From September 9 to 14, the international automotive industry gathered in Munich for IAA Mobility, one of the largest and most important automotive trade fairs in the world. European car manufacturers once again appeared more confident. Passend dazu zeigen auch jüngste Daten des Branchenverbands ACEA nach oben. At the same time, recent data from the industry association ACEA also showed a positive trend, with the European car market making up for the previous month’s slump in July. Sales rose by 7.4 per cent YoY, after an equally large decline in June. However, since the start of the year, there has still been a slight decline in sales of 0.7 per cent to just under 6.5 million new cars sold.

Note: The companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

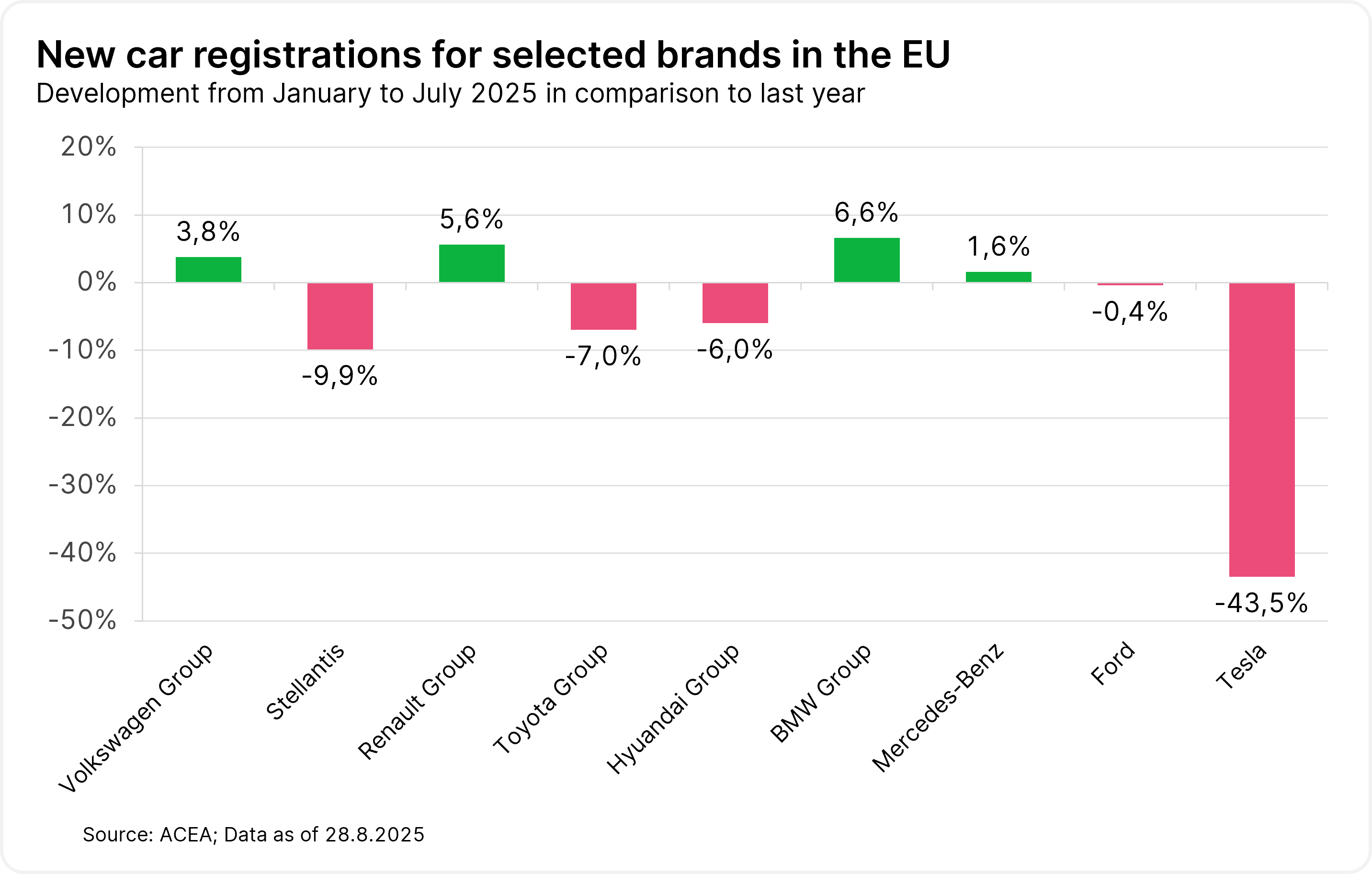

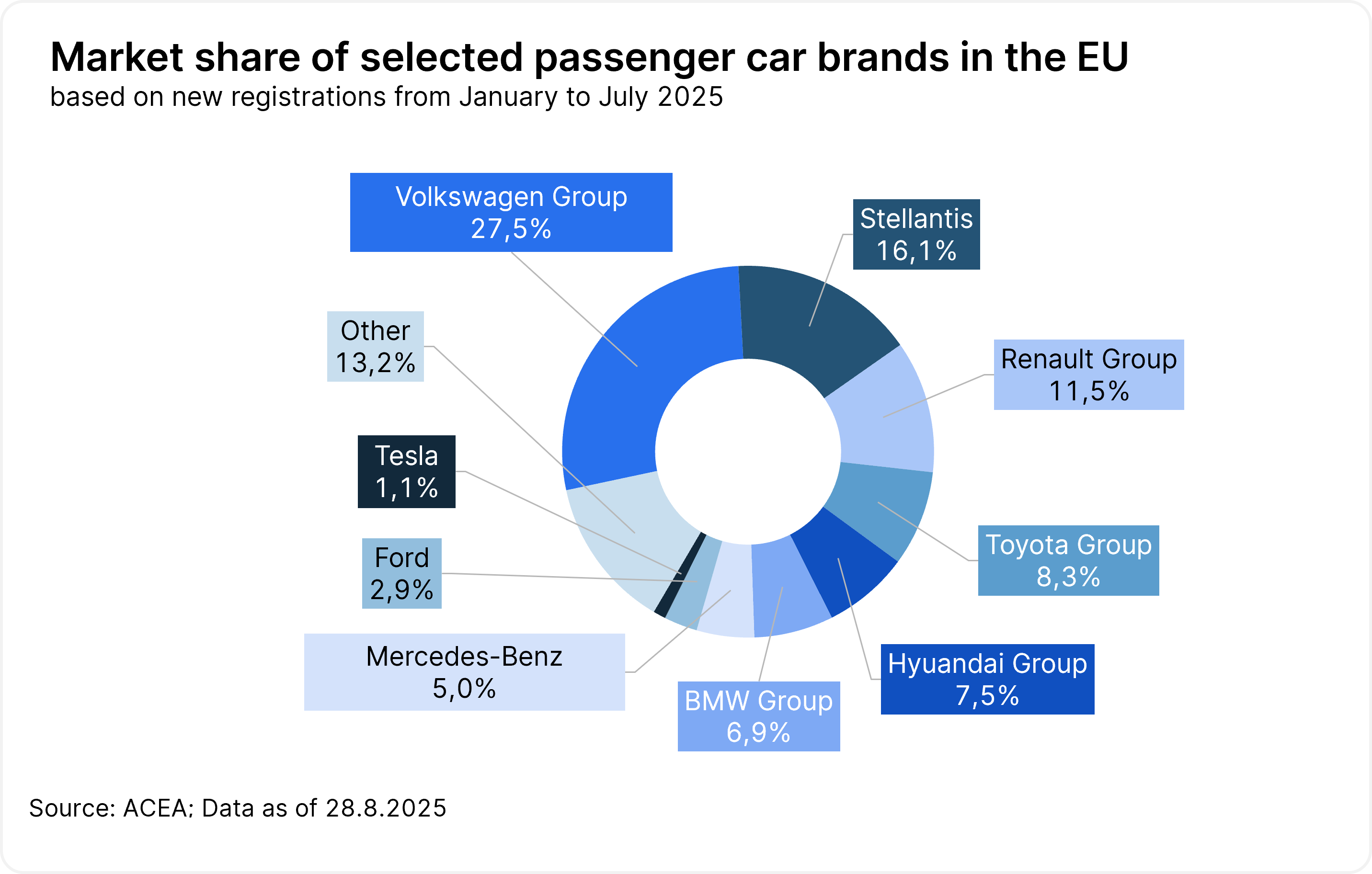

Among individual manufacturers, Volkswagen expanded its market leadership in the first seven months, selling 3.8 per cent more cars. BMW, Mercedes-Benz and Renault also sold more vehicles. By contrast, Opel’s parent company Stellantis and Tesla saw a decline, with the US electric car pioneer reporting a 43.5 per cent drop in sales. Chinese electric car manufacturer BYD sold around 58,000 cars in the EU in the first seven months of 2025. In the previous year, the figure was just over 16,000, representing an increase in sales of over 250%.

China and the US as problem children for European car manufacturers

The European automotive industry is currently particularly concerned about the key markets of China and the USA. In the US, car manufacturers and suppliers are facing a 15 per cent import tax in the future, six times as much as before. In China, Volkswagen, Mercedes-Benz and BMW are experiencing sales problems. In addition, Chinese car manufacturers are increasingly pushing into the European home market.

This year’s IAA also saw more Chinese cars than ever before. 116 manufacturers from China registered for the trade fair. Apart from Germany, no other country had anywhere near as many exhibitors at IAA. German and Chinese suppliers vied for the attention of trade show visitors, particularly in the field of electric cars. With their appearances at the IAA, Chinese car manufacturers such as BYD, Leapmotor, Changan and Xpeng demonstrated that they are serious about entering the European market. Their test vehicles could be seen all over the city, and the Chinese stands at the exhibition centre attracted a lot of attention.

China plans to develop and build cars “in Europe, for Europe”

“We are in Europe to stay,” said Stella Li, VP of Chinese carmaker BYD. The electric car company wants to serve the European market for electric cars from its factories in Europe going forward. Production is set to start at a new plant in Hungary by the end of the year. “We are practising becoming more European in our production,” the BYD top manager responsible for European business said at the IAA. In two to three years, BYD wants to cover the entire demand for Europe from local factories, said Li.

“Everything we do starts with the requirements of European customers,” said Wei Haigang, responsible for international business at GAC in Munich. “That means in Europe, for Europe.” This slogan was also heard at press conferences held by Chinese luxury brand Hongqi and leading exporter Chery. The motto is reminiscent of what German carmakers say about their business in China. “They are going by the same script as the Germans in China,” said Tu Le, founder of consulting firm Sino Auto Insights.

“In China, for China” is Europe’s leading car manufacturer Volkswagen’s strategy to turn the tide in the People’s Republic and regain a foothold after a drop in sales of nearly 25 per cent between 2020 and 2024. This means developing and building vehicles for the Chinese market in the People’s Republic. In this way, VW, BMW and Mercedes-Benz hope to better meet the tastes of customers. After all, what is important to customers in China is secondary in Europe, and vice versa. Driver assistance systems, for example, must be adapted to city traffic in Chinese megacities, whereas high speeds such as those on German motorways play a subordinate role. Many Chinese buyers also put high emphasis on infotainment systems that allow them to watch films or play games in traffic jams. In Europe, on the other hand, the demand is typically higher for smaller cars that are better suited to navigate narrow streets.

Leading automotive companies from around the world presented their latest models at the IAA Mobility in Munich. (c) Sven Hoppe / dpa / picturedesk.com

Xpeng and Co. want to catch up in research and development

In order to better meet the needs of European customers, China’s car manufacturers also want to invest more heavily in development centres in Europe. Brian Gu, vice president at Chinese manufacturer Xpeng, emphasised that his company is opening a development centre in Munich this week. Xpeng is focusing on laying the foundations for a long-term market presence with more local investment. Hongqi chief designer Giles Taylor said at the launch of the electric car EHS5 that his company has been operating a development centre in Europe for seven years, focusing on developing cars for European customers.

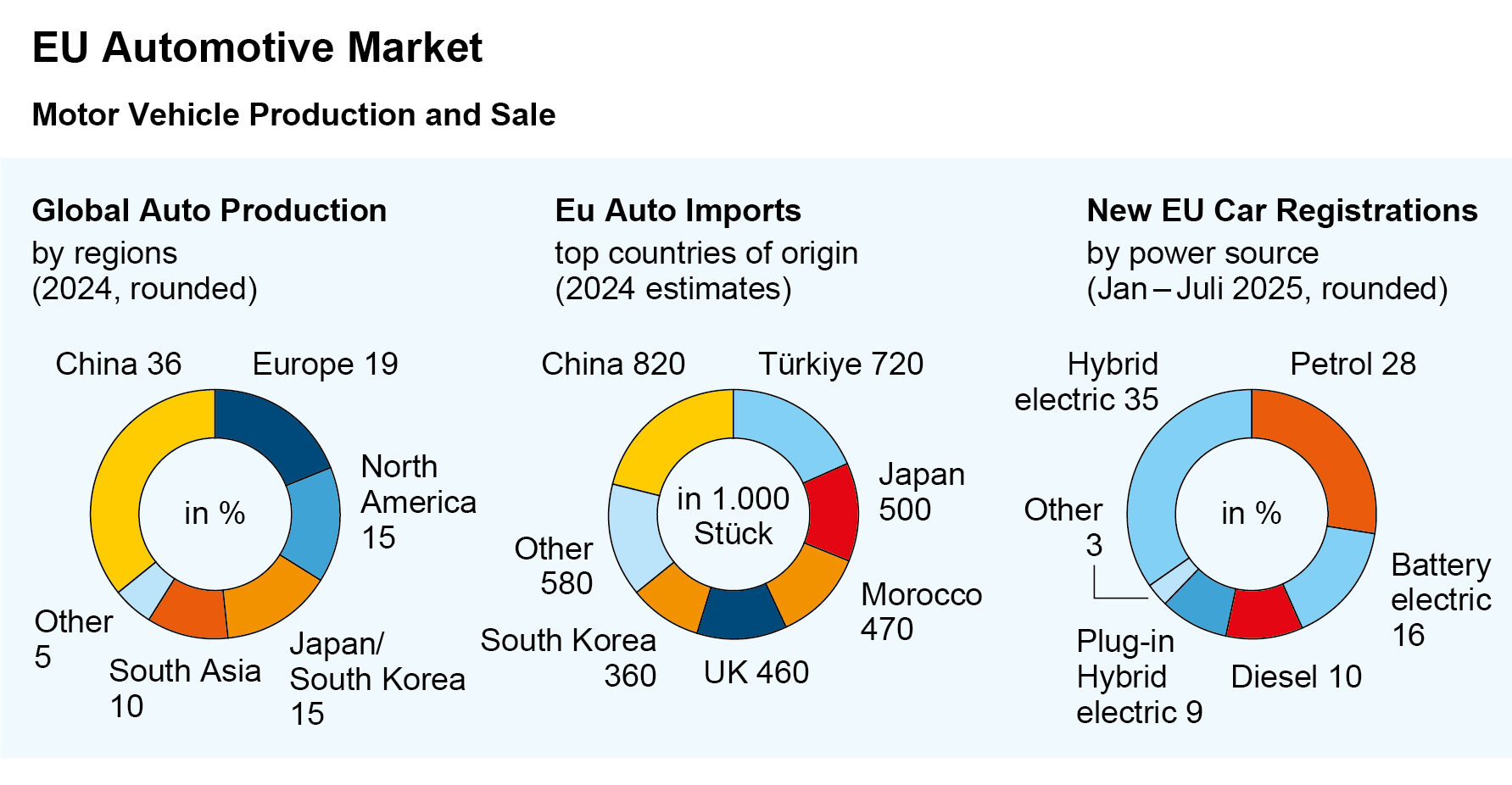

Data from the European industry association ACEA underscores China’s growing dominance in the global market and in the EU, but shows that Chinese carmakers still have some catching up to do in terms of development spending. In 2024, 34 per cent of all vehicles produced worldwide were manufactured in China. According to ACEA data, this puts the country far ahead of Europe, with a share of 19 per cent, and North America, with 17 per cent. However, at around USD 25bn, China’s research and development expenditure in 2023 was far behind the corresponding investment of the EU automotive industry, which amounted to nearly USD 85bn.

Source: APA / ACEA, Data as of September 2025

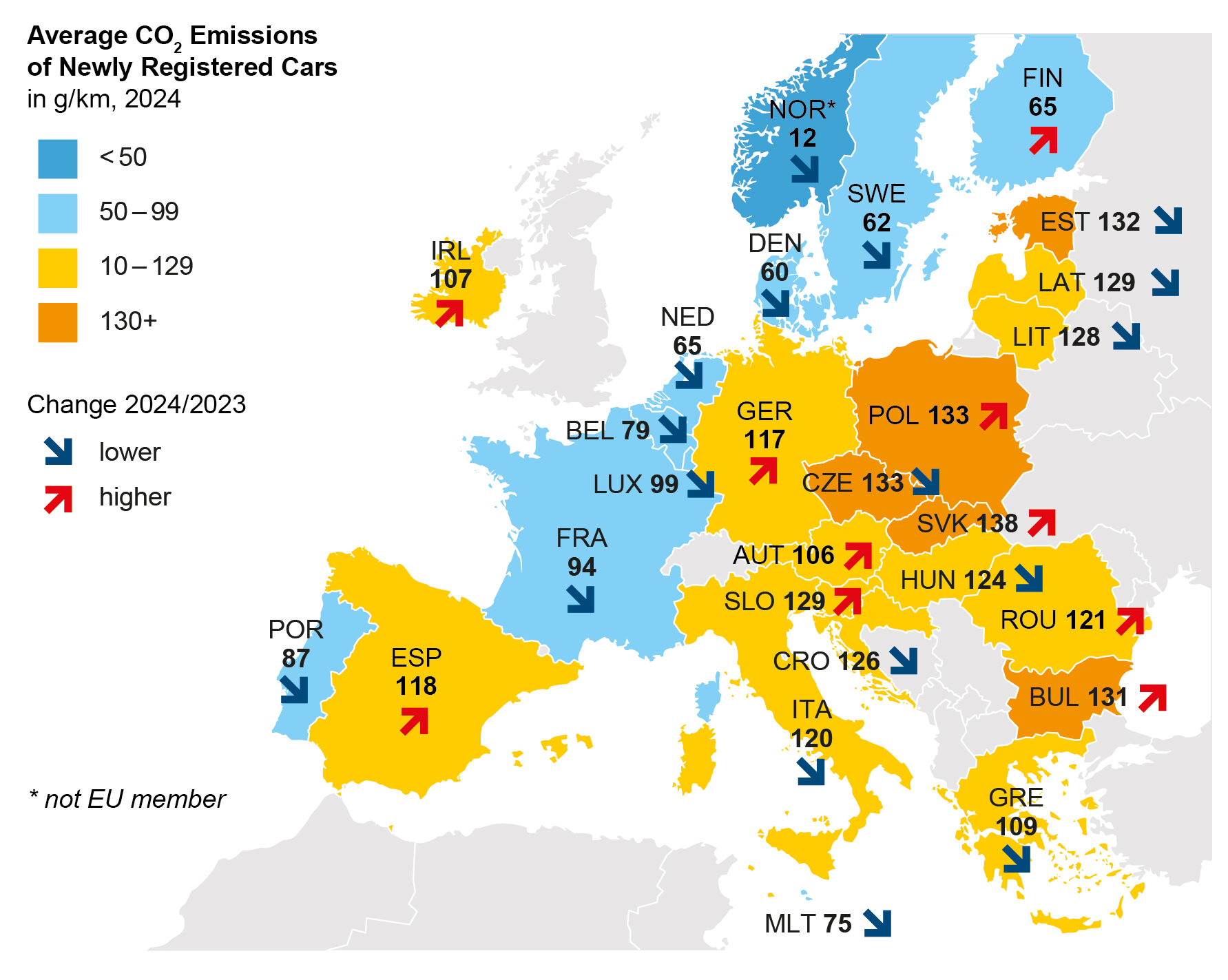

Europe on track with CO2 reduction, criticism of combustion engine ban in 2035

Not only Chinese car manufacturers, but also German carmakers are continuing to focus on electric mobility. Volkswagen is planning a 20 per cent market share for B-segment electric cars in Europe. A recent study sees Europe’s automotive industry well on its way to switching to electric mobility. Manufacturers only need to reduce their fleet emissions by a few grams of CO2 to reach the next EU interim target for 2027, according to the ICCT organisation. However, one controversial topic at the IAA was the planned ban on new cars with combustion engines in the EU starting in 2035. A number of German politicians and industry representatives at the IAA called for relaxation and more flexibility in the planned path to electric mobility.

Source: APA / ACEA, Data as of September 2025

German Chancellor Friedrich Merz (CDU) and the IAA organisers themselves spoke out in favour of changes to the planned ban at the opening of the trade fair. “Unilateral political commitments to certain technologies are fundamentally the wrong economic policy approach, not only for this industry,” said Merz. More flexibility is needed in regulation. Hildegard Müller, president of the German Association of the Automotive Industry, which organises the IAA, called for a reality check and a course correction in EU climate policy towards the automotive industry. Consumers are not yet sufficiently prepared to switch to electric mobility, Müller said.

Similar demands have also been made repeatedly by the industry recently. The German Social Democrats see things differently. “Those who question the phase-out of fossil fuel combustion engines may receive applause in the short term, but they jeopardise the long-term competitiveness of our country and unsettle the economy,” said Armand Zorn, deputy chairman of the SPD parliamentary faction in the German Bundestag.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.