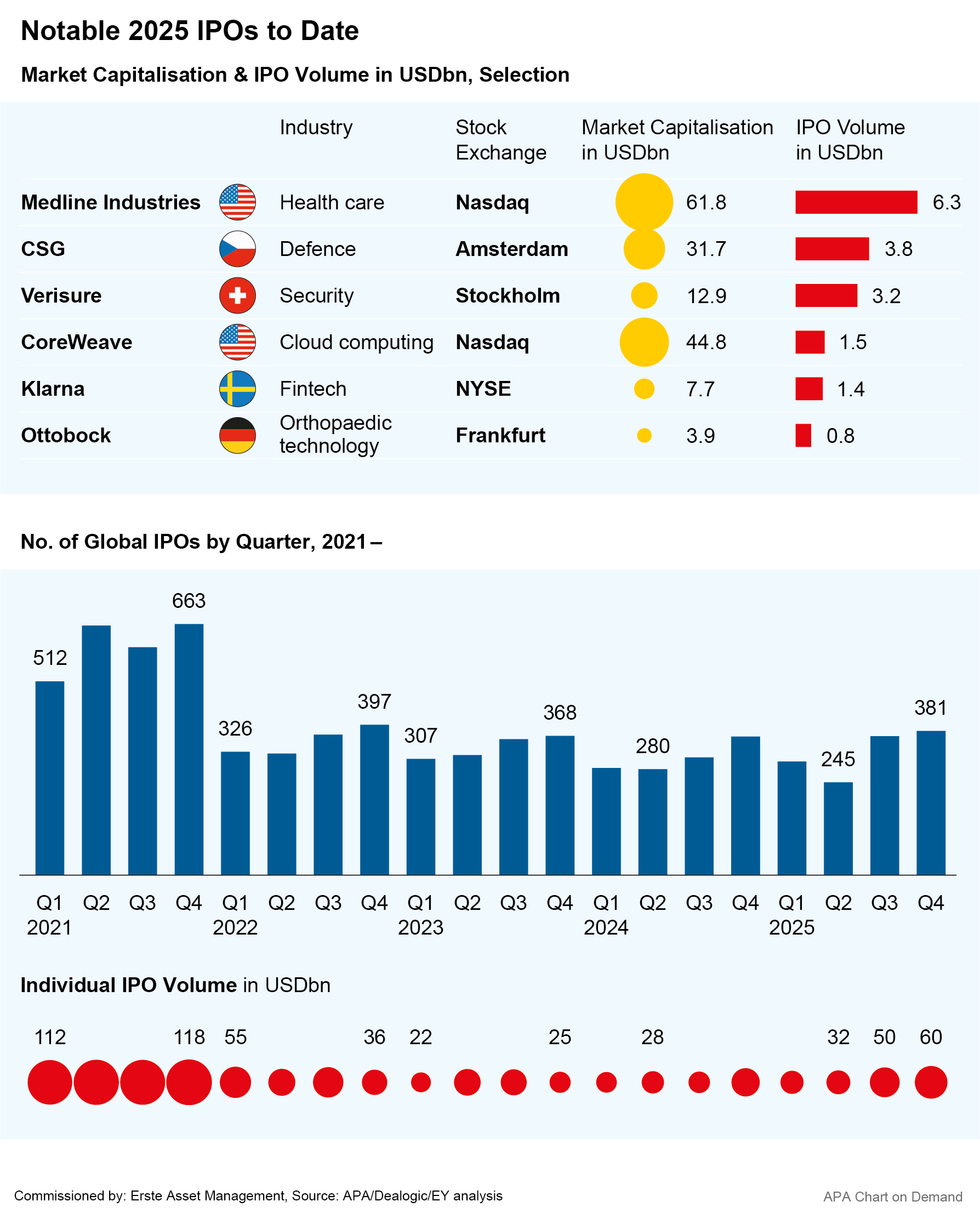

Following an upturn in initial public offerings (IPOs) in 2025, experts expect IPO volumes to increase further this year and even more new companies to go public. For 2025, the consulting firm EY counted 1,293 IPOs worldwide, which raised a good 171 billion dollars for companies – 39% more than in the previous year. According to an analysis by the provider Dealogic, IPOs in the USA alone raised a total of over 46 billion dollars in 2025, the highest figure since the boom year of 2021.

According to EY, the strongest growth in IPO volume was in Asia, particularly in China. Last year, there were many IPOs in the energy, financial services, technology and, in particular, cloud services, defense and healthcare sectors.

Please note: the companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

Medline delivered the largest IPO in 2025

Medical supplies provider Medline delivered the world’s largest IPO in 2025. The IPO raised 6 billion dollars for the company, which is currently valued at over 60 billion dollars. The IPO was the largest in the USA since that of electric car manufacturer Rivian in 2021. There was also a successful IPO in the industry in Europe. The world’s largest prosthesis manufacturer Ottobock from Germany raised a good 800 million euros in its IPO. The shares of both companies were in high demand and both rose significantly at the start of trading.

One of the largest IPOs of the past year was the stock market debut of US cloud provider CoreWeave with an issue volume of over USD 1.5 billion. CoreWeave specializes in the construction and operation of AI data centers and is therefore benefiting from the AI boom and the resulting rapid growth in demand for computing power in the cloud.

Another major IPO came from Switzerland. Verisure, a manufacturer of alarm systems and provider of security services, raised a good 3 billion euros at its IPO in Stockholm. The offer was several times oversubscribed. The Stockholm Stock Exchange – a Nasdaq Group company – has recently established itself as a popular stock exchange for IPOs of start-ups and established companies.

However, Sweden’s Klarna – another IPO star in 2025 – chose the New York Stock Exchange for its IPO. The fintech company is known as a provider of installment payments for online purchases. The Klarna IPO was also a success, with demand for shares significantly exceeding supply.

The good environment for IPOs has also recently attracted defense companies to the stock market. In October, Germany’s largest naval shipbuilder TKMS went public with a significant increase in its share price. The company value of TKMS even exceeded that of its parent company Thyssenkrupp at the time of the IPO. At the beginning of the year, the Czech armaments company CSG got off to a brilliant start on the stock market. The shares of the manufacturer of military vehicles and ammunition celebrated a successful stock market debut in Amsterdam, with the initial price 28 percent above the issue price.

Austria also saw an IPO at the start of the year. Copper specialist Asta Energy Solutions, owned by Austrian industrialist Michael Tojner, made its debut on the Frankfurt Stock Exchange with significant price gains.

Data as of 9.2.2026

Indicators point to a further increase in IPOs

Several experts expect IPO growth to continue this year. The US investment bank Goldman Sachs predicts that the US issue volume will quadruple to a record 160 billion dollars in 2026. The US technology exchange Nasdaq expects that several large start-ups in particular will seek to enter the US capital markets in the coming months. Looking at the IPO Pulse Index, the leading indicator, “many of the key metrics are pointing in the right direction,” Jeff Thomas of Nasdaq told Reuters in December.

These included falling interest rates, high company valuations and improved investor and consumer sentiment. The forecast points to a potential recovery in market confidence for new issues as both companies and investors have shrugged off the recent market volatility caused by US President Donald Trump’s trade policy and economic uncertainty. “So we have a very clear idea of a fast start to the year and are very optimistic about what we might see in the second half of the year,” says Thomas.

SpaceX and OpenAI are considered candidates for an IPO in the near future

Among the big names likely to go public on the US capital markets in 2026 are US mortgage lenders Fannie Mae and Freddie Mac. Tesla founder Elon Musk’s aerospace company SpaceX is particularly in the spotlight. A valuation of around 1.5 trillion dollars is being targeted – according to estimates, SpaceX’s IPO could surpass the largest in history (Saudi Aramco in 2019).

Elon Musk is aiming for an IPO with his space travel company SpaceX in 2026. Image source: APA-Images / REUTERS / DADO RUVIC

The AI companies OpenAI and Anthropic are also considered hot candidates for an IPO in the near future. The former is aiming for a market valuation of up to 800 billion US dollars. According to Erste Asset Management tech fund manager Bernhard Ruttenstorfer, the expected IPOs will also put the AI sector in general to the test: “IPOs in the AI sector are an indicator of whether the high valuations will be accepted by investors,” he recently explained in an interview with the business magazine Trend.

IPOs are also likely to follow in Europe

But it is not only in the USA that companies with valuations in the billions are pushing onto the trading floor. The crypto trading platform Bitpanda is reportedly planning to follow suit with an IPO on the Frankfurt Stock Exchange in the first half of the year.

Elevator manufacturer TK Elevator, the former elevator division of Thyssenkrupp, could also go public this year, according to media reports. According to Bloomberg, the IPO is likely to be one of the largest IPOs in Europe for years.

The experts at EY are cautiously optimistic about the global outlook, with the improved economic environment and stronger investor demand likely to have a positive effect. The expected growth in investments in AI technology is likely to remain an important driver here, according to an EY study.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.