSeek’s success has also improved sentiment on the Chinese stock markets since the beginning of the year. Tech stocks, which lost a lot of value over the years, were able to recover some of their losses and even reached new highs at times. The People’s Congress recently promised tech companies further aid.

Li addressed the issue specifically as well. According to the work report presented by the premier, the government is planning to support the “extensive application of large-scale AI models” and also intends to implement a mechanism to increase funding for “the industries of the future”. The government also wants to reduce the People’s Republic’s dependence on Western chip technologies with a new programme. To this end, a nationwide guideline will encourage companies to make greater use of processors based on the licence-free and open technology RISC-V, Reuters reported citing a number of insiders.

Surprisingly positive percent economic barometer and company figures

Positive signals recently came from a number of economic indicators. The Purchasing Managers’ Index for service providers compiled by the business magazine Caixin rose by 0.4 points to 51.4 points in February month-over-month. This improvement in sentiment came as a surprise to analysts, who on average had expected and decline to 50.7 points. The index for the manufacturing industry rose to 50.8 points in February, up from 50.1 points in January. The official Purchasing Managers’ Index climbed to a three-month high of 50.2 points in February, rising back above the 50-point mark that signals growth.

The quarterly results of some major Chinese companies also recently surprised with positive figures. Computer manufacturer Lenovo, for example, roughly doubled its quarterly profit to almost USD 700m. Internet giant Alibaba even more than tripled its quarterly profit. The group operates China’s largest e-commerce platform Taobao, therefore its business development is considered an important indicator of consumer sentiment in the People’s Republic.

Invest in the comeback of the Chinese economy with funds

Despite geopolitical uncertainties and the trade conflict with the US, the chances are good that the Chinese economy will recover in the coming months. Funds allow risk-conscious investors to participate in a resurgence of the Chinese economy. ERSTE STOCK EM GLOBAL invests broadly in companies headquartered or operating in global emerging markets. Chinese companies currently account for 35 percent of the fund’s holdings. Shares of other major Asian emerging markets such as Taiwan, India, and South Korea are also prominently represented. The top ten individual positions include chip manufacturer Taiwan Semiconductor and technology heavyweights Tencent and Alibaba.

Please note that investing in securities also involves risks besides the opportunities described. Past performance is not a reliable indicator for the future performance of a fund.

The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation.

Notes for ERSTE STOCK EM GLOBAL

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Advantages:

- Broadly diversified investment in companies in emerging markets with little capital investment.

- Active stock selection based on fundamental criteria.

- Participation in global emerging market growth opportunities.

- Opportunities for capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks:

- The price of the funds can fluctuate considerably (high volatility).

- An investment in emerging markets has a higher risk potential than an investment in developed markets.

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.