The ongoing boom in artificial intelligence (AI) continued to drive strong revenue growth for major US tech companies in the past quarter. Strong cloud business recently provided further tailwinds for Alphabet, Amazon, and Microsoft. With rapidly growing demand for AI applications, demand for storage and computing power is also rising, and with it demand for corresponding cloud solutions.

Note: The companies listed here have been selected as examples and do not constitute investment recommendations. Investments in securities involve both opportunities and risks.

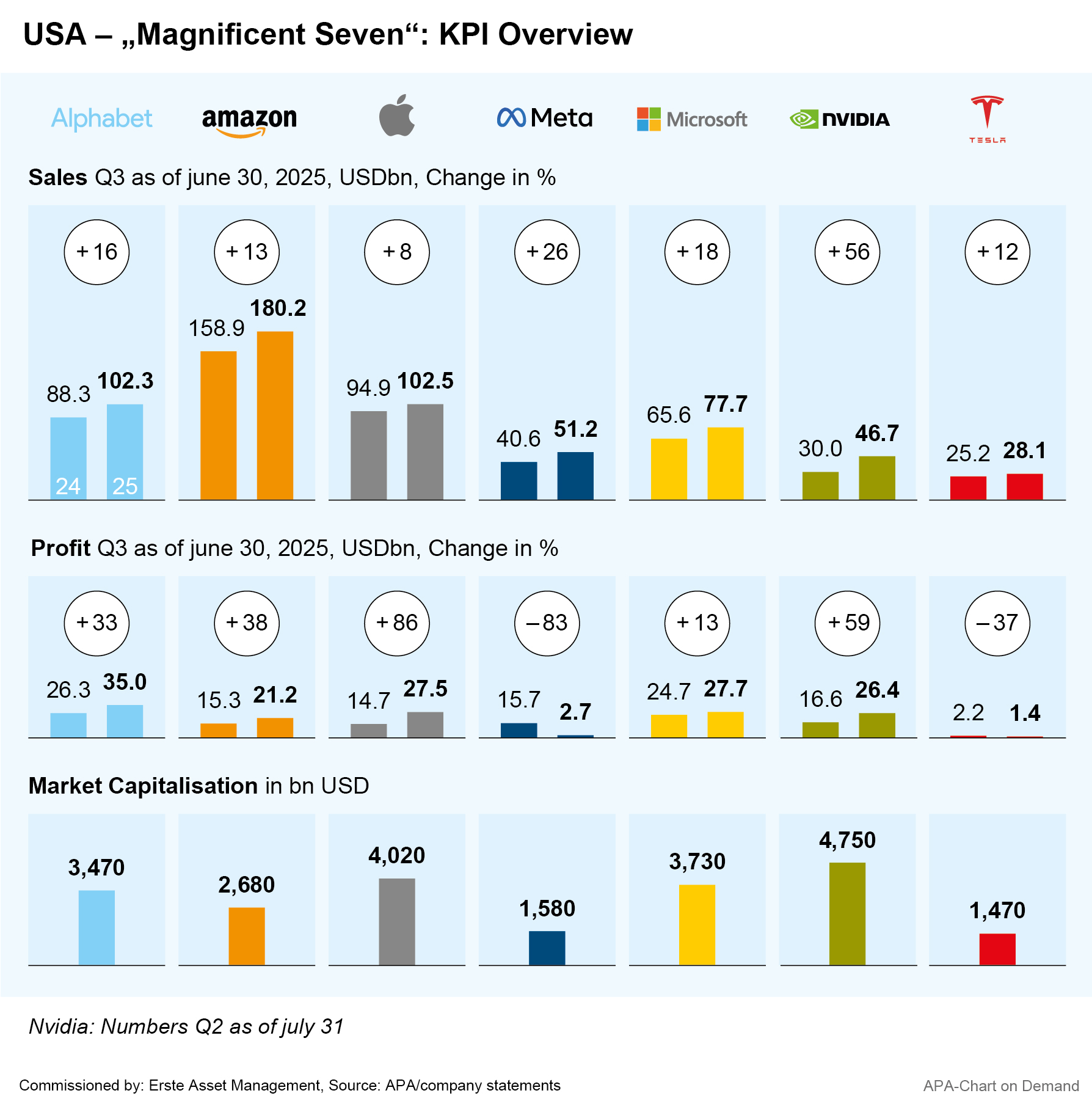

Thanks to their booming cloud divisions, the tech giants were able to achieve double-digit sales growth in the past quarter. Microsoft’s consolidated revenue grew by 18 percent to $77.7 billion. Microsoft’s Azure cloud division even grew by 40 percent. Overall, the software company increased its profit by 22 percent to $27.2 billion.

Alphabet’s quarterly revenue grew by a surprisingly strong 16 percent to $102.3 billion, exceeding the $100 billion mark for the first time. Of this, $74.2 billion was attributable to advertising revenue, which grew by just under 13 percent. The cloud division grew more than twice as fast to $15.2 billion. Net profit grew by 35 percent.

At Amazon, strong growth in the Amazon Web Services (AWS) cloud division more than offset the weakness in online retail. “AWS is experiencing its strongest growth since 2022,” said CEO Andy Jassy when presenting the figures. The group increased its revenue by 13 percent to $180.2 billion and its profit by 36 percent to $1.95 per share. Although the cloud division accounts for only about 15 percent of the group’s revenue, it contributes around 60 percent to its profit.

Meta benefited from strong advertising business in the past quarter, increasing revenue by 26 percent year-on-year to $51.2 billion. However, quarterly profit shrank by 83 percent to $2.7 billion due to a one-time tax charge of $16 billion.

Note: Past performance is not a reliable indicator of future performance.

Tech companies are massively expanding their data centers

The major tech companies have consistently announced further massive investments in the expansion of data centers and server farms for the AI cloud business. Alphabet and Meta recently raised their annual forecasts for investments in computing capacity to $91 billion to $93 billion and $70 billion to $72 billion, respectively. According to Meta CFO Susan Li, the Facebook parent company’s investments could be significantly higher again in 2026.

Microsoft is also focusing more on the cloud business, according to CEO Satya Nadella. The software company is expected to invest $120 billion in expanding its AI infrastructure in 2025, according to Nadella. Microsoft recently booked additional AI computing capacity with cloud provider Iren due to rapidly growing demand. The contract is worth $9.7 billion, Iren announced.

Meta plans to invest $600 billion in US infrastructure and jobs over the next three years to expand its AI infrastructure. “It’s the right strategy to aggressively build capacity in advance so that we are prepared for the most optimistic scenarios,” CEO Mark Zuckerberg said during Meta’s recent quarterly earnings call. The Meta boss has big ambitions to outperform rivals such as ChatGPT developer OpenAI, Google, and Elon Musk’s company xAI in artificial intelligence. To this end, he has poached some experts from competitors with exceptionally high offers.

Note: Prognoses are not a reliable indicator of future performance.

Nvidia becomes first company worth over $5 billion thanks to pioneering role in AI

The chip manufacturer Nvidia is also continuing to benefit from the AI boom. The company has evolved from a niche supplier of graphics cards to the backbone of the global AI industry. Many AI applications run on Nvidia processors, which were originally developed as graphics chips. Heavyweights such as Alphabet and Meta, but also AI startups such as OpenAI, are filling their data centers with Nvidia chips for training AI algorithms. The chip company thus occupies a key position among semiconductor companies. This is also reflected in the soaring price of Nvidia shares. At the end of October, the chip company became the first to break the $5 trillion mark in market capitalization.

Most recently, Nvidia CEO Jensen Huang has been able to build a good relationship with Donald Trump’s administration. He recently convinced the US president of Nvidia’s exceptional role and scored points with the construction of a factory in the US. Nvidia investors are now eagerly awaiting the presentation of the third-quarter figures on November 19.

Apple posts record sales after strong iPhone launch

Apple also recently reported record sales. Sales were driven primarily by strong initial sales of the new iPhone 17. In addition, CEO Tim Cook gave a surprisingly optimistic outlook for the current quarter in an interview with Reuters. However, due to supply bottlenecks, the electronics supplier was unable to meet some of the demand for smartphones. As a result, growth in this segment fell short of expectations. Apple also continues to suffer from tensions between the US and China. Due to US tariffs on goods from the People’s Republic, the company is currently relocating iPhone production to other countries such as India.

In the final quarter of the 2024/2025 fiscal year, revenue from iPhone sales grew by around 6 percent to $49.03 billion. In contrast, sales of Mac computers and accessories performed better than expected. Total group revenue rose by around 8 percent to $102.47 billion, the highest figure in the company’s history. Profit increased by 13 percent to $1.85 per share. Apple was recently valued at more than $4 trillion on the stock market for the first time.

Tesla earned less, but car sales rose surprisingly

Electric car pioneer Tesla recently continued its series of declining profits. The company, led by Elon Musk, earned a net profit of $1.37 billion, which was 37 percent less than a year earlier. Meanwhile, revenue rose 12 percent to just under $28.1 billion. This exceeded analysts’ expectations. In the third quarter, the final spurt in US subsidies for the purchase of electric cars gave Tesla a sales record after months of declining sales. Deliveries rose 7.4 percent year-on-year to 497,099 vehicles.

Musk had already said he expected a few tough quarters. However, the tech billionaire has been downplaying the importance of car sales for the company for some time. He claims that Tesla’s future lies in robotaxis and humanoid robots. In both areas, however, the company is still in its infancy – and faces a lot of competition.

Investing in tech stocks

It is not only AI that is opening up new possibilities in the technology segment and thus opportunities for investors. Other topics such as cybersecurity and cloud computing are also among the growth drivers in this segment. The ERSTE STOCK TECHNO equity fund combines these exciting future topics and invests specifically in companies that are pioneers in these industries. In addition to AI pioneers Nvidia, Alphabet, Meta, and Microsoft, the fund’s portfolio currently includes cybersecurity company Palo Alto Networks.

👉 You can find more information about the fund here

Note: Investing in securities entails risks in addition to the opportunities described.

Risk notes ERSTE STOCK TECHNO

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE STOCK TECHNO as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK TECHNO, consideration should be given to any characteristics or objectives of the ERSTE STOCK TECHNO as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.