In 1988, MSCI launched the Emerging Markets Index, which consisted of just 10 countries representing less than 1% of world market capitalization. Today the MSCI Emerging Markets Index consists of 24 countries representing 10% of world market capitalization. Until June 2020 several important changes to one of the most important global emerging markets equities indices are on the agenda. Read here which changes can be expected.

What is a stock index?

Stock indices play a very important role in the stock market. They summarize the performance of stocks from a specific country, industry or region. For example, professional investors such as pension funds or fund companies use the indices to assess the attractiveness of a stock exchange by taking into account additional key figures such as dividends or profits. Some financial services providers offer products for private and institutional investors that track the performance of certain indices. There are different types of indices. More information on the stock index here.

The creation of a new GICS sector in the MSCI Emerging Markets Index – Communication Services

There will be a new GICS sector – Communications Services – which will be made out of the current Telecommunication sector (e.g. China Mobile, China Telecom, Telekomunikasi Indonesia) and part of the Information Technology sector (e.g. Tencent, Baidu, Naspers). The new Communication Services sector will represent around 14% of the MSCI Emerging Markets Index. This change will be implemented on December 3rd 2018.

Saudi Arabia will become a new member of the MSCI Emerging Markets Index

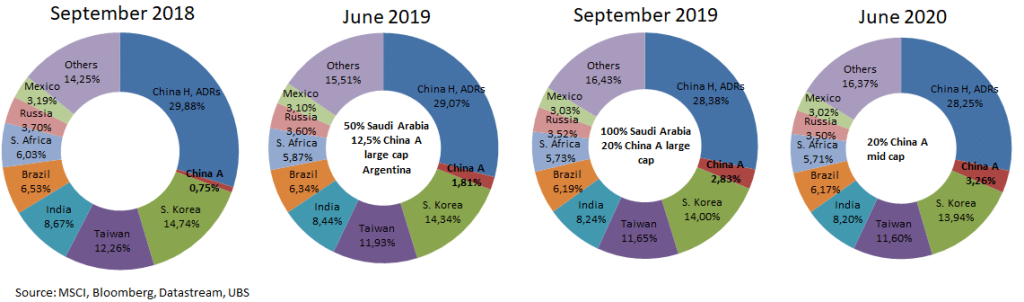

Saudi Arabia will have a weight of approximately 2,6%. The inclusion will be implemented in two phases: 1) on June 3rd 2019, 50% of the free float-adjusted market cap of Saudi Arabia stock market will be included; 2) on September 2nd 2019, 100% of market cap will be included.

Argentina will be reclassified

Argentina will be reclassified from Frontier Markets to Emerging Markets status with a weight of circa 0,3%. The inclusion will be implemented on June 3rd 2019. However, given the recent sharp depreciation of Argentine Peso and potential restrictions on market accessibility, MSCI would review this reclassification decision.

Increase of China A shares

In addition, after the successful effective implementation of the 5% inclusion of China A shares in MSCI EMs Index, MSCI has proposed to lift the inclusion factor to 20% of the free-float-adjusted market value of yuan-denominated stocks. The changes would mean that China A shares will make up around 2.8% of the MSCI Emerging Markets Index by September 2019, and further increase to circa 3.3% when mid-cap stocks are added in June 2020. The result of this consultation will be announced at the end of February 2019.

What kinds of consequences will the changes bring?

The region Emerging Europe & Africa (EMEA) will gain in importance

Changes in regional weights: due to the inclusion of Saudi Arabia, the weight of EMEA will rise to circa 15,9% from 14.1% currently. The weights of Asia and LATAM will decline to around 72,7% and 11,4% respectively from 74,2% and 11,7%.

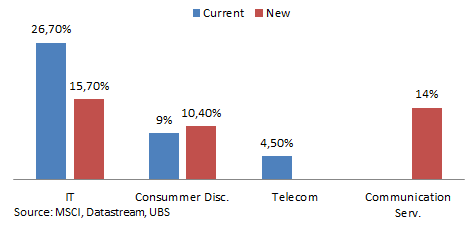

Communications Services will become the third largest sector

Changes of sector structure: with a weight of 14% the new Communication Services sector will become the third largest sector behind Financial sector and Information Technology sector. The weight of Information Technology sector will fall from 26,7% currently to circa 15,7%. The weight of Consumer Discretionary will rise to around 10,4% from 9%. Telecommunication sector will be completely deleted.

Sector weight shifts

China becomes more important

If the potential broadened coverage of China A shares is implemented, the number of China A shares in the MSCI Emerging Markets Index will rise to 434 from 235. International investors will be able to trade these A shares through Shanghai- and Shenzhen- Hong Kong Stock Connect, a cross-boundary investment channel, which connects the mainland China stock exchanges to the Hong Kong Stock Exchange. By June 2020 the weight of China in the MSCI Emerging Markets Index, including China A shares listed in Shanghai and Shenzhen, H shares listed in Hong Kong and ADRs listed in the USA, could reach 31,5% .

Country weight shifts

Data as of September 2018

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.