Interview with fund manager Bernhard Selinger on the development of the fund and the stock exchanges amid corona, his current strategy for the megatrends equity fund, and his opinion on the current situation.

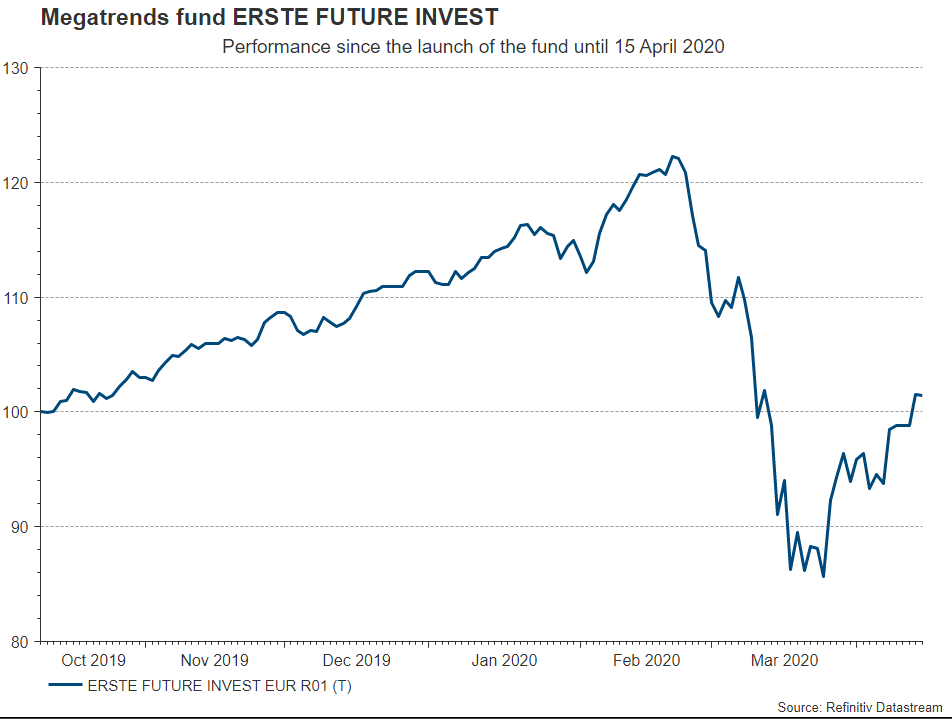

Equities in the technology and growth segments were among those hit by the spreading of COVID-19 in March. What was the impact on ERSTE FUTURE INVEST, and how has it performed in the current environment?

The market was unable to avoid the market distortions but has lost considerably less than the global equity market. By the end of March, the fund had shed about 15% of its value, as compared to minus 20% for the global equity market.

This means that the idea of a concentrated trend portfolio with a long-term focus and title selection on the basis of qualitative criteria has passed its litmus test. The broad thematic diversification of the megatrends, including healthcare, environment, and technology, was beneficial in the downward phase.

The equity markets are currently subject to very high volatility. How are investors reacting to this phase?

The continuous inflow into the fund suggests that investors are keeping cool and are using market spikes to invest. Due to the average cost effect, savings plans are also very popular when it comes to smoothing price fluctuations.

We used falling prices to selectively increase existing positions. In particular, US blue chips in software and e-commerce have become more attractive again from a valuation standpoint.

At the moment, many of us are spending our time at home and also work from there. What companies have been hardest hit by this trend, and what companies may even benefit from this situation?

Sectors that are directly affected by the stay-at-home orders such as cinemas, restaurants, and cafés, are having a particularly difficult time. In contrast to the purchase of a new TV set or a new car, which can easily be postponed for a few weeks, the consumption these specific sectors lose out on cannot usually be recovered at a later date.

Someone working from home who does not buy his usual cup of coffee on the way to work will probably not buy six of them once he can go outside again.

At the same time, there are companies that have been less severely affected or that have even benefited from the quarantine situation. In the context of the fund, these are for example Sun Art Retail, a Chinese supermarket operator with strong focus on online orders, and the Chinese logistics company ZTO Express.

These companies have benefited from the strong domestic increase in demand for home deliveries. GDS Holdings, an operator of server farms in China, has profited from the strong increase in internet use (home office, e-learning, gaming etc.).

“COVID-19 will subside. The challenges of climate change remain.”

Bernhard Selinger, Fund Manager ERSTE FUTURE INVEST

Does the recent oil price slump have any effect on the fund?

Due to their business model, we do not accept companies from the immediately affected sectors such as oil and gas production into our future-oriented fund anyway. That being said, the sharp decline in the oil price has still had an impact on the portfolio, because shares from the renewable energies sector were also sucked into the maelstrom of correcting oil prices.

From my point of view, excessively so: there is no direct relationship between the oil price and the demand for renewable sources of energy such as solar or wind power. Oil only accounts for less than 5% of global electricity production. The main fuels in this context are natural gas and coal.

Also, solar and wind power are more competitive than in the past due to massive investments in the sector and continuously falling production costs. At the moment, we can only see a generally lower demand for power due to the currently lower economic activity. Still, to put it pointedly: COVID-19 will subside, but the challenges of climate change remain.

Healthcare is also part of the future-oriented sectors in the fund. At the moment, the search is on for a vaccine or medication against COVID-19. Does the fund invest in companies that might benefit from this?

Absolutely, most recently we have seen promising reports from Abbott Laboratories, a global leader in medical engineering and market leader in diagnostic equipment for blood analysis. 60% of the global blood and plasma donations, for example, are screened by Abbot equipment.

At the moment, Abbott laboratory equipment (m2000 line) is being used in the USA for large-scale PCR tests (polymerase chain reaction) in search for COVID-19 and antibodies. Some 175 machines are in operation across the USA in universities and hospitals. They are automatically analysing thousands of tests around the clock.

What will be next on the stock exchange?

We witnessed a strong increase again last week. Of course, that supports our optimism for the weeks ahead. But we have to stay realistic: a lot depends on how quickly the global economy can get back on track. Investors may have to brace for volatile prices, depending on the news flow. But the virus cannot stop the megatrends.

What advice do you currently give your investors?

As pointed out earlier, we are happy that some of the earlier losses have already been recovered. This makes us optimistic for the medium to long term. The s fund savings plan with regular deposits is a good way of investing if you believe in the future and the potential of megatrends. And you need to relax and keep cool.

About the fund ERSTE FUTURE INVEST

ERSTE FUTURE INVEST is an actively managed, global equity fund that invests in megatrends (i.e. future-oriented themes). Shares are selected from one or more of the following trends: healthcare and pension, lifestyle, technology and innovation, environment and clean energy, and emerging markets.

Legal note:

Prognoses are no reliable indicator for future performance.

The companies mentioned above are of exemplary nature and do not constitute an investment recommendation.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.