What are High Yield Bonds?

High yield bonds are corporate bonds issued by companies with lower credit ratings. These ratings suggest a higher risk that the company might not be able to repay its debt. To compensate investors for this risk, these bonds offer higher interest payments – hence the term “high yield.”

How is “High Yield” defined?

Bonds are rated by credit rating agencies based on the issuer’s ability to repay. The three main agencies are Moody’s, Standard & Poor’s (S&P) and Fitch. A bond is considered investment grade if it’s rated BBB- or higher (S&P/Fitch) or Baa3 or higher (Moody’s). Anything below that is classified as high yield.

Why ratings matter: Default risk

Lower-rated issuers have historically shown a higher probability of default – failing to make interest payments or repay the principal. While exact numbers vary by source and period, here’s a rough guide based on long-term averages:

| Rating | Average default rate |

| BB | ~0.5–1.5% |

| B | ~2–5% |

| CCC | ~10–30% |

Source: S&P

However, not all is lost in a default. Investors often recover a portion of their investment – this is known as the recovery rate. Historically, recovery rates for high yield bonds have averaged around 40%, though this varies widely.

Credit Spreads: The risk premium

The credit spread is the difference between the yield of a high yield bond and a government bond (like a German Bund) of similar maturity. This spread compensates investors for:

- Default risk

- Liquidity risk (high yield bonds are harder to sell quickly)

- Market volatility

For example, if a German 5-year Bund yields 2% and a high yield bond yields 6%, the credit spread is 4 percentage points or, equivalently, 400 basis points (bps for short).

Are High Yield Bonds still worth the risk?

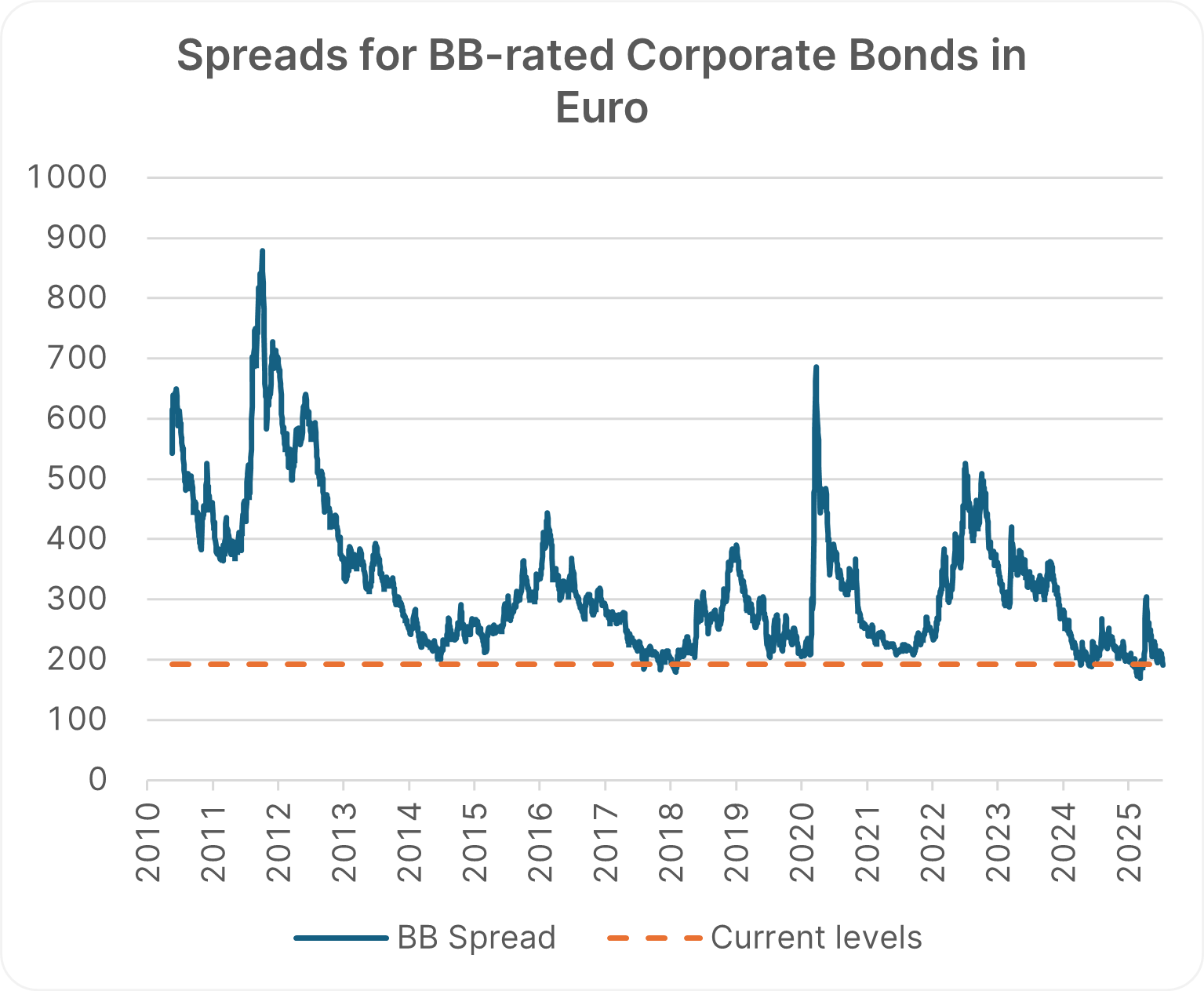

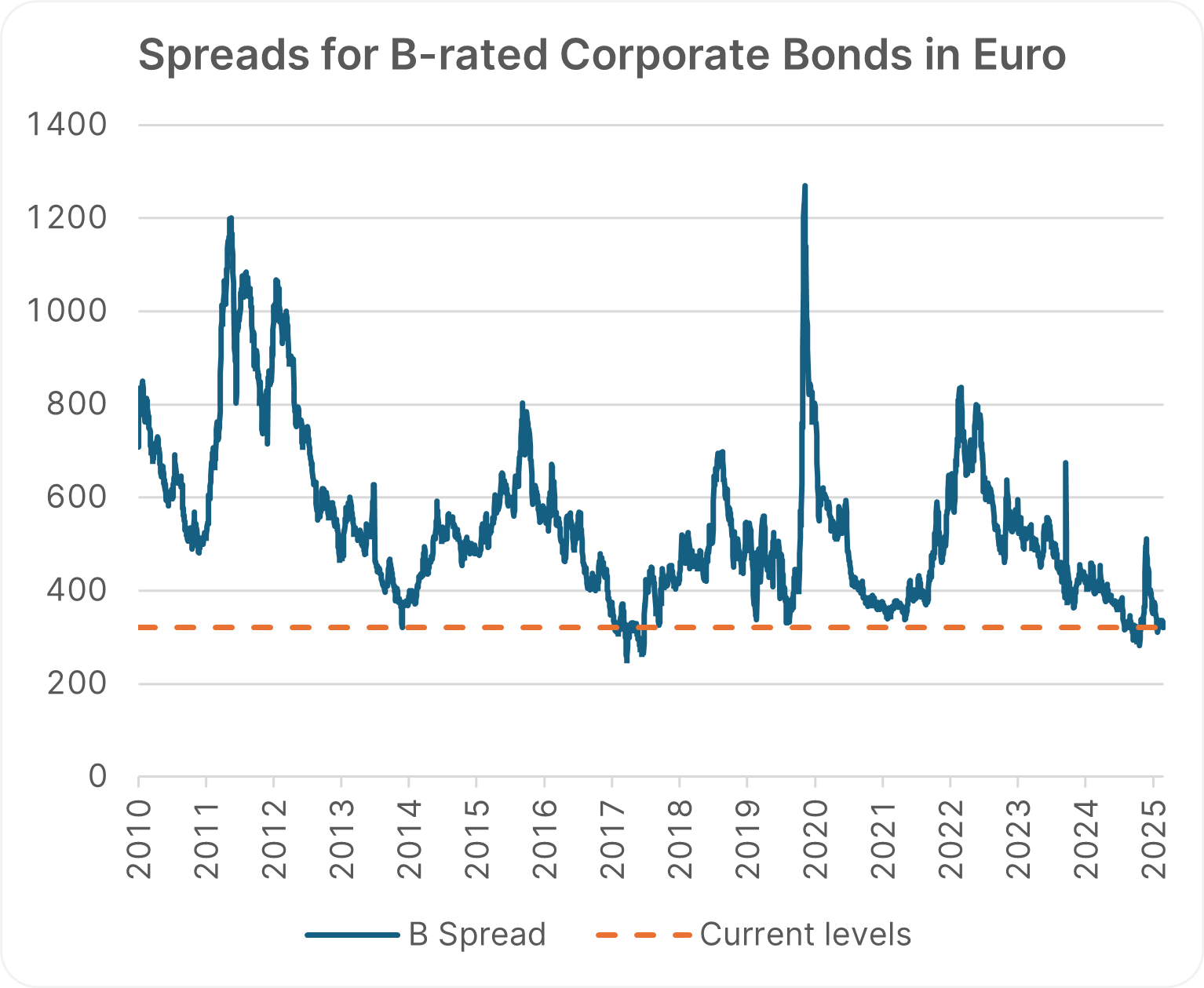

As of mid-2025, credit spreads for euro-denominated high yield bonds remain relatively tight by historical standards: BB-rated bonds are trading around 200 basis points (bps) over government bonds, while B-rated bonds are near 330 bps. These levels are low compared to long-term averages, yet they still should offer a positive risk premium. When viewed against historical default and recovery rates, current spreads appear broadly sufficient to compensate for expected credit losses – though the cushion above that, the so-called excess risk premium, is thinner than in the past.

Note: Past performance is not a reliable indicator of future performance.

Source: Refinitiv Datastream, Data as of 11.7.2025

Market structure and demand dynamics

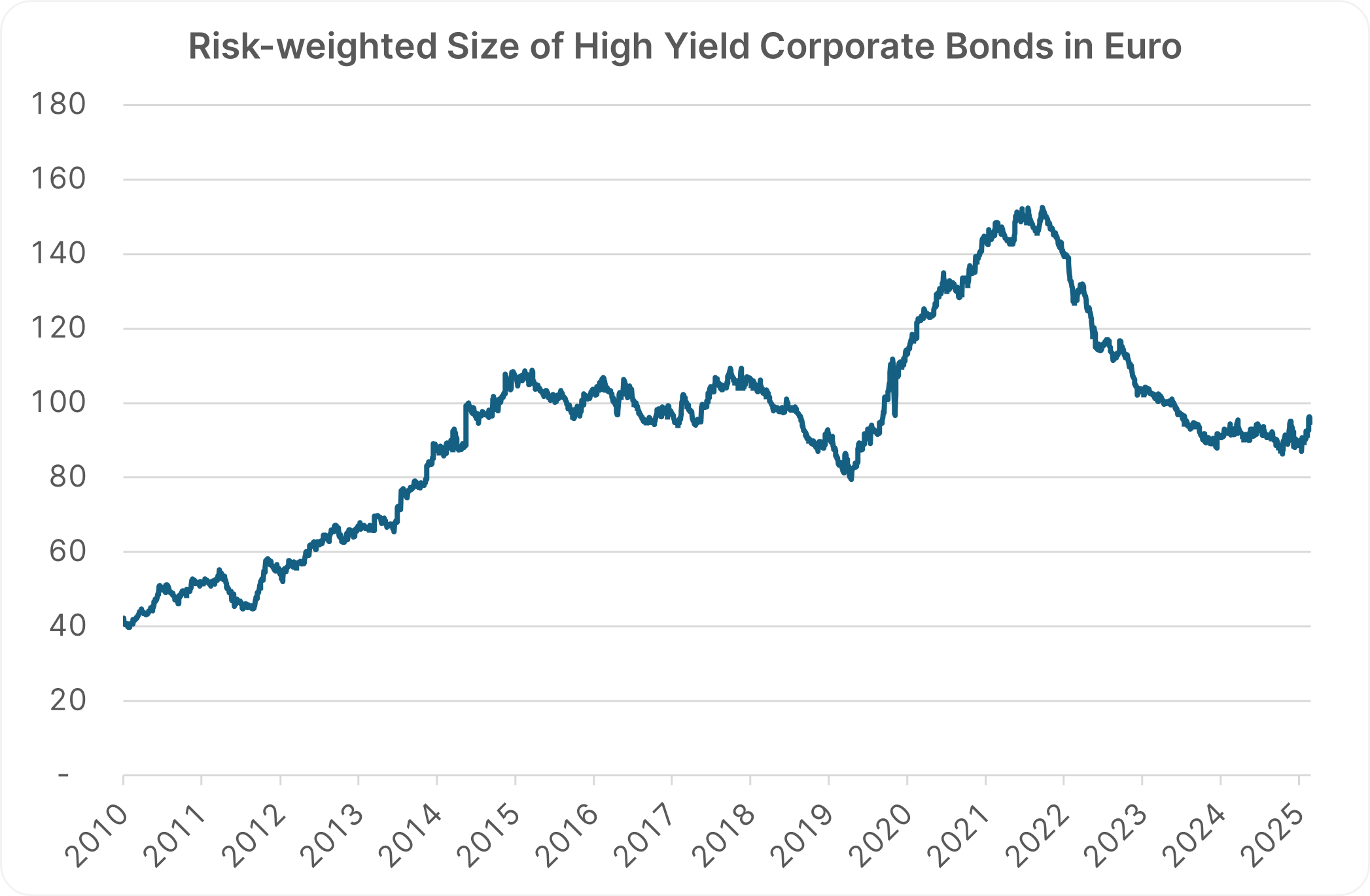

One reason spreads remain compressed is the persistent demand for high-yielding debt, even as the risk-adjusted size of the market – measured by DV01, a metric that captures the market’s aggregate sensitivity to interest rate and credit spread risk – has not meaningfully grown in over a decade.

Note: Past performance is not a reliable indicator of future performance.

Development DV01 since 2010 / Source: Refinitiv Datastream, Data as of 11.7.2025

Lessons from past cycles

In the last 15 years, similar spread levels were observed in 2014, 2017, 2019, and 2021. In each case, spreads eventually widened, but the catalysts were macroeconomic shocks – such as China’s slowdown and commodity price collapse (2014–15), Fed tightening (2018), the COVID-19 pandemic (2020), and an inflationary shock and war in Ukraine (2022–23) – rather than any inherent instability in spreads themselves. While today’s tight spreads warrant a degree of caution, history suggests that the higher yields offered by high yield bonds can still compensate for their risk over the long run.

Conclusion

High yield bonds can be a valuable part of a diversified portfolio, offering attractive returns in exchange for higher risk. Understanding how ratings, spreads, and defaults interact helps investors make informed decisions – especially in the current market environment.

Funds for High Yield Bonds

Investment funds allow investors to invest in a broadly diversified range of high-yield bonds. The ERSTE BOND EUROPE HIGH YIELD fund, for example, invests primarily in euro-denominated corporate bonds. The largest country weightings are currently in bonds from France and Germany.

The ERSTE BOND CORPORATE BB invests primarily in corporate bonds from international issuers with a ‘BB’ rating. Bonds with a BBB or B rating may also be included in the portfolio. The focus is therefore on bonds at the threshold between investment grade and high yield.

For investors who also value ethical and sustainable criteria in their investments, the bond fund ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD may be worth a look. The fund invests primarily in high-yield corporate bonds. As part of a holistic ESG approach, environmental and social factors as well as corporate governance factors are integrated into the investment process.

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Risk notes ERSTE BOND EUROPE HIGH YIELD

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE BOND EUROPE HIGH YIELD as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE BOND EUROPE HIGH YIELD, consideration should be given to any characteristics or objectives of the ERSTE BOND EUROPE HIGH YIELD as described in the Fund Documents.

Risk notes ERSTE BOND CORPORATE BB

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE BOND CORPORATE BB as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE BOND CORPORATE BB, consideration should be given to any characteristics or objectives of the ERSTE BOND CORPORATE BB as described in the Fund Documents.

Risk notes ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.