On the stock markets, the quarterly reporting season’s finale is the current focus of attention. Investors are hoping that this will provide information on how well the big companies have coped with the first full year of the Corona pandemic. Expectations of a recovery from the shock following the previous year’s outbreak were quite high in part.

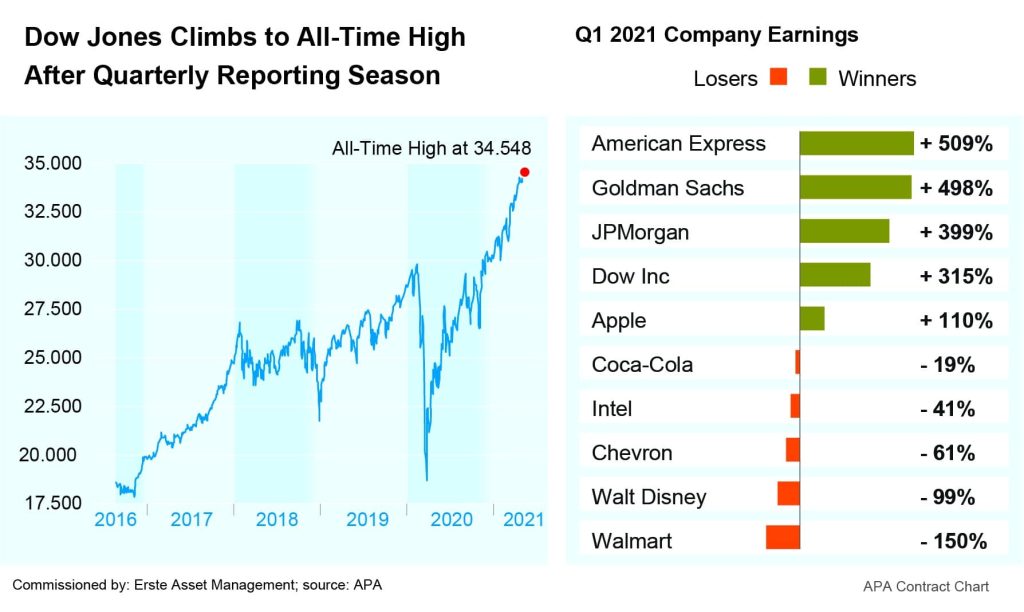

While some major players are still presenting figures in Europe, the most significant US companies have already published theirs. On the US stock markets, the results have corroborated the recent rally, with the Dow Jones recently reaching new record highs.

US financial companies multiply their quarterly profits

The biggest profit increases among the companies listed in the Dow were reported by several financial groups: American Express, Goldman Sachs and JP Morgan were able to multiply their profits in the past year.

US investment bank Goldman Sachs increased its net profit six-fold to USD 6.7bn in Q1, far exceeding market expectations. For the most part, Goldman Sachs profited from the boom in shell companies, the so-called SPACs. JP Morgan was able to quintuple its profit to USD 14.3bn thanks to a flourishing trading business. The US banking institutions are also benefiting from the White House-issued economic stimulus package – which, among other things, is meant to mitigate consumption drops and loan defaults during the Corona crisis.

American Express was also able to increase its profit six-fold to USD 2.2bn in the quarter. The credit card company particularly benefited from the fact that provisions for impending loan defaults made during the crisis were reversed due to the improved economic outlook. The operating business, however, remained lukewarm in the quarter, with sales falling by 12 per cent. American Express continued to suffer from the fact that the pandemic has paralysed international travel, virtually eliminating lucrative hotel or flight bookings.

However, some European banking houses also saw a strong recovery. Deutsche Bank, for example, reported its strongest earnings in seven years for the quarter, exceeding market expectations. The bank also expects a profit for the year as a whole.

IT giants continue to benefit from home office and digital transformation boom

Strong figures also came from the large US IT companies, which are among the greatest beneficiaries of the digital transformation boom resulting from lockdowns and home office initiatives. Apple, for example, reported a 54 per cent increase in turnover to almost USD 90bn for Q1, with a profit of USD 23.6bn double that of the previous year. Once again, the iPhone did most of the heavy lifting, bringing in almost USD 48bn in revenue – nearly two-thirds more than last year.

Facebook also benefited from the lockdowns, reporting a profit increase from USD 4.9bn to 9.5bn. With many areas of life shifting to online platforms, demand for advertising in the digital space is also likely to have increased. Facebook saw 12 per cent more ads last quarter; the average price of which rose by 30 per cent YOY.

Amazon naturally benefited from the internet shopping boom, as did the group’s enormous cloud business. In the first quarter, Amazon increased its turnover by 44 per cent YOY to around USD 109bn. The company more than tripled its profits to a record USD 8.1bn, clearly exceeding stock market expectations.

Retail giant Walmart, on the other hand, suffered from the pandemic-related measures and dropped into the red despite booming online sales. The bottom line was a loss of USD 2.1bn, after a profit of USD 4.1bn in the same quarter one year previous.

Disney was also among the big losers. The company’s thriving streaming business was unable to cushion the negative impact caused by the pandemic. The entertainment company’s profit plummeted by 99 per cent to a mere USD 29m. However, the figures and the success of Disney’s streaming service were positively received on the stock market, and the share price recently reached new highs.

Note: Past performance is no reliable indicator for future performance.

Europe also reports good figures

In Europe, reporting season is still in progress, but here, too, the recovery and the positive trend of Q4 should continue. German car manufacturers reported strong quarterly figures thanks to good business in China and a general market recovery. Daimler, for example, reported a surprisingly clear profit of EUR 4.3bn for Q1, where, a year ago, net profit was only EUR 94m. Volkswagen also multiplied its profits. However, supply bottlenecks for semiconductors continue to be a concern for the car manufacturers.

Siemens also profited from the good business with the automotive industry and was able to present good results recently. In the second business quarter from January to March the technology group’s profit increased from EUR 0.7bn to 2.4bn. In addition to the automotive business, the group’s mechanical engineering and software businesses also performed well.

CONCLUSION: Most listed companies seem to be emerging well from the Corona crisis. The robust condition provides support for the equities.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.