When the Italian government under Prime Minister Giuseppe Conte announced the “Superbonus” 110% in 2020, it was not yet clear whether this would help the construction industry in Italy to recover from years of underdevelopment. The measure was intended to boost construction activity and promote more efficient heating systems. Homeowners could receive generous tax breaks, which led to an intensive wave of modernization.

After years of problems, a certain spirit of optimism seemed to have entered the country. A process that is still continuing and is appreciated by investors. But where is the boot on the Mediterranean heading and what does the super bonus have to do with it?

Economy back to pre-financial crisis level

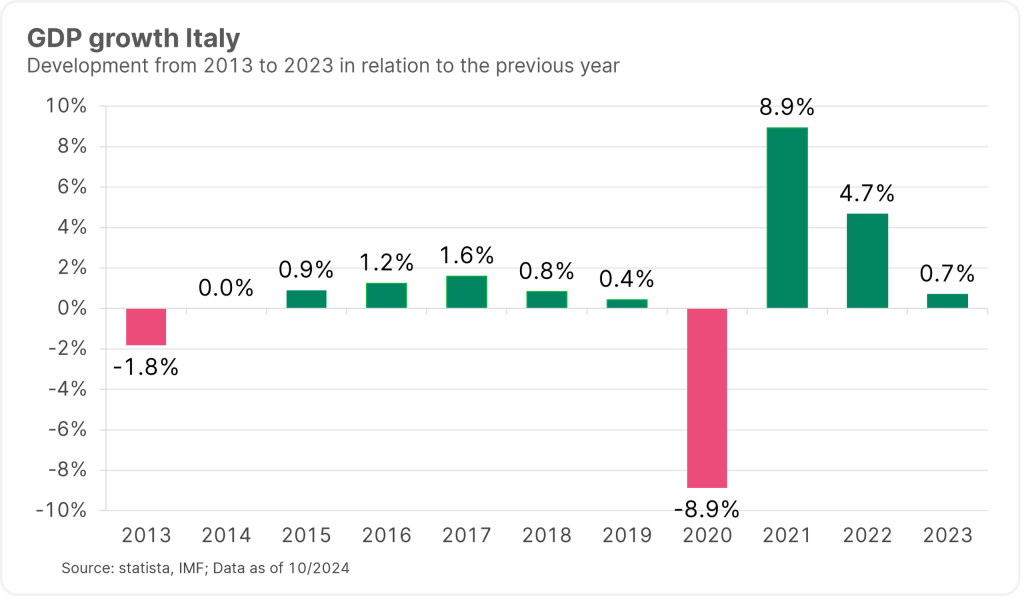

Four years later, Italy’s economy has finally returned to pre-financial crisis levels due to, or perhaps despite, the measure. It has taken more than a decade longer than most other advanced economies to reach this point. Hidden in an inconspicuous press release, the Italian statistical office declared that the economy had grown more strongly in 2021 and 2022 than previously assumed.

The Italian economy now grew by 8.9% in 2021. This represents an improvement of 0.6 percentage points compared to the previous data. In comparison, economic output in 2022 was even 0.7 percentage points higher than previously assumed at 4.7%. Only in 2023 did Italian production fall short of expectations. It only grew by 0.7 percent. This was 0.2 percentage points less than previously assumed. According to the new data, Italy’s GDP is now 0.2% above its 2007 peak. Italy’s government deficit is therefore lower than assumed due to the stronger economic performance.

In fact, Italy’s economy is not much bigger than it was at the turn of the millennium, compared to growth of 60 percent in the US, 30 percent in France and Germany and 40 percent in the UK. This stagnation in Italy is the result of a persistent sideways trend in its productivity performance. This is mainly due to a lack of investment in connection with an uncertain political environment.

In addition, the population is ageing and shrinking rapidly. Italy has the highest average age in the EU and one of the lowest fertility rates in the world. In addition, labor force participation is low. Especially among women.

Labor market offers growth potential

Italy is generally characterized by the lowest employment rate within the EU. In addition, the country also has the highest proportion of part-time employment among women. As a result, Italy has great potential for economic growth if more women were included in the labor market. There are estimates from the Banca d’Italia that show that a 10% increase in the working population would increase the country’s economic output by roughly the same amount in the long term. This would mean that the employment rate of Italian women would approach the current EU level. Making this possible would be an important step towards a sustainable recovery of the Italian economy.

Investments to boost the economy

In October 2024, the Italian government under Meloni adopted a medium-term budget plan for the next seven years. This provides for a moderate increase in expenditure and a reduction in the deficit. The public debt ratio is expected to rise until 2026 and then fall by one percentage point per year. This is the plan. The government’s growth target over the seven years is around one percent. However, this figure has been described as too optimistic. The Banca d’Italia expects average GDP growth of 0.8 percent for 2024. The parliamentary budget office also expressed skepticism and described the one percent target as highly questionable.

Irrespective of this, however, high levels of investment have also been made in infrastructure. For example, the Italian government is planning to expand its electricity grid by around 70 gigawatts of renewable energy plants by 2030. Up to 60 billion euros are also to be invested in the rail network there. Many projects are also underway in water and waste management. Italy will continue to receive large amounts of funding from the European Union’s Recovery and Resilience Facility until 2027.

The billions invested in infrastructure in Italy, among other things, are also supported by funds from the European Union. Image source: unsplash

The state is also supporting major investments in electromobility and the chemical industry. For example, the chemical industry is implementing a number of “waste-to-chemicals” waste recycling plants and projects for more sustainable resource consumption. The major fashion and furniture industries are also building more environmentally friendly production facilities.

Strong export industry could suffer from Trump’s tariff policy

Italy’s export industry is the strongest economic driver across all sectors, while consumption is almost stagnating. However, the election of Donald Trump as the 47th president of the USA could spoil the current good mood among Italian business leaders. The European Commission estimates that Italy’s exports of goods and services will increase by 2.4% in 2024 in price-adjusted terms. According to the forecast, imports will increase by 0.9 %. This will increase Italy’s current account surplus. However, possible upcoming tariff increases could cloud this positive picture.

In international competition, Italian companies benefit above all from innovative strength and low wage costs. In 2023, gross hourly wages in the private sector were 6.3% below the EU average. Energy costs in Italy, on the other hand, are more expensive than the EU average.

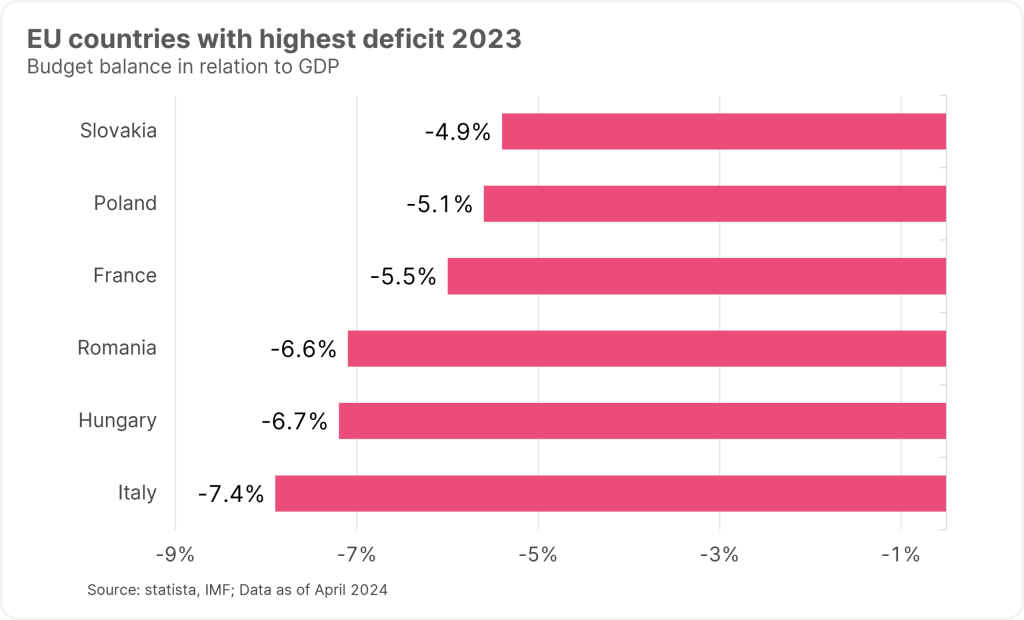

Tense budget situation

Nevertheless, the budget discipline of the public sector remains problematic. The European Commission expects Italy’s budget deficit to account for around 5% of GDP in 2024. Together with France, this is the third worst figure in the EU after Romania and Slovakia. If we take 2023 as a comparison, Italy was already at the bottom of the league in terms of budget deficit in the EU back then.

Furthermore, as purchasing power in 2024 will still be significantly lower than in 2021, consumer demand will only increase marginally in price-adjusted terms. In order to offset the increased cost of goods, many households are now resorting to credit financing. The volume of consumer loans issued in Italy at the end of 2023 was 15% higher than four years previously.

In addition to consumer investment, real construction investment will also fall by 2% in 2024 according to the European Commission. Despite the many major civil engineering projects and subsidized energy-efficient renovations. This is due to more expensive real estate loans.

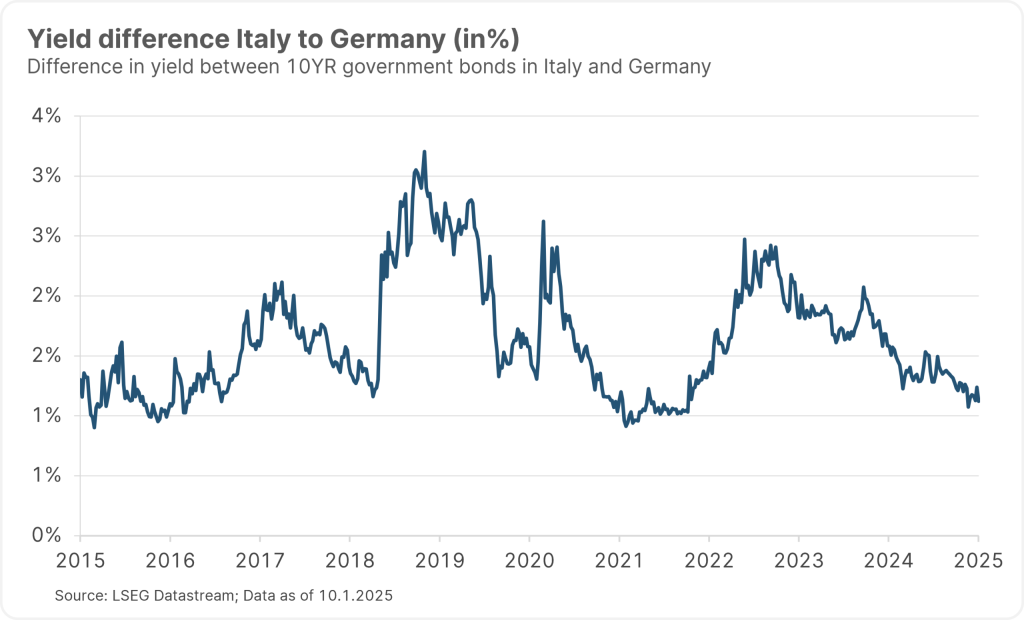

Conclusion: Bond market gives government confidence

Although the GDP level of 2008 was only reached again last year, economic growth is low compared to countries such as the USA, France, Germany and the UK. The reasons for this are stagnating productivity, a lack of investment and innovation and restrictive policies. Italy also has an ageing population and a low birth rate, which is further hampering growth.

Despite some positive developments, such as rising real wages and investments through the Next Generation EU program, the long-term outlook for Italy’s economy remains subdued. However, the bond market expects further steps in the right direction and has confidence in the Meloni government. A picture that is reflected in the fall in risk premiums on Italian government bonds.

Note: Past performance is not a reliable indicator of future performance.

And what happened to the “Superbonus 110%”? Critics claim that the superbonus never achieved its actual goal of promoting private property ownership and, by extension, increasing prosperity. The program was susceptible to fraud. For example, cases were uncovered in which refurbishment work was only faked. Under the subsequent Meloni government, subsidies for heat pumps and home renovations were therefore reduced, which led to a slump in the market

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.