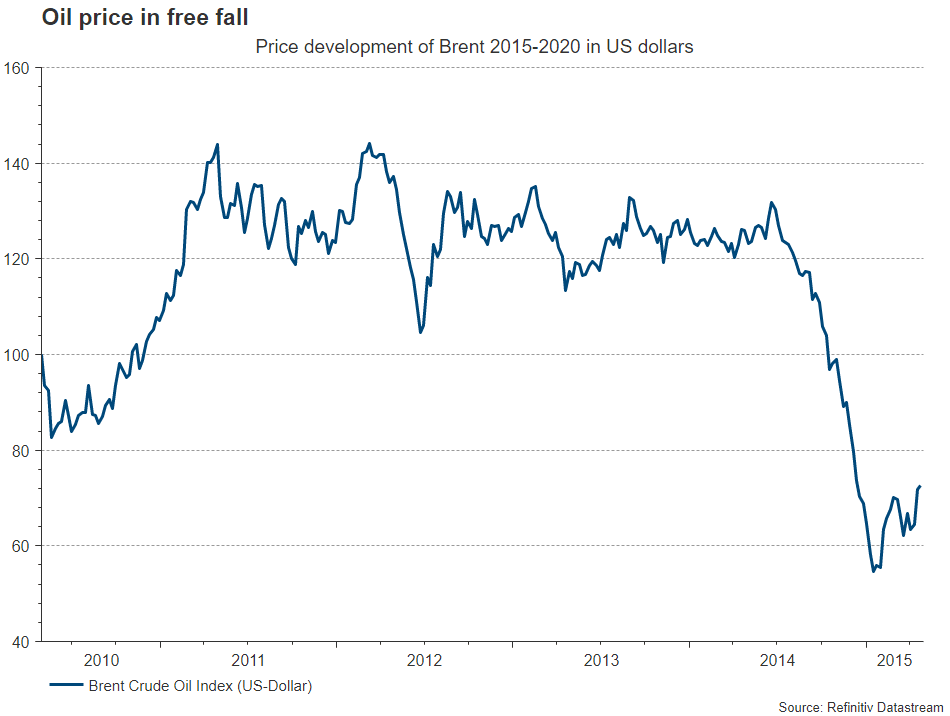

The oil market won’t escape the corona virus unscathed either. Within only two weeks, oil recorded its best and its worst day of the millennium so far.

On 9 March 2020, the most important oil benchmarks fell by more than 35%, a loss last exceeded at the beginning of the second Gulf War. On 20 March, prices increased by almost 24% – the biggest jump ever recorded. In order to understand the extreme volatility on the oil market, one has to look at its idiosyncrasies.

“Free market”

In contrast to normal markets, which are determined by supply and demand, the oil market is strongly influenced by a cartel that tries to stabilise the market.

OPEC, headquartered in Vienna, is an organisation of oil-exporting countries whose goal is to keep the oil market in equilibrium. This is largely achieved by voluntary production cuts, i.e. the various countries relinquish some of their potential production in order to ensure higher oil prices.

However, the power of OPEC has waned in recent years, which is why it has teamed up with Russia. Russia “ratifies” the decisions of OPEC and also participates in the production cuts.

Cue corona

At the last OPEC meeting on 6 March, Saudi Arabia suggested to expand the production cuts of 2.1mn barrels/day already in place to 3.6bn barrels/day. The reason cited was the falling demand resulting from the corona crisis. Russia only wanted to extend the existing cuts of 2.1mn barrels/day until the effects of the virus on the economy were better predictable.

The various parties became entrenched in their different points of view, and political escalation followed. The already agreed-on production cuts were cancelled, and Russia and Saudi Arabia started a price war and flooded the markets.

At the same time, demand declined at a rate the market had not seen before, with the need for oil plummeting due to the corona containment measures. This caused a precarious situation on the oil market: rising supply amid falling demand. The oil price fell by more than 50% within only 16 days.

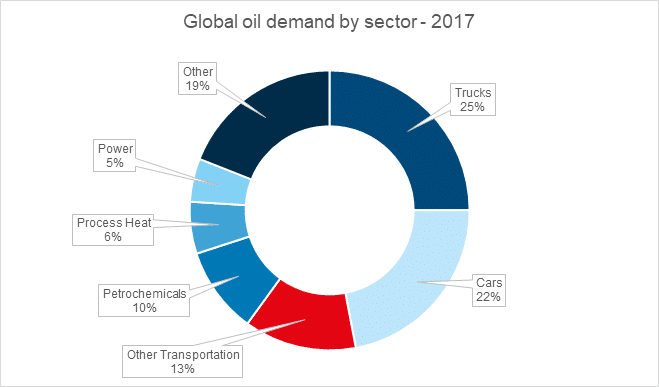

Source: Barclays Research. ‘Other’ refers to buildings, agriculture, transformation and other non-energy use, mainly bitumen and lubricants

The Art of the deal

Both Saudi Arabia and Russia can maintain a price war over longer periods of time, i.e. overcome extensive phases of low prices.

The country hardest hit by the low oil price is the USA. The shale gas boom made the USA the biggest oil producer in the world – however, the complex extraction is only profitable at prices above USD 45 per barrel. Many shale gas derricks have to be discontinued amid low oil prices, with thousands of jobs in the oil sector possibly lost.

This got US President Donald Trump involved, who announced that he would intervene in the dispute between Russia and Saudi Arabia if it were to continue unabatedly. The announcement alone was enough for the oil price to set the highest intraday gain in history: on 20 March, the price of the American oil grade WTI increased by almost 24%. Telephone calls with Vladimir Putin and Mohamad Bin Salman did result in a rapprochement, and OPEC announced an emergency meeting for 9 April 2020.

An Easter miracle?

In negotiations, which turned out difficult and lasted until Easter Sunday, OPEC agreed to cut production by 9.7mn barrels/day. In addition, other G-20 states (e.g. USA, Canada, Brazil, and Norway) also wanted to reduce their production without giving specific numbers. Whereas the oil price jumped 8% in reaction to the agreement, it later closed at -1%, i.e. in negative terrain, which reflects the critical attitude of market participants towards oil demand.

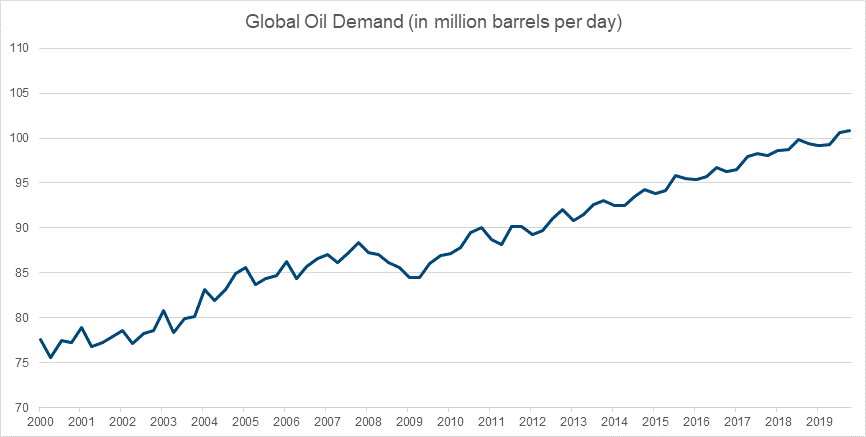

Despite Fridays for Future, Green New Deals, and promises from politicians to make the world “greener”, crude oil consumption has continuously increased in recent years.

*all data until 2019

The corona crisis has turned many business trips virtual, and more people are working from home. Both aspects are good for the environment, and climate initiatives such as the 2-degree target of the Paris Climate Agreement finally seem achievable.

If we keep some of the habits the corona virus has forced us to adopt, we will be able to reduce our dependency on mineral oil.

The world would thank us for learning from this teachable moment!

Our dossier on coronavirus with analyses: https://blog.en.erste-am.com/dossier/coronavirus/

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.