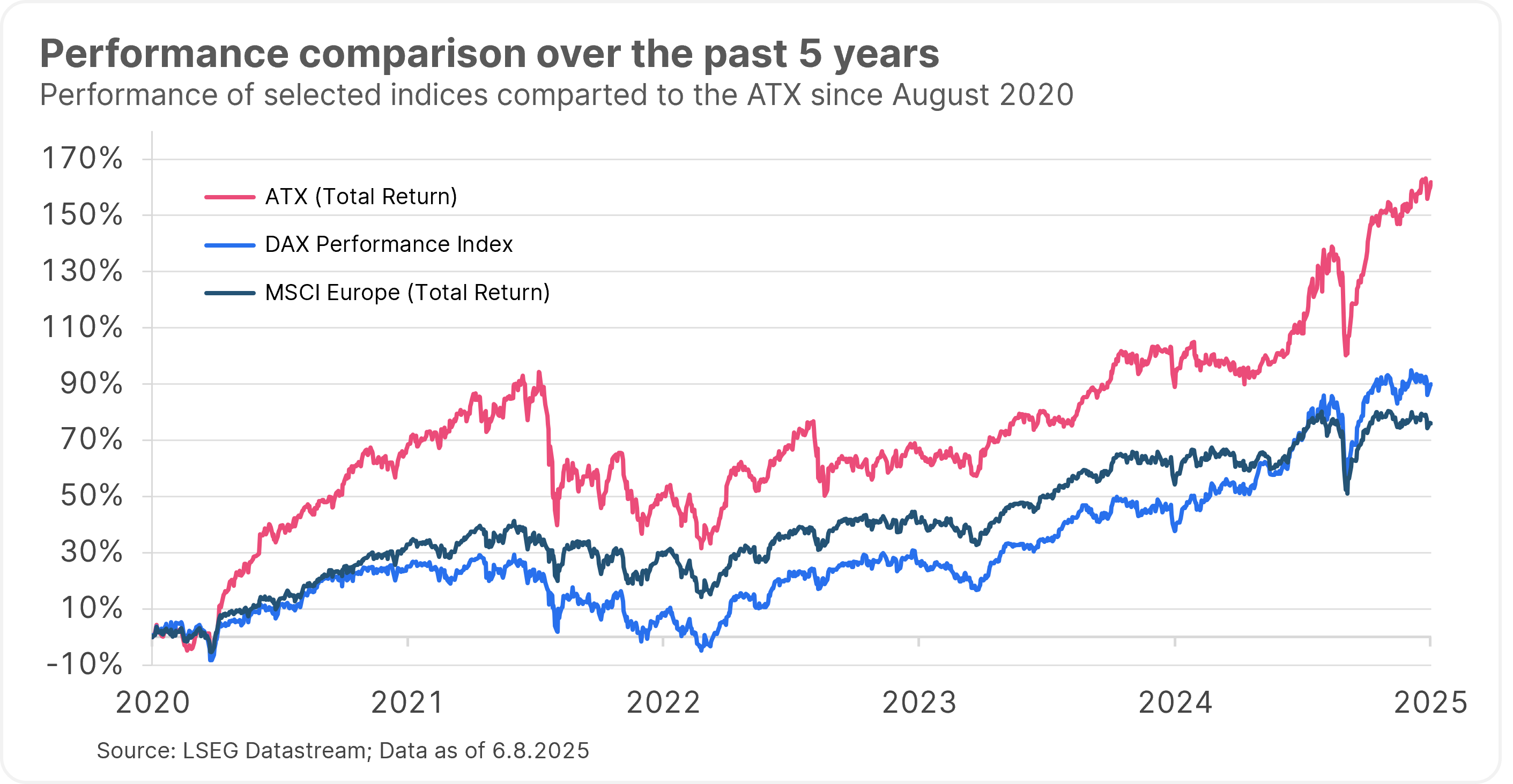

Investors who have put their money into Austrian equities have had a lot to smile about so far in 2025. The main domestic equity market index, the ATX, has outperformed some of its European and global peers this year, including Germany’s DAX and the Eurozone’s leading index, the Euro Stoxx 50.

Note: Please note that investing in securities involves risks as well as opportunities. The companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

This is despite the fact that inflation in Austria has recently picked up again and the economy remains in recession. So where has investors’ appetite for Austrian equities emerged from this year? We asked Bernhard Haas, fund manager of the Austrian equity fund ERSTE STOCK VIENNA.

Despite the rather weak growth figures for the domestic economy, the ATX has posted significant gains in the year to date – why is that?

In principle, it is of course true that such a contrarian development appears unusual at first glance. That being said, I should like to point out that the companies listed on the ATX are not overly dependent on the Austrian economy. These companies operate internationally, which means that exports and their very strong exposure to the Eastern European market are much more important factors.

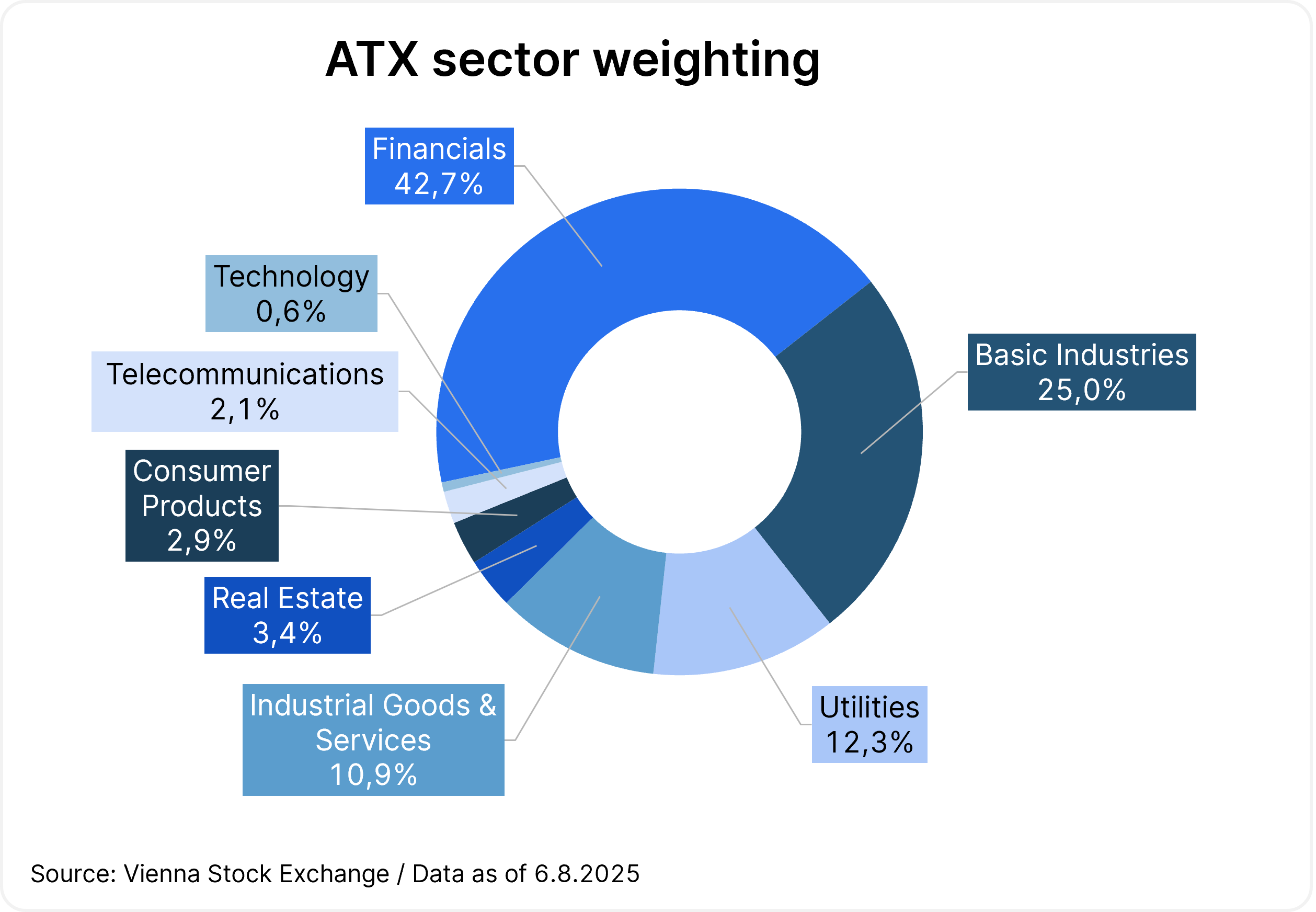

Another factor is the high proportion of financial equities in the domestic benchmark index, i.e. banks and insurance companies, which have generally been among the best performers so far in 2025.

Note: Past performance is not a reliable indicator of future performance.

They say that the future is traded on the equity market. Could the ATX’s strong performance therefore also be an indicator that growth is picking up again?

The Austrian equity market is generally rather more on the cyclical side. As already correctly noted, equity markets are forward-looking: if investors believe that the economy will pick up again in the future, then the Austrian market, due to its composition, is one of those that will perform better in such an environment. We can already see signs that the improved economic figures in Eastern Europe and a general decline in pessimism in Europe are benefiting the domestic market.

Some of Austria’s largest listed companies have already presented their half-year results. How has the current reporting season been so far?

Overall, ATX companies recently reported good figures in line with expectations, partly contrary to the public image. Still, it should be noted that the environment in some sectors, such as manufacturing, remains challenging, mainly due to rising production costs. Some companies are responding by becoming more global, for example by setting up overseas plants, which helps with the ongoing tariff issue.

Speaking of tariffs, the tariff deal between the USA and Europe has been making headlines recently. How badly will this affect the ATX?

There is no single overall impact on the ATX; rather, companies are affected to varying degrees by the issue. The upside is that it has been clear for some time that something was going to happen with tariffs. Companies therefore had a certain amount of lead time to prepare. voestalpine is a case in point here. About 50% of its products for the US market are already produced locally, so in this respect it is actually benefiting from the tariffs. The other half of the products for the US market have little local competition. Here, it is possible to pass on at least a large part of the tariffs to customers.

The tariffs have very little impact on the large block of financial companies in the ATX mentioned above. The bottom line is that the issue is not as bad as may seem in the news, and most companies will be able to cope well with the tariffs.

The US dollar remains weak against the euro. Shouldn’t that be a disadvantage for export-oriented companies?

Here, too, it depends on the individual company and its business model. Companies with a larger share of exports tend to be more affected. From a long-term perspective, the euro-dollar exchange rate is currently at roughly the same average level as when the euro was introduced. Even though there has been a lot of movement recently, we are not at an extreme level in terms of long-term historical data. My assessment is that this is also something that domestic companies can cope with.

Europe is ahead of the USA in its cycle of interest rate cuts. As a result, refinancing costs for companies should become more favourable. Can you already see an increased level of investments here, or are companies waiting to see how the economy develops?

An environment with many uncertainties, such as the current customs disputes, does not necessarily encourage investment. The first agreements and customs deals have been reached – perhaps we will soon see the first signs of momentum in the investment arena. The outlook of companies has been optimistic recently: crane manufacturer Palfinger, for example, reported a resurgence in orders for construction machinery. The German infrastructure package could be an important driver for Palfinger and the Austrian market as a whole. This has already had a significant positive impact on the performance of domestic construction companies in the year to date.

How do you position yourself with ERSTE STOCK VIENNA after this strong first half of the year? Where do you see further potential?

We pursue a long-term approach in our fund and therefore focus primarily on the quality of a company and its management. In terms of business models, we currently like the catering group Do&Co and the plant engineering company Andritz, among others. We tend to be more cautious with regard to utility companies at the moment.

Speaking of utilities, the new EU-US tariff deal also includes an agreement on energy. What role does this play for domestic utilities?

Many details of this deal are still unclear, and experts are left guessing. However, the USA is already Europe’s second-most important gas supplier after Norway. Many LNG terminals that were commissioned after the outbreak of the war in Ukraine are now gradually being completed, and the capacity to take more LNG from the USA should soon be available. This should further alleviate the availability problem for gas from Russia.

We have already discussed the reasons for the good ATX performance. In your opinion, are there any risks that should be mentioned?

Geopolitical tensions and conflicts, such as those we are currently seeing, always pose a certain degree of risk. Escalation is very difficult to predict, as the outbreak of the war in Ukraine and the attack on Israel have shown. Although an agreement has now been reached between the USA and Europe on the tariff issue, little progress is currently being made in negotiations with China, which is having a negative impact on the European economy.

Finally, let’s take a look at both the past and the future: the ATX last reached record levels almost 20 years ago. When will we reach a new high?

Looking at the ATX Total Return index, i.e. the performance of the equity index including dividends, we can see that new record levels have already been reached for some time now. The ATX is currently still around 10% short of this level – whether the domestic equity market will continue its very good performance in the second half of the year depends on several factors and is difficult to predict. Sadly, the infamous crystal ball does not exist. Given the risks already described, there is a danger of unforeseen events occurring. In our view, growth potential exists, for example through the infrastructure package mentioned above in Germany, our most important trading partner.

Investing broadly diversified in the Austrian equity market

The equity fund ERSTE STOCK VIENNA invests in companies that are listed on the Vienna Stock Exchange, have their registered office in Austria, or have strong ties to Austria. When selecting securities, the focus is on high-quality companies with strong growth potential. Environmental, social, and corporate governance factors are integrated into the investment process.

Notes: The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE STOCK VIENNA as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK VIENNA, consideration should be given to any characteristics or objectives of the ERSTE STOCK VIENNA as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.