Interview with Peter Szopo, equity strategist Erste Asset Management (EAM) and Andreas Rieger, fund manager of ESPA STOCK GLOBAL

ESPA STOCK GLOBAL is an actively managed equity fund that invests in selected single stocks from around the world. In the last year the fund gained 14.31%, over the last five years the annualized performance was 10.45% p.a. *). For equity investors, the new year started very turbulent. I have asked Peter Szopo, our equity strategist and Andreas Rieger, fund manager of the ESPA STOCK GLOBAL about the latest developments (esp. China, interest rate cycle, valuation etc.) and how they navigate the global equity portfolio in this environment.

*) The performance is calculated in accordance with the OeKB method. It already includes the management fee. However, the illustration is net of the one-off load of up to 5,00 %, which falls due at the time of purchase, and of other fees that reduce the return as well as of the individual account and deposit fees. Past performance is not a reliable indicator of the future performance of a fund.

Peter, the start into the new year has been more than bumpy on the equity markets. Do investors have to brace themselves for a difficult year?

Yes. Although I am fairly confident that we will see a recovery after the turbulent start, volatility will remain high. For one thing, the interest rate turnaround in the USA is causing uncertainty. The question is what path to expect in the wake of the interest rate hike in December, and how the American economy and emerging markets will react to the new situation. Add to that the turbulences in China and the volatility on the commodity markets…

Many eyes are looking at China. What do you expect will happen?

The transformation of the Chinese growth model from an investment-based to a consumption-based model makes sense and has been expected by economists and investors. But a transformation process like this one comes with frictions, even more so since in this case we are talking about the world’s biggest economy, going by certain criteria. In addition, China is bit of a black box, because it is hard to fully trust the economic data, and economic policies are often erratic. The crucial question will be whether Chinese authorities push for a pronounced devaluation, as many currently fear. This would directly have a negative impact on emerging markets.

What sort of impact do commodity markets have on global equities?

Falling commodity prices are seen as sign of a weakening global economy, which, of course, equity investors do not appreciate. Also, the decline in commodity prices supports deflationary tendencies that we have witnessed on a global scale, which makes monetary policy even more difficult, given that interest rates are already hovering around the zero lower bound.

In the USA further moderate interest rate increases are expected. What sort of impact will that have on equities?

Past experience of initial interest rate hikes after extended periods of stable rates has shown that volatility will be elevated for a few weeks or months. But at least in the two most recent cases, i.e. in 1999 and 2004, keyUS and European equity indices had passed the level prior to the rate lift-off after twelve months.

How do you rate the earnings situation in the corporate sector?

I can see only little potential for positive surprises in the USA, given that profit margins are at the upper limit of their long-term range. In addition, the strong US dollar is burdening the companies. In Europe and Japan there is more reason to be optimistic, both on cycliccal grounds and due to the currency situation.

Are the stock exchanges too expensive?

They are not too expensive, but at the same time, they are not exactly excessively cheap either. There is little to suggest that we will see a re-rating across the board this year, i.e. an increase in the price-earning ratio of the overall equity market, like we saw in the past five years in the USA and in Europe. A reasonably positive development in the stock markets would require stable earnings in the USA and improving earnings momentum in Europe and Japan.

Performance ESPA STOCK GLOBAL (31.12.2010 – 18.1.2016)

Chart ESPA STOCK GLOBAL compared with 30 days and 200 days moving average

Source: Datastream as of 19.1.2016; The performance is calculated in accordance with the OeKB method. It already includes the management fee. However, the illustration is net of the one-off load of up to 5,00 %, which falls due at the time of purchase, and of other fees that reduce the return as well as of the individual account and deposit fees. Past performance is not a reliable indicator of the future performance of a fund.

Let us talk about the global equity portfolio. Andreas, last year you managed to outperform the global index significantly. What were the main contributing factors?

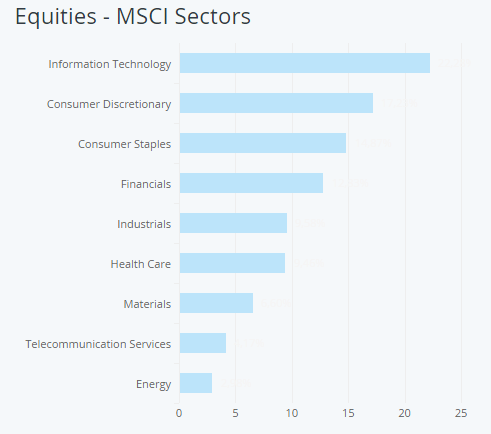

The focus of the investment is on quality shares and companies with strong growth rates. This positioning paid off last year. In terms of sectors, we achieved particularly strong contributions to the outperformance of the fund from consumer goods and technology. In addition, underweighting the energy sector was a good decision, in view of the declining oil price.

What regions and sectors do you prefer?

As far as sectors are concerned, we can see opportunities in staples, i.e. non-cyclical consumer goods, and in the technology sector while regionally we maintain our focus on North America and Western Europe. Emerging markets will continue to play a secondary role this year.

ESPA Stock Global – Portfolio split by

What role does cash play in your strategy?

We think we have a fairly volatile year ahead of us and will therefore generally hold a bit more cash in the fund than in 2015. There may be more swings in terms of inflows and outflows into the fund.

What advice can you give private investors in this sort of environment?

Keep calm and seize opportunities.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.