„Much ado for about nothing“

The first half of 2025 was definitely not for the faint-hearted. The past few months felt like they were peppered with numerous dramatic events that kept investors around the world on their toes every day. Political upheavals, geopolitical escalations and, ultimately, the unclear impact on the economy caused a constant seesaw between uncertainty and recovery. This was accompanied by particularly high capital market volatility.

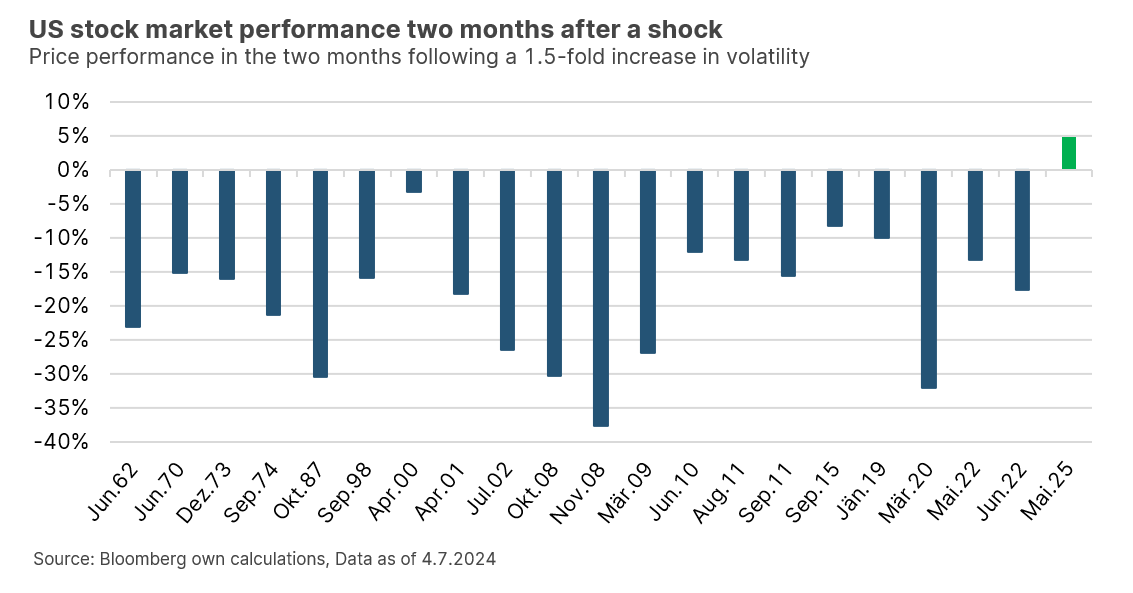

Looking at price performance over the year as a whole, one might be tempted to conclude that it was ‘much ado about nothing’. Global equities, based on the MSCI World Index in euros, ended the year slightly down, and numerous stock market indices even reached new all-time highs. However, this view ignores the temporary stock market slump in April and the subsequent recovery in May. The speed of the recovery was particularly impressive, as the chart below illustrates. It shows the performance of the US stock market two months after a slump that was accompanied by a 1.5-fold increase in volatility. Since the Second World War, there has been no comparable counter-movement in which losses were completely offset and ultimately even exceeded in such a short period of time.

The bond markets also experienced a similar rollercoaster ride, with US government bonds fluctuating particularly sharply. Driven by growing concerns about rising US government debt, long-term yields on US debt securities rose sharply in the past quarter, before recovering again. This raises the legitimate question of why the markets have performed relatively well despite the numerous sources of uncertainty. (Note: Past performance is not a reliable indicator of future performance.)

Note: Past performance is not a reliable indicator of future performance.

It’s the economy, stupid!

Uncertainty is usually the poison of the stock markets – with Donald Trump’s trade policy and smouldering geopolitical hotspots such as the recent escalation in the Middle East and the unresolved Ukraine conflict, the current environment is anything but secure. Nevertheless, negative events currently have a surprisingly short half-life, and it seems as if investors are simply overlooking them.

One of the main reasons for the current market resilience is likely to be that the postponement of tariffs seems to have taken the ‘worst-case scenario’ off the table. Unlike at the beginning of April, the probability of a US recession in the near future has fallen significantly. Even though the tariff dispute seems far from resolved, recent weeks have shown that Trump ultimately has no interest in a complete escalation. If the tariffs do come into force as currently announced, the effective tariff rate is likely to rise to around 15-16%. The effect on the economy will definitely be negative – companies can either pass on the tariff-related cost increases directly to end customers or accept a reduction in margins. Falling real incomes or increased pressure on the labour market should therefore have a dampening effect on consumption.

This is already reflected in analysts’ lower growth expectations for the US this year, which have fallen from a consensus of 2.3% at the beginning of the year to 1.5% currently. However, analysts expect the anticipated dip in growth in the second half of the year to be followed by an economic recovery in 2026.

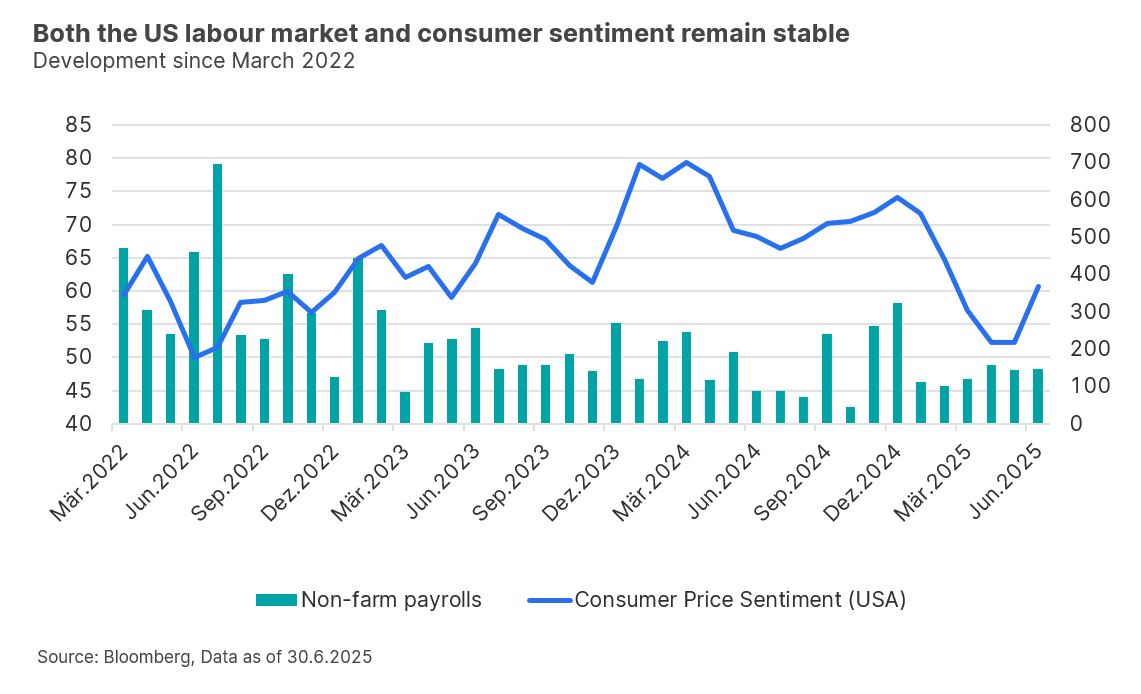

The latest economic figures also continue to paint a robust picture overall. Although the much-watched US labour market is cooling, demand for labour remains stable. As shown below, for example, 147,000 new jobs were created in June, significantly exceeding economists’ expectations (110,000 jobs). In addition to the labour market, consumer spending, which is so important for the US economy, is not showing any signs of weakness for the time being. US consumer sentiment, as shown below, has recovered surprisingly quickly after the low in April and gives the impression that the worst is behind us.

Although to a lesser extent, the economy is therefore currently expected to grow. Corporate profits are proving resilient for the time being, and the much-cited ‘One Big Beautiful Bill’ should be followed by further tax cuts and deregulation measures in the course of the year. However, there are two sides to every coin, and the risks associated with Trump’s spending policy in particular need to be examined more closely.

US dollar loses its strength

As already mentioned, the new budget law includes measures to stimulate the economy. However, it is doubtful that the planned additional expenditure can be fully financed by customs revenues. The savings potential of the much-vaunted Department of Government Efficiency (DOGE) is also likely to remain limited and has lost momentum anyway following the rift between Donald Trump and Elon Musk. The result will be a further increase in the budget deficit, which already appears unnecessarily high at just under 7%. The non-partisan Committee for a Responsible Federal Budget, for example, estimates that the recently passed law could increase the US deficit by up to $5.5 trillion by 2034. In addition to the debt ratio, however, the annual interest burden, which has more than doubled in the last three years and will soon exceed 1,000 billion dollars per year, is a particular cause for concern.

Lower interest rates would help the US government, which is why the power struggle between Donald Trump and US Federal Reserve Chairman Jay Powell, which has been smouldering for months, is likely to continue until the end of Powell’s term in office (May 2026). The Fed chief has so far remained hesitant to cut interest rates further, citing inflation risks – consumer prices rose again by 2.7% in June, which is likely to confirm Powell’s strategy. Regardless of this, market participants expect two interest rate cuts in the US by the end of the year.

The central bank’s independent approach is essential, as otherwise the global financial community’s confidence in the US government bond market would be even more at risk. Interest rate developments will remain an important indicator here and should therefore be monitored particularly closely. Donald Trump should actually thank Jerome Powell, because without a steadfast central bank chief, yields would probably be much higher and the US dollar would have lost even more value. Since the beginning of the year, the greenback has lost more than 11% against a broad basket of currencies. This is the worst half-year performance in over 50 years, which is particularly remarkable given the global uncertainties. The US dollar and US government bonds have generally been regarded as safe havens in times of crisis, but this is increasingly being called into question.

Those who swing too far lose their balance

The capital market environment remains challenging, which is another reason why we continue to focus on a balanced and, above all, broadly diversified portfolio. The current situation suggests that the second half of the year will be quite volatile, which is why we continue to focus on ‘long-term investing rather than short-term speculation’.

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.