5 November is the day many have been waiting for – in addition to the election of the House of Representatives and about a third of the Senate, a new president will be elected in the USA. Since the incumbent’s decision not to stand for election, the Democrat Kamala Harris has made an impressive comeback against the Republican Trump.

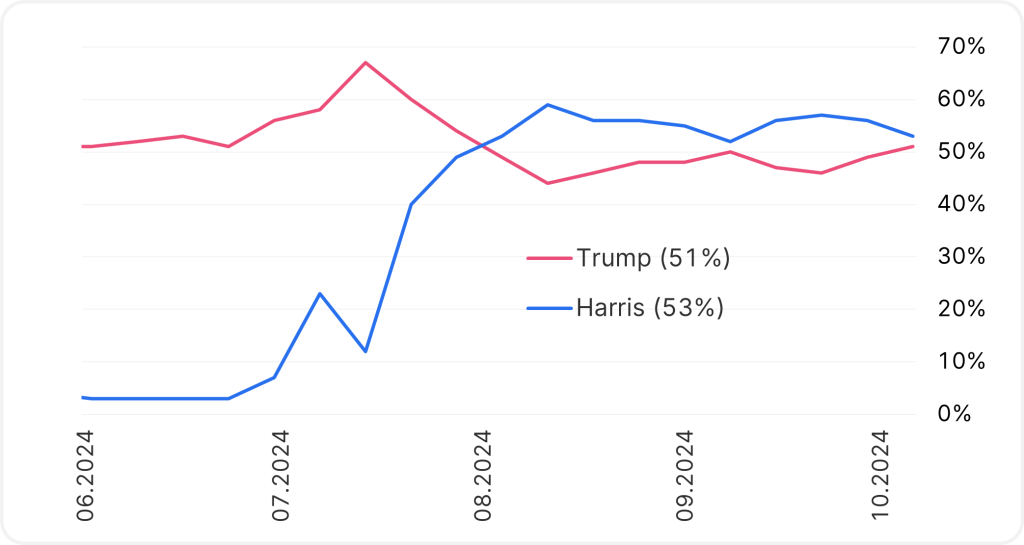

There are many polls and bookies where you can voice your opinion (and bet on it). This comes in the context of the fact that traditional telephone polling no longer produces the kind of forecasts in the internet age as they used to. We will use one of the polls here, which shows a varying but constant lead for Harris over the last two months:

Trends in the polls for the US presidential election

Source: Bloomberg, PredictIt; as of 30 September 2024

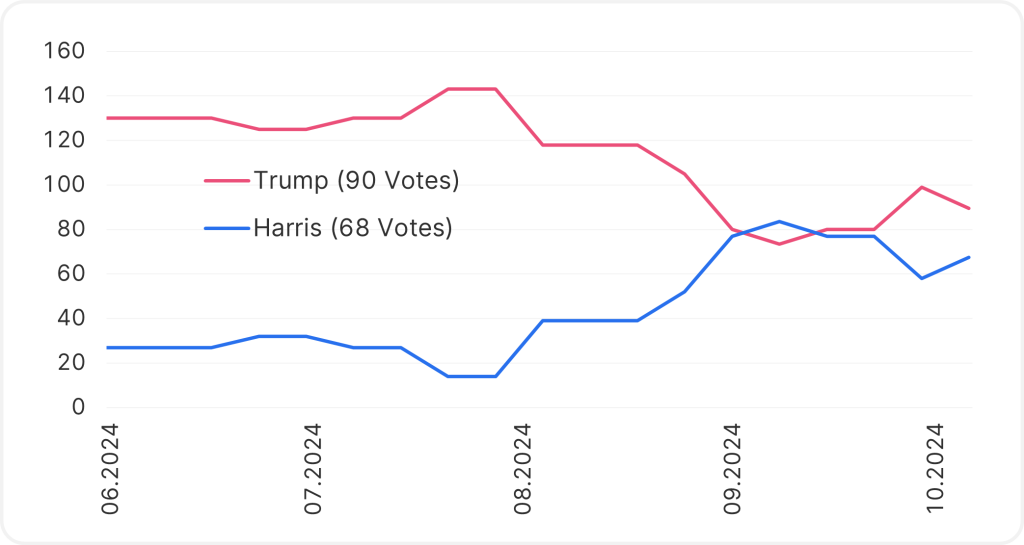

At the same time, it is not the overall result (i.e. the so-called popular vote) that is decisive for the election, but the result of the vote of the Electoral College, which is determined and sent by each federal state. It is important to note here that there are federal states that historically rarely change their voting behaviour, and others where decisions are traditionally close and changing. The candidates’ campaign activities are concentrated on these so-called swing states.

Currently, 157 of the electoral college votes are considered to come from swing states, out of a total of 538 votes. This shows that the situation could ultimately be different – that’s because Trump has a certain lead in the polls in this regard:

Detailed results of swing state polls for the US presidential election

Source: Bloomberg, PredictIt; as of 30 September 2024

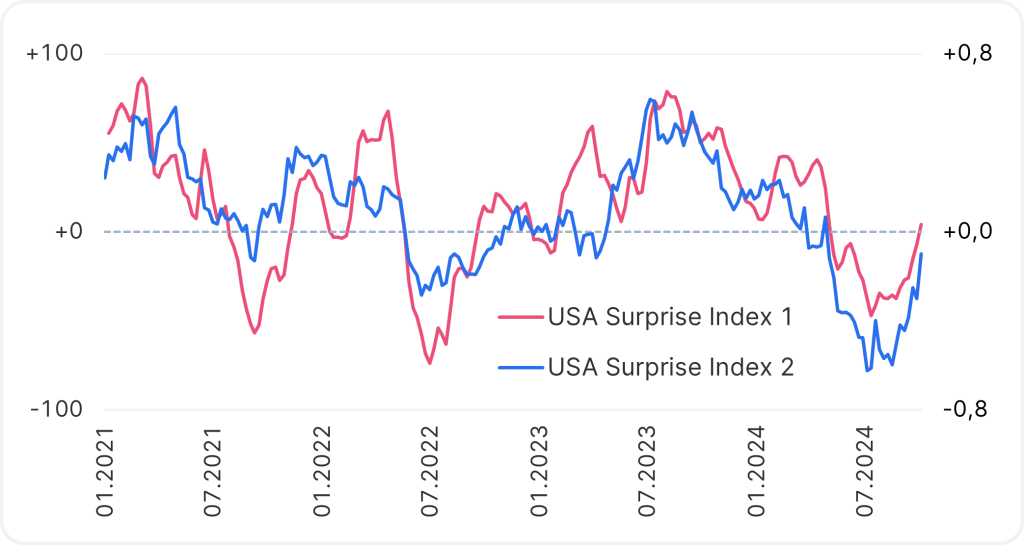

Overall, it is fair to say that the two camps – Republicans and Democrats – in the USA are roughly equal in strength. Tactical voting, i.e. voting for one party in presidential elections and another in the parliamentary houses – is not uncommon, and economic sentiment is very important: is the economy is growing or shrinking, is the disposable income rising or falling, what is the petrol price? The geopolitical situation also plays a role, but traditionally to a lesser extent than the economic situation, with local issues being more decisive.

The “temperature” of the US economy can be measured not only in absolute terms, but also relatively: does new data come in above or below analysts’ expectations? This shows that the situation turned positive in September after a negative situation from June to August.

Economic surprise indices

Source: Bloomberg, PredictIt; as of 30 September 2024

A positive economic mood in the USA favours the incumbent – and this should also apply to Vice President Harris.

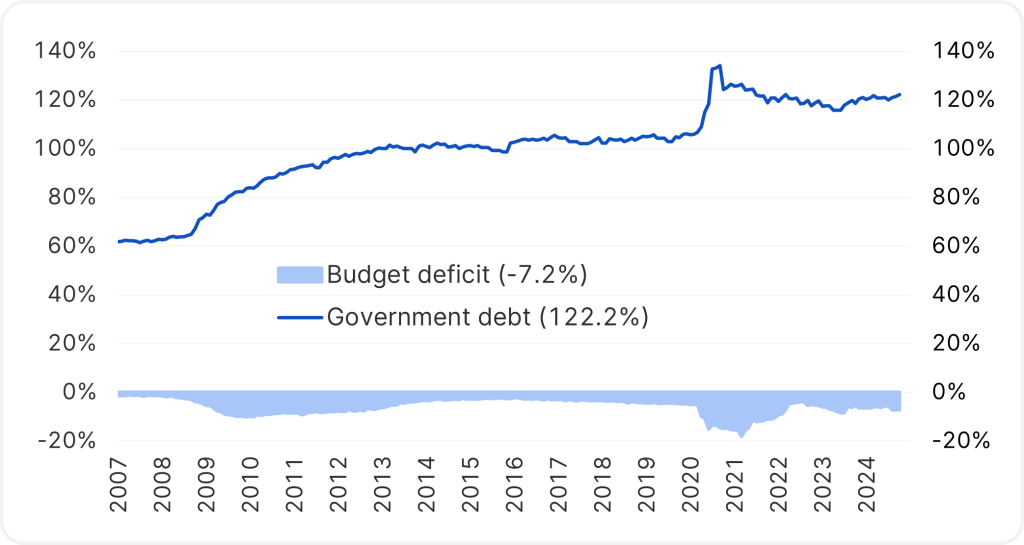

One issue that needs to be addressed for the future is the comparatively high budget deficit as compared to Europe, where a deficit of 3% is a customary assessment basis (which is sometimes better, sometimes less well met within the EU). In the USA, the deficit is currently 7.2%, as the following chart shows. On the other hand, national debt is relatively constant as measured against economic output, which is driven by consistently high growth.

Budget and government debt

Source: Bloomberg; as of 30 September 2024

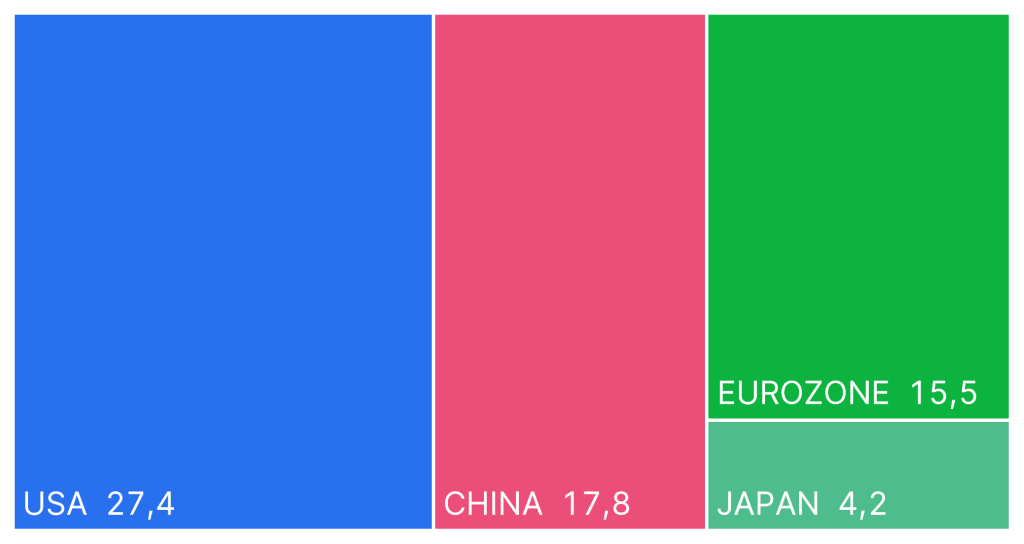

Finally, it is interesting to take a look at large economic areas. Just a few years ago, it was predicted that China would overtake the USA in the near future due to its even higher growth rates than the ones generated by the United States, which in turn has been growing faster than Europe for a long time (N.B. the weakening growth and low innovative strength in Europe are indeed becoming more and more of a cause for concern). Now, however, growth in China is slowing down, and so the USA’s global pole position seems to be secure for the time being.

Output of large economic areas (in USD trillion)

Source: Bloomberg; as of 30 September 2024

Conclusion

At the moment, the race for the US presidency is still undecided: in the nationwide polls, Harris has a lead, while in the swing state polls, Trump is ahead. On 5 November, the final outcome may be decided by economic sentiment – here, the data situation has improved since October, following some previously uncomfortable readings.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.